All gain, no pain

Hong Kong Company Registration Services

Launch your Hong Kong business in less than a week—only with Statrys, offering everything you need, including company registration, accounting, and business accounts.

Simple and

Transparent Pricing

One price covers everything you need.

No hidden costs, zero surprises.

Incorporation Services

- Verification of the company name availability

- Preparation and filing of incorporation documents

- Articles of Association

- Government fees (HKD3,745 - included in our price)

- Certificate of Incorporation

- Business Registration Certificate (for 1 FYE)

- Company chops (corporate seals)

- 24/7 access to company documents on our online platform

Company Secretary Services

- Provision of a Secretary Company (1 FYE)

- Provision of a Designated Representative (1 FYE)

- Filing of Annual Return (NAR1)

- Automated reminders of filing deadlines

- Maintenance of the significant controller register

- Maintenance of the statutory records

- Preparation of the Annual General Meeting (AGM)

- All of your statutory records and compliance documents in one place, accessible online 24/7

Registered Address in Hong Kong

- Registered address (1 FYE)

- Scanning and forwarding of mail

Business Account

- Assistance with online business account opening

- Certification of documents for business account opening

Everything included:

Your company up and running in 5 days!

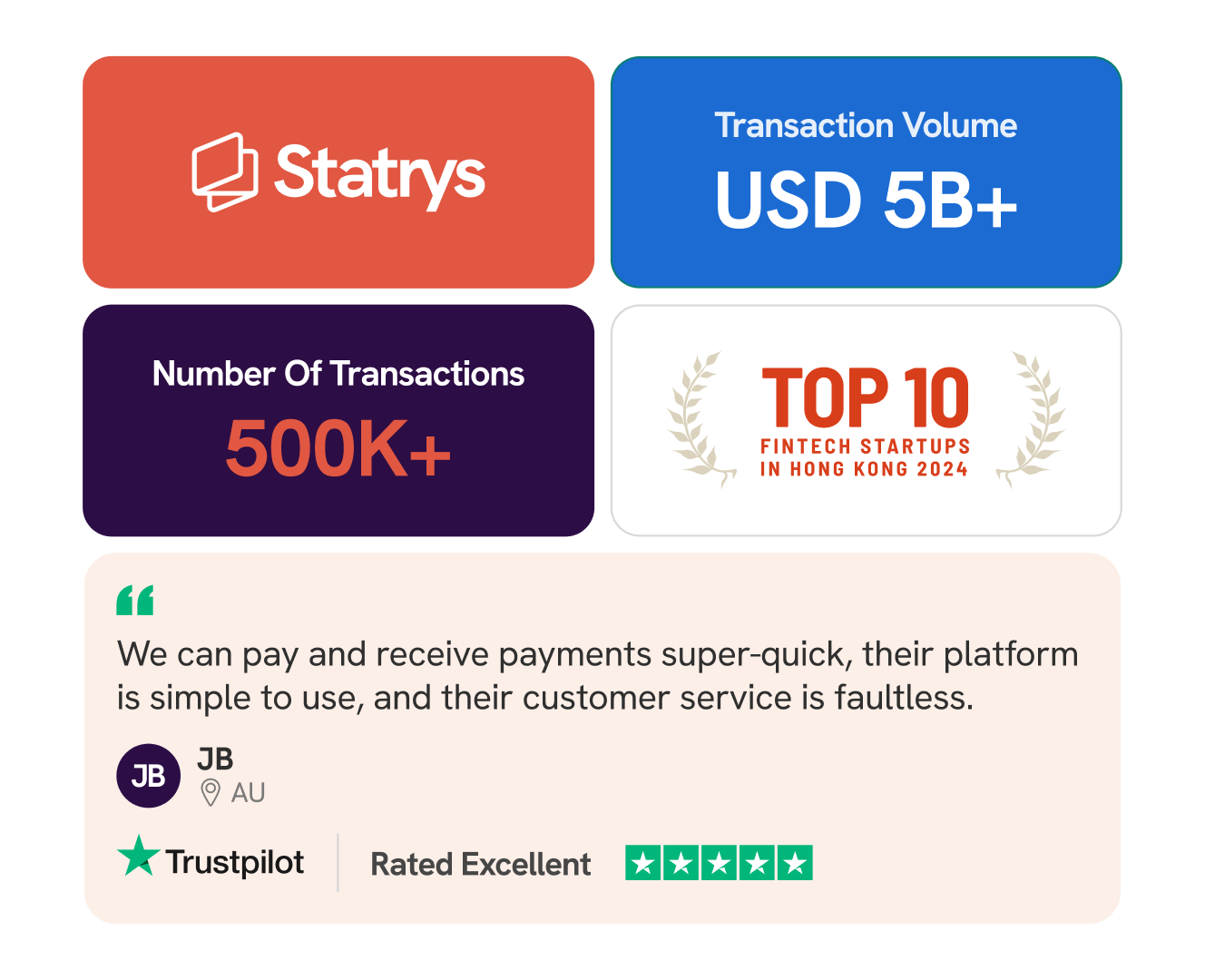

Why choose Statrys?

