All gain, no pain

Hong Kong business account designed for your needs

Get your company a multi-currency business account in Hong Kong. Boost your payment options and competitive foreign exchange rates.

Recognised as Hong Kong Top 10 Fintech 2024.

Trusted by 5k+ Businesses

SME Payment Solutions of the Year 2023

Top 10 Fintech Startups in Hong Kong 2024

Best Payments Solution 2024

Best Cross-Border Fintech Payments Platform in Hong Kong 2025

Overview

You don't need a bank to run your business

Statrys is the modern alternative to traditional business accounts in Hong Kong.

Save time by making your application online

Save money when receiving, sending and converting funds

Save trouble with a dedicated account manager

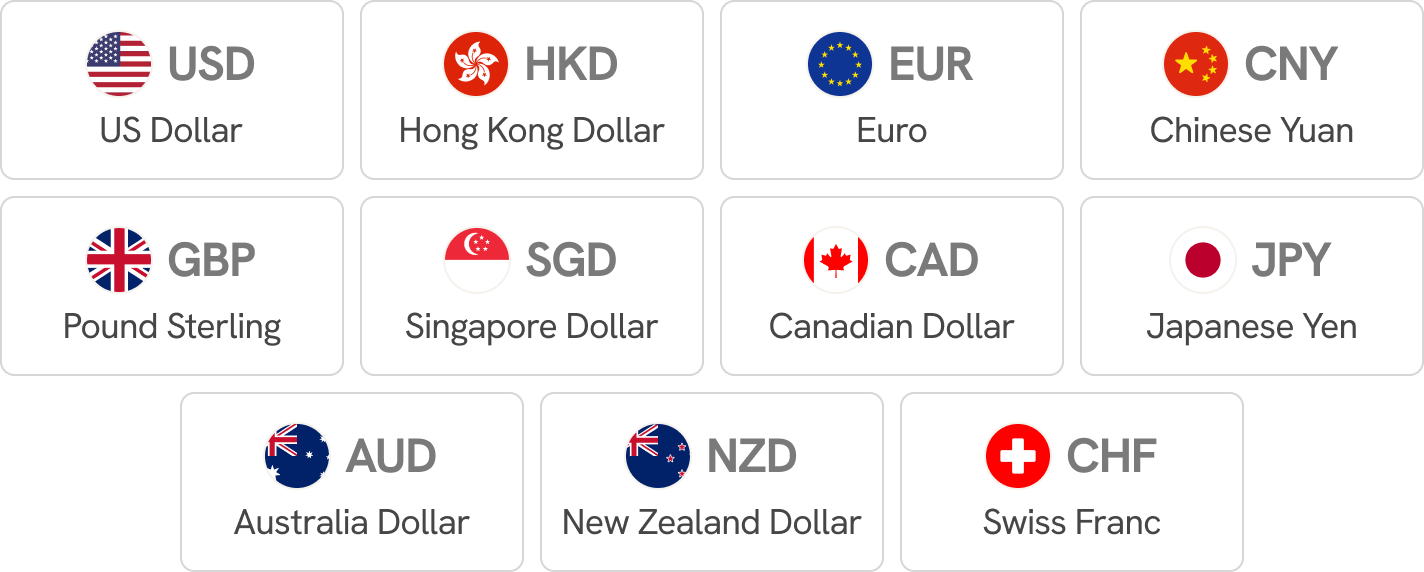

1 Account Number = 11 Currencies

Boost your business opportunities by receiving and making payments in all major currencies.

It's your decision if and when you want to do foreign exchange.

Spot orders at competitive FX rates.

