If you’re comparing Statrys and Aspire, you’re probably trying to find the better option. The reality is, there isn’t a clear winner.

Both offer business accounts in Singapore, but they’re built with different priorities in mind, which is why one can feel like a great fit while the other doesn’t.

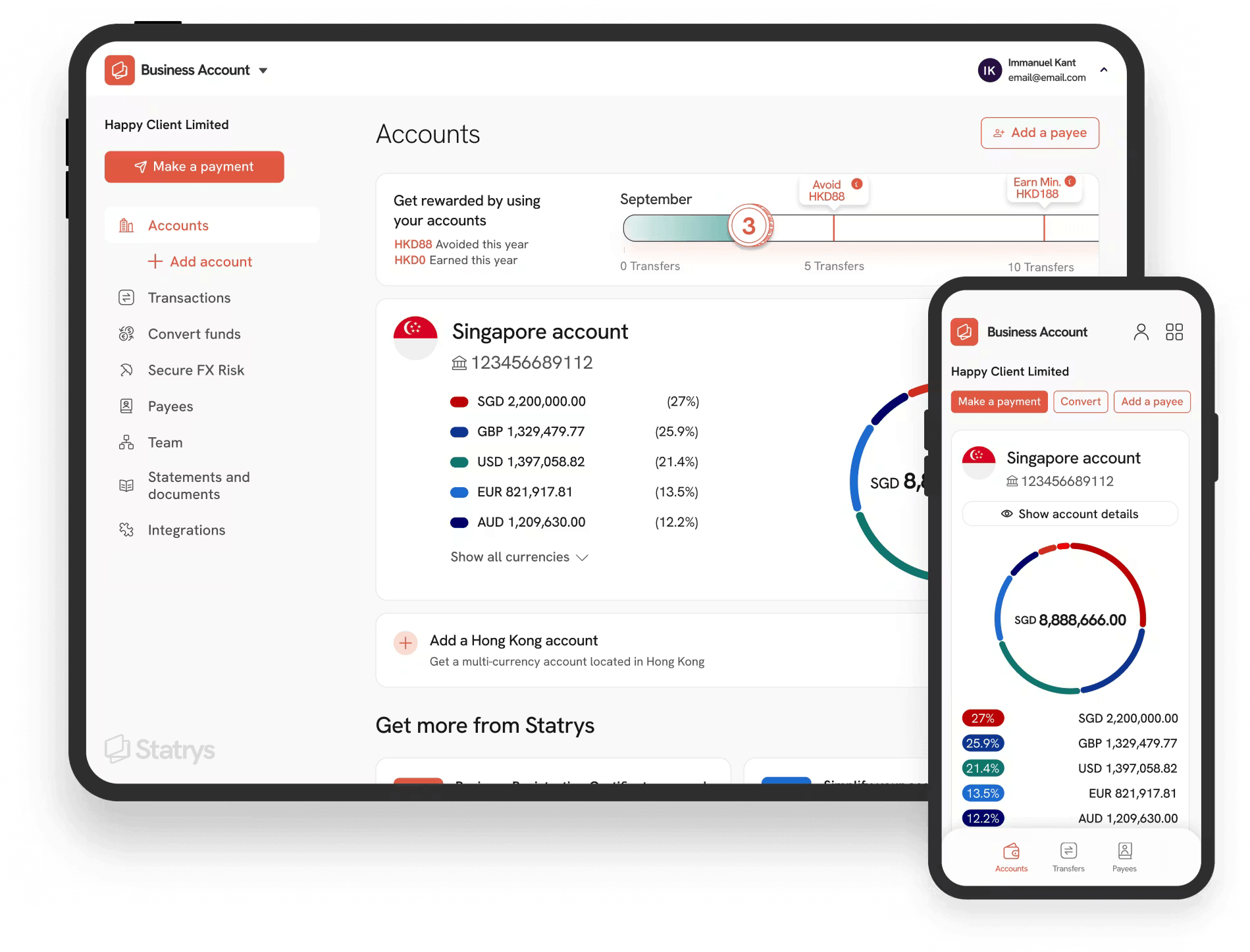

This comparison will take a closer look at each provider, from features and fees to onboarding and support, so you can decide for yourself which one fits your business best.

Disclaimer: The information in this article is accurate as of 17 December 2025. Please note that these details are subject to change. We recommend checking with Airwallex and Aspire for the latest information.

Quick Take: Which One You Should Use?

Choose Statrys if:

✔️ Your business sends higher-value international payments, and you want fewer conditions to manage.

✔️ You care about FX costs over time and want predictable pricing as volumes grow.

✔️ You prefer to speak to a dedicated contact who understands your business.

Choose Aspire if:

✔️ Your business is registered outside Hong Kong, Singapore, and the BVI.

✔️You want unlimited virtual cards, with cashback for eligible purchases.

✔️You rely on integrations or APIs to connect payments with your internal systems.

Ultimately, the choice depends on whether you prioritise predictable international payments and direct support, or system-driven workflows.

