Key Takeaways

A sort code is a unique six-digit number predominantly used by banks in the UK. When making domestic or international wire transfers in the UK, the sender is required to provide the sort code and account number.

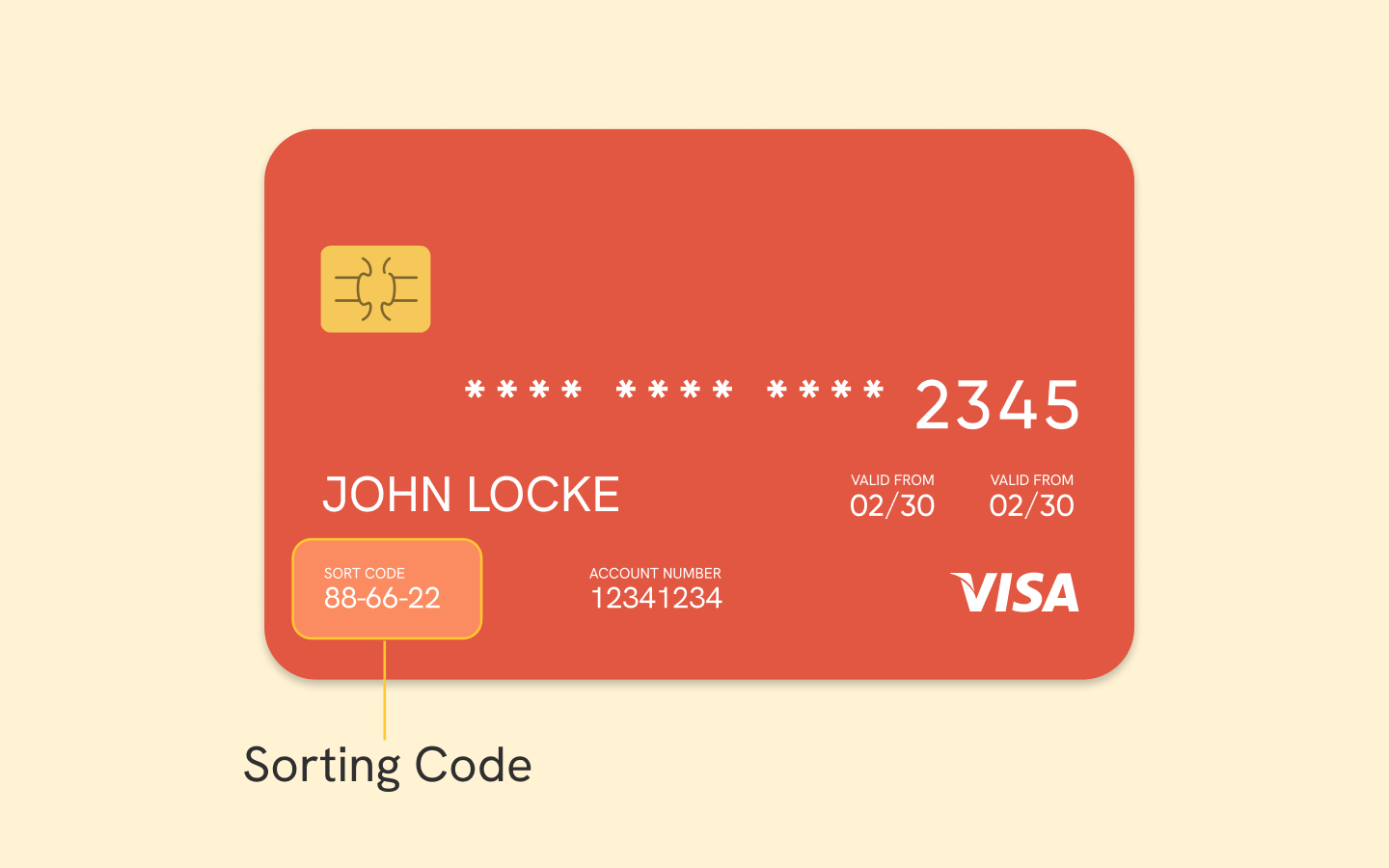

If you have a credit card or a debit card, your sort code should be printed on the front or back of the card, along with your account number. Alternatively, you can check your bank statements for the six-digit number located near your bank account number. The last option is to check your chequebook, where your sort code should be printed on the bottom left corner of each cheque, along with your account number and cheque number.