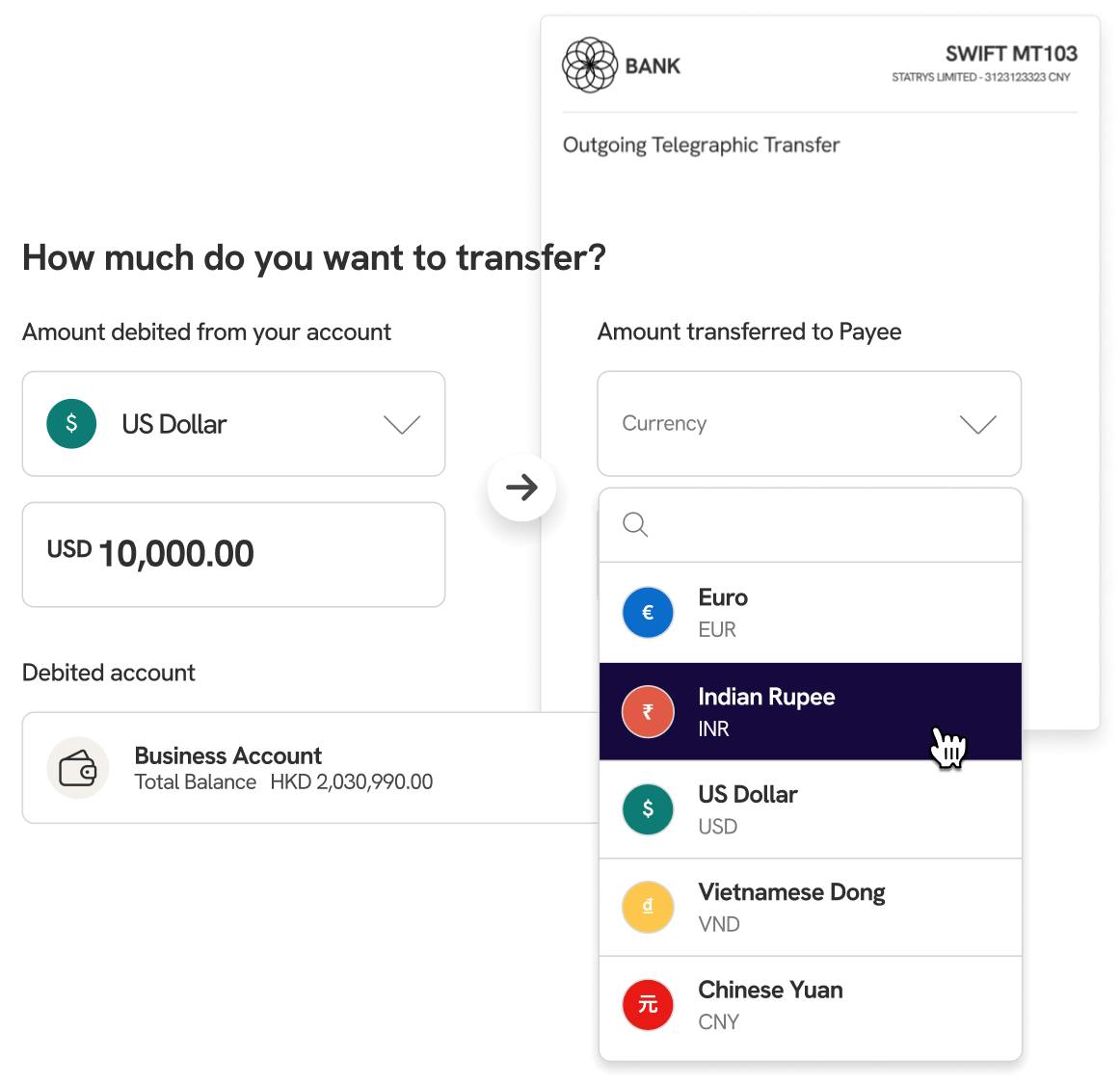

International and local payments alike

Transfer money anywhere

Make hassle-free international SWIFT payments to any country with our payment system. MT-103 available upon request.Convenient and fast local payments

Pay easily in local currency in just minutes through our partnership with local banks.Best FX rates

No matter the type of transfer, we offer you competitive rates that are close to mid-market rate, helping you save money in any transaction.

