5 Best Payment Gateways for Small Businesses in 2026

1.

PayPal Business: Best for international payments

2.

Stripe: Most flexible and customisable gateway

3.

Square: Best all-in-one solution for online and in-store sales

4.

Braintree: Best for dedicated merchant accounts and advanced control

5.

Shopify Payments: Best for Shopify stores with integrated multi-currency checkout

You’ve built a great product and a user-friendly website, and customers are ready to shop. But even a well-designed store can lose sales if card and digital transactions fail. A reliable payment system ensures your customers can pay smoothly and helps you capture every opportunity.

Your payment gateway is at the forefront of this system, handling transactions securely and verifying payments. The performance of your gateway can directly impact revenue and the customer experience, which is why choosing the right provider is crucial.

In this guide, we’ll share the 5 best payment gateways for small businesses. You’ll learn about their core features, payment methods, supported countries, and fees, including transaction, monthly, setup, and chargeback fees.

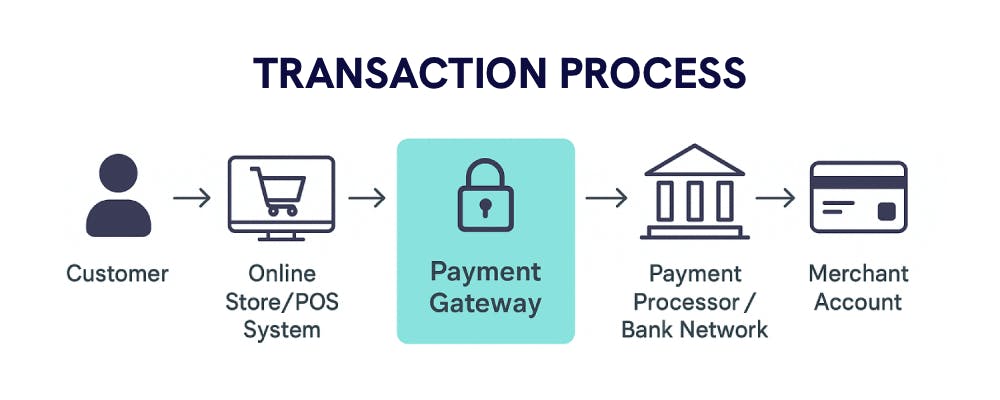

Before diving into the providers, let’s make sure you understand how payment gateways work and where they fit in the overall payment system.

What is a Payment Gateway?

A payment gateway is the technology that securely passes your customer’s payment details from your website or checkout system to the companies that process and settle the transaction. Think of it as the secure courier for payment data. It ensures the card or wallet information is encrypted, validated, and sent to the right place for approval.

Importantly, a gateway doesn’t actually move the money into your bank account. That responsibility belongs to the payment processor or acquiring bank. However, many modern providers bundle gateway, processing, and even merchant account services into a single platform, so you don’t have to piece everything together yourself.

Want to dive deeper? Check out our detailed guide to learn more about payment gateways to learn how they work, or watch our YouTube video for a quick visual breakdown.

Overview of the 5 Best Payment Gateways for Small Businesses

| Payment Gateway | Supported Countries & Currencies | Fees (Setup + Monthly) | Dispute/Chargeback Fee |

|---|---|---|---|

| PayPal Business | 200+ Countries, 25 Currencies | Setup: USD 0 Monthly: USD 0 |

USD 15 / 20 / 30 |

| Stripe | 46 Countries, 135+ Currencies | Setup: USD 0 Monthly: USD 0 |

USD 15 |

| Square | 8 Countries, 8 Currencies | Setup: USD 0 Monthly: USD 29–69 |

USD 25 |

| Braintree | 44 Countries, 130+ Currencies | Setup: USD 0 Monthly: USD 0 |

USD 5 / 15 |

| Shopify Payments | 39 Countries, 130+ Currencies | Setup: USD 0 Monthly: USD 0 |

USD 15 |

1

PayPal Business

Best for: International payments and small businesses looking to sell across borders.

