Key Takeaways

Cash flow forecasting is a method for estimating cash inflows and outflows over a future specific period of time.

A cash flow forecast is created by having an opening cash balance, calculating the predicted net cash flow, calculating the ending balance, and doing this for each chosen month on the forecast.

Forecasting provides clarity for the next 3-6 months, guiding decisions related to investments, company expansion, and strategic planning for various financial scenarios.

Did you know that only 27% of businesses have prepared a cash flow forecast? This explains why 82% of small businesses fail because of cash flow problems, and it suggests that understanding and managing cash flow plays a key role in achieving success in running a business.

So, what makes cash flow forecasting so difficult that business owners want to avoid it so much? This article will explain what cash flow forecasting is and provide the necessary steps, requirements, and templates for entrepreneurs so you don't fall into the same trap as other entrepreneurs.

What is Cash Flow Forecasting?

Cash flow forecasting, also known as cash flow projection, is a method of estimating the number of cash inflows and outflows of a given business across a future, specific amount of time. Conducting a cash flow forecast allows businesses to plan for cash deficits further and manage risk effectively.

A typical cash flow forecast might take anywhere from a few weeks to several months to complete, depending on the time interval chosen.

The primary goal of cash flow forecasting is to provide insight into a company's liquidity, allowing for better decision-making and strategic planning. By analyzing expected cash movements, businesses can identify potential cash shortages or surpluses, enabling them to take proactive measures to address any financial challenges or capitalize on opportunities.

Which Businesses Should Conduct Cash Flow Forecasting?

A common question that gets asked is whether conducting a cash flow forecast is worthwhile for companies and what type of businesses can benefit from a cash flow forecast.

All types of businesses can benefit from a cash flow forecast, however, those that experience fluctuations in income & expenses, such as SMEs, seasonal market changes, such as those in hospitality, and newer companies that involve risk, such as startups, tend to benefit the most.

In addition, forecasting in businesses that experience significant upfront costs, such as manufacturing and construction, is a fundamental practice to help with cash flow management.

Here are other sectors that can benefit from a cash flow forecast.

High-growth tech startups - Cash flow forecasting is crucial for high-potential tech startups, as its goal will always be rapid growth. A tech startup needs to plan for research and development costs and attract investors by demonstrating financial prudence. A cash flow forecast aids in this endeavor.

Healthcare - Healthcare organizations, including hospitals and clinics, rely on cash flow forecasting to manage operational costs, plan for capital expenditures, and navigate the complexities of insurance reimbursements.

Agriculture - Agricultural businesses benefit from cash flow forecasting to manage planting and harvesting cycles, purchase necessary equipment, and navigate the impact of weather conditions on crop yields and revenues.

The Importance of Cash Flow Forecasting

Why is cash flow forecasting important? Here are a variety of reasons:

Improved Financial Planning

Cash is the lifeblood of all businesses. Without a clear overview of the cash that’s coming in and out of a business at any given time, a company may run into unforeseen financial challenges, cash bottlenecks, and increased debt levels. On the other hand, strong financial planning will result in high business liquidity, stronger team morale, and better investment opportunities.

Forecasting can help financial reporting by giving businesses an accurate lens of potential operational challenges that may come up in the case of low cash flow. Through a forecast, a company can also make better decisions such as choosing to cut budgets in the case where cash flow is tight or allocate funds in the case of healthy cash flow.

Risk Management

During periods of low liquidity, forecasting allows businesses to better plan for economic downturns. While in periods where cash flow is predicted to be strong, a business can pre-plan business expansion activities.

This early identification of potential cash bottlenecks can help avoid situations where the business may struggle to meet its financial obligations.

Compliance and Reporting

A cash flow statement is a type of financial statement required for GAAP compliance. GAAP, abbreviated as “generally accepted accounting principles,” is a set of principles that provide a standardized framework for financial reporting, helping ensure consistency and comparability across different organizations.

These statements are mandatory for GAAP compliance, while forecasts are only relevant for internal planning and decision-making. However, they contribute to compliance by creating a clear understanding of a company’s financial position. This can help entities fulfill regulatory filings, making sure tax obligations are paid for when due, and also aid meet debt obligations.

Further Enhanced Decision Making

Forecasting can help drive decision-making because forecasts can provide much-needed clarity for the next 3-6 months of a given firm. This enhances decision-making in the following ways:

- Dictates investment and company expansion opportunities.

- Business decisions are made based on informed selections.

- Decision-makers can use forecasts to plan to prepare for different potential financial scenarios in the case of an economic downturn. Or the case of a bull market, to plan to take advantage of economic upswings.

How to Create a Cash Flow Forecast?

