Features

Fees

Account Opening

User Reviews

Founded in 2019, Volopay is an expense management platform that brings company cards, expenses, bill payments, and basic accounting tools into one system. It was created to offer businesses a faster and more organised way to manage business spending, especially in areas where traditional reimbursement processes tend to slow teams down.

Today, the platform is used by companies across Southeast Asia and the wider APAC region.

In this review, we’ll break down Volopay’s features, fees, account opening process, and feedback from real users to help you decide if it fits your business needs.

Volopay has a “Pricing” page, but it doesn’t show the actual fees. Instead, they show statements like “No hidden fees”, along with an overview of features like virtual cards, multi-currency wallets, and accounting integrations.

It sounds quite contradictory to say “No hidden fees” but have a pricing page that doesn’t display any fees.

If you’re comparing providers or planning your budget, this lack of detail can make things harder. You don’t know the FX markup, the real cost of international transfers, or what you might pay once your team starts using cards regularly. And these are the kinds of fees that directly affect your monthly spend, so not seeing them upfront makes evaluation harder.

To get the full picture, you’ll need to speak with their sales team first. In practice, this can mean waiting several days for information that many other providers publish openly, which slows you down if you prefer to compare pricing on your own before booking a call.

Important: You’ll need to submit your company details through Volopay’s website or support chat to initiate the pricing discussion with their sales team.

Volopay Features

Volopay offers products that are tailored for startups and SMEs in Singapore to manage their finance more efficiently.

Business Account

Volopay’s business account is built for operational payments. In Singapore, you can hold and transact in major currencies such as SGD, USD, GBP, EUR and AUD, and send cross-border transfers to more than 180 countries. This is helpful if your business pays overseas suppliers or receives client payments in different markets, since it reduces forced currency conversion. Payroll, reimbursements and vendor payments can also run from the same dashboard, which is a practical improvement over constantly switching between platforms.

However, this is not a full banking service. You do not get savings products, trade finance services or more advanced FX tools, so you still need to find another service if your company requires those capabilities.

Note: Client funds are safeguarded in a trust account held by DBS Singapore.

Corporate Cards

Volopay provides virtual and physical Visa debit cards that help businesses separate and control spending. You can create multiple virtual cards and assign them to employees or specific subscriptions, which reduces the risk of shared-card misuse and makes it easier to see which costs belong to which activity.

For example, a team member handling ad campaigns can use a dedicated card for Meta or Google Ads, while departments managing software tools can each have their own subscription card to prevent unexpected renewals.

The ability to set limits and monitor transactions in real-time is useful for teams that want clearer oversight of everyday expenses without relying on a single company card.

Expense Management

Volopay’s expense management system focuses on giving businesses clearer oversight of everyday spending. Instead of scattered spreadsheets or informal email approvals, all requests move through one platform, where managers can review payments and confirm that each expense is properly documented before it goes through. This adds a layer of security by ensuring every transaction is checked by the right person.

Employees can upload a receipt immediately after a purchase, which keeps records accurate and reduces the risk of missing paperwork later. If something is unclear, approvers can ask questions directly within the same workflow, keeping the full conversation tied to the expense itself.

Once connected to accounting tools like Xero or QuickBooks, expenses sync automatically into the ledger. This cuts down on manual entry and gives finance teams a more up-to-date view of spending as it happens, rather than waiting until the end of the month to piece things together.

Volopay Business Account Opening

You can initiate your application online, but you must go through a demo presentation to complete the process.

To apply for a Volopay account, you’ll need to visit Volopay’s website and click "Sign up". Afterwards, you’ll be prompted to provide your basic information, including full name, work email, phone number, and company name. Then, book a 30-minute demo with a sales representative, who will walk you through the platform and answer your questions about setup and features.

While Volopay claims that the account opening process is simple, there is no public information on how long it takes to fully open a business account.

Who Can Apply?

Individuals and business owners aged 18 or older who plan to use the account for professional purposes can open a Volopay account.

Note: Volopay doesn’t provide a list of eligible countries. If your business is registered outside Singapore, it’s best to contact the Volopay team for more details.

Required Documents

You will need to prepare and submit the following documents:

- ACRA business registration document

- ID of the person opening the account

- Proof of address (POA) for the designated point of contact (POC)

Volopay may request additional documents depending on your business structure.

Volopay from Real Users

Before wrapping up, it is useful to look at what actual users say. Volopay is rated a 4.3 out of 5 on G2, based on 104 reviews. The feedback shows a generally positive experience, but also highlights areas where the platform may not fit every business.

Many reviewers say the platform is also described as easy to navigate, with simple approval flows and straightforward controls for both virtual and physical cards. Users who work with tools like Xero and NetSuite also mention that the integrations help reduce manual work during month-end. Card management stands out too, especially for teams that manage online subscriptions or small day-to-day expenses.

Some users report that virtual cards occasionally fail when paying certain online merchants. Others note that they still need to do some manual steps for bill payments or receipt uploads, even after connecting their accounting software. A few reviewers also felt that international fees were higher than they expected.

