5 Best Cash Flow Formulas You Can Use in 2024

1.

Operating cash flow - The operating cash flow formula is a key indicator of a company's ability to generate cash from its core operations and is calculated by adding net income, non-cash expenses, and changes in working capital.

2.

Financing cash flow - The financing cash flow formula reflects the cash transactions related to a company's financing activities, such as issuing or repurchasing stock, paying dividends, and obtaining or repaying debt.

3.

Investing cash flow - The investing cash flow formula represents the cash flow generated or spent on a company's investments in assets, including property, equipment, and other long-term assets.

4.

Free cash flow - The free cash flow formula is a crucial metric indicating the amount of cash a company has available for distribution to investors, debt reduction, or further investments.

5.

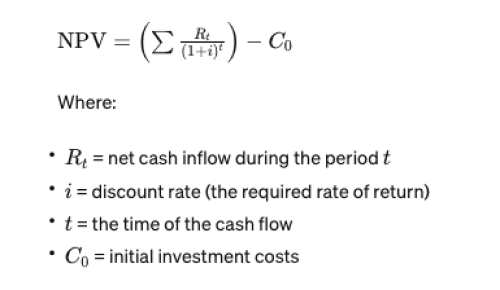

Net present value - The net present value (NPV) is a financial metric used in capital budgeting to assess the profitability of an investment by calculating the present value of expected cash flows, discounted at a specific rate, and subtracting the initial investment cost.

What is a Cash Flow Formula?

Do you know what a cash flow formula is? Well, you probably have heard something called a cash flow statement. These formulas are used to calculate the operating cash flow, financing cash flow, and investing cash flow in the cash flow statement.

The formulas are also financial metrics that can be used to measure the net amount of cash and cash equivalents flowing into or out of a business during a specific period. It provides insights into a company's ability to generate cash and is an important indicator of its financial health.

Best Cash Flow Formulas to Use in 2024

There are five cash flow formulas that you need to know to gather insight into your business.

- Operating cash flow

- Financing cash flow

- Investing cash flow

- Free cash flow

- Net present value

The three main cash flow formulas are the operating cash flow, financing cash flow, and investing cash flow. Free cash flow and net present value are also recorded in financial statements and can be calculated through the values in the cash flow statement.

Each cash flow formula calculates cash flow from a different aspect of a given company, i.e. investments, financing, and future profitability. One thing to clarify is that the net present value is a valuation and is not directly a cash flow formula.

NPV calculates the present value of future cash flows, taking into account the initial investment. This clarification is pivotal for comprehending NPV's significance in evaluating the profitability of investments or projects by considering the time value of money. Nevertheless, it is an important metric to evaluate an investment/company project.

Utilising a cash flow formula is important because it can give you background information about a company’s financial health. Going through these formulas is an integral part of cash flow analysis, which should be conducted on a regular basis.

The information you will derive from a cash flow analysis is calculated through cash flow formulas.

| Methods | Calculation Formula | What For | Pros | Cons |

| Operating Cash Flow | Operating Cash Flow (Indirect Method = Net Income + Non-Cash Expenses + Changes in Working Capital | Represents cash flow from core business activities. | Provides a more direct measure of the cash generated or consumed by a company's day-to-day operations. | Only limited to core activities, not applicable if a company’s revenue is generated mainly from financing or investments. |

| Financing Cash Flow | Net Financing Cash Flow = Cash Inflows from Financing Activities − Cash Outflows from Financing Activities | Represents cash flow from equity/liabilities, debt repayment, and dividends repayment. | Gives you a picture of cash flows from a company’s debt or equity financing and debt repayment. | Only limited to debt-equity/financing only gives you a limited picture of a company. |

| Investing Cash Flow | Cash Flow from Investing Activities = (Capital Expenditures) + Proceeds from the Sale of Long-Term Assets + Proceeds from the Sale of Investments - Costs of Acquisitions | Represents cash flow from fixed assets and investments. | Gives you a picture of cash flow from investing activities that come from a company’s investments in long-term assets. | Negative investing cash flow does not denote bad cash flow management, rather, a company is investing in long-term assets. |