PayPal is one of the world’s largest and most trusted online payment platforms, with over 400 million active accounts across more than 200 countries. Known for its ease of use and reliability, it has become a go-to solution for businesses of all sizes looking to sell internationally.

With a long history of secure transactions, PayPal Business offers merchants an efficient way to accept payments in multiple currencies and supports both online and in-person sales.

PayPal Business Key Features

- PayPal Zettle for integrated in-person payments

- Multiple payment options, including PayPal balance, credit, and debit cards, Apple Pay, Venmo, and Pay Later

- Online invoicing and a mobile card reader to help businesses manage payments on the go

- PCI compliance for secure transactions and barcode scanning to keep track of sales and inventory

- Easy integration with ecommerce platforms and marketplaces

PayPal Business Pricing

- Setup Fee: USD 0

- Monthly Fee: USD 0

- Transaction Fee (Online US transactions): 3.5% + USD 0.15

- Transaction Fee (In-person swipes): 2.9%

- Transaction Fee (E-checks): 3.49% + up to USD 300 for large payments

- Dispute Fee: USD 15

- Chargeback Fee: USD 20

PayPal Business Pros and Cons

Pros of PayPal Business

- Broad integrations and mature merchant ecosystem

- Available in 200+ countries

- Instant account approval

- Multiple payment options including Venmo, Pay Later

Cons of PayPal Business

- Funds may be frozen unpredictably

- Limited POS features and benefits

- Not ideal for high-risk or high-volume businesses

- High transaction fees and FX markup

2

Stripe

Best for: Businesses handling high-value transactions with a need for flexible, developer-friendly integrations.

Stripe is a payment platform that’s become a go-to for businesses looking to customise their payment systems. It’s trusted by companies worldwide, offering both payment gateway and processing solutions.

It’s especially great for businesses that want to build their payment workflows from the ground up, thanks to its developer-friendly tools and scalable features.

Stripe Key Features

- Supports over 135 currencies, allowing businesses to easily scale internationally

- Developer-friendly with tools like Stripe Elements for custom checkout experiences

- Offers prebuilt solutions with Stripe Checkout for faster setup and simpler integration

- Ideal for platforms and marketplaces with Stripe Connect, which allows easy management of multiple vendors

- Customer-centric features like real-time card verification, one-click payments, and address autofill help improve the shopping experience and reduce cart abandonment

Stripe Pricing

- Setup Fee: USD 0

- Monthly Fee: USD 0

- Transaction Fee (Touchless/Online transactions): 2.9% + USD 0.30

- Transaction Fee (Card-present transactions): 2.7% + USD 0.05

- Transaction Fee (ACH): 0.8% up to USD 5

- Transaction Fee (Manual entry): 3.4% + USD 0.30

- Chargeback Fee: USD 15

Stripe Pros and Cons

Pros of Stripe

- Transparent and simple pricing model, making it easy to understand costs

- Flexible payment options that cater to a variety of business needs

- Multi-currency support, making it ideal for international businesses

- Advanced anti-fraud features to ensure secure transactions

Cons of Stripe

- Some advanced features require developer expertise for implementation

- Extra fees for invoicing and recurring billing can add up

- First fund transfer may take between 7-14 days, which can be a delay for some businesses

3

Square

Best for: Businesses that need flexible, omnichannel payment solutions for online, in-store, and on-the-go sales.

Square is a versatile payment platform that offers an all-in-one solution for both online and in-store businesses. It seamlessly integrates software and hardware into a single platform, making it easy for businesses to process payments across multiple channels.

Whether you're running an online store, a brick-and-mortar location, or both, Square has you covered with tools that streamline payments and make the entire process more efficient.

Square Key Features

- Versatile platform supporting online, in-store, and in-person transactions

- Allows embedding payment links and turning mobile devices into POS systems

- Offers card readers, cash drawers, and receipt printers for in-store payments

- Supports credit/debit cards, gift cards, ACH transfers, mobile wallets, checks, cash, and QR codes.

