Advanced FX

Optimize your FX

Advanced forex services help your business

protect against currency fluctuations and uncertainty.

Fintech Hong Kong

Fintechnews.hk

Statrys Limited

Best Payments Solution 2024

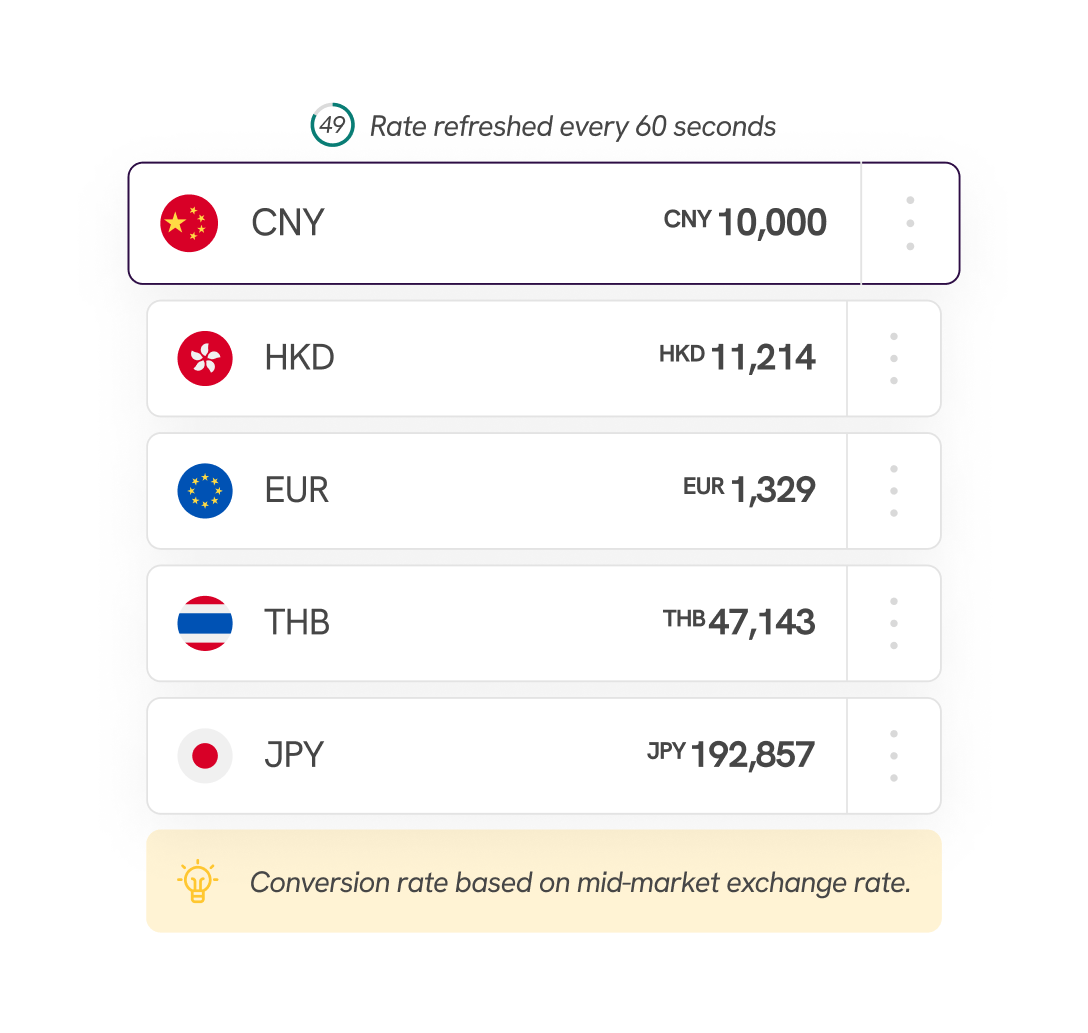

Real-time exchange rate

We provide real-time exchange rates so you can know when it’s the right time to ride the current or book the right price for you.

Spot and Forward orders

Our Trade Desk is available to assist you in booking preferable exchange rates or to facilitate your Spot orders at the precise rate you can get.