| Free Cash Flow | Free Cash Flow (FCF) = Operating Cash Flow (OCF) − Capital Expenditures (CapEx) | Represents cash flow generated that’s available for distribution. | Gives a snapshot of a company’s financial health. | Free cash flow can be influenced by a company’s capital expenditures. A company might have negative free cash flow due to long-term investments they made but it might not reflect the health of a company. |

| Net Present Value | NPV= Cash flow / (1+i) t − initial investment | Used to calculate the profitability of a project. | NPV provides an objective measure for comparing and evaluating different investment opportunities. It considers all relevant cash flows over the project's life, helping to make more informed decisions. | NPV assumes that cash flows received from a project can be reinvested at the discount rate. This assumption may not always hold, especially in situations where finding similar investment opportunities with the same rate of return is challenging. |

What is Operating Cash Flow (OCF)?

OCF gives the cash inflows and outflows of core business operations. The usage of this cash flow formula is important because you can understand how a business is operating and at what efficiency through this statement.

To calculate OCF, you’ll need three statements:

Net Income(NI):

- NI is the total profit or loss of a company after deducting all expenses from its revenue.

- It includes revenues and expenses from all business activities, not just operating activities.

- While NI is a crucial measure of profitability, it does not directly reflect a company's cash position because it includes non-cash items like depreciation and amortization.

Non-cash Expenses:

- Non-cash expenses include items such as depreciation and amortization.

- Depreciation represents the gradual reduction in the value of tangible assets over time.

- Amortization is similar to depreciation but pertains to the gradual reduction in the value of intangible assets.

- These expenses are added back to NI in the OCF formula because they do not involve the actual outflow of cash.

Changes in Working Capital:

- Working capital is the difference between a company's assets and liabilities.

- Changes in working capital reflect the variations in a company's short-term assets and liabilities over a specific period.

- Positive changes in working capital (increase in current assets or decrease in current liabilities) typically use cash, while negative changes (decrease in current assets or increase in current liabilities) usually generate cash.

- Examples of working capital changes include fluctuations in accounts receivable, accounts payable, and inventory.

Operating Cash Flow Formula

For OCF, the direct and indirect methods are used in the cash flow formula. The direct method is good for transparency and detail, but the indirect method is easier to calculate because all of its information can be derived from the balance sheet. Calculate the operating cash flow formula through these two methods:

Calculate Operating Cash Flow Through the Direct Method

OCF = operating income + non-cash charges - changes in working capital - taxes

Calculate Operating Cash Flow Through the Indirect Method

OCF (Indirect Method = Net Income + Non-Cash Expenses + Changes in Working Capital

In short, the direct method lists actual cash inflows and outflows from operating activities, making it more transparent while the indirect method adjusts net income for non-cash items and changes in working capital.

The basic differences between the indirect and direct methods for the operating cash flow formula can be visualized in this table.

| Aspect | Indirect Method | Direct Method |

| Overview | Adjusts net income by accounting for non-cash items and changes in working capital. | Lists actual cash inflows and outflows related to operating activities. |

| Net Income Adjustment | Starts with net income and adjusts for non-cash items such as depreciation and amortization. | Adjusts for non-cash items and changes in working capital to reconcile net income to OCF. |

| Adjustment for Changes in Working Capital | Incorporates changes in working capital through adjustments in current assets and liabilities. | Directly includes cash receipts and payments related to changes in working capital accounts. |

| Treatment of Non-Cash Items | Adjusts for non-cash expenses, such as depreciation and amortization, to reflect actual cash movements. | Includes non-cash items in the OCF section but excludes them from the direct calculation. |

| Ease of Preparation | Generally easier and more commonly used, as it relies on readily available information. | More complex, as it requires detailed information on cash transactions related to specific operating activities. |

| Reconciliation to Net Income | Provides a reconciliation from net income to OCF. | Provides a detailed breakdown of actual cash receipts and payments for each operating activity. |

| Commonly Used in Practice | More commonly used due to simplicity and reliance on readily available information. | Less commonly used due to its complexity and the need for detailed transaction data. |

Example

To apply the OCF formula, let’s take the example of Bob, an owner of a 7-person freelance design agency. Her financials for the year look like this.

