Features

Fees

Customer Support

Ease of opening an account

MariBank Singapore Private Limited is a digital full bank licensed by the Monetary Authority of Singapore. It is a wholly owned direct subsidiary of SeaMoney Holding Limited, which is part of Sea Limited, the parent of Shopee and Garena.

Today, it offers retail and SME products in Singapore that are delivered through a mobile-first app. These include savings accounts, the Mari Business Account, business loans, and domestic and overseas transfers. SGD deposits are typically covered by SDIC deposit insurance within the scheme limits.

In this article, we’ll review the Mari Business Account, explaining what it offers, who it suits, and where it may fall short.

Key Highlights

Fast and Paperless Account Opening

Apply entirely online through Singpass with no document uploads. Most applications are approved within 1 - 2 business days.

Free Local Transfers

Supports FAST and PayNow for local payments, so you can pay suppliers and staff in Singapore for free.

Instant Transfers to China and India

Supports UnionPay and UPI for instant overseas transfers to China and India, respectively.

1% Interest on Balances

Earn 1% p.a. interest on all balances with no minimum deposit, far higher than the 0.05% p.a. of typical SME current accounts.

Mobile-Only Banking

MariBank business accounts are mobile-only. You must use the MariBank app to open, access, and manage your account, and there is no desktop interface available.

Strict Eligibility Rules

Only Singapore-registered entities with no shareholders can open an account, and all key individuals must be Singapore citizens or Permanent Residents.

✅ MariBank is a good fit for

- Singapore-focused SMEs and startups:

MariBank is best for businesses operating mainly within Singapore that send and receive payments in SGD. - Entrepreneurs holding short-term operating cash:

The 1% interest helps businesses earn extra on idle funds used for day-to-day expenses.

🚫 MariBank isn’t a good fit for

- Foreign-owned entities or corporate structures with multiple shareholders:

Companies with corporate shareholders or foreign directors aren’t eligible to open a Mari Business Account. - Companies that regularly manage overseas payments:

While transfers start at just S$3, agent bank fees (up to S$25) and FX conversion margins can make cross-border transactions less cost-effective. - Businesses that need expense tools or payment cards:

MariBank doesn’t offer business debit cards or accounting integrations, limiting expense tracking and automation.

Mari Business Fees

MariBank keeps business banking affordable with no monthly or account opening fees and free local transfers.

For overseas transfers, MariBank charges a flat fee of S$3 per transaction, plus any agent bank fees, which can range from S$0 to S$25, depending on the destination and currency.

Below is a breakdown of overseas transfer fees by currency:

| Currency | Fee (SGD) |

|---|---|

| Chinese Yuan | $3 |

| Malaysdian Ringgit | $3 |

| US Dollar to the US | $3 |

| US Dollar to other countries | $3 + $25 |

| Hong Kong Dollar | $3 + $25 |

| South Korean Won | $3 + $10 |

| Japanese Yen | $3 + $25 |

| Taiwan Dollar | $3 + $10 |

| Thai Baht | $3 |

| Philippine Peso | $3 |

| Indonesian Rupiah | $3 |

For the full fee schedule, you can refer to the Mari Business Account’s fees and rates page.

MariBank’s fees are straightforward for local transfers, but overseas payments are not transparent. We weren’t able to find any information about the exchange rates or FX fees that Maribank charges, so at this point, it’s not possible to predict overseas payment costs until you actually try to make the payment.

For businesses that make frequent overseas payments, this lack of clarity can make budgeting and cost control more challenging.

Mari Business Features

MariBank’s Business Account offers essential tools for Singapore-based startups and SMEs that value simplicity. Its main features include local and international transfers and interest-bearing balances, all accessible via a mobile-first platform that keeps business banking easy to use.

Local and International Transfers

MariBank supports PayNow and FAST for local payments, making it easy to pay suppliers and staff instantly. It also offers overseas transfers to more than 40 destinations, with instant transfer options for China and India through UnionPay and UPI, respectively.

Transfers are made directly in the app, with exchange rates shown upfront before confirmation. MariBank can also receive overseas transfers, but in SGD only. That works well if your clients pay in SGD, but if they pay in other currencies, you may need an additional solution to avoid extra conversion costs.

Interest on Balances

MariBank pays 1% p.a. interest on all business account balances, with no minimum deposit required. Most current accounts for SMEs in Singapore offer very low interest rates, often below 0.05% p.a., so MariBank’s rate is quite competitive. For companies that keep cash on hand for daily expenses or payroll, this helps them make the most of their balance.

Mari Business Account Opening

Opening a Mari Business Account is quick and entirely digital, though eligibility is limited to certain Singapore-registered businesses.

The application takes about 15 minutes to complete through Singpass, and accounts are usually approved within 1–2 business days after KYC checks.

Who Can Open?

MariBank accepts applications from Singapore-registered businesses only.

Eligible entities include:

- Sole Proprietorships

- Partnerships

- Limited Liability Partnerships (LLPs)

- Private Limited Companies without corporate shareholders

To qualify, all key individuals, including owners, directors, partners, and major shareholders (who hold 25% or more of the shares), must be Singapore Citizens or Permanent Residents.

Required Documents

MariBank’s application process doesn’t require you to upload any files. All business and personal details are automatically retrieved from Myinfo Business through Singpass, allowing the application to be verified quickly and paper-free.

Google Play Review: MariBank

MariBank’s reviews on Google Play are mixed, averaging around 4.4 out of 5.

Many users appreciate the simple mobile app, fast onboarding, and interest on deposits, which is higher than most SME current accounts in Singapore. The quick, paperless setup is also frequently mentioned as a positive feature.