1. Determining Your Objective

The first step is to determine your objective and what purpose are you creating a forecast. We will list a few examples:

Interest and debt reduction. The purpose of interest/debt reduction is to ensure that a business has enough cash on its hand to pay out debts and loans.

Growth planning. The purpose of growth planning is to ensure that a business has enough working capital to fund business expansion needs.

Short-term liquidity planning. Short-term liquidity involves overseeing the daily cash availability to guarantee that your business can fulfill its immediate financial responsibilities.

2. Selecting Your Interval

Cash flow forecasts can be long-term or short-term. There are three time frames you must choose from before conducting a cash flow forecast:

Short term forecast

A short-term forecast typically lasts less than 3 months. A general principle is that the shorter a forecast, the more accurate the forecast is. Therefore, short-term forecasts last no more than 3 months. This is optimal for short-term liquidity planning.

Mid-term forecast

Mid-term forecasts can make you look between 2 months to 12 months.

Long term forecast

Long-term forecasts last over a year and can play a role in long-term budgeting and financial planning. A comment to make is that the longer a forecast is, the less likely the accuracy of the forecast will be.

3. Direct Method or Indirect Method

There are two common ways of forecasting cash flows: the direct method and the indirect method. The direct method is suited for daily cash management, while the indirect method provides a better basis for strategic planning:

Direct method - focused on cash receipts and transactions. The direct method is transparent.

Indirect method - net income and adjusts it for non-cash items and changes in working capital to derive the cash flow from operating activities. The indirect method is less detailed.

Alignment - Companies may choose the method that aligns with their reporting preferences and regulatory compliance.

We will cover the indirect method in this article in the section “cash flow forecast templates.”

4. Sourcing the Data Needed to Conduct a Forecast.

You can pull data from your account payables, account payables, bank accounts, and accounting software that you use. You will need three pieces of data.

- Opening cash balance.

- Cash inflows for the forecasting period.

- Cash outflows for the forecasting period.

A comment to make here is that the forecast cash inflows and outflow predictions will be made based on your current financial statements.

5. Making a Forecast

A forecast sheet is created. Please refer to the section on cash flow forecast templates for further details.

6. Regular Review

Once a forecast has been completed, it’s crucial that ongoing monitoring is done to make sure that results and the forecast match up, to ensure relevance and accuracy. Depending on the outcome, businesses may need to update their forecasts.

Best Cash Flow Forecast Templates for Free

Standard 1-Year Forecast Using Excel

Here's an explainer video from "The Finance Story Teller" to walk you through the step-by-step process.

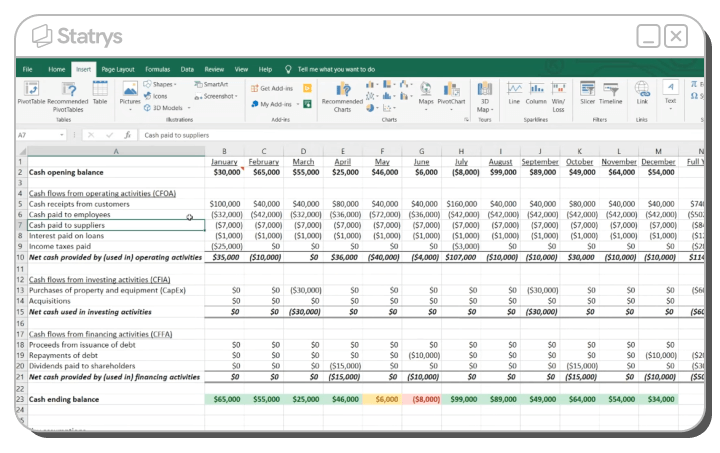

Many cash flow forecast templates are created through Excel. Here’s an example of a forecast. Let’s break down each section:

In the case of a 12-month interval

Months - This denotes the chosen cash flow forecast interval.

Cash opening balance - this denotes the amount of cash a business has at the beginning of each month.

Net cash used in operating activities - this denotes the amount of cash a business is producing or losing from its core business operations.

Net cash used in investing activities - this denotes the amount of cash a business is producing or losing from its financial activities.

Net cash used in financing activities - this denotes the amount of cash a business is producing or losing from its investing activities.

Cash ending balance - this denotes the predicted ending cash balance from each month.

Using a cash flow forecast template in Excel is one of the many ways businesses can project and manage their financial liquidity.

A well-constructed cash flow forecast template not only aids in financial planning but also serves as a crucial tool for monitoring and managing the overall financial health of a business.

💡 Note: Excel is one of the methods of conducting a cash flow forecast. However, you can also produce a forecast using accounting software.

