Key Takeaways

An IBAN (International Bank Account Number) is a standard format for identifying bank accounts in international transfers.

First introduced in Europe to reduce errors in cross-border payments, it combines a two-letter country code, two check digits, and up to 30 characters for the account number (BBAN).

Your IBAN can be found on bank statements or online banking. It’s best to validate it before sending funds to avoid delays or extra fees.

IBANs are essential for payments to and from countries that use this international banking standard. Without the correct IBAN, your payment could be delayed, rejected, or hit with additional fees. These complications can strain vendor relationships and disrupt cash flow.

This guide will show you exactly what an IBAN is, when you need IBANs, how to find the right numbers, and how to use them confidently for international payments.

What is an IBAN?

Developed by the European Committee for Banking Standards, an International Bank Account Number (IBAN) is an international numbering system used to facilitate information in relation to cross-border payments.

An IBAN number contains a two-letter country identification code, two check digits, and up to 30 characters for the Basic Bank Account Number (BBAN). Each country decides the BBAN format to cater to its national standard for bank accounts.

Originally, the IBAN was designed for bank transfers between European Union countries. However, it has now been adopted by over 80 countries worldwide, significantly reducing payment errors and processing times for international payments.

Quick Fact: While the United States, Canada, and Australia don't use IBANs domestically (Australia uses BSB codes instead), they still recognise and process IBAN payments for international transactions. Most Asian countries primarily rely on SWIFT codes for cross-border transfers.

IBAN vs SWIFT/BIC Code: What’s The Difference?

When you make an international payment, you may come across an invoice containing both an IBAN and a SWIFT/BIC Code. The reason is that they are not alternatives, but are complementary tools. Together, they reduce errors and ensure international transfers reach the right bank and the right account. For example:

- If you’re transferring within IBAN countries (e.g. France → Germany): You need both. The SWIFT/BIC identifies the recipient’s bank, while the IBAN pinpoints the specific account.

- If you’re transferring to non-IBAN countries (e.g. France → US): You provide the SWIFT/BIC plus the account and routing number, since the US does not use IBAN.

| Feature | IBAN | SWIFT/BIC Code |

|---|---|---|

| Purpose | Standardised format to identify a specific bank account across borders. | Unique identifier for a bank or branch within the SWIFT messaging network. |

| Role in Transfers | Ensures the money is credited to the correct account by reducing formatting errors in account numbers. | Directs the payment through the correct bank in the global network before it reaches the final account. |

| Structure |

Up to 34 alphanumeric characters. Format: – 2 letters (country code) – 2 digits (check digits) – Up to 30 alphanumeric characters (BBAN, country-specific). |

8 or 11 alphanumeric characters. Format: – 4 letters (bank code) – 2 letters (country code) – 2 letters/digits (location code) – Optional 3 letters/digits (branch code). |

| Origin | Introduced by the EU in the late 1990s to standardise cross-border euro payments. | Created in the 1970s by the SWIFT organisation to replace unreliable telex instructions. |

| Adoption | Used in ~80–90 countries, mainly Europe, Middle East, parts of Africa. Not used in the US, Canada, Australia, or much of Asia. | Global: nearly all international transfers require a SWIFT/BIC, even if an IBAN is also provided. |

Did you know?: BIC and SWIFT codes are also used interchangeably.

How IBAN Numbers Work

IBAN numbers work as a bank account identifier that contains all the necessary information for international transfers:

- Country identification - Shows which country the account is in

- Error checking - Built-in validation prevents incorrect transfers

- Bank identification - Specifies the exact bank and branch

- Account identification - Points to the specific account number

When you provide an IBAN for an international transfer, banks can immediately validate the number and route the payment correctly, often completing transfers within minutes rather than days.

For example, if you're a business in the UK receiving payment from a German client, providing your correct IBAN allows their bank to verify your account details and process the transfer instantly. Without an IBAN, the same payment might require manual processing and currency routing through multiple intermediary banks, and could take 3-5 business days to reach your account.

The Format of an IBAN Number

Now that you understand what an IBAN is and how it works, let's break down how these numbers work together to identify your bank account.

Components of an IBAN:

- Country Code (2 letters) - ISO country code (e.g., GB for UK, DE for Germany)

- Check Digits (2 numbers) - Validation digits to prevent errors

- Basic Bank Account Number (BBAN) - Up to 30 characters containing:

- Bank identifier code

- Branch identifier

- Account number

IBAN Length by Country:

- Germany: 22 characters

- France: 27 characters

- United Kingdom: 22 characters

- Spain: 24 characters

- Italy: 27 characters

- Netherlands: 18 characters

The total length varies from 15 to 34 characters, depending on each country's domestic banking structure.

ISO Requirements for IBAN Numbers

Country-Specific IBAN Examples

Below are examples of what an IBAN looks like.

The French IBAN Number Format

In this example, the country code 'FR' represents France, the IBAN check digits are 12, followed by five digits for the bank identifier (34567), five digits for the branch identifier (89234), 11 characters for the account number (888963D56774), and the last two digits (01) as the BBAN check digits.

