Features

Fees

Account Opening

User Reviews

ANEXT Bank is a digital wholesale bank in Singapore that started operations in 2022. It is licensed by the Monetary Authority of Singapore (MAS), and eligible SGD deposits are covered under the Singapore Deposit Insurance Corporation (SDIC) scheme.

The bank serves SMEs through a fully online business account with multi-currency support, daily interest on balances, and collateral-free business loans. It is designed for Singapore-registered businesses seeking a simple and low-cost digital banking option.

In this review, we examine ANEXT Bank’s business account in detail, covering its features, fees, account opening process, and suitability for different types of SMEs operating in Singapore.

ANEXT Bank Fees

ANEXT Bank removes many common costs that small businesses usually face. There are no account opening fees, no monthly charges, and no minimum balance requirement. This makes it suitable for startups and SMEs that want to open an account without worrying about ongoing fees.

For day-to-day use, ANEXT is very cost-friendly. Local transfers and batch payments are free, so businesses that mainly operate within Singapore can keep their banking expenses low.

Costs start to matter more when you send money overseas. ANEXT charges fixed fees for telegraphic transfers, which are easy to understand, but the bank doesn’t publish its FX margin. Without clear FX information, it is difficult to know the full cost of a cross-border payment before you send it. For companies that make frequent international transfers, this can lead to higher overall costs compared with providers that publish their FX rates openly.

This makes ANEXT a good choice for simple domestic business banking, but not the strongest fit for businesses with regular overseas payments.

Let’s look at the fees & charges for ANEXT’s business account services.

| Type | Fee |

|---|---|

| Minimum Initial Deposit | SGD 0 |

| Fall Below Fee | SGD 0 |

| Annual Account Fee | SGD 0 |

| Outward Telegraphic Transfer – BEN / SHA Charge Option |

SGD: SGD 15 USD: USD 10 CNH: CNH 125 EUR: EUR 10 |

| Outward Telegraphic Transfer – OUR Charge Option |

SGD: SGD 50 USD: USD 35 CNH: CNH 300 EUR: EUR 35 |

| Inward Telegraphic Transfers | SGD 0 |

| Local Transfers | SGD 0 |

| Batch Payment (up to 100 transactions) | SGD 0 |

| Account Statement (for closed accounts) | SGD 15 / USD 10 per statement |

For the full pricing structure, please refer to the Fee Schedule of ANEXT Bank.

ANEXT Bank Features

ANEXT Bank offers business banking services tailored to small businesses in Singapore. Below are the products of ANEXT Bank.

Business Bank Account

ANEXT Bank offers a simple virtual bank account that works well for SMEs. It supports SGD, USD, EUR, and CNH, and balances in SGD, USD, and EUR earn 1% daily interest, which benefits businesses that keep funds in the account. Any incoming payment in a currency the account doesn’t support is automatically converted to USD.

You can send local payments for free via FAST, GIRO, MEPS, and PayNow. For overseas transfers, ANEXT supports major currencies through SWIFT and shows conversion fees before you confirm your transfers. The account also has a daily transfer limit of SGD 1 million. Batch payments of up to 100 SGD transfers make tasks like payroll and supplier payouts easier.

The limitations become clearer when your business requires more than basic banking services. ANEXT doesn’t support cheques or GIRO direct debit, so you can’t accept cheque payments or collect recurring payments from customers. There are no accounting software integrations either, meaning bookkeeping needs to be handled manually or through another tool. On top of that, ANEXT doesn’t provide debit cards, which limits how employees can pay for expenses or manage day-to-day spending.

ANEXT is a good fit for SMEs that want a low-cost account for local payments and interest on balances. If your business needs advanced tools, automated collections, or employee spending options, you may find the account too limited.

Business Loans

ANEXT Bank provides collateral-free business loans for startups and SMEs. Loans of up to SGD 30,000 do not require additional documents beyond the standard application.

Borrowers can choose between two repayment methods: Pay-Per-Use or Pay Monthly. The loan includes a facility fee of 2% or SGD 200, whichever is higher.

Each loan is paired with an ANEXT Business Account, which earns daily interest and can be used to manage loan repayments. You can estimate loan terms and monthly repayments using the calculator on ANEXT Bank’s business loan page.

