Features

Fees

Account Opening

User Reviews

Launched in 2022, YouBiz is the business account developed by YouTrip, a payment service provider regulated by the Monetary Authority of Singapore. YouBiz provided corporate cards, business accounts, international payments, and expense tracking features to help startups and SMEs in Southeast Asia manage payments and reduce costs.

This review outlines what YouBiz offers, fees, how to register for an account and the types of businesses it may be suitable for.

Key Highlights

Support 9 major currencies

YouBiz lets you hold, receive and send money in SGD, USD, EUR, GBP, JPY, HKD, AUD, CHF, and THB. However, you can’t receive THB at the time of review.

No monthly fees and free local transfers

There is no monthly fee, and FAST transfers within Singapore are free. This keeps everyday use relatively low-cost.

Debit cards with simple spend controls

YouBiz offers virtual and physical debit cards that can draw directly from specific currency balances. Basic controls are available, and cards support Apple Pay and free foreign currency spending.

No pricing page

Fee information is mentioned across different Help Centre sections, so users need to piece details together manually.

Only available to Singapore-registered businesses

YouBiz accounts are limited to companies incorporated in Singapore.

✅ YouBiz is a good fit for

- SMEs that look for a simple multi-currency account.

The ability to hold 9 currencies, send payments in 20+, and create sub-accounts suits businesses with moderate cross-border activity. - Teams that need basic card controls.

YouBiz supports card-level limits, merchant restrictions, and linking cards to specific currency balances. - Businesses that prefer quick online onboarding.

Applying with Singpass (MyInfo Business) allows most users to complete the process in minutes.

🚫 YouBiz isn’t a good fit for

- Businesses that need full fee transparency upfront.

YouBiz doesn’t have a dedicated pricing page, and fees are scattered across different help-centre categories, which may make cost comparison harder. - Founders who rely on public user feedback

There are no independent reviews on platforms like Google Reviews or Trustpilot, so it is difficult to gauge real customer experience. - Firms that need advanced payment or accounting automation.

YouBiz offers basic approval flows and CSV exports but lacks deeper integrations and automated workflows found in more advanced platforms.

YouBiz Fees

YouBiz doesn’t have a dedicated pricing page.

Instead, fee information is spread across different sections of the YouBiz Help Centre, which can make it harder for you to understand YouBiz’s pricing. For example, receiving fees appear under the Managing My Finance category, while sending fees are listed separately under Managing My Transfers.

To help you navigate this, here are the key fees you should know.

| Fee Types | Amount (SGD) |

|---|---|

| Opening Fee | $0 |

| Monthly Fee | $0 |

| Local Transfers |

Receive: $0 Send: $0 |

| International Transfers |

Receive: $0, but the 3rd party bank may charge a fee. Send: Fee will be shown on the dashboard when you make a transfer. |

| FX Rate and Fee | Based on the wholesale FX rate with a fee ranging from 0.1% - 0.4% |

| Withdrawal Fee |

Waived Note that overseas ATM operators may charge an extra fee. |

YouBiz Features

YouBiz combines corporate cards, a multi-currency business account, and basic payment and expense tools. Below is a summary of the main features available.

YouBiz Cards

YouBiz provides virtual and physical debit cards that businesses can issue to employees. Each card can be linked to a specific currency balance, and supported currencies include AUD, CHF, EUR, GBP, HKD, JPY, SGD, THB, and USD.

Cards can be added to Apple Pay, and foreign card transactions are free. You can also set basic controls such as individual spending amounts, daily or monthly limits, and merchant category restrictions. Finally, ATM withdrawals are supported, although overseas ATM operators may charge their own fees.

Note: Physical card arrives in 5-8 working days after submitting the card request.

Business Account

You can open foreign currency accounts in 9 currencies: SGD, USD, EUR, GBP, JPY, HKD, AUD, CHF, and THB. These accounts let you hold and send funds in each currency. YouBiz currently allows free incoming payments in SGD, USD, EUR, GBP, JPY, HKD, AUD, and CHF.

You can send money overseas in more than 20 currencies and create up to 30 sub-accounts to separate budgets. Batch payments of up to 1,000 transactions can be sent by uploading an XLSX file.

There is no overall balance limit, but there are per-transaction limits that vary by currency. For more information, please refer to YouBiz's FAQ page.

Important: You cannot receive Thai Baht in THB currency accounts at the time of review. However, you can hold THB balance, exchange, make transfers and link cards to your THB account.

Expense Management

YouBiz includes tools to help businesses control and track company expenses. Team members can submit transactions or out-of-pocket claims, and you can set up to two approval steps so payments are reviewed before they go through. Receipts and notes can be attached to each transaction, and the mobile app makes it easy to take photos of receipts and tag expenses immediately, which helps keep records organised.

For accounting, YouBiz supports exporting transactions in pre-formatted CSV files that can be uploaded directly to software such as Xero, NetSuite, and QuickBooks. This reduces manual data entry and helps keep accounts up-to-date.

YouBiz Business Account Opening

Opening a YouBiz account is a fully online process. You can apply using Singpass (MyInfo Business), which auto-fills most company information, or complete the form manually. The application takes only a few minutes to submit, and YouBiz typically reviews applications within 2 business days.

Who Can Open?

YouBiz accounts are available to businesses incorporated in Singapore. Applications must be submitted by a company director or someone formally authorised by the business. If the applicant is not a director, an authorisation letter is required.

Required Documents

The documents needed depend on the application method. When applying through Singpass (MyInfo Business), no additional documents are required unless the applicant is not a director.