Business Account

Made Easy

Equip your company with a Statrys business account built to support your needs.

Account name matching your company name

One account, 11 currencies (HKD, USD, EUR, CNY, SGD, JPY, GBP,CHF, AUD, NZD, CAD)

Send and receive payments in over 100 countries.

Competitive transfer fees and FX rates.

Your own dedicated account manager.

Smart Accounting Solutions

Our competitors rush you into purchasing an accounting package before your company sees any revenue.

Avoid this common pitfall and potentially high costs with our approach to smarter accounting:

Take Your Time

Operate your business for a few months to understand your needs.Get Tailored Quotes

Receive competitive quotes from accounting firms that match your actual activity level.

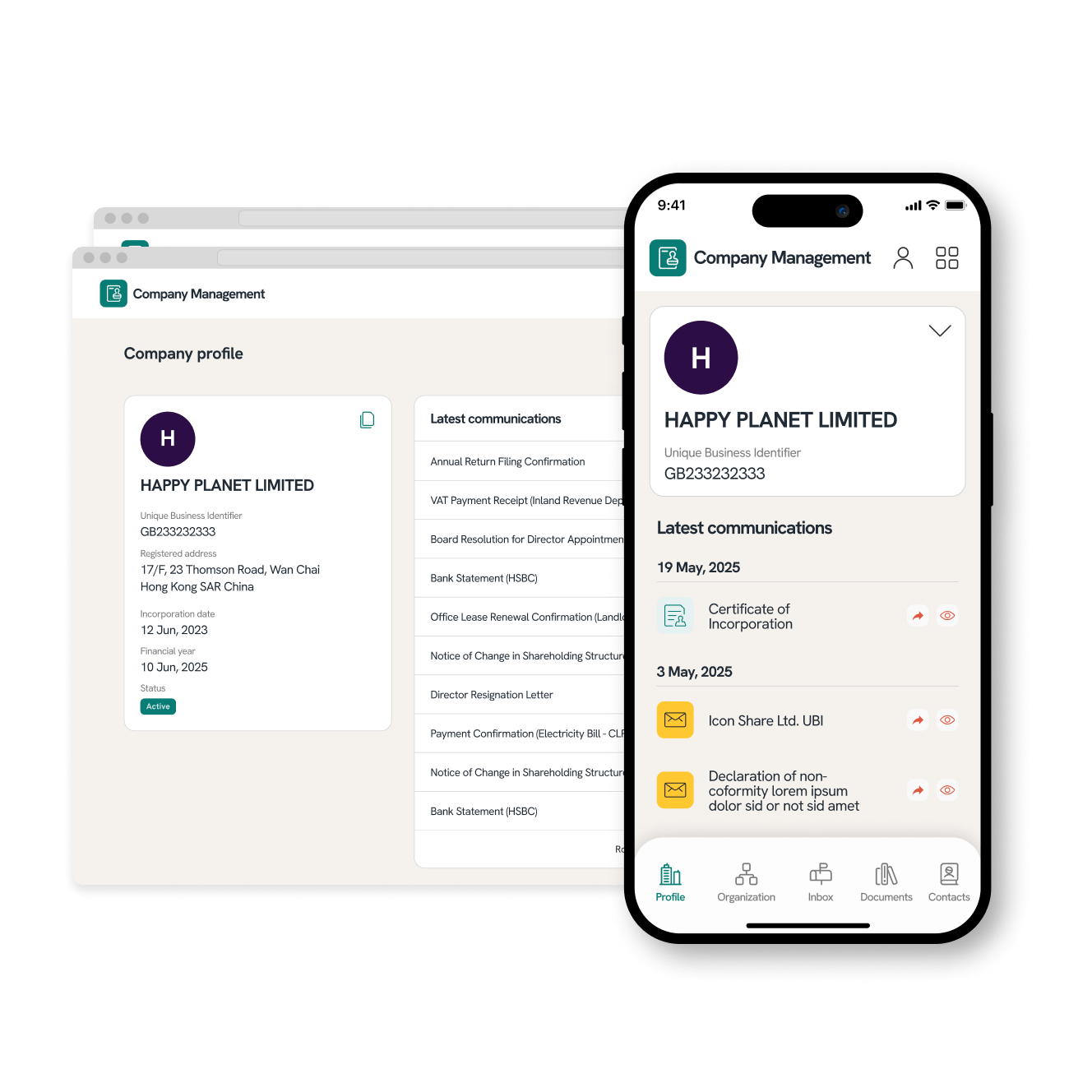

All Your Company Information in One Place

Keep all your company information within easy reach on your Statrys dashboard.

Enjoy convenient access anytime, anywhere:

Digital Document Storage

Safely store all corporate documents in one digital space.Complimentary Mail Scanning

Receive all your communications seamlessly with our free mail scanning service.

Zero Risk

We will refund our fees if you are not satisfied with our service within the first 30 days.

What Our Clients Say

They are on time with promised schedules...

They are on time with promised schedules. Nestor is my account manager and super helpful during the process. Thanks again for the service.

EXPRESS STUDY SOLUTION LIMITED

TH

Boutique services from Statrys

We strongly suggest Statrys for the Company Incorporation Services. The easy process, outstanding customer assistance, and complete service offerings make them the ideal choice for company incorporation with peace of mind. Before we hired them, we read a lot of good reviews online, which made us feel confident in their honesty and we experienced the same during our company creation process.

Machinex Global Limited

UAE

Fantastic service from Michelle in...

Fantastic service from Michelle in Singapore and Nestor for Hong Kong. Were able to get my new Singapore company set up with in 2 days. Highly responsive and quick for any questions I asked.

Robert King

SG

Very professional and high quality...

My experience with the company creation team, the first step in opening my business account, was fantastic. I talked with several people and all of them were polite and professional. Nestor went above and beyond from day one to the approval of the account, his in-depth understanding of Hong Kong made the proccess worry-free...

Lancelot Girard

TH

Company Incorporation perfection

They helped me alot with getting my company up and running with HK. Perfect support and great help! Company Incorporation with them, haven't been easier.

Frederik Therkildsen

TH

The best way to incorporate in HK with a bank account

