Revolut or Wise? These two names keep coming up as alternatives to traditional options. But what works well for one may not work for you.

This comparison breaks down how each platform differs across fees, features, cards, and support, so you can decide which one actually makes sense for your business.

So let’s get started.

Disclaimer: The information in this article is accurate as of 6 January 2026. Please note that these details are subject to change. We recommend checking with Wise and Revolut for the latest information.

Quick Take: Which One You Should Use?

Choose Revolut if:

✔️ You run an online business and want customers to pay directly on your site, not just invoices or payment links.

✔️ You rely heavily on cards for spending or managing team expenses, with the need for higher limits and many virtual cards.

Choose Wise if:

✔️ You need a simple way to send and receive money internationally.

✔️ You prefer usage-based fees rather than managing a paid plan.

✔️ You value having access to local phone support in Singapore.

If your business is growing into more complex payments and spending workflows, Revolut tends to be a better fit. If you simply need a tool to manage cross-border payments, Wise might fit your needs better.

Business Account Features Comparison

| Features | Revolut | Wise |

|---|---|---|

| Hold currencies | 30+ currencies, including GBP, EUR, USD, ZAR, TRY, HKD, and SGD | 55+ currencies, including GBP, AUD, CAD, EUR, HKD, HUF, MYR, NZD, PHP, and RON |

| Send money | To 150+ countries | To 140+ countries |

| Local account details | SGD | 9 currencies, including AUD, CAD, EUR, GBP, HUF, MYR, NZD, PHP, RON, SGD, TRY, and USD |

| Payment acceptance tools | Payment links, invoices, and a payment gateway | Payment links and invoices |

| Batch payments | ✔️ Up to 1,000 payees | ✔️ Up to 1,000 payees |

| Advanced FX tools (e.g. forward contracts) |

❌ | ❌ |

| Integrations | Xero, QuickBooks, FreeAgent, Shopify, WooCommerce, and more | Xero, QuickBooks, FreeAgent, Odoo, and more |

Wise focuses on moving money across borders, with multiple local account details, which work well for businesses that primarily need to send and receive low-cost international payments. Revolut offers similar core transfer features but adds more flexibility by including a payment gateway, allowing customers to pay directly on your website or app, not just through invoices or links.

This matters if you sell online and handle higher payment volumes, as a checkout-style payment flow reduces manual steps and makes it easier to collect payments as your business grows. Therefore, the choice comes down to whether you want a simple way to manage international cash flow or a more versatile setup that supports your growth.

Business Account Fees Comparison

| Fees | Revolut | Wise |

|---|---|---|

| Account opening fee | Free | Free to open, SGD 99 to access all features |

| Monthly account fee |

Depends on the account plan: Company Basic: Free Grow: From SGD 15 Scale: From SGD 84 Enterprise: SGD 417 |

Free |

| Receive local payments |

SGD 0.20 outside of each plan’s allowance Fee free for all inbound transfers in EUR, GBP, USD, and CHF |

Free |

| Send local payments | SGD 0.20 outside of each plan’s allowance |

Within Singapore: Free To other countries: Starting from 0.26% |

| Receive international payments (SWIFT) |

SGD 8 per transaction outside of each plan’s allowance Fee free for all inbound transfers in EUR, GBP, USD, and CHF |

Depends on currency: USD: 6.11 per payment GBP: 2.16 per payment EUR: 2.39 per payment For other currencies, refer to Wise’s FAQ |

| Send international payments (SWIFT) | SGD 8 per transaction outside of each plan’s allowance |

Varies by amount, payment method, and exchange rate. Final price shown before transfer |

| FX fee |

0.6% for FX over allowance 1% outside market hours Exchange rate based on the interbank rate |

Starting from 0.26%, based on the mid market exchange rate |

Wise uses pay-as-you-go pricing, with the total cost shown before you confirm each transfer. This suits businesses with variable transfer volumes, as there is no monthly fee or allowance to manage. Revolut is better suited for businesses with higher and more consistent payment volumes, where a paid plan can help lower per-transaction costs.