Forex exposure hedging

The forex market is volatile. With Statrys forex exposure hedging, you’ll stay insulated from fluctuations and volatility.

Forex services you can count on

Forex services aren’t just for big companies, they’re for your business too.

Real-time exchange rates you need

Currency exchange rates fluctuate rapidly, Statrys offers rates based on mid-market with low fees.

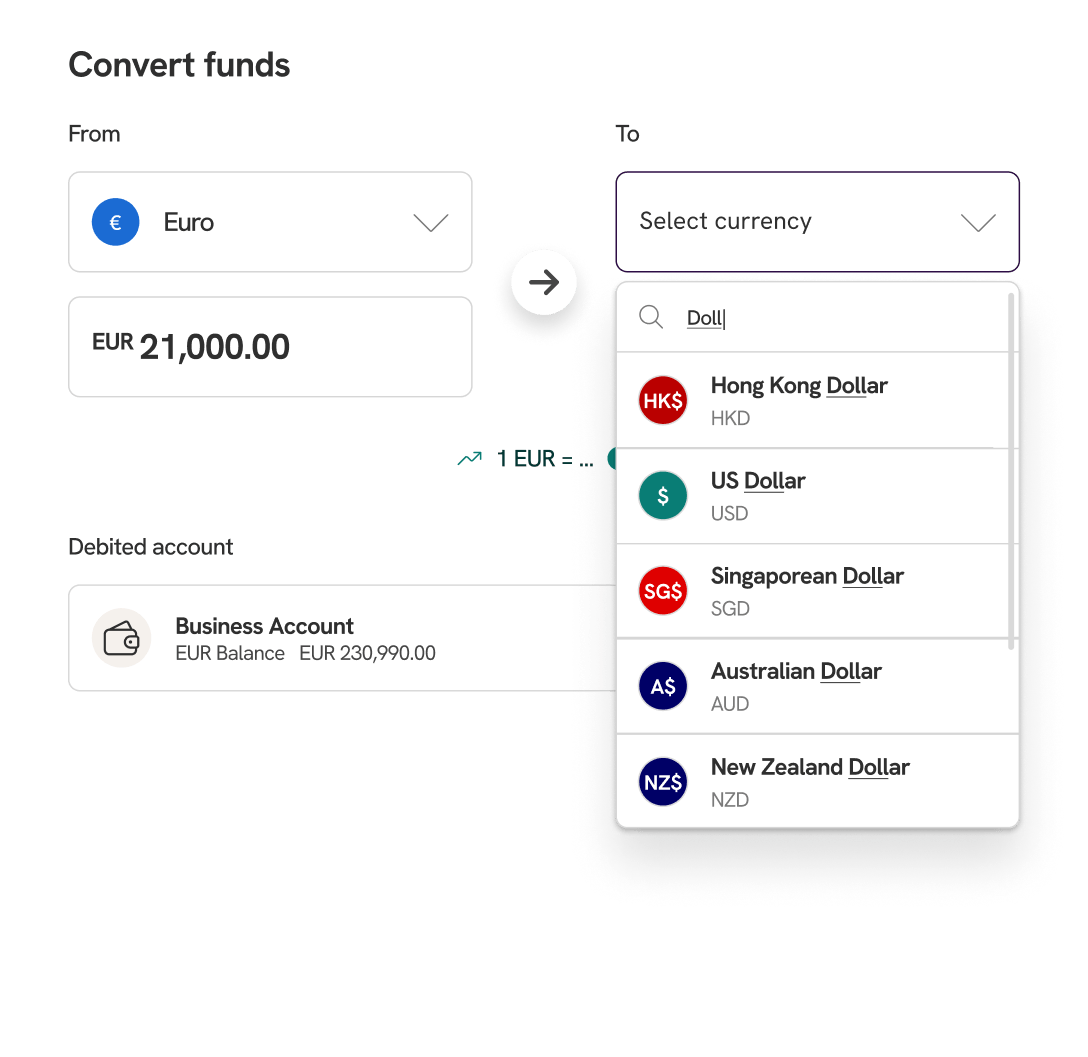

11 currencies. Infinite possibilities.

