Looking up Airwallex vs Wise usually means you already know both names. What you’re really trying to work out is which one fits how your business actually runs.

Wise is built around simple, transparent international transfers. Airwallex offers more controls and tools for managing payments as teams grow. Which one works better depends on how often you move money and how much structure you need.

Below, we compare where each platform performs well and where the trade-offs start to show, covering fees, features, and real user experience so you can decide which option makes more sense for your business.

Disclaimer: The information in this article is accurate as of 18 December 2025. Details may change over time; please check the providers' websites for the most current information.

Quick Take: Which One You Should Use?

Choose Airwallex if:

✔️ Your Singapore business is expanding into multiple markets and makes frequent cross-border payments

✔️ You need integrations or payment tools to support more complex operations

✔️ You issue cards to team members and want tighter control over spending

Choose Wise if:

✔️ You mainly need a simple way to send and receive money internationally.

✔️ You rely on PayNow for making and collecting payments.

✔️ You prefer access to local phone support

If your payments are becoming more complex as your business grows, Airwallex tends to be the better fit. If you want a simple way to move money with strong local support, Wise fits your needs better.

Business Account Features Comparison

| Features | Airwallex | Wise |

|---|---|---|

| Hold currency | 20+ currencies, including GBP, HKD, AED, AUD, CAD, CHF, EUR, JPY, NZD, SGD, and USD | 55+ currencies, including GBP, AUD, CAD, EUR, HKD, HUF, MYR, NZD, PHP, and RON |

| Send money | To 200+ countries | To 140+ countries |

| Send money via local-route network | To 110+ countries | To 40+ countries |

| Support PayNow | For payment collections only | ✔️ |

| Payment acceptance tools | No-code payment gateway, payment links, and invoices | Payment links and invoices |

| Batch payment | ✔️ Up to 1,000 payees | ✔️ Up to 1,000 payees |

| Advanced FX tools (e.g. forward contracts) | ❌ | ❌ |

| Integration | Xero, Sage, QuickBooks, NetSuite, Amazon, Lazada, Shopify, and more | Xero, QuickBooks, FreeAgent, Odoo, and more |

If your Singapore business is expanding into multiple markets and needs tools like integrations or a payment gateway, Airwallex is the better choice. If you mainly need a simple way to send and receive money across borders, Wise is a better fit.

Want to dive deeper? Check out our review of Airwallex Singapore to learn more about

Business Account Fees Comparison

| Fees | Airwallex | Wise |

|---|---|---|

| Account opening fee | Free | Free, but a one-time fee of SGD 99 applies to access all features |

| Account monthly fee |

Explore: SGD 0 Grow: SGD 79 Accelerate: SGD 399 |

Free |

| Receive local payments |

0.6% for KRW and VND payments 0.3% for PHP payments Free for others |

Free |

| Send local payments | Free |

Within Singapore: Free To other countries: starting from 0.26% |

| Receive international payments (SWIFT) |

0.6% for KRW and VND payments 0.3% for PHP payments Free for others |

Depends on currency: USD 6.11 for USD payments GBP 2.16 for GBP payments EUR 2.39 for EUR payments For other currencies, refer to Wise’s FAQ |

| Send international payments (SWIFT) |

SGD 20 (SHA) SGD 35 (OUR) |

Varies by amount, payment method, and exchange rate. Final price shown before transfer |

| FX fee |

0.4% above interbank rate (major currencies) 0.6% for all others |

Starting from 0.26%, based on the mid-market exchange rate |

For small businesses and SMEs, the main difference in fees is how easy they are to plan for. Wise uses a pay-as-you-go model, which makes it easier to estimate costs if you send or receive money occasionally or in smaller amounts. Airwallex tends to make more sense as payment volume grows, since many local transfers are free and SWIFT fees are clearly set.

That said, if your business often receives payments in currencies like KRW, VND, or PHP, Airwallex’s percentage-based receiving fees can add up, and Wise may feel more predictable for managing incoming funds.

Considering Wise? There are some key things you should know about the Wise business account before you get started!

