Features

Fees

Account Opening

User Reviews

Established in 1932, OCBC Bank is one of Singapore’s 3 major local banks and has grown into a regional financial institution serving customers across Asia. It offers a full suite of business services, including current accounts, multi-currency solutions, lending, trade finance, treasury services, and digital banking tools.

In this review, we’ll walk through what OCBC offers for startups and SMEs, including pricing, account features, the onboarding process, and what business customers say about OCBC Singapore.

OCBC Fees

OCBC offers several business account options, with account-related fees varying by account type and where the company is registered. Transfer fees apply across all OCBC business accounts.

With an OCBC business account, local transfers within Singapore are free to receive and cost SGD 20 to send. For international transfers, the bank charges SGD 10 for incoming payments and SGD 30 for outgoing payments, plus any applicable agent bank fees.

The table below shows the fees that apply to businesses registered in Singapore.

| Account Fee Type | Business Growth Account | Business Entrepreneur Account Plus | Multi-Currency Business Account |

|---|---|---|---|

| Account setup fee | $0 | $0 | $0 |

| Initial deposit | $1,000 | $30,000 | Not applicable |

| Monthly fee | $10 (waived for the first 2 months) | $0 | $10 (waived if you have a SGD account) |

| Fall-below fee | $15 (if average balance below $1,000) | $50 (if average balance below $30,000) | Not applicable |

| Benefits |

Free 80 FAST transfers per month Free 80 GIRO transfers per month |

Not applicable | Not applicable |

For non-Singapore companies, a different pricing structure is applied. This includes:

- A one-time setup fee of USD 1,200

- A monthly fee of SGD 50 for an SGD account

- Or USD 50 for a multi-currency account

For more details, you can refer to OCBC’s Business Foreign Account Pricing Guide.

Overall, OCBC offers affordable banking for Singapore-registered businesses, especially if you make domestic transfers regularly. For non-Singapore companies, however, the higher setup and monthly fees mean it is worth comparing the total cost against alternative providers before committing.

OCBC Features

Since OCBC Singapore offers a range of financial products tailored to different groups, this section focuses on the key features most relevant to small and medium businesses.

Business Account

OCBC business account supports local payments through FAST, GIRO, and MEPS, and offers international transfers in over 60 currencies via telegraphic transfer. Transactions can also sync with Xero and InvoiceNow, which is a big plus for bookkeeping.

Here are business account options for SMEs in Singapore:

- Business Growth Account

80 free FAST and 80 free GIRO transfers per month, plus up to 1% cashback with the debit card. Suitable for businesses focused on local payments. - Multi-Currency Business Account

Hold and transact in 13 currencies, including SGD, HKD, USD, GBP, EUR and AUD. Best for SMEs dealing with overseas clients or suppliers, though FX rates may vary.

While the platform isn’t as modern as fintech alternatives, you gain stability, access to lending, and a wider set of banking services. If you prefer working with an established bank, OCBC is a good choice.

Do note that OCBC offers the Business Foreign Account for businesses registered outside Singapore. It's an SGD account that lets you send and receive domestic payments in Singapore. However, this account doesn’t include the free transfer allowances like the Business Growth Account.

Business Debit Cards

OCBC’s business debit card offers simple cashback with no minimum spend or annual fee. You earn 1% on categories like digital marketing, software, online retail, and travel, and 0.2% others. All spending is deducted directly from your business account and shown in a single consolidated statement. The card is accepted worldwide through Mastercard and NETS.

You’ll need to submit an application before receiving the card. After approval, the physical card arrives in about seven days, while the digital version is available immediately in the OCBC Business Banking app. You can request additional cards for your team, but OCBC does not specify how many can be issued and how much they cost, so you’ll need to check with the bank.

OCBC Business Account Opening

OCBC Singapore allows eligible businesses to open an account fully online using Singpass. If your company can use Myinfo Business, the process is quick and requires only a few steps.

If your business has Singpass access:

- Log in with Singpass and start the application through Myinfo Business.