With 11 currencies at your fingertips, you’ll find your perfect exchange pair in no time.Order forward contracts

Order forward contracts at rates you prefer and hedge against unknown market changes.Analyze spending

Generate monthly statements that are driven by data, not only see your spending, but understand it too.

Trade 24 hours a day

Exchange rates wait for no one, so your business shouldn’t wait either. Statrys offers 24 hour trading.

Trade desk support

Our Trade desk is here to support your trading needs, any time you need it.100% virtual trades

Make all your necessary forex bookings and trades any time of the day with real-time rates.Analyze spending

Generate monthly statements that are driven by data, not only see your spending, but understand it too.

Avoid volatility in the market with Statrys

Hedge against volatility in the forex marketplace with Statrys.

Book Forward rates

Booking an exchange rate for a currency pair is a great way to avoid uncertainty.Hedge against uncertainty

Hedging services are offered to all forex add-on customers who wish to book stable exchange rates and avoid forex pitfalls.

Frequently Asked Questions

What are the business hours to trade FX ?

FX trade can be booked online from 8am to 8pm Hong Kong time, Monday to Friday. After 8pm, FX trade can be booked by calling our trading desk+852 5449 1545FX market is closed on weekends and public holiday.

What is the FX fee charged by Statrys?

All FX trades are based on real-time mid-market rate. We offer competitive pricing with FX fee determined in accordance with transaction volume. Start a discussion with our trading desk to get a quotation+852 5449 1545

What is the deposit amount for a FX forward contract?

Deposit for FX forward contract is 2%. Deposit is entirely refunded after settlement of the contract

Do you deal with flexible forward ?

Yes, we do. You can enter an FX forward transaction with Statrys and proceed with early-draw, which means that you can get your fund before the initial settlement date, or you can extend your settlement date if necessary. We offer these options to our customers as we know it will help them to manage their money flow and relationships with both suppliers and customers.

How many currencies can I deal in ?

You can deal in 11 currencies: EUR, USD, GBP, CAD, CHF, SGD, HKD, CNH, AUD, NZD and JPY.

Do I need to hold funds with Statrys before booking an FX rate ?

We give the ability for our customers to book an FX rate. To do so, you will need to have your Statrys account funded prior to booking a rate. Then, once your Statrys Multi-Currency Account is funded, Statrys will book the rate for you and settle your trade.

Can I book a rate by phone or email?

Yes, you can leave your FX order to our FX dealer. You can contact him via email Jonathan.cusimano@statrys.com or WhatsApp +852 5449 1545.

As a company, we want to deal with any possible FX orders when the market reaches a level we expect. Can Statrys do that ?

Yes, you can leave your FX order (limit order) to Statrys and when the market reaches your limit, your order will be automatically executed.

Why is there a difference between the Spot rate and the Forward rate ?

The Spot rate refers to the immediate exchange rate while the Forward rate refers to the future exchange rate agreed upon in Forward contracts.The difference is due to what we call 'the interest rate differential', a difference in the interest rate between two currencies in a pair. If one currency has an interest rate of 3% and the other has an interest rate of 1%, it has a 2% interest rate differential.

Now let's take an example based on the most commonly traded currency pair in the world: EUR - USD.

Let's assume the interest rate for EUR is -0.4%, and the USD interest rate is 0.5%. If the EUR / USD spot value is 1.18, then the forward rate will be 1.1906.

1.1906 = 1.18 * (1 + 0.5% / 1 - 0.4%)What is an FX mandate ?

FX mandates are specific contracts between Statrys and the customer who wants to outsource their FX currency management to Statrys based on their specifics demand and goal. The specifics are defined both by customers and Statrys until reaching an agreement.

The specificities are based on:

• Frequency of customer cash flow

• Currencies to be hedged

• Frequency of hedging

• Limit exposure acceptedWith proactive support that goes beyond payments

Something here for entrepreneurs and small companies and how their business depends on the reliability of an efficient payment platform.

Discover what a global business account can do for your business

100% online application

No account opening fee, no initial deposit

Account manager