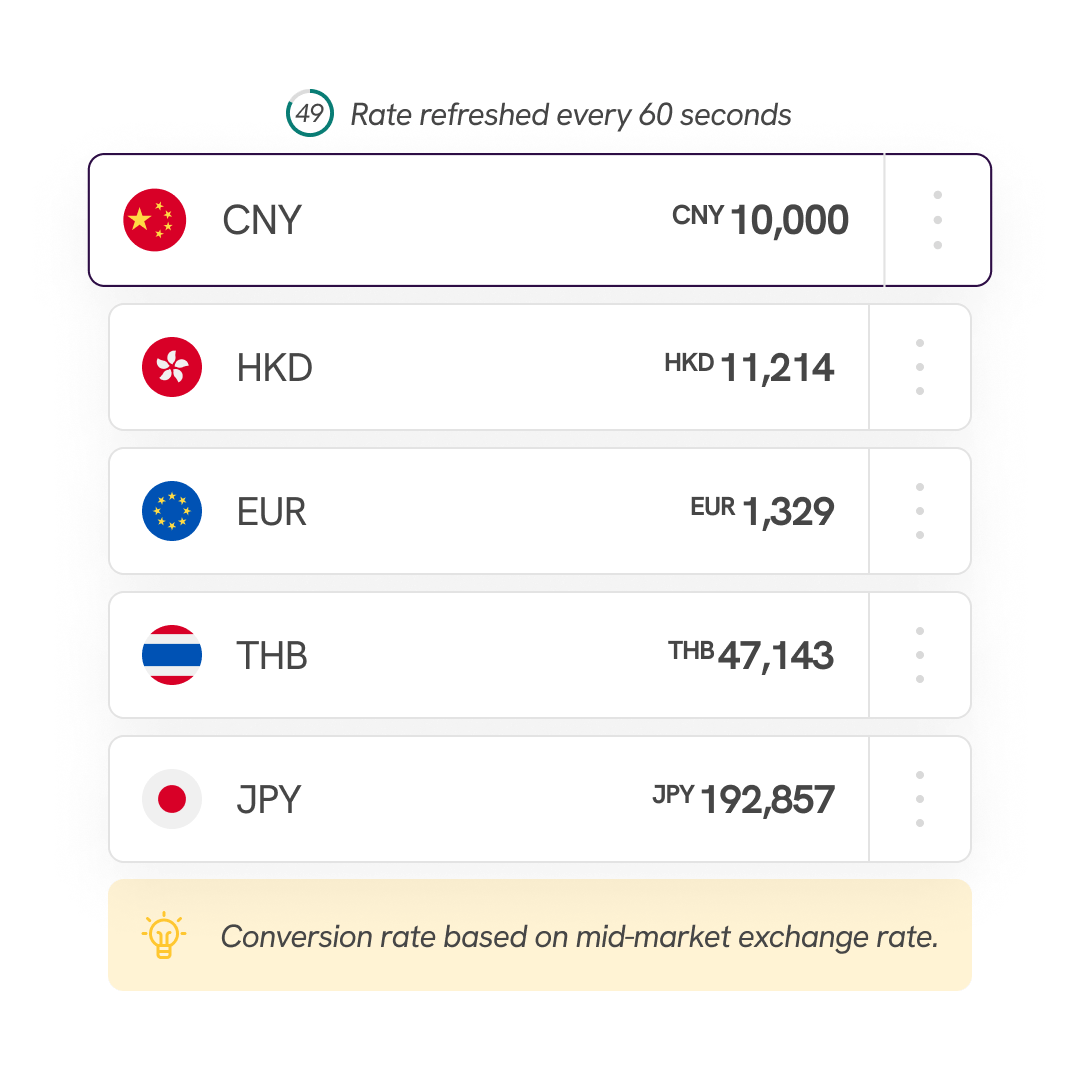

Foreign Exchange

Manage your FX risk and save money with a multi- currency business account tailored for you. If your business has specific foreign exchange needs, get the support of our forex expert relationship manager.

Get rates always based on real-time mid-market.

Make Spot FX transactions.

Enjoy FX fees starting from 0.1%.