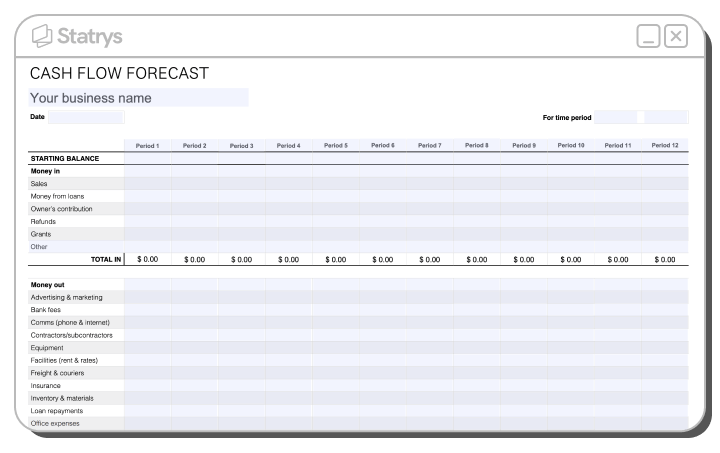

Xero’s Cash Flow Forecast Template

Xero, a popular accounting software, has cash flow forecasting built into one of its features, but it also gives a free template that anyone can use. Xero’s cashflow forecast template uses a simple layout to help you predict your upcoming business costs.

Unlike a standard cash flow template where operating cash flow, financing cash flow, and investing cash flow are calculated - the template is split into two categories: “cash in” and “cash out” for simplicity.

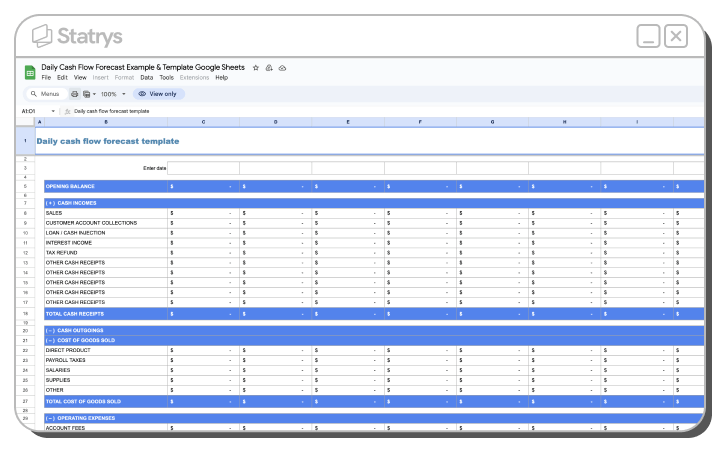

Creating a Cash Flow Forecast Using Google Sheets

Google Sheets are more commonly used than Excel spreadsheets because of their sharing features across teams, making it a much more accessible option. Here’s a template created by Coupler.io that encompasses a short-term cash flow forecast.

For this template specifically, they are more focused on operating cash flow, splitting its categories into cash incomes, cash outgoings, and operating expenses.

You can also create your own Google sheet template using the information shared on creating a forecast using Excel by breaking up the categories into opening cash balance, operating cash flow, and finally, the ending cash balance.

Information to Look Out for During a Forecast:

While analyzing your data, you should take note of the two following areas to prepare for scenarios:

Months with low net cash balance or negative cash flow. This means that there will be foreseen challenges regarding cash flow during the months that show a low net cash balance. Businesses can use this information to prepare for future events.

Months with high net cash balance or strong cash flow. This means that businesses can use this interval to invest in activities such as hiring more staff, investment opportunities, and repaying debt.

Advantages & Limitations of Cash Flow Forecasting

Advantages

There are several reasons to conduct a forecast on an interval basis. (bi-monthly or bi-yearly)

- Foresight/Strategic planning. Businesses with a clear understanding of expected cash inflows and outflows can allocate resources more strategically. This also allows businesses to anticipate potential challenges, such as delayed payments, cash shortages, and unexpected expenses, to proactively address issues before they occur.

- Keeps finances organized. Forecasting assists in the creation of comprehensive budgets. This organized financial planning helps businesses manage their finances more effectively.

- Early identification of issues. Early detection of potential cash flow issues allows businesses to implement proactive measures to mitigate risks in the case of months with negative cash flow.

- Builds investor confidence. Regular and accurate forecasts provide investors with transparent insights into a company's financial health. This transparency builds trust and confidence among existing and potential investors.

- Liquidity management. Forecasting helps businesses maintain optimal cash reserves to cover operational needs and capitalize on strategic opportunities. This is crucial for avoiding liquidity crises and taking advantage of favorable market conditions, such as during which there's a positive cash flow figure predicted.

- Suitable for businesses with lots of transactions. Businesses with a high volume of transactions benefit significantly from forecasting, as it helps manage the complexity associated with numerous financial interactions.