Operating Income = $90,000

Depreciation = $0

Taxes = $6,000

Change in Working Capital = – $7,000

Bob’s OCF formula will be represented using the indirect method:

[$90,000] + [$0] – [$6,000] + [-$7,000] = $77,000

This means that Bob will generate $77,000 in operating cash flow for a typical year, which will be recorded in the operating activities on the cash flow statement.

What is Investing Cash Flow?

Investing cash flow is a section of a company's cash flow statement that reflects the cash inflows and outflows related to its investments in long-term assets. You’ll need the following information to calculate investing cash flow.

Capital Expenditures ( (CapEx) ):

- Cash is spent on acquiring, upgrading, or maintaining long-term assets such as property, plant, equipment, and intangible assets.

- CapEx is a crucial component as it reflects the company's commitment to expanding or improving its productive capacity.

Acquisitions and Disposals:

- Cash transactions related to the acquisition or disposal of other businesses or investments.

- Acquiring another company involves cash outflows while selling a business unit or investment results in cash inflows.

- These activities are indicative of a company's strategic decisions and growth initiatives.

Investments in Marketable Securities:

- Cash is spent on the purchase of marketable securities, such as stocks, bonds, or other financial instruments.

- These investments may be part of the company's financial strategy for generating returns or managing liquidity.

Formula

Cash Flow from Investing Activities = (Capital Expenditures) + Proceeds from the Sale of Long-Term Assets + Proceeds from the Sale of Investments - Costs of Acquisitions

Example

Let's consider a scenario where a company engages in both investing cash outflows and investing cash inflows.

Investing Cash Outflows:

Purchase of Equipment: The company decides to invest in new machinery for its production facility, incurring a cost of $300,000. This would be a cash outflow and is categorized under investing activities.

Investing Cash Inflows:

Sale of Investments: The company decides to sell some of its marketable securities to generate cash. The sale of these investments brings in $150,000 in cash.

Cash Outflow: -$300,000

Cash Inflow: +$150,000

Divestment of a Business Unit: The company also decides to sell one of its non-core business units. The transaction results in a cash inflow of $500,000.

Cash Inflow: +$500,000

In this example, the company had a net positive investing cash flow of $350,000, indicating that, overall, it received more cash from its investing activities than it spent.

This positive net cash flow from investing activities could be used for various purposes such as debt reduction, funding other strategic investments, or returning value to shareholders.

What is Financing Cash Flow?

Financing cash flow represents the cash transactions associated with a company's financing activities, which involve raising capital and repaying debts. Key elements of financing cash flow include:

Issuing or Repurchasing Stock

Cash flow from financing includes proceeds from the issuance of new stocks or other equity instruments. Conversely, it includes cash payments for the repurchase of company stock.

Borrowing and Repaying Debt

Cash flow from financing includes cash received from borrowing, such as loans or bonds issued. On the flip side, it includes cash payments for the repayment of debt, including both principal and interest.

Dividend Payments

Cash dividends paid to shareholders are also part of FCF. This is the cash distributed to the company's equity holders as a return on their investment.

Other Financing Activities

Other financing activities may include cash transactions related to derivative instruments, lease liabilities, or any other financing-related transactions.

Formula

Net Financing Cash Flow = Cash Inflows from Financing Activities − Cash Outflows from Financing Activities

Example

Let's consider a hypothetical example of financing cash flow for a company. Suppose Company ABC Financial engages in the following financing activities during a specific period:

Issuance of Bonds: The company issues bonds to raise capital, resulting in a cash inflow of $1,000,000.

Repayment of Long-Term Debt: Company ABC repays a portion of its long-term debt, leading to a cash outflow of $500,000.

Dividend Payments: The company distributes dividends to its shareholders, resulting in a cash outflow of $200,000.

Share Buyback: Company ABC decides to repurchase some of its outstanding shares from the market, leading to a cash outflow of $300,000.

Now, let's calculate the net financing cash flow using the formula:

Formula: Net Financing Cash Flow =(Cash Inflows from Financing Activities)−(Cash Outflows from Financing Activities)

Net financing cash flow = (1,000,000) − (500,000+200,000+300,000)

Net financing cash flow = 1,000,000−1,000,000

Net financing cash flow = 0

In this example, the net financing cash flow is zero, indicating that the cash inflows from issuing bonds are offset by the cash outflows from debt repayment, dividend payments, and share buybacks.