Cards Features and Fees Comparison

| Card features | Revolut | Wise |

|---|---|---|

| Card type | Physical and virtual business debit cards issued on Mastercard® | Physical and virtual business debit cards issued on either Visa or Mastercard® |

| Card base currency | 34 currencies | 25+ currencies |

| Number of cards | 3 physical cards and up to 200 virtual cards per team member | 1 physical card per account holder and up to 3 virtual cards per user |

| Payment limit | Up to GBP 5 million or equivalent per month | Up to SGD 100,000 over 12 months |

| ATM withdrawal limit |

GBP 3,000 or equivalent per day Revolut cards work with ATMs outside Singapore only |

Included in the payment limit |

| ATM withdrawal fee | 2% per transaction |

Up to 2 free withdrawals within the allowance, then fees apply Example: 0.5 GBP + 1.75% over the limit |

| Apple Pay and Google Pay | ✔️ | ✔️ |

If cards are a big part of how you pay for tools, ads, or suppliers, Revolut is a better fit for teams with higher spending needs. Wise is a better option if cards are mainly for smaller, occasional expenses, especially for founders or lean teams.

Application Process Comparison

| Eligibility & application | Revolut | Wise |

|---|---|---|

| Who can apply? |

Standard incorporated entities such as sole proprietorships, LLCs, and LLPs registered in Singapore Applicants must live in supported countries, including Singapore, Australia, the US, the UK, the EEA, or Switzerland |

Standard incorporated entities registered in 70+ countries, including Singapore, Hong Kong, China, the US, the UK, and Australia |

| 100% online application | ✔️ | ✔️ |

| Approval time | Depends on the complexity of your application | Within 3 business days |

Wise offers more flexibility around applicant nationality and company setup. This can make Wise a better fit for companies with international shareholders or directors. Wise also sets clearer expectations on approval timelines, which provide founders with a clearer sense of when they can access their accounts and can plan operations accordingly.

Customer Support Comparison

| Customer support | Revolut | Wise |

|---|---|---|

| Dedicated account manager | ❌ | ❌ |

| Communication channels |

Help centre in 30+ languages Email and in app chat in 100+ languages |

Help centre for all users Email, phone, and in app chat for Wise Business account holders |

| Singapore phone line |

❌ No phone number to call customer support. Automated phone line to block cards: +44 203 322 8352 |

✅ +65 313 51147 for Wise Business clients Additional carrier charges may apply |

| Working hours | 24/7 in app chat | 24/7 including phone support |

The availability of a Singapore phone line gives Wise’s customer support a slight edge for local businesses that need quicker resolution. If you value being able to speak to someone directly when needed, Wise is likely the better choice.

Revolut, by comparison, may be better suited for companies that have predictable payment flows or are comfortable handling support matters solely through digital channels.

User Reviews & Ratings

| Ratings and reviews | Revolut | Wise |

|---|---|---|

| Trustpilot score | 4.6/5 based on 336,000 reviews | 4.3/5 based on 277,000 reviews |

| Common praise | Easy to use app, wide multi currency support, and reliable transfers | User friendly app, fair foreign exchange rates, and reliable transfers |

| Common complaints | Fees and limits are not always clear | Mixed reviews on customer service quality |

Both platforms are well-rated overall, suggesting they are reliable for international payments. Reviews point to different strengths rather than a clear winner.

Revolut is often praised for its app experience and range of features, which may suit businesses that rely heavily on day-to-day app usage. Wise’s reviews more frequently highlight fair exchange rates and consistency, which may appeal to businesses that prioritise predictable pricing over additional features.

Best Revolut and Wise Singapore Alternatives

If Revolut and Wise are not the right fit for your company, here are some alternatives to consider instead:

1st Choice

Multi-currency business account supporting 11 currencies with FX fees as low as 0.1%