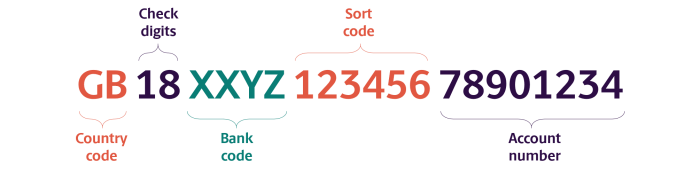

The UK IBAN Number Format

In this example, the country code 'GB' represents the United Kingdom, the IBAN check digits are 18, followed by the four-character bank code (XXYZ), the six-digit sort code (123456), and the eight-digit account number (78901234).

As mentioned, each country has its own BBAN format. Therefore, the length of the IBAN number varies from country to country. Although the UK IBAN number consists of 22 characters, it contains all the necessary details to ensure your international transfers arrive safely.

Tip: Enter the complete IBAN in the account number field, as most banking systems will auto-format and validate it. The check digits aren't filler but security features that help banks detect typos and prevent failed or misdirected transfers.

Why Do I Need an IBAN Number?

An IBAN is required when you make a cross-border payment, and your beneficiary’s bank is in a country participating in the IBAN system.

As a business, you'll encounter IBAN requirements when:

- Paying European suppliers, contractors, or service providers

- Receiving payments from clients in IBAN-participating countries

- Setting up recurring payments or direct debits with European partners

- Opening business accounts with banks in IBAN countries

- Processing refunds or reimbursements to European customers

How IBAN Transfers Work

When sending money overseas, you need the recipient's full name, address, IBAN, and bank details to ensure your funds will be wire-transferred to the intended bank account.. For UK/EEA payments, you'll also need their BIC/SWIFT code. You may also be asked about the purpose of the payment and your relationship with the recipient.

Once you have the recipient’s details, choose a transfer method. Consider two main options: traditional bank wire transfers or online services. While bank wire transfers initiated at a bank branch can be expensive due to fees, online services like Wise, OFX, or similar providers often make sending money via IBAN significantly cheaper.

When receiving money, ensure the sender has your complete personal details, IBAN, and BIC (if applicable). Money received in foreign currencies will be converted at current exchange rates before reaching your account.

Note: Using IBANs for US payments (which use routing numbers) or omitting them for European payments can route transfers through multiple banks, causing 3-5 day delays and £15-40 in additional fees. Always check which payment format your recipient's country requires before sending.

Where to Find Your IBAN Number

If you need to find your IBAN for an international transfer, there are several easy ways to locate it. Most banks provide it directly on statements or inside online banking, but you also have backup options if it’s not immediately visible.

| Method | How to Find It |

|---|---|

| Bank Statements | Check paper or electronic statements; usually near your account number and sort code. |

| Online Banking |

Step 1. Log in to your online banking account Step 2. Navigate to account details or account information Step 3. Look for "IBAN" or "International bank account number" Step 4. Copy the full alphanumeric code |

| Mobile Banking Apps | Open your app → Account details / International details / Payment details. |

| Bank Cards | Some banks (esp. in Europe) print the IBAN directly on debit/credit cards. |

| Contact Your Bank | Call customer service or visit a branch. |

| IBAN Calculators | Enter your country code, bank code, and account number. |

Tip: Consider opening a virtual IBAN account if your local bank doesn't provide IBANs or you need IBANs for multiple countries.

Best Practices for IBAN Validation

Always validate before transfers: Double-check your IBAN when making international or telegraphic transfers. Even small errors can cause significant delays and fees.

Use IBAN calculators for incomplete data: If you only have part of your beneficiary's IBAN, you can use an IBAN calculator to find the missing pieces. We have tested this tool multiple times and found it reliable in providing the correct IBAN.

Regular validation checks: Use an IBAN validation tool to flag potential errors, especially since beneficiaries may not always update their payment details promptly on websites or invoices.

By following these validation steps, you can easily verify IBANs and ensure smooth international money transfers without costly errors or delays.

What Happens if You Use the Wrong IBAN Number?

If you enter an incorrect IBAN, your international transaction will be rejected. Your bank will charge an additional fee to retrieve the funds, and it will take time to process them. Therefore, your payments will be further delayed.

However, if you enter a valid IBAN that belongs to someone else, your money will go to the wrong recipient and may be much harder to recover, since banks don’t typically verify that recipient names match IBAN holders.

Hence, it's important to double-check the IBAN before making any transactions and consider using IBAN validation tools to prevent costly mistakes.

Important: If you suspect an incorrect IBAN was used, contact your bank immediately in order to make fund recovery easier.

Conclusion

Knowing how to use, locate, and validate IBANs properly eliminates the complexity from international transfers, making overseas payments as simple as domestic ones.

From managing personal foreign transactions to running global business operations, IBANs provide the reliability that modern commerce requires.

For businesses managing cross-border transactions, Statrys offers multi-currency support across 11+ currencies, global SWIFT connectivity, competitive FX rates from 0.1%, and digital-first convenience.

FAQs

What is an IBAN number, and how does it work?

An IBAN (International Bank Account Number) is a standardised code that identifies your bank account internationally. It combines your country code, check digits, and local bank details into one string of up to 34 characters, allowing banks worldwide to process your international transfers accurately and quickly.