I have been very pleasantly surprised by the experience as a whole. Everyone I have communicated with has been polite, responded quickly and every issue solved in a short amount of time. The app and website work seamlessly. All around a great product that I have already recommended to friends.

Ken H.

TH

Highly Professional Service

I used Statrys for my Company Incorporation in Hong Kong, as well as opening my Company Account. The service was very professional throughout and of absolute 5 star quality. I can't recommend it enough!

Frederik Schipper

HK

Featured on:

How to Register Your Hong Kong Company

Choose Your Company Name

Select a unique name for your company in either Traditional Chinese or English. The name must not be identical to any existing companies or trademarks, and it should comply with Hong Kong’s naming regulations.

The right name is important, as your application will be rejected if the name is already in use or doesn’t meet the guidelines. You can check if your desired name is available through the Hong Kong Companies Registry website or refer to our guide on company name rules and tips for more information.

Determine Your Company Structure and Share Capital

Choose Your Company Structure

The first step for company incorporation is deciding on the type of company to incorporate. In Hong Kong, most entrepreneurs opt for a private limited company (Ltd) due to its limited liability and tax benefits.

To incorporate a private limited company, you’ll need at least one director and one shareholder, and they can be of any nationality.

Appoint Directors and Shareholders

Both individuals and companies are eligible to be directors or shareholders. One person can serve as both director and shareholder, but there must always be at least one individual acting as a director.

Decide on Share Capital

After appointing your directors and shareholders, you’ll need to decide on the share capital. Hong Kong doesn't have minimum or maximum share capital requirements, except in certain regulated industries like finance. The minimum share capital is typically HKD 1 or its equivalent in other currencies.

Appoint a Company Secretary

Hire a Local Company Secretary

Every Hong Kong company is required to have a local company secretary. The company secretary's key role is to handle communication with government agencies and ensure your business stays compliant, including filing tax returns on time.

The company secretary must be either a Hong Kong resident or a registered service provider, such as a Hong Kong Trust and Corporate Service Provider (TCSP). If you’ve chosen Statrys for your company registration, we can act as your company secretary, ensuring seamless compliance with all legal requirements. As a registered TCSP, Statrys is fully equipped to handle these responsibilities.