Card Features and Fees

| Card Features | Airwallex | Wise Singapore |

|---|---|---|

| Card Type |

Company card: Virtual Visa debit card Employee card: Physical and virtual Visa debit card |

Physical and virtual business debit cards issued on either Visa or Mastercard® |

| Card Base Currency | 11 currencies, including AUD, SGD, HKD, GBP, USD, EUR, JPY, CAD, NZD, CHF, and ILS. | 25+ currencies |

| Number of Cards |

Company cards: Explore: max. 10 Grow: max. 50 Accelerate: Unlimited Employee cards: Not specified |

1 physical card per account holder, and up to 3 virtual cards per user |

| Payment Limit | Default limit of $50,000 or equivalent (adjustable) | Up to S$100,000 in 12 months |

| ATM Withdrawal | ❌ | ✔️ |

| ATM Withdrawal Limit | N/A | Included in the payment limit |

| ATM Withdrawal Fee | N/A | Up to 2 free withdrawals up to allowance, then fees apply (e.g. 0.5 GBP + 1.75% over limit) |

| Foreign Transaction Fee | No transaction fee | No transaction fee |

| Monthly Card Fee | Free up to 5 active users Then S$5 per user/month |

Free |

| Manage and Control Card in App | ✔️ | ✔️ |

Airwallex works well if you need to give cards to several team members and keep spending under control as your business grows, with higher limits and more flexible card management. This is useful once expenses are shared across staff or departments. Wise is better suited to simpler setups, where you mainly need a business card for everyday spending and occasional cash withdrawals, without worrying about monthly card fees.

Application Process Comparison

| Eligibility & Application | Airwallex | Wise |

|---|---|---|

| Who can apply? | Standard incorporated entities (sole proprietorships, LLCs, LLPs, etc.) registered in 50+ countries, including Hong Kong, China, Singapore, the US, the UK, and Australia | Standard incorporated entities registered in 70+ countries, including Hong Kong, China, Singapore, the US, the UK, and Australia |

| 100% online application | ✔️ | ✔️ |

| Approval time | Within 3 business days | Within 3 business days |

Both Airwallex and Wise keep eligibility broad and the application process simple, making them equally accessible for Singapore businesses. The real decision comes down to other aspects rather than setup.

Customer Support Comparison

| Support Type | Airwallex | Wise Singapore |

|---|---|---|

| Dedicated Account Manager | Available only on the Accelerate plan | ❌ |

| Communication Channels | Help centre, contact form, email, chatbot, regional phone lines (China only) |

Help centre (for everyone) Email, phone, in-app chat (for Wise Business account holders) |

| Singapore Phone Line | ❌ |

+65 313 51147 (for Wise Business clients) Additional carrier charges may apply |

| Working Hours | Regional phone lines available during business hours (9:00–18:00 CST) | 24/7 including phone support |

If you value a dedicated account manager, you will only find that with Airwallex’s Accelerate plan, which is for large companies or enterprises.

For SMEs and solopreneurs, Wise offers broader access, including a Singapore phone line with 24/7 support, which is helpful in urgent situations.

User Reviews & Ratings

| Rating & Reviews | Airwallex | Wise |

|---|---|---|

| Trustpilot Score | 3.5/5 (2,211 reviews) | 4.5/5 (279k reviews) |

| Common Praise | Helpful support team, competitive rates, and an easy-to-use platform. | Fair exchange rates, reliable transfers, and a user-friendly app. |

| Common Complaints | Unclear communication on pricing changes. | Mixed reviews on customer service quality. |

Wise’s higher score reflects broad user trust built on a large base of reviews. Airwallex’s rating is more mixed, but feedback consistently points to the usefulness of its business-focused features. If ease of use and predictability matter most, Wise’s reviews may feel more reassuring. If your business needs features built for ongoing operations, Airwallex’s feedback remains relevant.

Best Airwallex and Wise Singapore Alternatives

If Airwallex and Wise are not the right fit for your company, here are some alternatives to consider instead:

1st Choice

Multi-currency business account supporting 11 currencies with FX fees as low as 0.1%