The reviews suggest that Volopay is reliable for daily spending and basic expense tracking, especially for small teams that want simple tools and easy integrations. However, if your business depends heavily on cards or makes frequent overseas payments, it is worth paying attention to these user concerns before moving all your payments to the platform.

Best Volopay Alternatives

If Volopay is not the right fit for your company, here are some alternatives to consider instead:

1st Choice

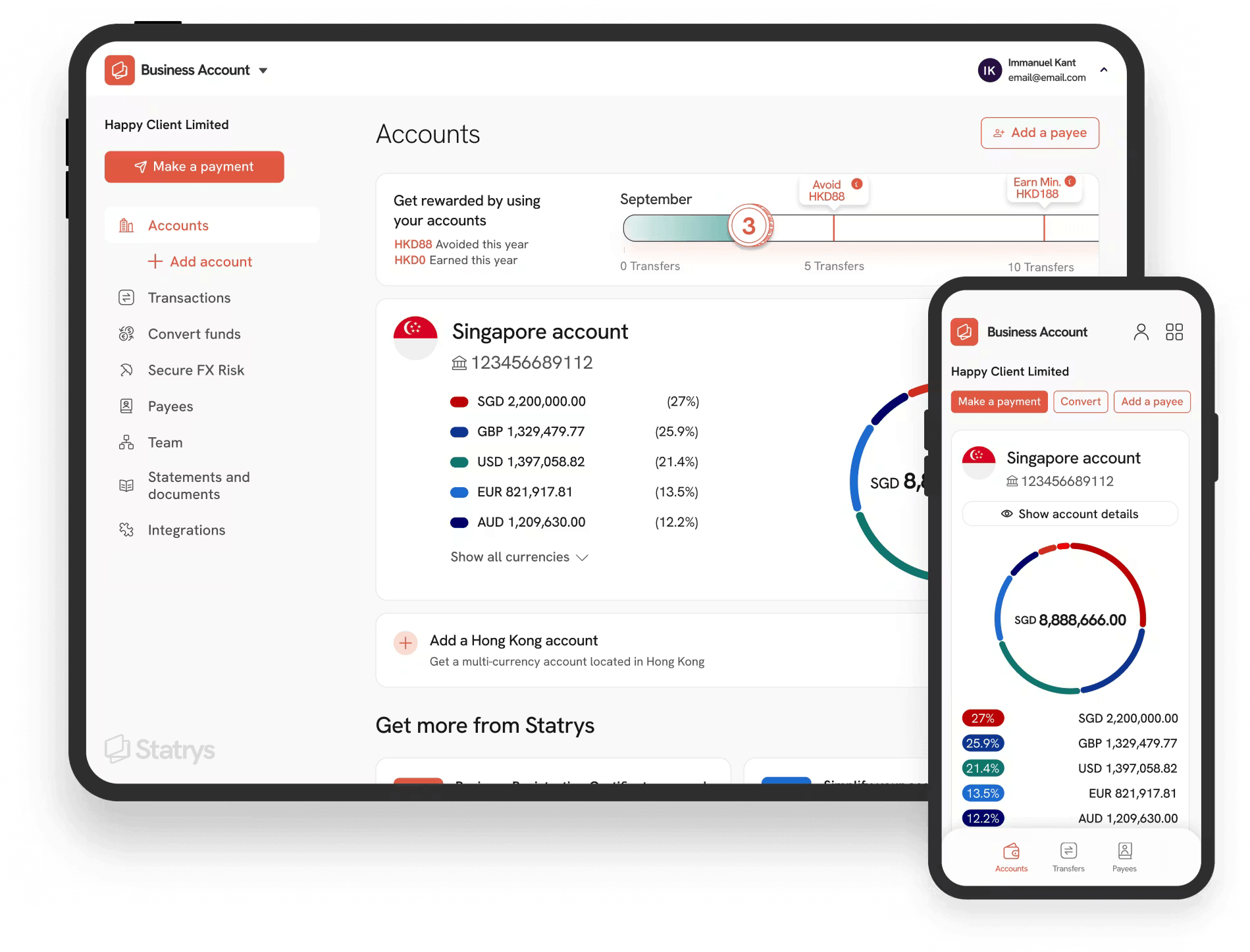

Multi-currency business account supporting 11 major currencies with FX fees as low as 0.1%

2nd

Airwallex

Multi-currency business accounts with extensive expense management tools.

3rd

OCBC

Business account from a traditional provider with business loans and trading services.

Why Statrys?

Statrys is a better choice for SMEs that value clarity and human support. While Volopay claims to offer business accounts with competitive fees and rates, you still need to contact their team to understand the full pricing details before making an informed decision.

Our approach is different. We clearly outline on the website what you get and how much it costs. You also have direct access to a dedicated account manager via channels such as phone and WhatsApp, so you will get the support you need from a real person.

Was this article helpful?

Yes

No

FAQs

What countries is Volopay available in?

Volopay operates in Singapore, Australia, India, Indonesia, and the Philippines. Additionally, it facilitates international money transfers to over 130 countries using both SWIFT and non-SWIFT payment methods.

What does Volopay do?

Is Volopay safe to use?

Is Volopay a credit card?

Disclaimer

Statrys competes directly with Volopay in the Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.