- Check that your company name, UEN, and product selection are correct.

- Upload your signature when prompted.

- Submit your application.

Instant approval is possible, but it is not guaranteed. It only occurs if OCBC’s automated checks are successful. Applications may be flagged for manual review in cases such as corporate shareholders, foreign directors or shareholders, non-standard business activities, newly incorporated companies, or AML and KYC concerns.

If approved instantly, you will get an account number issued on the spot. Otherwise, OCBC will follow up to continue the review process.

If your business cannot use Singpass:

Foreign-owned companies or businesses registered outside Singapore can still apply online. Once you submit the form, an OCBC representative will contact you to guide you through the remote onboarding process. The onboarding is done fully online, and there is no need to visit a branch.

However, OCBC doesn’t provide a clear timeline for account approval. Therefore, applications without Singpass can take several weeks, especially for more complex business structures.

Who Can Apply?

Any businesses registered in Singapore must be registered in Singapore with a valid UEN (Unique Entity Number). Eligible business structures include

- Private Limited Companies

- Sole Proprietorships

- Partnerships

- LLPs

- Societies, Associations, and Clubs.

Foreign-owned or foreign-registered businesses may also be able to apply, but OCBC does not publish clear eligibility guidelines for these cases. If your company is registered outside Singapore, you will need to contact OCBC directly to confirm whether you can open an account.

Required Documents

You'll also need to provide documents, which vary slightly depending on your business type. In general, prepare:

- Valid ID for all directors and authorised signatories

- Company Constitution (for Private Limited Companies)

- Certificate of Incorporation or Registration

- Latest ACRA business profile (dated within 3 months)

- Board Resolution (if required)

- Proof of residential address (for some business types)

OCBC provides a detailed document checklist on its website for Singapore-registered businesses. If your company is registered outside Singapore, you’ll need to check directly with OCBC, as the required documents are not publicly listed.

OCBC from Real Users

As we approach the end of this review, it’s helpful to see what real customers say about OCBC business account in Singapore. We pick Apple Store and Google Play Store reviews as there are solid amount of reviews to reflect user experiences of OCBC.

Apple Store

OCBC Singapore has a strong Apple Store rating of 4.6 out of 5 based on more than 7,200 reviews, which is notably high given that traditional banks often score closer to 2 or 3.

That said, many of the most recent reviews highlight problems with installation, login, and overall app stability. This suggests the app performs well for some users but has faced growing reliability issues in recent months.

Google Play Store

The Android version also shows a relatively high rating of 4.4 out of 5 from 3,240 reviews. However, recent Google Play reviews reflect much of the same experience shared by Apple users.

Many comments mention installation difficulties, login issues, and device compatibility concerns after updates. While the app works well for many businesses, these points suggest that performance can vary, and some users may encounter reliability issues depending on their setup.

Best OCBC Alternatives

If OCBC is not the right fit for your company, here are some alternatives to consider instead:

1st Choice

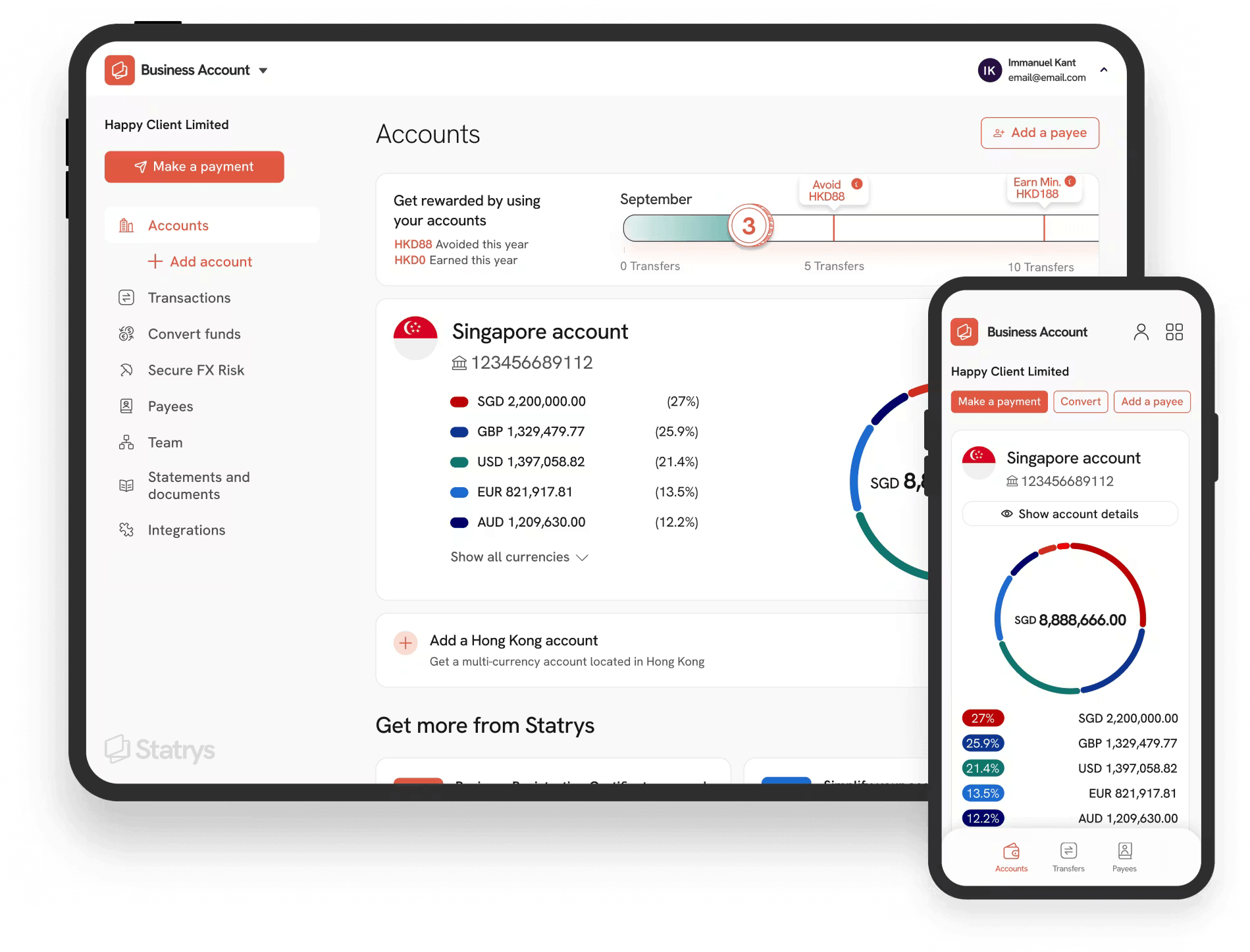

Multi-currency business account supporting 11 major currencies with FX fees as low as 0.1%

2nd

Business account that supports up to 40 currencies and comes with multiple debit cards.

3rd

Multi-currency business account with extensive business management tools.

Why Statrys?

Statrys is a stronger fit than OCBC if you want support that is easy-to-reach and a reliable platform. While OCBC is a major bank, its mobile app has mixed reviews regarding stability, and resolving issues often requires waiting in phone queues or visiting a branch. These delays can get in the way of your business operations.

With Statrys, you get a platform designed for reliable, everyday use and direct access to a dedicated account manager who you can contact via channels like phone and WhatsApp when you need help with accounts and payments.

FAQs

What is the minimum balance for OCBC business account?

The minimum balance depends on the account type. For instance, the Business Entrepreneur Account Plus requires an average balance of SGD 30,000 to waive monthly fees. The Business Growth Account has no minimum balance requirement but charges an SGD 10 monthly fee, waived for the first two months.

Which business bank account is best in Singapore?

Which bank is best for a business account?

Is OCBC a good bank?

Disclaimer

Statrys competes directly with OCBC in the Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.