Square Pricing

- Setup Fee: USD 0

- Monthly Fee: USD 29 – USD 69

- Transaction Fee (Manually keyed transactions): 3.5% + USD 0.15

- Transaction Fee (Online transactions): 2.9% + USD 0.30

- Transaction Fee (In-person payments): 2.6% + USD 0.10

- Chargeback Fee: USD 25

Square Pros and Cons

Pros of Square

- Transparent pricing structure

- Versatile hardware options

- Support for diverse payment methods

- Advanced fraud prevention

- Customisable analytics and reporting

Cons of Square

- Offline features are limited compared with dedicated POS systems

- High-risk industries may not be supported

- Limited integration with some third-party platforms

- Monthly fee required

4

Braintree

Best for: Businesses seeking flexible, developer-friendly solutions with dedicated merchant accounts and advanced payment controls.

Braintree is a payment gateway built on the same infrastructure as PayPal, offering businesses more control over their payment processing by providing dedicated merchant accounts. While it requires a PayPal Business account for merchants wanting to accept PayPal, it also supports independent card processing, giving businesses flexibility in how they manage transactions.

The platform is particularly attractive to developers, offering customisation options and advanced payment controls. While Braintree provides extensive flexibility, it does require some coding expertise to make the most of its developer tools and customisable checkout workflows.

Braintree Key Features

- Customisable workflows for more control over payment processing

- Supports PayPal, Venmo, credit and debit cards, ACH direct debits, and digital wallets like Apple Pay, Google Pay, and Samsung Pay

- Available in 44 countries, with support for 130+ currencies

- No setup fees or monthly fees, offering transparent pricing

Braintree Pricing

- Setup Fee: USD 0

- Monthly Fee: USD 0

- Card and third-party digital wallet transactions: 2.89% + USD 0.29

- Venmo transactions: 3.49% + USD 0.49

- PayPal transactions: 3.49% + USD 0.49

- ACH direct debit transactions: 0.75% up to USD 5

- Chargebacks: USD 15

- Disputes: USD 5

Braintree Pros and Cons

Pros of Braintree

- Transparent pricing

- Supports PayPal, Venmo, credit and debit cards

- Offers individual merchant accounts

- No early termination or contract fees

Cons of Braintree

- High transaction fees

- Requires web development or technical integration expertise

- No POS hardware or in-person transaction solutions

5

Shopify Payments

Best for: Shopify merchants looking for a seamless, integrated checkout experience with multi-currency support and fast payouts.

Shopify Payments is Shopify's native payment gateway, built to integrate seamlessly with the Shopify platform. This means you can accept payments directly in your store without needing third-party processors, making the setup easier and faster.

It’s designed to give Shopify merchants a smooth and secure checkout experience, handling everything from transactions to payouts. If you’re using Shopify for your online store, this is the most straightforward way to manage payments without the hassle of additional setups.

Shopify Payments Key Features

- Seamless integration with the Shopify platform

- No additional transaction fees for Shopify users

- Built-in fraud analysis and PCI compliance

- Fast payouts with Shopify Balance (available in supported countries)

- Supports credit and debit cards, Apple Pay, Google Pay, and Shop Pay

Shopify Payments Pricing

- Setup Fee: USD 0

- Monthly Fee: USD 0

- In-person transactions: 2.4% – 2.7% depending on plan

- Online transactions: 2.4% – 2.9% + USD 0.30

- Currency conversion fee: 1.5% (US) / 2% (other regions)

- Chargebacks: USD 15

Shopify Payments Pros and Cons

Pros of Shopify Payments

- Seamless integration with Shopify

- No additional Shopify transaction fees

- Built-in fraud analysis

- Supports multiple currencies and payment methods

- Fast payouts with Shopify Balance

Cons of Shopify Payments

- Some merchants report slower settlements or payout reserves

- Advanced settings may be confusing for new merchants

- Checkout has limited flexibility for gift orders or alternate shipping addresses

Criteria for Selecting the Best Payment Gateways

When choosing a payment gateway for your business, it helps to focus on the factors that matter most. These criteria will ensure smoother transactions, secure payments, and a better experience for your customers.