Find a Registered Address

Every company is required to have a registered business address in Hong Kong. This must be a physical location where the government can send official notices and legal documents, which your company secretary will receive and manage for compliance. PO boxes are not allowed. Statrys offers a registered office address service, including mail scanning and forwarding, to ensure all legal documents are properly handled.

Prepare the Documents

Gather the Required Documents

To incorporate a company in Hong Kong, you’ll need the following documents:

- Identification Documents: Provide certified ID for all directors, shareholders, and the company secretary. This can include Hong Kong ID cards (HKID) or passports Certified by a CPA, notary public, licensed trust or company service provider, or a consular officer.

- Articles of Association: This mandatory document outlines your company’s internal structure, including details on share capital, shareholder rights, and operational procedures.

- Proof of Address: You’ll need to supply documents such as utility bills or lease agreements to confirm the residential addresses of directors and shareholders.

- Incorporation Form (NNC1/NNC1G/IRBR1): These forms capture details about your business, including its nature, registered address, share capital, and information on directors, shareholders, and the company secretary. They are available for download or online submission through the Hong Kong Companies Registry.

Submit Your Application

There are two methods to incorporate your company, and they are:

Offline Application:

- Prepare all required documents.

- Download the incorporation forms from the Companies Registry website

- Submit the completed forms by mail or in person to the Companies Registry on the 14th Floor, High Block, Queensway Government Offices, Hong Kong.

Online Application:

- Visit the Company E-Registry at www.e-services.cr.gov.hk

- The director or a verified representative must create an account, submit the application, and upload certified identity documents for the directors and shareholders.

If you are registering a private limited company, the process can be done entirely online unless you have a corporate shareholder, in which case incorporation documents must be submitted in person.

Registering a Hong Kong Company As a Foreigner

Setting up a 100% foreign-owned business in Hong Kong is simple. Just provide two key documents, and we’ll handle everything for you:

Passport copies of directors and shareholders

Proof of address of directors and shareholders

Don’t have the time?

Let us help you register your Hong Kong company.

Hong Kong Business Guides

Read our detailed guides to learn more about doing business in Hong Kong

Business Guide

Business GuideHow to Set up a Company in Hong Kong in 2024 - Is It Difficult?

In this video, Nestor García, Head of Company Creation Services at Statrys, will explain how to set up a company in Hong Kong. Whether you are a foreigner or local who is starting a company or already started but needs company registration, this video is for you.

Hong Kong Guides

Hong Kong Guides6 minute read

What Is a Company Secretary in Hong Kong & Why It's Important

Every business in Hong Kong, in or outside the territory, must have a company secretary. Find out what it is and why you need one with this guide.

Hong Kong Guides

Hong Kong Guides10 minute read

6 Best Company Incorporation Services in Hong Kong in 2025

Discover the top 6 company incorporation services in Hong Kong. Compare their features, pricing, and pros and cons to find the best fit for your business.

Hong Kong Guides

Hong Kong Guides5 minute read

Certificate of Incorporation Hong Kong: What It Is & How It Works

Hong Kong Certificate of Incorporation is a document that confirms the legal establishment of a Limited Liability Company and its registration in the Hong Kong Companies Registry.

Hong Kong Guides

Hong Kong Guides8 minute read

Company Formation in Hong Kong - The Easiest Way in 2025

This article will outline the steps to company formation in Hong Kong and provide the easiest way for entrepreneurs to incorporate a company in 2025.

Hong Kong Guides

Hong Kong Guides5 minute read

Guide to Hong Kong's Tax Systems and Rates in 2025

Learn everything you need to know about Hong Kong's tax system and rates in 2025 with our comprehensive guide.

Hong Kong Guides

Hong Kong Guides5 minute read

Legal Entities in Hong Kong: A Guide for Entrepreneurs

Learn what a legal entity is, main types of business entity in Hong Kong and how to choose the right one for your business.

Why Register a Hong Kong Company

Strategic Location in Asia

Hong Kong serves as a gateway to Mainland China's dynamic markets. The proximity to China means faster payments and shipments, giving you a competitive edge in supplier relationships.

Global Financial Hub

Hong Kong's financial system is optimised for international business. With business accounts like Statrys offering multi-currency capabilities, you can effortlessly handle transactions in various currencies, enhancing your global operations.

Low Taxes

The Hong Kong tax system is flat-rate and territorial, meaning that the tax rate is not progressive and the tax is only applicable to the profits derived from a trade or business in Hong Kong. The normal profits tax rate in Hong Kong is 16.5% for corporate income tax. Incorporated companies pay 8.25% tax on the first $2 million of profits and 16.5% on the remainder, while unincorporated businesses pay 7.5% on the first $2 million and 15% on the rest.