For manual applications, YouBiz asks for:

- An ACRA Business Profile issued within the last three months

- A copy of the applicant’s NRIC or another accepted form of identification.

These documents are required to meet verification obligations under the guidelines of the Monetary Authority of Singapore. YouBiz may request additional information depending on your company structure or risk profile.

YouBiz from Real Users

YouBiz doesn’t publish customer feedback on its website, and there are no independent reviews on platforms such as Google Reviews or Trustpilot. As a result, there’s very little public information about how businesses feel about the service or what the day-to-day experience is like, which makes it harder to compare YouBiz with other fintech providers that have more visible user feedback.

Best YouBiz Singapore Alternatives

If YouBiz is not the right fit for your company, here are some alternatives to consider instead:

1st Choice

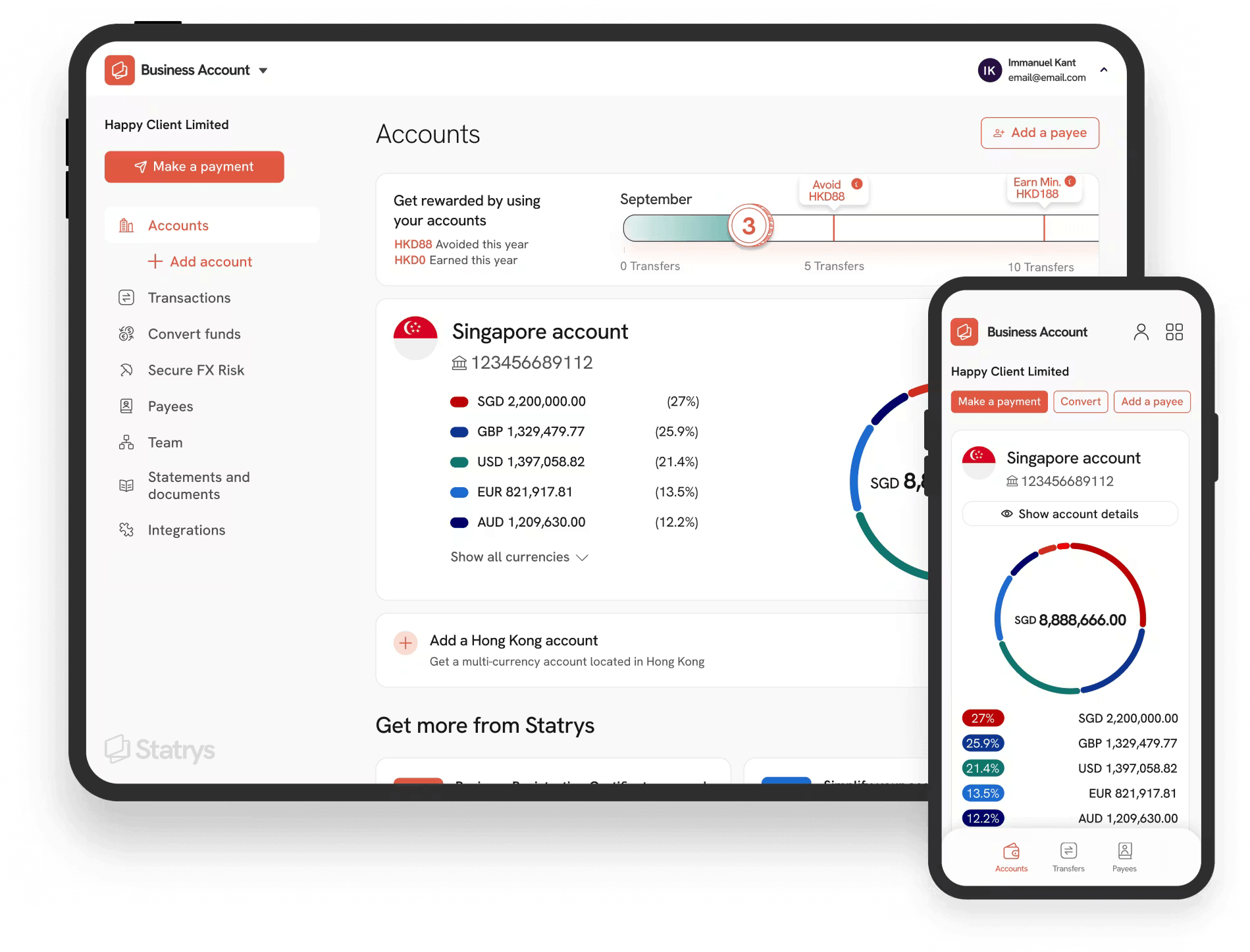

Multi-currency business account supporting 11 major currencies with FX fees as low as 0.1%

2nd

Business account supporting 4 currencies with expense management tools.

3rd

Multi-currency business account with loans and trading services.

Why we recommend Statrys

Statrys is a stronger fit than YouBiz if you prioritise clear pricing and direct human support. YouBiz provides solid basics, but its fees are scattered across help centre pages, and there’s no public user feedback to understand service quality. For SMEs, this makes it harder to understand costs or how the service performs in practice.

With Statrys, you know exactly what you’ll pay, and you can reach a real person when you need help. If transparent pricing and human support are what you’re looking for, Statrys is the stronger choice.

Was this article helpful?

Yes

No

FAQs

Is YouBiz safe to use?

Yes, YouBiz is safe to use. It is operated by YouTrip, a licensed financial services provider, and follows regulatory compliance and security measures to protect user funds and transactions.

Is YouBiz a bank account?

Is YouBiz a credit or debit card?

What is the limit on the YouBiz card?

Disclaimer

Statrys competes directly with YouBiz in the Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.