OFX is a popular service provider that allows businesses to send money overseas at lower costs than traditional banks. But if you’re already using it, or comparing it with other providers, you may have run into some limits. OFX is strong on international transfers and FX, but it doesn’t fully replace a business account if you want to hold balances in multiple currencies, issue cards, or manage day-to-day team spending.

In this guide, we’ve shortlisted 5 practical OFX alternatives for 2026. Each one takes a different approach to solving the gaps many businesses hit with OFX, whether that’s multi-currency accounts, local receiving details, marketplace payouts, or better tools for controlling costs.

Whether you’re paying overseas suppliers, running an SME that’s outgrown simple transfers, or looking for clearer fees and more automation, you’ll find realistic options here.

We’ll start with three quick picks, then dive into each provider in more detail: what they offer, who they’re best for, and where they fall short so you can choose based on how your business actually operates.

Our Top Picks

1st Choice

Multi-currency business account with 11 major currencies, online onboarding & low FX fees.

2nd

Multi-currency business accounts with debit cards and an extensive payment network.

3rd

Business accounts with local account details and expense management tools.

Why trust us?

This shortlist is built to help you choose the alternative that genuinely fits your use case, even if that is not Statrys. Onboarding the wrong client increases costs for both sides, so our incentive is to be precise, not promotional.

We compare providers using consistent criteria across pricing and FX, transfer speed, coverage, features, and support, and we base claims on public documentation and corroborated user feedback.

Last reviewed: 20 November 2025.

How We Evaluated These Alternatives

We focused on payment and business-account platforms that are available to Singapore-based freelancers, startups, and SMEs using or considering OFX. Invite-only, enterprise-only, region-restricted, or unsupported-in-SG products were excluded, so the comparison reflects practical choices.

📌 How We Evaluated Each Provider

If a feature or fee is critical to you, confirm it on the provider’s site, then use the sections below to weigh the trade-offs.

1

Statrys

Trustpilot Score: 4.5 (360 reviews)