If you have provided the wrong or failed to provide the sort code, it can result in your bank transfer being delayed or even rejected.

Whenever you have to make or receive international payments or domestic wire transfers, if the UK is in the equation, you may have to know what a sort code is and where to find it.

In this guide, we will cover what a sort code is, when you will need one, what happens if you provide the wrong sort code, where to find it, and much more.

What Is a Sort Code?

A sort code is a six-digit numerical code that identifies the specific bank and the specific branch where the bank account was initially opened. It is mainly used in the UK banking system to indicate where payment is going or coming from.

Every bank account in the UK is assigned a sort code.

🔎 Insight: UK online-only banks without branches may provide a single unique sort code that all clients use.

When Do You Need a Sort Code?

In a nutshell, you need a sort code when processing transactions that involve banks in the UK.

To elaborate, here are some common scenarios when you will need a sort code:

When Processing Domestic Wire Transfers within the UK

Each bank branch in the UK possesses a unique sort code, which allows for accurate and efficient routing of funds during domestic bank wire transfers.

So, if you want to receive payments from another bank account in the UK, you will need to provide your bank sort code and account number to the sender.

When Processing Transfers from Abroad to the UK

In other words, when other countries are sending money to the UK.

If you are overseas and want to send money to an account in the UK, you will need to know the beneficiary’s sort code and account number, among other account details. However, most banks may instead ask for an IBAN code (International Bank Account Number), which is another code that is more comprehensive and contains both the sort code and account number in itself.

For example, if you are abroad and want to send £1000 through a SWIFT network to your friend's bank account in London, you will need to know your friend’s name, SWIFT/BIC code, sort code, account number, etc. - or you need to know your friend’s name, SWIFT/BIC code, an IBAN number, etc.

When Setting Up Direct Debits or Standing Orders in the UK

Direct debit is an automated payment method where you allow a third party to collect money from your account on a regular basis. Similarly, a standing order is when you allow your bank to pay a fixed amount to another account on a regular basis. For both of these payments, if it’s happening in the UK, you will need to provide your sort code and account number.

For example, if you want to pay your monthly rent in the UK by direct debit or standing order, you must provide your landlord with your account number and sort code.

When Registering for Mobile Banking or Online Banking Account in the UK

If you have an account in the UK and you want to set up online banking for it, you’ll need an account number and a sort code.

🔎 Insight: Sort codes are not as frequently used directly in the Republic of Ireland. As part of the Eurozone, most transactions in Irish banks are now processed using an IBAN code.

What Does a Sort Code Look Like?

Typically, the sort code is written in three pairs such as 12-34-56. The first two digits identify the bank, the following four digits refer to the branch.

A sort code is also embedded in the International Bank Account Number (IBAN), used for international payments. In this case, it will be six digits hidden in a 22- to 34-digit code

How Can I Find the Sort Code?

Now that you have an understanding of what a sort code is, the next step is to locate it.

Good news, your sort code can never be too far, it’s somewhere within your financial documents.

Here are how and where to find your sort code.

Decode Your IBAN Number

IBAN stands for International Bank Account Number and serves as a global identification system designed to facilitate cross-border transactions. An IBAN number within the UK comprises a country identification code, check digits, Basic Bank Account Number (BBAN) and a sort code.

If you know your IBAN number, you can decode other information inside it.

To be succinct, the sort code is the 9th - 14th digits of an IBAN.

Access Your Digital Banking

Check your online banking app or website, where your sort code should be displayed along with your account number.

Communicate with the Bank Directly

Contact your bank directly by phone, email or visiting a branch, and ask them to provide you with your sort code.