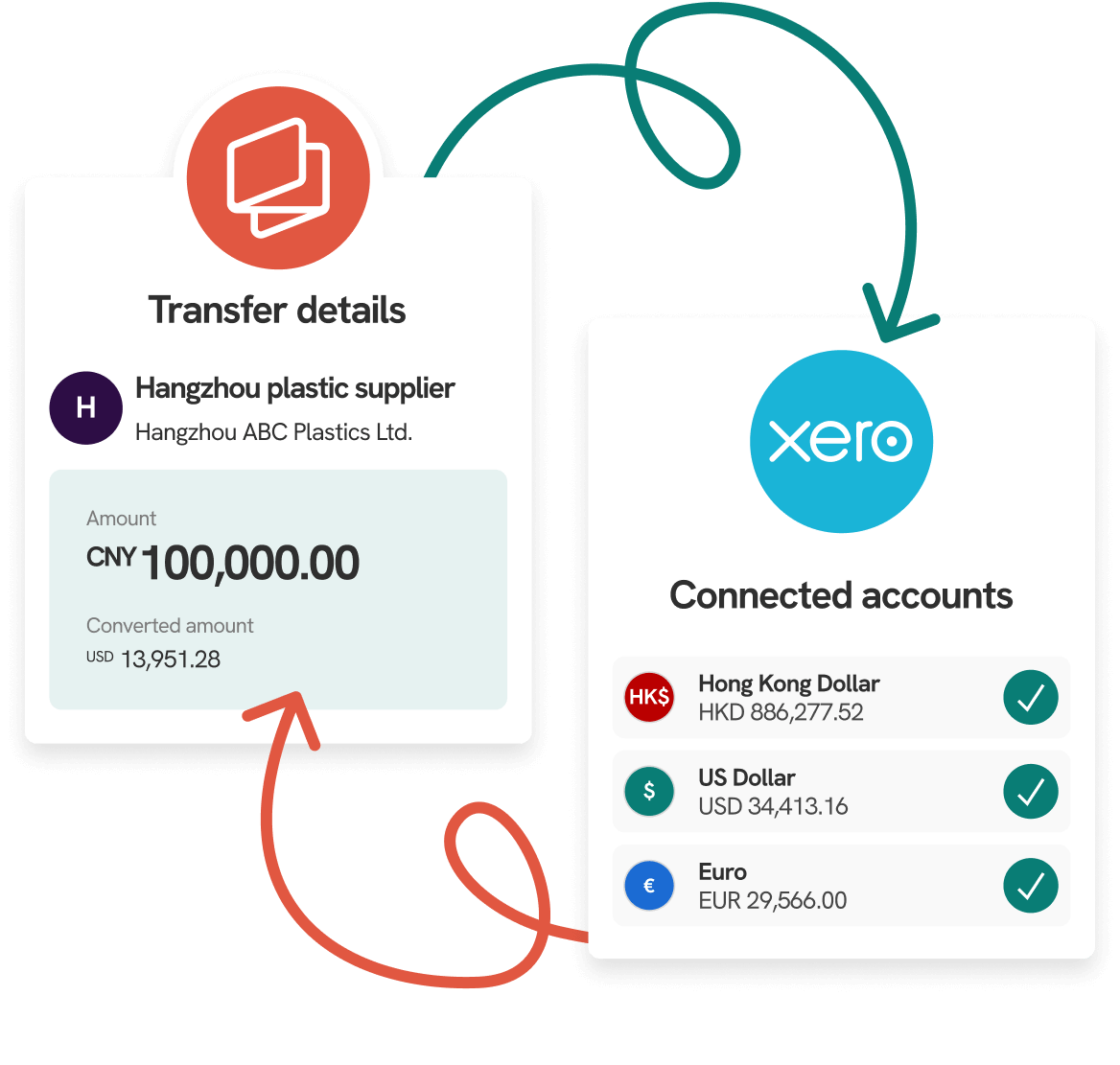

Seamless Xero integration

Automate accounting

Simplify your accounting process by automatically syncing transactions, eliminating manual data entry.Simplified reconciliation

Save time and reduce errors by quickly matching payments with invoices and keeping records updated.Multi-currency support

Track and manage transactions in multiple currencies providing you with a comprehensive view of your global finance.