1. Ease of Use

How easy is it to set up and run your payment gateway? That’s what ease of use is all about. Small businesses usually want something plug-and-play that can be customised quickly and managed straight from your website dashboard without any technical expertise required.

Self-hosted checkout options are a plus. They keep the payment process fast and smooth, so customers don’t get stuck or abandon their carts. On the other hand, if your setup relies too much on third-party checkouts, it can slow things down and frustrate shoppers.

Did you know? According to Statista, a long and complex checkout is the fifth biggest driver of shopping cart abandonment.

2. Security

Keeping payments secure is non-negotiable. At the very least, your gateway should be PCI DSS Level 1 compliant. That’s just a technical way of saying it meets strict standards to keep card transactions safe from fraud.

Look for end-to-end encryption too. This scrambles payment data as it travels from your site to the bank, making it almost impossible for hackers to read. Tokenisation adds another layer of protection by turning sensitive card details into secure codes before they’re sent through the payment network.

Other features to watch for include 3D Secure 2.0, which adds an extra step to verify cardholders; SSL/TLS certificates, which ensure your site’s connection is safe; and Address Verification Service (AVS), which checks that the billing address matches the one the card issuer has on file.

3. Pricing

Understanding pricing is crucial. Look beyond advertised rates and consider your total expected costs, including setup fees, monthly fees, transaction charges, dispute or chargeback fees, and any FX or cross-border surcharges.

High-volume businesses may benefit from gateways with higher monthly fees but lower per-transaction costs. Smaller merchants or low-volume businesses may prefer no monthly fees, even if transaction rates are slightly higher. The goal is to calculate your annual costs under each pricing model so you can choose the most cost-effective solution for your business.

Transparency is key. Some providers make it difficult to see the full cost upfront, which can lead to unpleasant surprises. Always read the fine print and clarify any hidden charges before committing.

4. Compatibility with Popular Ecommerce Platforms

Most leading payment gateways offer plugins or extensions for major ecommerce platforms. For example, WooCommerce, Shopify, Wix, Squarespace, and Magento support PayPal, Stripe, Square, Braintree, and Shopify Payments.

Check that your chosen gateway works seamlessly with your platform, themes, apps, and checkout customisations. Some integrations are plug-and-play, while others may need developer input.

A practical approach is to set up a staging environment or clone of your website. This lets you test each gateway safely, ensuring features like multi-currency payments, refunds, and recurring billing work as expected before going live.

Tip: Not sure which payment gateways and methods are best for your ecommerce store? Check out our detailed guide to find the right solution for your business.

Wrapping Up

There is no single best gateway for every small business. Choosing the right payment gateway starts with understanding your needs, priorities, and transaction volumes. Use this guide to match your requirements with the features of each provider so your business runs smoothly and your customers have a seamless experience.

Here’s a quick summary to help you decide:

- Choose PayPal if you sell internationally and need a trusted global gateway.

- Choose Stripe if you handle high-value transactions and want lower processing fees with flexible integration options.

- Choose Square if you sell both online and in person and need a flexible omnichannel solution with POS hardware.

- Choose Braintree if you want a dedicated merchant account with strong control over payments, ideal for managing chargebacks or returns.

- Choose Shopify Payments if you run a Shopify store and want a fully integrated checkout, multi-currency support, and fast payouts.

Even after selecting a gateway, managing multi-currency payments across borders can be complex. Statrys simplifies this by letting companies incorporated in Singapore, Hong Kong, and the BVI send and receive payments in 11 currencies, including USD, CNY, and SGD, to over 140 countries. All your transactions, FX conversions, and account management are handled in a single business account, helping to simplify international payments and reduce operational hassle.

FAQs

What is a payment gateway?

A payment gateway is a service that securely processes customer payments, transmitting transaction information from your website or app to your merchant account.