Check Your Physical Banking Belonging (Cards, Bank Statements, Chequebook)

If you have a credit card or a debit card, your sort code should be printed on the front or back of the card, along with your account number.

Alternatively, you can check your bank statements, where your sort code should be shown somewhere near your account number.

The last choice is to check your chequebook, where your sort code should be printed on the bottom left corner of each cheque, along with your account number and cheque number.

Where Is the Sort Code on the Bank Card?

The sort code on the bank card is either on the front or on the back of the card. Look for the six digits presented in three pairs of two digits each, that is your sort code. It is typically under your name and next to the account number.

However, online-only banks with no branch may not provide a sort code on the bank card because all of their customers will get the same sort code. In this case, chances are, you can look it up on the bank’s website.

Why Is the Sort Code Important?

The sort code is important because it allows financial institutions to confirm the validity of a transfer and correctly route money to the beneficiary’s accounts.

Without a sort code, payment can be delayed, rejected, or even misdelivered, causing inconvenience and possible fees for both the sender and the recipient, especially for international transfers that may involve currency conversion and additional charges.

What Happens if You Provide the Wrong Sort Code?

If you provide the wrong sort code, it can result in your bank transfer being delayed, rejected, not being processed, or, although unlikely, ending up in the wrong account. This mistake can cause inconvenience, extra fees, or even loss of funds.

If there is a loss of money following the wrong sort code provided, your bank may try to get your money back but it won’t often be liable if you lose any money. So it’s always best to double-check your sort code and other bank details.

Contact your bank immediately if you’ve provided an incorrect sort code.

What’s the Difference Between Sort Code, SWIFT Code, and BIC Code?

Finances and banking come with a fair share of abbreviations used to identify banks and branches for electronic transfers. Apart from a sort code, you will encounter SWIFT, and BIC codes.

What are they and how are they distinct from one another? Let’s find out.

| Code Type | Definition | Purpose |

| Sort Code | 6 digit number used by UK banks to identify where a bank account is based. | Used for domestic or international wire transfers within or towards the UK. |

| SWIFT Code | 8-digit or 11-digit alphanumeric code used by banks and institutions in the SWIFT network to initiate international wire transfers. | Used for international wire transfers between banks. |

| BIC Code | 8-digit or 11-digit alphanumeric business identifier code which refers to an international bank code that identifies banks nationwide. | Used for international wire transfers and other financial transactions between banks globally. |

Sort Code

Sort code is a 6-digits number used to identify the precise bank branch. Its main function is to facilitate money transfers between financial institutions in the United Kingdom

When to Use a Sort Code:

- You are sending or receiving money within the UK

- You are sending money from abroad to the UK

SWIFT/BIC code

SWIFT refers to Society for Worldwide Interbank Financial Telecommunications and is a payment system designed for international transfer. BIC refers to Bank Identifier Code or Business Identifier Code used to identify a specific financial institution globally.

Each bank member of the SWIFT network is assigned a BIC. As time passed, people have come to refer to it as “SWIFT code” and used it interchangeably with BIC code.

Hence, the SWIFT code and BIC code are exactly the same code. It’s an 8-digit to 11-digit alphanumeric used when making international transfers.

When to Use a SWIFT/BIC Code

- You are sending or receiving money internationally

💡 Tip: Are you using the right bank code? Read more on this detailed comparison between SWIFT vs IBAN

Conclusion

To summarize, a sort code is a six-digit code that identifies a specific bank and bank branch in the United Kingdom. It is required when making domestic or international wire transfers. If the sort code is incorrect or missing, the transfer may be delayed or rejected.

If you own a business registered in the British Virgin Islands, Hong Kong, or Singapore and are looking for an alternative option, Statrys' virtual business account can be your answer.

Statrys virtual business account can accommodate domestic, SWIFT payment and cross-border payments, as well as hold multi-currencies at better rates, all in one account, with transparent fees.

FAQs

What is a sort code and what is it used for?

A sort code is a unique six-digit code used in the UK to identify banks and their branches for electronic payments.