Account Management

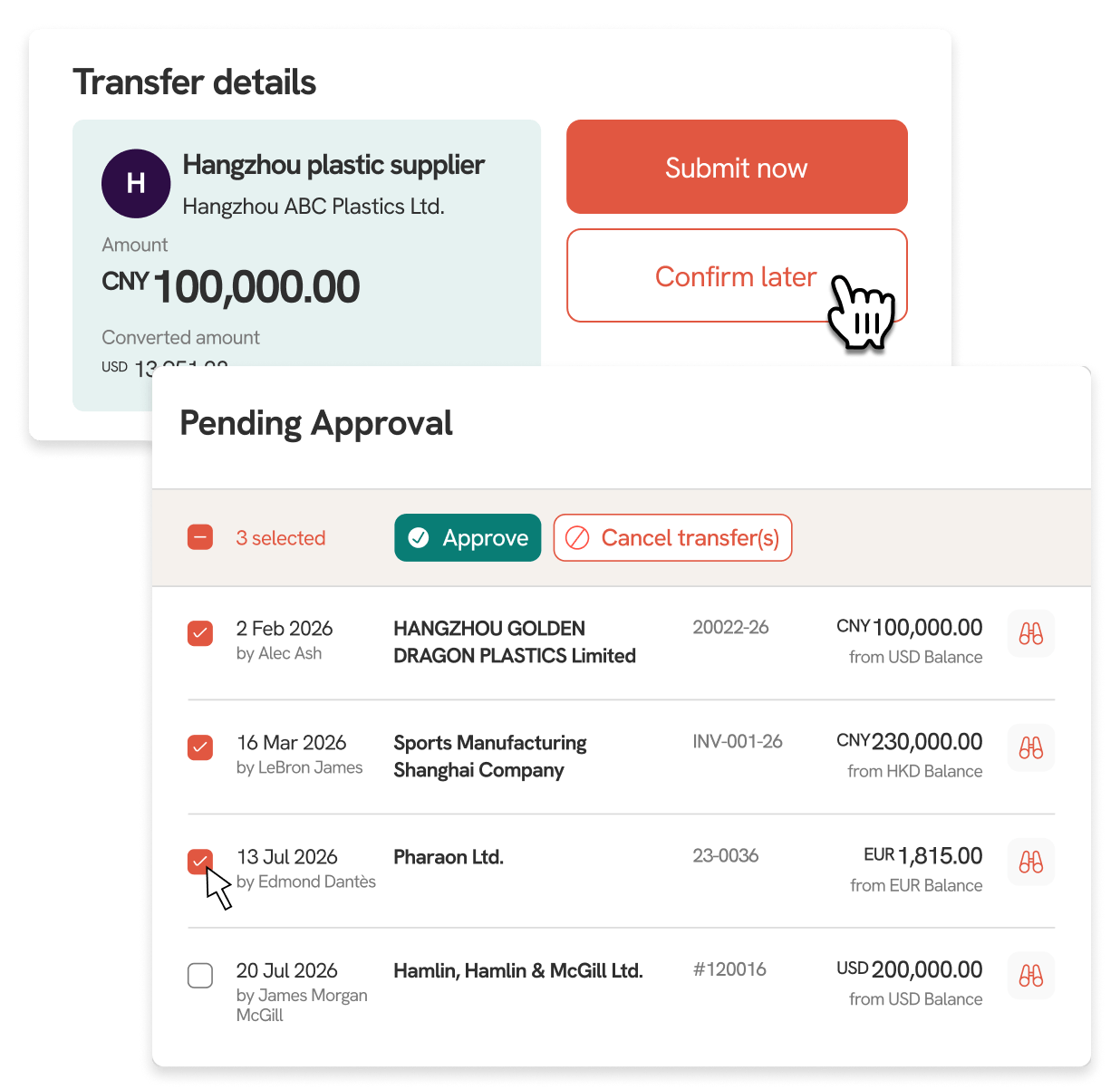

Assign different roles to different users

Always keep control of your account with the viewer, maker and approver roles.Clear and simple payment process

The “Maker” instructs the payment, the “Approver” confirms.Instruct payments without balance restrictions

Funds are necessary in your account only when approving the payment.

SWIFT payment tracking

Better financial planning

Get a clear view of when you'll receive payments, making it easier to manage your finances.Complete transparency

Keep an eye on your outgoing payments in real-time, ensuring complete clarity throughout the process.Seamless sharing with your payees

Share a tracking link with your payees effortlessly, allowing them to track the payment's progress alongside you.

Connect your business to the digital economy

Sell online all around the world,

and collect payments in one place.

Link your business account to marketplaces such as Shopify,

or payment processors like Stripe and PayPal.

What Clients Say About Statrys

Statrys is here to help

Statrys support always gives prompt and helpful replies. Not only does Statrys offer business solutions but, more importantly, as a client I feel valued.

Gloria

Hong Kong

Never had a problem with Statrys.

I’ve been using their service for nearly a year to manage my company in Hong Kong, and it’s been smooth from the start.

Everything works efficiently, and the support has been great throughout.

Eli

France

Fantastic support team

After 6 years with Statrys, I can confidently say it’s one of the best services for SMEs.

They’ve been reliable, consistent, and clearly understand what small businesses need.

A very good service I continue to trust.

Diego

France

Best business account out there.

Onboarding was smooth, the fees are fair, and customer support has been consistently helpful.

It’s everything you need in a business account—simple, reliable, and well-priced.

Hugo

Czech Republic

I’d recommend it to any business owner.

I’ve been using Statrys for 3 years—it’s reliable, transparent, and easy to use. Plus, I’ve saved a lot compared to traditional banks.

Works well for my business needs.

Benel

Malaysia

Very satisfied with Statrys.

Everything works smoothly, it’s easy to use, and I’ve had no issues at all.

I’ve also seen improvements to the platform, including features I personally suggested—which shows they take feedback seriously.

Er'an

China

Opening a multi-currency business account with Statrys was easy and straightforward.

Opening a multi-currency account was smoother than expected. The platform is simple and works well for daily business tasks. I also appreciate how quickly the team respond whenever I have a question.

Fraser

United Kingdom

Outstanding customer support.