2nd

Business account that comes with expense management tools

3rd

Business account with a good rate for high-value transfers

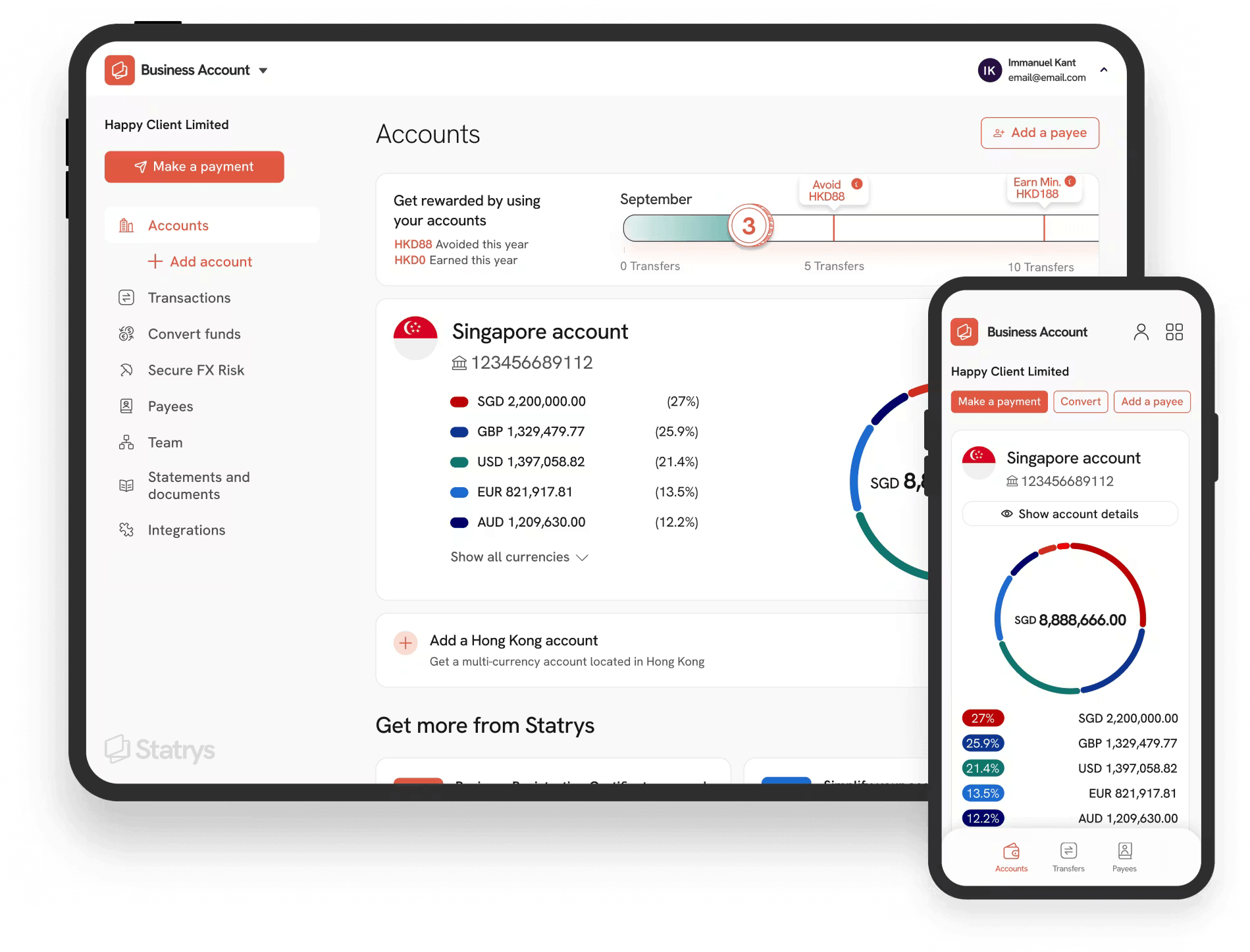

Why Statrys?

If you are an SME making international payments regularly, Statrys is a strong option. A Statrys business account lets you hold and manage 11 major currencies, with FX fees starting from 0.1%, helping reduce conversion costs over time. You also get access to a dedicated account manager who understands your business and can support you when issues arise with payments or your account.

For businesses that value real human support when managing their finances, Statrys is the better choice.

Read more:

FAQs

Is Airwallex comparable to Wise?

Yes, Airwallex and Wise both offer business accounts with features tailored to cross-border business needs. They both offer some similar features, such as multicurrency capability, business debit cards, a 0% fee for foreign transactions (though both have conversion fees applied.), and so on. However, they differ in details; for example, Airwallex advertises a more streamlined process for marketplace integration but lacks access to ATMs. Wise is more well-known to be a convenient choice for frequent business travellers.

Which is better, Wise or Airwallex?

How are the business cards from Airwallex and Wise different?

Disclaimer

Statrys competes directly with Airwallex and Wise in the payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.