- Facilitates better budgeting and planning. Forecasting allows businesses to conduct scenario analysis, evaluating the impact of different variables on their financial position. This enables more informed decision-making and the development of resilient budgets that can adapt to changing circumstances.

Limitations

There are also several limitations of a forecast that you should be aware of.

- Does not account for market and economic volatility. Cash flow forecasts may not fully capture the impact of sudden market fluctuations or economic downturns. Unforeseen external events can significantly deviate actual cash flows from forecasted values.

- Not flexible. Some forecasting models may lack flexibility, making it challenging to adapt to changing business conditions. This inflexibility can result in inaccurate predictions if the business environment evolves differently than expected.

- It may be prone to human error. Forecasts often involve manual data entry and calculations, increasing the likelihood of human error. Inaccuracies in input data or formulae can lead to unreliable forecasts.

- It may be time-consuming, but other pressing matters may take priority. Developing and maintaining accurate forecasts can be time-consuming. In fast-paced business environments, other urgent matters may take precedence, leading to less attention to the forecasting process.

- Difficult for startups. Startups often lack a substantial historical financial record, making it challenging to develop accurate forecasts. The absence of reliable data can hinder businesses' forecasting process.

- Requires specialized skills/software. Effective forecasting may require specialized financial knowledge and the use of sophisticated software tools. Small business owners with limited financial expertise may find it challenging to implement and maintain such systems.

- Based on estimates and assumptions. Forecasts heavily rely on estimates and assumptions about future business activities. If these estimates prove to be inaccurate or assumptions change, the forecasted cash flows may deviate from actual results.

The Role of Automation in Cash Flow Forecasting

There are a multitude of ways you can automate your cash flow forecasting process, from the simple: integration with popular apps such as Xero, Quickbooks & Freshbooks, to the complicated - using machine learning tools and AI to analyze financial data.

To what degree of automation you do in your cash flow forecast will depend on your business size, resources, and time available.

Automation in Cash Flow Forecasts Helps Save Time

For finance teams, setting up a cash flow forecast takes time away from other work activities. Therefore, setting up an automation system can help save time. There are two types of ways you can automate your forecasting.

First is through the inputs you insert into your sheets. For example, you can automate the input of data into the cash flow forecast sheet. You can also set up notifications that notify teams when a cash flow forecast needs to be made and automate the input process using software.

The second way you can automate a cash flow forecast is through its output. Automation can be done through automatic reporting and analytics. Many cloud-based accounting software have pre-built features for cash flow forecasting and forecasting, which you can use to generate automated reports.

You can also automate outputs to integrate with CRM (Customer Relationship Management) systems, payment processors, and banking platforms to consolidate financial data automatically.

Artificial Intelligence and Machine Learning in Cash Flow Forecasts

Using machine learning, teams can create an accurate cash flow forecast based purely on artificial intelligence calculating the output. There are a variety of ML models teams can use, such as neural networks, random forests, and Autoregressive Integrated Moving Averages.

A recent article by cfo.com shows that JPMorgan has 150 data scientists and engineers working with payment-flow data to refine its ML solution for cash-flow forecasting. Many major banks, such as Bank of America, Wells Fargo, and Citi Bank, also utilize artificial intelligence to automate their forecasting processes.

Using Data Analytics for Pattern Identification

Business analytics plays a role during the data consolidation phase in a cash flow forecast. You can use many statistical and mathematical models to generate a cash flow forecast, which is called predictive analysis.

There are also analytic tools to help you present & visualize the data you have from a cash flow forecast; this information can be used to be presented to stakeholders and potential investors of your company.

Here are business intelligence tools that can be employed to visualize cash flow forecasts:

- Tableau

- Microsoft Power BI

- QlikView

- XLReporting

While Excel’s core features also allow you to visualize the information in the form of line graphs and charts. Finally, you can also use Python - a popular programming language data scientists use to visualize data using its libraries such as Numpy, Pandas, and Matplotlib. Which data analytic tool you use will depend on your current situation and the resources available.

Automation Reduces Human Error

Automated systems reduce human error because technology is consistent and able to run without fatigue, whereas a human being is prone to make mistakes.

Automation in a cash flow forecast streamlines the workflow by automating approval processes, invoicing, and other financial tasks. This reduces delays and errors that may occur in manual workflows, ensuring a more efficient process.

It's common for analysis to be done manually with a finance team. However, bigger corporate companies teams with better access to resources tend to rely on automation to reduce the human error involved. Though budgets may vary, we would recommend using accounting software to generate your own cash flow forecast as a baseline.

FAQs

Does forecasting differ in terms of startup and corporate companies?

Yes, startups work with financial data on a smaller scale, so their forecasting methods will be more straightforward. While larger corporate companies are dealing with more complex structures, with diverse revenue streams. This means that larger corporate companies will need more sophisticated forecasting models.