Fixed Deposit

ANEXT Bank offers fixed deposits in SGD, USD, and EUR. Minimum placement amounts are SGD 250,000, USD 5,000, or EUR 5,000. Businesses can place multiple fixed deposits as long as the total amount doesn’t exceed USD 5 million per currency. Tenure options include 1, 3, 6, 9, and 12 months, giving businesses a range of short- to medium-term choices.

ANEXT Business Account Opening

The ANEXT Bank application process is completely online and can be completed within a few minutes, as long as your business has a Corppass account.

To begin, visit the ANEXT Bank registration page to start your application.

You will then need to log in with Singpass, either by scanning the QR code in the Singpass app or using your Singpass credentials as a Corppass user. This step allows ANEXT to retrieve your business information through Myinfo Business.

Once the application is submitted, directors, partners, owners, and authorised operators will receive a link via SMS and email to complete their identity verification. After all parties have authenticated, the designated approver must authorise the application.

Some accounts may be approved on the same day, while others may require additional information and take up to 14 business days to process.

Who Can Apply?

You can apply for an ANEXT Business Account if your company is incorporated in Singapore as a:

- Sole Proprietorship

- Partnership

- Limited Partnership

- Limited Liability Partnership

- Private Limited Company

Required Documents

ANEXT’s document requirements depend on the business’s ownership structure.

For companies with corporate shareholders:

- Ownership chart with all direct and indirect shareholders, including details for Ultimate Beneficial Owner (UBO) holding 25% or more.

- Certified true copy (CTC) of the Certificate of Incumbency or Certificate of Good Standing (issued within 6 months).

- CTC of the Register of Directors.

- CTC of the Register of Members.

- Company registry extract showing shareholders and directors.

Certified true copies must be wet-ink certified by a qualified professional, such as a Notary Public, Chartered Accountant, or external legal counsel.

For companies with foreign business owners:

- Certificate of incorporation of the foreign entity.

- The latest 3 months of bank statements as proof of the source of funds.

- 2 sets of customer invoices with the corresponding Bill of Lading or Airway Bill.

- Details of the top 3 buyers each month and the nature of the transactions.

For identity verification:

- Singapore Citizens, PRs, and valid Work Pass holders can authenticate using Singpass.

- Non-Singaporeans must provide a passport and a recent residential address document. Chinese and Malaysian nationals may use their identity card as proof of address.

- All applicants must complete facial verification using a mobile device.

ANEXT Bank from Real Users

ANEXT Bank currently has a 3.6 out of 5 rating based on 49 Google reviews. This is a small number of reviews, and Google is the only independent platform where public feedback is available, so the comments give a general sense of user experience but may not reflect every situation.

Many users say the account opening process is quick, fully online, and convenient for small businesses. They also like the no minimum balance, free local transfers, and the simple interface. Several reviews mention helpful support staff who guided them through onboarding or account setup.

At the same time, a number of users share concerns. The most common issues include accounts being frozen or closed without a clear explanation, slow follow-up from support, and strict checks when moving money, especially for payroll or cross-border transfers. Some users also report delays with international payments, problems tracking funds, or requests for sensitive business information that they felt were excessive. However, these issues are not unique to ANEXT. Strict reviews and document requests are common across regulated financial institutions in Singapore.

Overall, user feedback suggests that ANEXT works well for SMEs in Singapore that mainly need a low-cost digital account for local payments.

Best ANEXT Bank Alternatives

If ANEXT Bank is not the right fit for your company, here are some alternatives to consider instead:

1st Choice

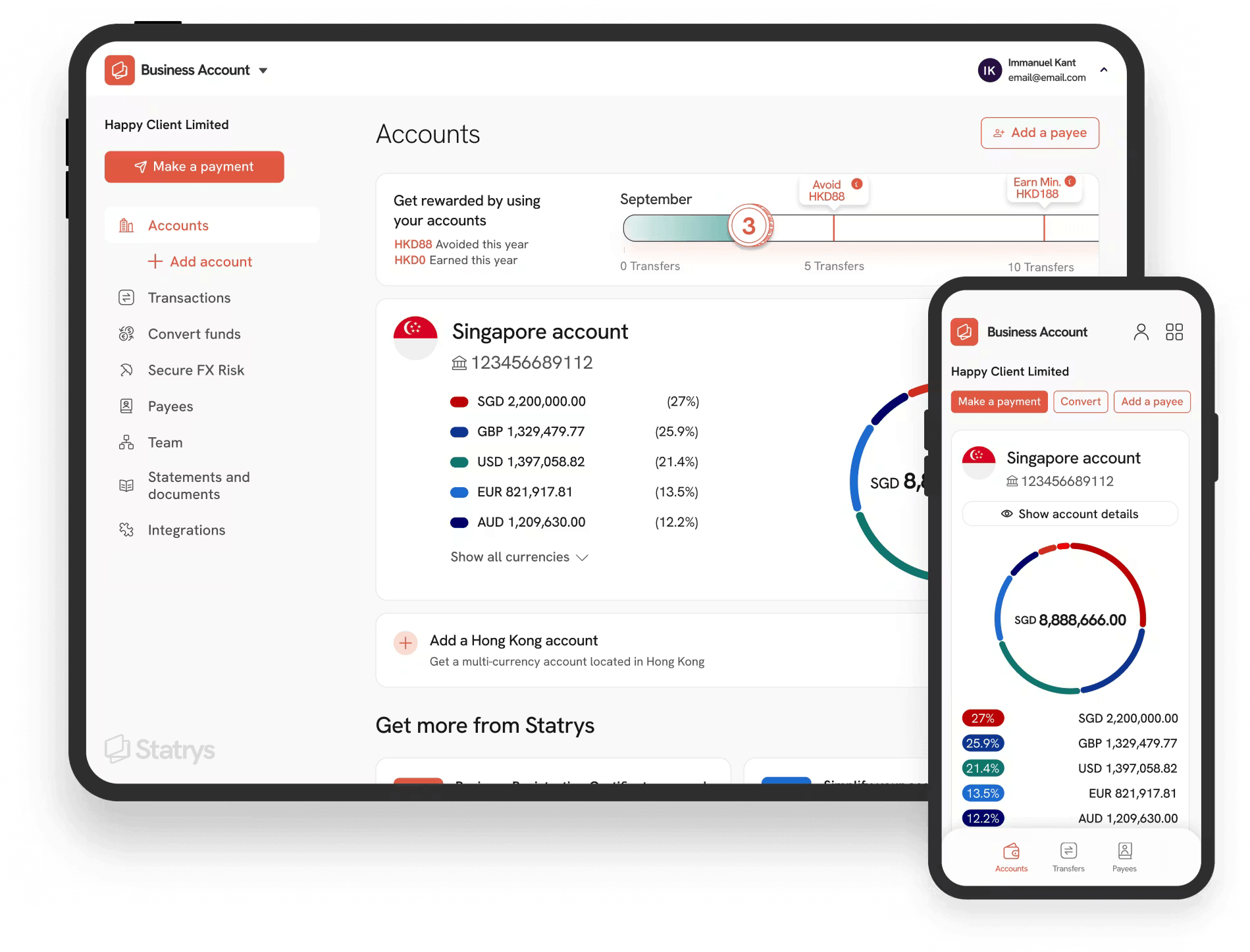

Multi-currency business account supporting 11 major currencies with FX fees as low as 0.1%

2nd

Multi-currency business account with an extensive payment network.

3rd

Multi-currency business account with expense management tools

Why Statrys?

If you need more than a basic local account, Statrys gives you features built for everyday international operations. You can receive, hold, and pay in 11 currencies without depending solely on SWIFT, and our FX fee starts from just 0.1%, helping you save more on international payments. You also get a dedicated account manager who understands your business and can assist you directly whenever you need support.

Was this article helpful?

Yes

No

FAQs

Is ANEXT Bank safe in Singapore?

Yes, ANEXT Bank is safe to use. It is a licensed digital wholesale bank regulated by the Monetary Authority of Singapore (MAS). Moreover, it employs advanced security measures, such as biometric verification and multi-factor authentication, to ensure the safety of its customers' accounts and transactions.

Who owns ANEXT Bank?

What is the minimum balance in Anext Bank?

What types of businesses can open an account with ANEXT Bank?

Disclaimer

Statrys competes directly with ANEXT Bank in the Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.