However, complaints are common around login and access problems, including repeated face verification requests, app crashes, and temporary account freezes. Several users also cited slow or unresponsive customer support, especially when resolving payment or verification issues.

Overall, MariBank is appreciated for its ease of use and competitive interest, but support responsiveness seems to be an area for improvement.

Best Mari Business Account Alternatives

If the Mari Business Account isn’t the right fit for your company, here are some alternatives to consider:

1st Choice

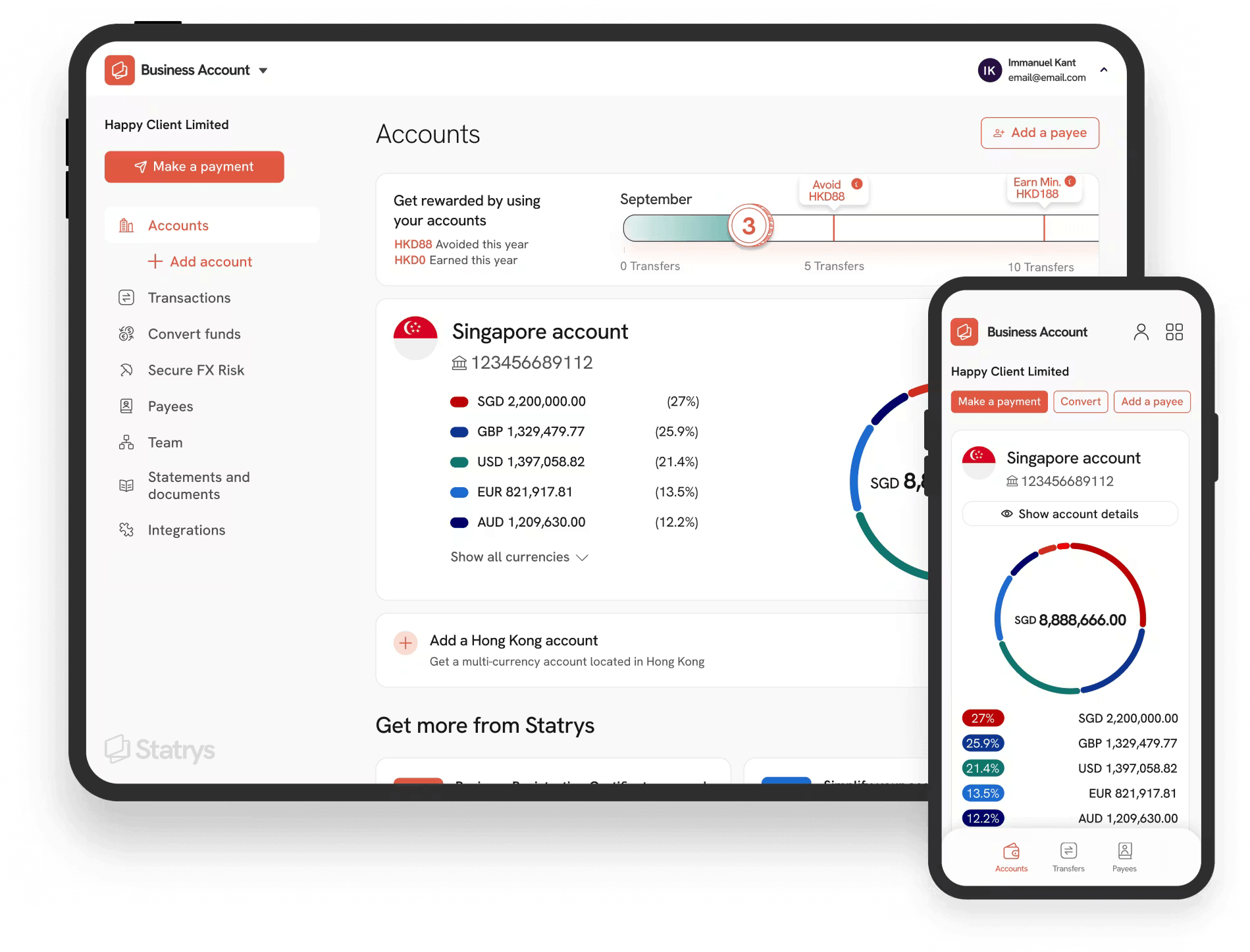

Multi-currency business account supporting 11 major currencies with online onboarding, and FX fees as low as 0.1%

2nd

Virtual business account with an extensive payment network.

3rd

Multi-currency account with expense management tools

Why Statrys Often Works Better for SMEs

Statrys is suited to SMEs that trade beyond Singapore and need more flexibility. You can open an account even with foreign ownership or more complex shareholding structures, and hold and manage multiple major currencies instead of being limited to SGD only. Statrys also supports both desktop and mobile access and provides transparent FX pricing and fees, so you always know your total costs when sending and receiving overseas payments.

Was this article helpful?

Yes

No

FAQs

Is it safe to use MariBank in Singapore?

Yes, MariBank is considered safe. It is licensed by the Monetary Authority of Singapore (MAS) and complies with local regulatory standards. Deposits in Singapore dollars are insured up to S$100,000 under the SDIC scheme. Additionally, it uses industry-standard encryption, identity verification, and fraud monitoring to protect customer accounts.

How much does the Mari Business Account cost?

Is MariBank owned by Shopee?

What is the limit of the MariBank business account?

Disclaimer

This review is written by Statrys, a company that competes with MariBank in the Singapore business payments space. Click More info to read the full disclaimer on our review.