Business Account Features Comparison

| Features | Statrys | Aspire |

|---|---|---|

| Hold currency | 11 currencies: SGD, USD, EUR, GBP, HKD, CNY, AUD, CAD, CHF, JPY, NZD | 4 currencies: SGD, USD, GBP, EUR |

| Currencies you can send | 18 currencies | 40+ currencies |

| Send money locally (Local payout)* | To 45 countries | To 50+ countries |

| Transfer limit | No minimum or maximum transfer limit | Varies based on the sending account, currency, and transfer method (local or SWIFT) |

| International (SWIFT) transfer speed | 1–3 business days | 2–4 business days |

| Support PayNow | ❌ | ✅ |

| Real-time payment tracking tool | ✅ | Not specified |

| FX tools | ✅ Limit orders | ❌ |

| Integration | Xero, Shopify, Stripe, PayPal | Xero, QuickBooks, NetSuite, Amazon, TikTok, Shopee, Stripe, PayPal, and more |

Statrys is the better fit if you value control, predictable costs, and flexibility when sending larger payments, especially where FX margins matter. Aspire makes more sense if you prioritise reach, automation, and integrations, with PayNow offering added convenience for local Singapore payments.

It is also worth noting that local SGD transfers are not exclusive to PayNow. Statrys supports FAST for domestic payments, so the real difference is convenience, not access. If your local beneficiaries are already set up, PayNow becomes less important.

*Explore our FAQs to understand how Statrys local payouts help you get lower fees, faster processing, and ensure recipients receive the exact amount you send.

Business Account Fees Comparison

| Fees | Statrys | Aspire |

|---|---|---|

| Account Monthly Fee | Free |

Basic: SGD 0 Premium: SGD 15 |

| Receive Local Payments | Free | Free |

| Send Local Payments |

SGD 1.5 (FAST) SGD 15 (MEPS) |

Free (FAST and GIRO for payroll) |

| Receive International Payments (SWIFT) | SGD 5 |

SGD 35 (collected in SGD account) USD 8 (collected in USD, EUR, and GBP accounts) |

| Send International Payments (SWIFT) | SGD 20 |

USD 15 (SHA) USD 30 (OUR) Premium plan gets 5 free transfers per month |

| FX Fee | Starts from 0.1% |

Starts from 0.22% Premium plan gets 0% on the first SGD 13,000 |

Statrys offers simpler, more predictable pricing, with no monthly fee and flat transaction costs as volumes change. Aspire can be cheaper for light usage or when its Premium allowances are fully utilised, but costs would increase quickly once you exceed those limits.

Application Process Comparison

| Statrys | Aspire | |

|---|---|---|

| Who can apply? | Standard incorporated entities (sole proprietorships, LLCs, LLPs, etc.) registered in Hong Kong, Singapore, and the British Virgin Islands (BVI) | Standard incorporated entities registered in 19 countries, including Singapore, Hong Kong, Australia, New Zealand, China, Japan, and Taiwan |

| 100% online application | ✅ | ✅ |

| Approval time | Within 3 business days | Within 5 business days |

Both platforms offer a fully online application process. Aspire’s wider country coverage makes it easier for companies in more regions to apply, although onboarding can take slightly longer in practice. Statrys is more limited by jurisdiction but tends to offer a quicker, more predictable approval experience.

Customer Support Comparison

| Statrys | Aspire | |

|---|---|---|

| Dedicated Account Manager | ✅ | ❌ |

| Communication Channels | FAQs, phone, email, website, live chat, WhatsApp, and WeChat | FAQ pages, in-app chat, email, phone, WhatsApp |

| Working Hours |

10 am to 7 pm (GMT+8), Monday to Friday (except Hong Kong public holidays) 24/7 through website chat (automated; Statrys replies during business hours if not resolved) |

9:00–21:00 (UTC+8), Monday to Sunday |

Statrys focuses on relationship-based support. Having a dedicated account manager means issues are handled by someone who understands your business, which is helpful when dealing with payments, compliance questions, or exceptions that need context rather than generic replies.

Aspire focuses on availability and self-service. Support hours are longer and extend into weekends, which can be useful for basic queries or urgent issues outside standard business hours. However, support is generally more channel-driven rather than relationship-based.

User Reviews & Ratings

| Rating & Reviews | Statrys | Aspire |

|---|---|---|

| Trustpilot Score | 4.5/5 (367 reviews) | 3.9/5 (146 reviews) |

| Common Praise | Fast onboarding, responsive human support, and a user-friendly platform | Clean interface, simple expense submissions, and convenient payments |

| Common Complaints | Application rejection due to a prohibited business type or location | Delayed or missing transfers and unclear communication on product changes |

Reviews suggest that Statrys delivers a consistent experience for businesses that meet its eligibility criteria, with fewer reported issues after onboarding.

Aspire’s reviews reflect use across a wider range of business profiles. While many users report a smooth experience, some feedback points to operational issues after signing up.

Was this article helpful?

Yes

No

FAQs

What is the key difference between Statrys and Aspire business account?

Statrys supports holding more currencies and focuses on personalised support for managing international payments. Aspire focuses on a broader payment network, with API integrations to support automated workflows.

Does Statrys or Aspire charge an account fee?

Which business account is better?

Disclaimer

Statrys competes directly with Aspire in the Hong Kong and Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.