Key Takeaways

A SWIFT/BIC code identifies banks during international money transfers.

These codes consist of 8 or 11 characters, including letters and numbers.

Banks use SWIFT/BIC codes for secure transactions, including payments and direct debits.

If you’ve ever sent or received an international payment, you’ve likely come across the terms BIC and SWIFT codes. These unique codes are essential for ensuring that money reaches the right bank securely and efficiently. Yet, many people don’t know where to find them or why they are required for cross-border transactions.

Financial institutions worldwide rely on the SWIFT network to process telegraphic transfers while complying with regulatory requirements. However, using the wrong SWIFT/BIC code could result in your funds being delayed or even lost within the international banking network—retrieving them could take days or even weeks.

To avoid costly mistakes, it’s crucial to know how to find and use SWIFT and BIC codes correctly. In this guide, we’ll break down everything you need to know—from what SWIFT and BIC codes are, where to find them, and how they work in international payments.

Tip: You can also watch our video that explains BIC and SWIFT codes in 2 minutes

What Are SWIFT and BIC Codes?

These codes play a key role in international banking, ensuring funds reach the correct financial institution without delays. But what exactly do SWIFT and BIC codes mean? Let’s break them down.

Definition of SWIFT and BIC Codes

A SWIFT code, also known as a BIC (Bank Identifier Code), is a unique alphanumeric code used to identify a specific bank in international transactions. These codes help ensure that funds are securely and accurately routed across borders.

The terms SWIFT code and BIC code are often used interchangeably because they refer to the same system. The term "BIC" was originally introduced by the SWIFT network to create a standardized identification system for banks. Over time, people began referring to these codes as SWIFT codes after the organisation that assigns them.

You may see these codes referred to as BIC, SWIFT, BIC/SWIFT code, or SWIFT/BIC code, but they all mean the same thing.

How SWIFT Codes Work

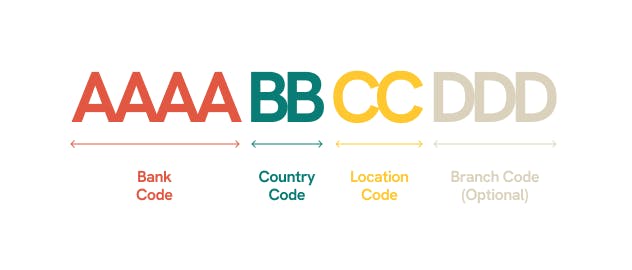

A SWIFT code follows a standard format that helps banks securely process international transactions. It consists of 8 or 11 characters, each providing specific details about the bank and its location. Here’s how it is structured:

- Bank Code (4 letters) – Identifies the bank and is usually a shortened version of the bank’s name.

- Country Code (2 letters) – Specifies the country where the bank is registered.

- Location Code (2 characters: letters or numbers) – Indicates the city or region of the bank’s headquarters.

- Branch Code (3 characters, optional) – Represents a specific branch. If omitted, the default SWIFT code directs to the bank’s head office.

Example: Statrys' SWIFT/BIC Code

Banks use these codes to ensure accurate and efficient processing of cross-border payments, reducing errors and delays in transactions.

Where Can You Find BIC and SWIFT Codes?

There are several ways to find your bank’s SWIFT or BIC code, whether through your bank’s official resources or trusted online tools.

1️⃣ Bank Statements & Online Banking

Most banks display their SWIFT/BIC codes on account statements (both digital and paper). You can also check within your bank’s online banking platform under the international transfers or account details section.

2️⃣ Official Bank Websites

Many banks list their SWIFT/BIC codes on their websites, typically under the FAQs, international banking, or wire transfer instructions sections. Searching for "[Your Bank] SWIFT/BIC Code" on their official website is often the quickest way to locate it.

3️⃣ SWIFT’s Official Lookup Tool

If you can’t find the code on your bank’s website, you can use SWIFT’s official lookup tool to search for the correct SWIFT/BIC code. [1] Simply enter the bank name, country, and location, and the tool will identify the correct code.

4️⃣ Contact Your Bank Directly

If you’re unsure or want to verify the SWIFT/BIC code, the safest option is to contact your bank’s customer support. This ensures you’re using the correct code for international transactions.