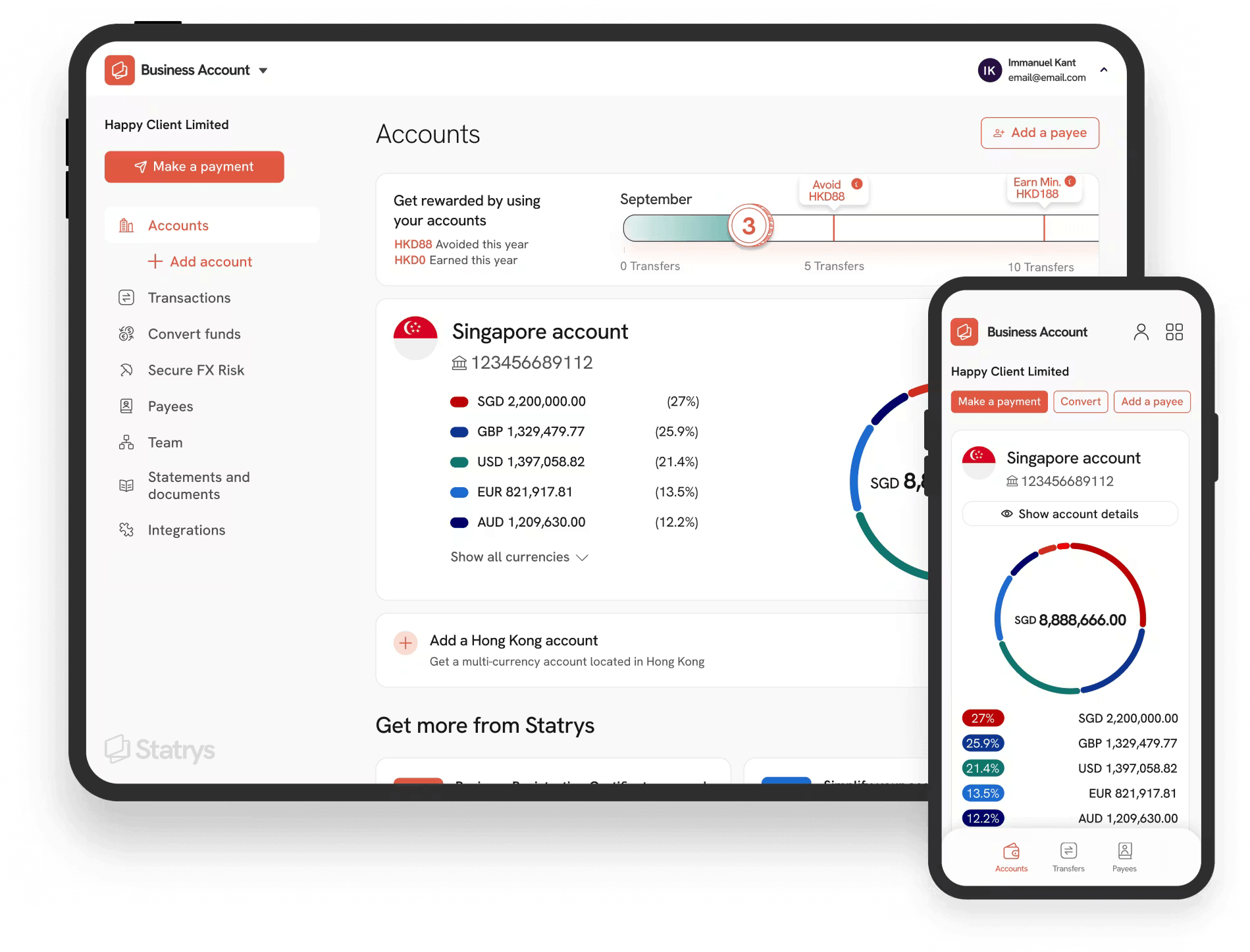

Founded in 2020, Statrys helps SMEs manage their finances with a multi-currency business account designed for international payments. Companies incorporated in Hong Kong, Singapore, and the British Virgin Islands (BVI) can send and receive payments across borders while keeping full visibility on FX costs and transfers.

Every account comes with a dedicated account manager, who can be reached via phone, WeChat, WhatsApp and more when you need help with accounts and payments.

Considering Statrys? See our step-by-step guide on how to open a Statrys business account .

2

Wise

Trustpilot Score: 4.3 (275,000+ reviews)

Founded in 2011, Wise is a London-based fintech known for simplifying global payments for individuals and small businesses. Its business account gives users access to local bank details in over 20 currencies, combined with low-cost international transfers and transparent FX pricing.

Unlike OFX, Wise includes automation tools like batch payments and accounting integrations, making it well-suited for freelancers, startups, and SMEs managing payments across multiple currencies, without relying on traditional banking infrastructure.

Comparing Wise and OFX? See our full breakdown of Wise vs OFX for side-by-side analysis.

3

Airwallex

Trustpilot Score: 3.6 (2,157 reviews)

Airwallex is designed for businesses that need a faster and more centralised way to manage money across borders. For companies that have moved beyond basic payment tools and now require more automation, wider currency support, or smoother international operations, it offers a consolidated platform to handle these needs.

Founded in 2015, the platform now serves businesses in more than 50 countries. With features such as batch transfers, local account details in 20+ currencies, and ecommerce integrations, Airwallex is a practical option for companies with distributed teams or international customers.

Interested in a deeper dive? Read our Airwallex Business Account Review for insights on features, availability, and account setup.

4

WorldFirst

Trustpilot Score: 3.7 (3,057 reviews)

Launched in 2004, WorldFirst is a UK-based payment provider geared toward ecommerce businesses. Its platform is designed to help sellers collect payments from global marketplaces like Amazon and Shopify, convert currencies at competitive rates, and send funds to suppliers in over 200 countries.

Where OFX leans toward FX-focused transfers, WorldFirst is better suited for merchants handling regular marketplace payouts. With no monthly fees, access to local collection accounts, and a business card for global spending, it offers a straightforward solution for managing revenue across regions.

Tip: See our WorldFirst Business Account Review for insights on features, usability, and whether it fits your business needs.

5

Payoneer

Trustpilot Score: 3.6 (2,100+ reviews)

Founded in 2005, Payoneer is designed for freelancers, ecommerce sellers, and small businesses collecting international payments, especially from platforms like Amazon, Fiverr, or Upwork. With local account details in multiple major currencies and integrations with 2,000+ platforms, it’s a flexible choice for managing cross-border income without needing a full business setup.

The account is easy to open online and supports batch payments, payment requests, and global card spending. However, some features, like card availability or payout options, vary by region. Fees can also add up for lower-volume users, and customer support is limited unless you're logged in.

We’ve reviewed Payoneer in full. Check out the breakdown of features, fees, and support to help you decide if it’s the right fit.

Final Note

Picking the right OFX alternative depends on what your business needs most. Some services focus on cheaper transfers, others offer multi-currency accounts, marketplace payouts, or better ways to manage team spending. The best choice is the one that makes your payments easier and keeps your costs clear.

As you compare providers, look at the features you use every day, the currencies you need, the fees, payout options, cards, and the type of support available. Choose the option that fits how you work now and can still support you as your business grows.

FAQs

What are the best OFX alternatives?

The top OFX alternatives include Statrys, Wise, Airwallex, Payoneer, and WorldFirst. These providers offer features that OFX doesn’t, such as multi-currency accounts, local payment options, business cards, marketplace payouts, or clearer fees depending on your needs.

What services does OFX offer?

Can I have both OFX and Statrys accounts?

Is OFX better than TransferWise?

When should I consider switching from OFX to another provider?

Disclaimer

Statrys competes directly with OFX in the Hong Kong and Singapore payment industry. However, we're committed to providing an unbiased, thorough review to help you make an informed choice.