A net financing cash flow of zero suggests that the company's financing activities are balanced during this period. Positive net financing cash flow would indicate a net inflow of cash from financing activities, while a negative net financing cash flow would indicate a net outflow of cash.

What is Free Cash Flow (FCF)?

Free Cash Flow (FCF) is a measure that represents the cash generated by a company's operations that is available for distribution to investors, debt repayment, or reinvestment in the business. It's a key financial metric that provides insights into a company's financial health and ability to generate cash.

FCF is a popular metric used by investors and analysts to measure a company’s performance because it only focuses on the cash aspect. Free cash flow is not just available for distribution to investors but also for reinvestment in the company's operations, paying off debt, or holding as liquidity. FCF includes the following metrics:

Operating Cash Flow (OCF):

- OFC is the cash generated or used by a company's core operating activities. It includes cash from sales, payments to suppliers, employee wages, and other operating expenses.

- OCF serves as the starting point for calculating FCF.

Capital Expenditures (CapEx):

- Capital Expenditures represent the cash outflows related to the purchase or improvement of long-term assets, such as property, plant, equipment, and intangible assets.

- CapEx is subtracted from OCF in the free cash flow formula because it represents the cash used for investments necessary to maintain or expand the company's productive capacity.

Free Cash Flow Formula

Free Cash Flow (FCF) = Operating Cash Flow (OCF) − Capital Expenditures (CapEx)

Example of Using The Free Cash Flow Formula

Let’s take an example of a company that has the following financials:

Net Income: $500,000

Depreciation and Amortization: $100,000

Changes in Working Capital: -$50,000 (indicating an increase in working capital)

Capital Expenditures (CapEx): $200,000

Plugging the company’s information into the free cash flow formula, you’ll get:

FCF = $550,000 - $200,000 = $350,000

What is Net Present Value (NPV)?

Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or project. It calculates the present value of the expected cash inflows and outflows associated with a project, taking into account the time value of money.

Net present value relates to the cash flow of a company because it helps analysts judge the profitability and feasibility of an investment or project. Something to note is that net present value is not exactly a cash flow formula but more of a measure to help judge a company’s cash flow.

Here’s the Formula for Net Present Value

For projects with multiple sources of cash flow, you can use the following formula:

Example

Let's walk through an example of calculating the Net Present Value (NPV) for a potential investment.

Suppose Company XYZ is considering a project that requires an initial investment of $200,000. The project is expected to generate cash inflows of $50,000 annually for the next four years. The discount rate (required rate of return) for the company is 8%. Using the formula presented above, if we plug in the numbers.

Calculating this expression will give us the Net Present Value.

NPV = 36,722.98

If the result is positive, it suggests that the project is expected to generate a return higher than the company's required rate of return (8%). If negative, it may indicate that the project's expected returns do not meet the company's investment criteria. In this scenario, the net present value is $36,772.

What is the Net Cash Flow Formula?

Finally, the net cash flow in a cash flow statement is calculated by summing up the cash flows from three main categories: Operating Activities, Investing Activities, and Financing Activities. The net cash flow provides a comprehensive view of how cash has been generated or used in these different aspects of the business.

You can calculate net cash flow using the Net cash flow formula, which is visualized through this:

Net Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

Conclusion

In summary, you can evaluate the results of a cash flow formula by following this simple rule. Positive cash flow shows that a company is making more cash than losing, while negative cash flow may show that a company is losing more money than they are bringing in.

Analyzing these cash flow metrics helps stakeholders, including investors and management, make informed decisions about a company's financial performance, liquidity, and investment opportunities.

Positive cash flows are generally indicative of financial strength, while negative cash flows may signal potential financial challenges. Ultimately, a thorough understanding of cash flow is essential for effective financial management and strategic decision-making. Using a cash flow formula on specific areas of your business e.g., financing cash flow, can give you key insights into your business’s strengths and weaknesses.

FAQs

What is cash flow analysis?

Cash flow analysis examines a company's cash inflows and outflows over a specific period to assess its financial health, profitability, and investment worthiness, guiding strategic planning and decision-making.