Important: Always double-check the SWIFT/BIC code with the recipient before making a transfer to avoid delays or failed transactions.

If you cannot find a SWIFT/BIC code for your bank, it may be because not all banks issue one. While most major financial institutions participate in the SWIFT network, some smaller banks, credit unions, and digital-only financial institutions operate outside of it.

In such cases, your bank may rely on an intermediary bank to process international transactions. If this applies to your situation, you will need to provide the SWIFT code of the intermediary bank instead.

When Do You Use a BIC/SWIFT Code?

You might need a SWIFT or BIC code in various banking situations, especially when making international payments. Here are common scenarios where these codes are required:

1️⃣ Sending Money Internationally

If you're transferring money to someone in another country, your bank will ask for the recipient’s SWIFT/BIC code to ensure the payment reaches the correct financial institution. Without the correct code, your transfer may be delayed or rejected.

Before making an international wire transfer, make sure you have:

- The recipient’s SWIFT/BIC code

- Their full name and bank account details

- Any additional bank codes required for specific countries (refer to our international payment guide for country-specific requirements)

2️⃣ Receiving Money from Overseas

If someone is sending money to your account from abroad, they’ll need your bank’s SWIFT/BIC code to complete the transaction.

What to provide to the sender:

- Your bank’s SWIFT/BIC code

- Your full name and account number

- Any other required details based on your bank’s requirements

SWIFT transfer costs depend on your bank, the number of intermediary banks, and the destination country. Additional fees may apply, especially for transfers routed through multiple institutions.

Note: Before making a SWIFT transfer, check with your bank for the total cost, including potential intermediary bank and exchange rate fees.

How Long Does a SWIFT Transfer Take?

SWIFT transfers typically take 1 to 5 business days to complete, depending on the banks involved, the destination country, and whether intermediary banks are required.

The transfer process involves multiple steps before the funds reach the recipient:

- The sending bank processes and forwards the payment via the SWIFT network.

- Intermediary banks (if involved) review and process the transfer.

- The recipient’s bank verifies and deposits the funds.

What Can Cause Delays?

While many transfers are completed within this timeframe, delays can still occur due to:

- Intermediary Banks → Transfers passing through multiple banks may take longer.

- Banking Hours & Time Zones → Transfers outside business hours or across different time zones may not be processed immediately.

- Public Holidays & Weekends → Many banks do not process international transactions on non-business days.

- Compliance & Security Checks → Banks may hold transactions for verification, especially for large transfers or high-risk countries.

Tip: For a more detailed breakdown, check our guide on how long a SWIFT transfer takes.

Alternative to SWIFT for International Payments

While SWIFT remains the standard for international bank transfers, businesses seeking faster and more cost-effective alternatives can explore local payment networks and fintech solutions.

Statrys offers a multi-currency business account that supports local payments in various currencies with local banks. This approach allows for:

- Faster Transactions: Local payments can be processed within minutes, enabling quick payments to suppliers or vendors.

- Lower Costs: Local transfers are more affordable, often at a fraction of the cost of international transfers.

- Reduced Intermediary Fees: By utilising local payment networks, businesses can minimise fees associated with intermediary banks.

Statrys supports local payments in the following countries and currencies:

- Hong Kong: Hong Kong Dollar (HKD)

- Australia: Australian Dollar (AUD)

- United States: US Dollar (USD)

- Thailand: Thai Baht (THB)

- Vietnam: Vietnamese Dong (VND)

- India: Indian Rupee (INR)

- European Countries: Euro (EUR) in 33 countries

- United Kingdom: British Pound Sterling (GBP)

- Philippines: Philippine Peso (PHP)

- Singapore: Singapore Dollar (SGD)

- Indonesia: Indonesian Rupiah (IDR)

- Turkey: Turkish Lira (TRY)

- South Korea: South Korean Won (KRW)

You can reach out to Statrys’ live chat for more information or contact the customer support team at support@statrys.com

FAQs

How do I find my SWIFT Code?

You can find your SWIFT/BIC code via your bank statements, online banking, the bank's website, SWIFT directory, or reach out to your bank's customer support.

Do all banks have a SWIFT BIC code?

What is a BIC code, and why is it important?

What is the bank code in Hong Kong?

Sources

1.

Swift