We’ve been with Statrys for over a month, and the service has already exceeded expectations.

Their team responds within an hour and consistently goes above and beyond to help.

We’ve also saved a lot on fees compared to traditional banks in Hong Kong.

Ishaan

Hong Kong

Featured on:

Frequently Asked Questions

What is a Business Account?

A business account, often referred to as a "corporate bank account," is a type of bank account intended for managing the financial transactions of businesses. This account is not just for large corporations but is also widely used by small and medium-sized enterprises (SMEs), as well as small business owners and entrepreneurs.

In essence, a business account is a comprehensive financial tool for managing day-to-day business operations and facilitating growth.

What are the benefits of a Business Account?

There are many benefits to having a business account for your business. Here are some of those reasons:

- A business account helps keep business finances separate from personal finances, simplifying accounting and tax preparation.

- Using a business account to send and receive payments in your company’s name is more professional and trustworthy. Clients may not be comfortable making a large fund transfer to a personal account instead of a business account.

- Establishing a credit history through a business account is essential for maintaining eligibility and enhancing the chances of obtaining business loans and credit cards in the future, which is crucial for startups and small businesses.

- It helps with tracking and managing business expenses, which is important when it comes to budgeting and financial planning.

- Business accounts can provide online banking services that a business needs, such as higher transaction limits, foreign currency, merchant services, access to business loans, and financial services.

Which companies can apply for a Business Account?

Companies registered in Hong Kong, Singapore, and the BVI can apply for an online business account with Statrys.

What documents are required to open a Business Account?

The application process is simple and straightforward, and all you need to do is submit the following documents:

- A copy of the passport(s) of the director(s) and/or shareholder(s)

- A copy of your Business Registration Certificate

Once you have submitted your application, our dedicated onboarding team will review your information and reach out to you within 24-48 hours to discuss the next steps. We are committed to providing efficient and reliable onboarding support to all our clients.

What if my company is not registered in Hong Kong, Singapore, or the BVI?

We can provide a Business Account to companies not incorporated in Hong Kong, Singapore, or the BVI that engage in specific industries like international logistics and transportation, mobile phone trading, or IT and telecom services and have some business links with Hong Kong.

Alternatively, you may register a Limited Company in Hong Kong using our Company Incorporation Services or check our Company Secretary Review Page if you need assistance.What are my Business Account details?

Your Business Bank Account details are as follows:

Account name: [Your company name]

Account Number: [Your unique account number]

Bank Name: DBS Bank (Hong Kong) Limited

SWIFT: DHBKHKHH

What kind of payments can I make?

With Statrys, you can make local payments in Hong Kong via FPS (Faster Payment System) and CHATS (Clearing House Automated Transfer System) to bank accounts opened in Hong Kong local banks. You can also make international telegraphic transfers (TT) via the SWIFT network to any bank account outside of Hong Kong.

Lastly, you can also make local payouts to supported countries in their domestic currencies.How long does it take for an incoming payment to be credited to my Business Account?

All incoming payments are credited to your Business Account as soon as our custodian bank in Hong Kong receives them. Payments are received during business hours: 8 am to 5 pm Hong Kong time, Monday to Friday (except bank holidays)

- The day on which your Business Account is credited actually depends on the nature of the payment made by the remitter:

- Autopay payment is sent out from another Hong Kong bank account; your Business Account is credited the next working day.

- FPS/RTGS/CHATS payment sent out from another Hong Kong bank account = your Business Account is credited the same working day.

International payment (SWIFT) sent out from a bank account outside of Hong Kong = your Business Account is usually credited within a maximum of two working days.

Is Statrys a bank?

Statrys is not a bank.

Statrys is a financial institution holding a Money Service Operator license in Hong Kong (19-02-02726). We are regulated by the Hong Kong Customs & Excise Department. Our corporate customers' funds are held in bank accounts opened with our custodian bank in Hong Kong.

Is there an account opening fee?

Account opening is free for most users. However, companies that are not incorporated in Hong Kong or Singapore, have complex structures or are not strongly rooted in Asia may be required to pay an account opening fee. For all other users, opening an account with Statrys is completely free.

What are the transaction fees?

The transaction fees at Statrys are usually determined by the currency involved, the amount, and the nature of the transaction, i.e., whether it's a local payment within Hong Kong or an international payment originating from outside Hong Kong. Please visit our FAQ page here.

Get your Hong Kong business account open in a few days

100% online application

No account opening fee, no initial deposit

Dedicated account manager