Easy Incorporation Process

Companies in Hong Kong can be registered swiftly and managed easily, removing bureaucratic hurdles from your path to business success. Plus, our dedicated support team is here to assist you every step of the way.

Quiz

Is Your Company Eligible for Offshore Status?

Find out if your company will pay zero corporate tax in Hong Kong.

In collaboration with PKF

Frequently Asked Questions

Check out the most frequently asked questions from our clients.

Do I have to visit Hong Kong to register a company?

No, you do not need to visit Hong Kong in person to set up your company. With Statrys, the process is 100% online – no physical presence or travel is required. This makes it convenient for overseas entrepreneurs and business owners to incorporate their Hong Kong company remotely. All identification verification, document submissions, and even signatures are handled through our online platform, so you can enjoy a hassle-free company formation without leaving your home or office.

Do I need to rent an office to register a company in Hong Kong?

No, you are not required to rent a physical office space when registering a company in Hong Kong. The only address requirement is that your company has a registered office address in Hong Kong for legal correspondence. Statrys provides a Hong Kong registered office address as part of our service, so you can fulfil this requirement without the cost and hassle of renting an actual office.

Is it necessary to have a Company Secretary?

Yes. Every Hong Kong private company limited by shares is required by law to appoint a Company Secretary. The Company Secretary can be either an individual or a corporate entity. If you appoint a corporate service provider as your Company Secretary, that provider’s main office must be in Hong Kong.

Statrys includes Company Secretary services in our incorporation package – our in-house Company Secretary department will act as your company’s secretary to ensure your business stays compliant with local regulations. This service also provides you with a local registered office address in Hong Kong (for official government communications), so you don’t need to maintain a physical office yourself.

What is the pricing for Statrys’ Hong Kong company registration service?

Statrys offers transparent pricing with a single, all-inclusive package for Hong Kong company incorporation. The standard company formation package is priced at HKD 7,740. This price includes the official Hong Kong company registration fees (government charges totalling HKD 3,745 for incorporation and business registration) as well as Statrys’ service fees.

In other words, for HKD 7,740, Statrys handles the entire company registration process on your behalf with no hidden fees. You receive everything needed to set up a Hong Kong private limited company, from name reservation and document preparation to 12 months of company secretary service and a local registered address. Our pricing is straightforward and competitive, designed to give entrepreneurs a hassle-free start with no surprise costs.

Can Statrys help with company formation?

Yes, we assist entrepreneurs, startups, and other business owners in registering a new company in Hong Kong with a hassle-free online process. The company registration process only takes about 3–5 working days if all requested documents are provided.

Simply follow these steps:

Step 1. Submit your application and make payment online. No in-person visits are required.

Step 2. Fill in the incorporation form online.

Step 3. Upload the required documents, including the passport and proof of address for each director and shareholder.

Step 4. Complete the electronic identity verification process (eDIV) online.

Step 5. Sign the incorporation documents digitally once we’ve reviewed them.

Afterwards, your company is incorporated within 3 to 5 business days.

The total cost for our Hong Kong company formation package is HKD 7,740, which is an all-inclusive fee with no hidden charges. This one-time pricing covers all essentials of the company setup, including:

- Incorporation filings: Verification of your company name’s availability, preparation and filing of all incorporation documents, and standard Articles of Association for a private limited company.

- Government fees: All government registration fees (HKD 3,745, covering the Certificate of Incorporation and a 1-year Business Registration Certificate) are included in our price.

- Company Secretary & address: Provision of a Company Secretary service for 1 year (Statrys acts as your company secretary and designated representative) and a registered office address in Hong Kong for 1 year (with mail scanning and forwarding).

- Company kit: Company chops (official corporate seals) and preparation of statutory registers (e.g. Significant Controllers Register, share registers, etc.).

- Account opening assistance: Guidance and support to help you open a Statrys multi-currency business account for your new company.

This comprehensive package provides everything you need to complete your Hong Kong company setup smoothly, with transparent pricing and zero surprise fees.

What is Statrys Company Secretary's license number?

Statrys Corporate Services Ltd's Trust or Company Service Provider License number is TC008677.

Is there any difference between company registration, company formation, and company incorporation?

Hong Kong company formation, registration, and incorporation are basically the same thing, a set of processes to get a license to operate a business in Hong Kong legally.

Register Your Company in Hong Kong

One package, all included.

Everything you need to get your business started.