2nd

Business account that comes with expense management tools

3rd

Business account with a good rate for high-value transfers

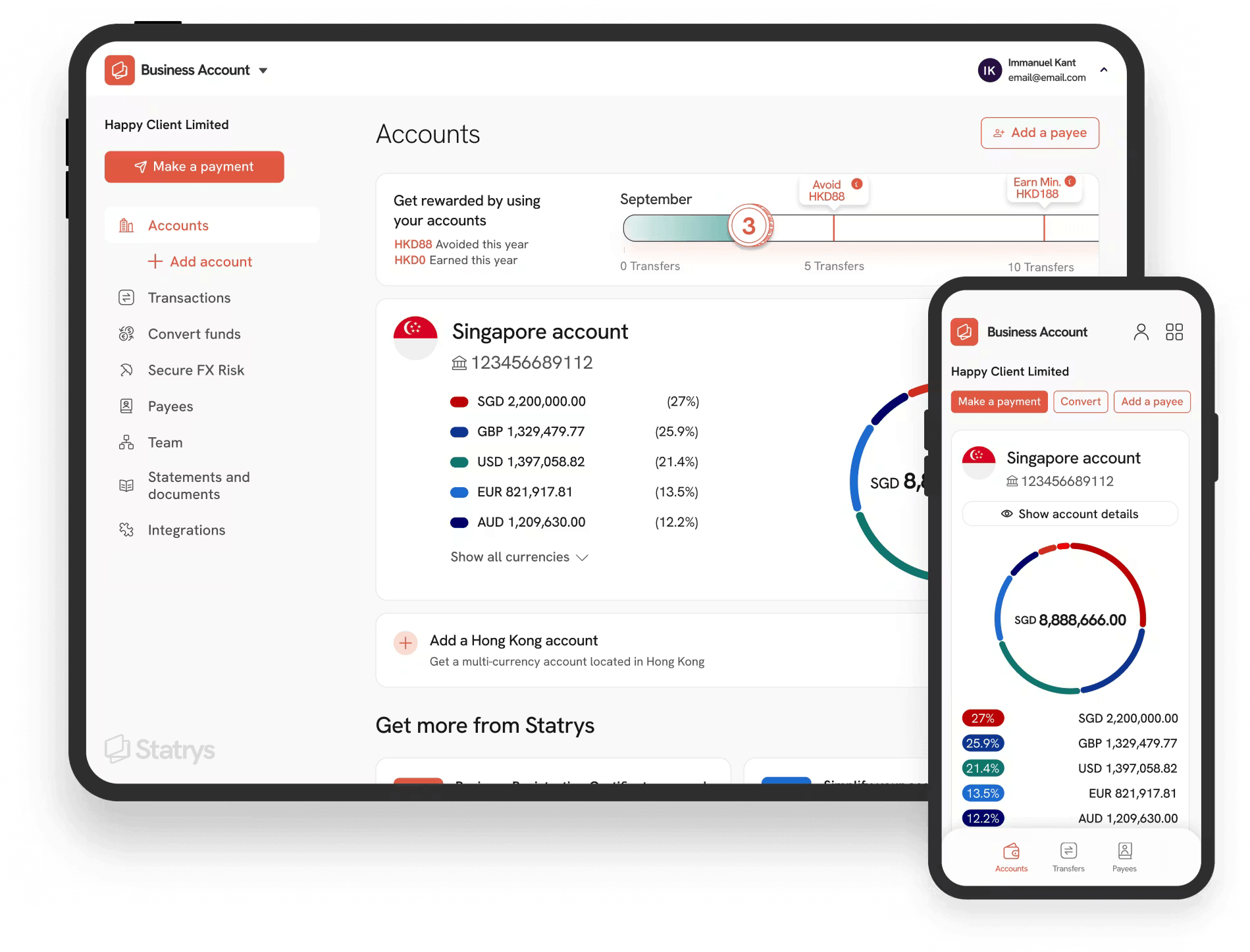

Why Statrys?

For SMEs in Singapore, Statrys offers a multi-currency account supporting 11 currencies, with FX markups as low as 0.1% and low-cost transfers in major currencies, including SGD, USD, EUR, and GBP.

More importantly, you're never alone in managing your account. When you need help with your account or payments, your dedicated account manager is available via phone, WhatsApp, and WeChat. Real human, no template replies.

If you value clear pricing with no hidden fees and direct human support, Statrys is built for you.

Read more:

Was this article helpful?

Yes

No

FAQs

Which is better, Wise or Revolut?

It depends on how your business operates. Wise is better suited for SMEs that mainly need a simple, pay-as-you-go way to send and receive money internationally, especially if the business has international shareholders or directors. Revolut is a stronger fit for SMEs with more complex needs, such as accepting payments directly through an online checkout and managing higher card spending.

Are Revolut and Wise safe to use in Singapore?

How are the business cards from Revolut and Wise different?

Which one offers better exchange rates and fees?

Disclaimer

Statrys competes directly with Revolut and Wise in the payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.