What Is a Single Euro Payments Area (SEPA)?

SEPA stands for Single Euro Payments Area, which is a transaction system of the European Union that facilitates cashless payments between Euro countries.

It is regulated by the European Commission and is used by individuals and entities in the area to make electronic transactions such as direct debits, instant credit transfers, and credit transfers.

Key Takeaways

SEPA is administered to 36 countries by the European Payments Council (EPC), with 27 countries in the European Union (EU) and 9 countries in the European Economic Area (EEA).

The EPC provides different payment schemes, which are used by over 4,000 Payment Service Providers (PSPs) in Europe for customers to make electronic payments in SEPA regions using a single bank account.

SEPA enables businesses and individuals across the European region to streamline Euro payments with ease, similar to how domestic transfers are made.

| Facts and Figures | |

| Name | Single Euro Payments Area |

| Year established | 2014 for Euro area countries 2016 for Non-euro area SEPA countries |

| Currency | Euro (€) |

| SEPA areas | 36 countries, including 27 countries in the European Union (EU) and 9 countries in the European Economic Area (EEA) |

| Cashless payment instruments | Direct debit and credit transfers |

Which Countries Can Use SEPA?

There are currently 36 countries that are members of SEPA. However, not all of the countries are in the European Union (EU).

For instance, the United Kingdom (UK), which went through Brexit in 2020, or other European countries, including Iceland, Norway, and Liechtenstein, are still members of SEPA but are not part of the EU.

Let's take a look at the breakdown of each set of countries eligible for SEPA.

EU Member States with EURO Currency

1. Austria

2. Belgium

3. Cyprus

4. Estonia

5. Finland

6. France

7. Germany

8. Greece

9. Ireland

10. Italy

11. Latvia

12. Lithuania

13. Luxembourg

14. Malta

15. Netherlands

16. Portugal

17. Slovakia

18. Slovenia

19. Spain

EU Member States with Non-EURO Currency

20. Bulgaria

21. Croatia

22. Czech Republic

23. Denmark

24. Hungary

25. Poland

26. Romania

27. Sweden

Non-EU Country SEPA

28. Andorra

29. Iceland

30. Liechtenstein

31. Monaco

32. Norway

33. San Marino

34. Switzerland

35. United Kingdom (UK)

36. The Vatican City State

How Does a SEPA Bank Transfer Work?

The SEPA system was designed to make international transfers as simple and inexpensive as possible, just as they are within a country.

According to the European Payments Council (EPC), there are over 46 billion transactions in SEPA each year. The EPC uses what is known as " payment schemes" to facilitate payments, which are used by over 4,000 Payment Service Providers (PSPs) in Europe alone.

SEPA enables customers to make electronic payments to any account located in the SEPA area with a single bank account and one set of payment instruments.

There are five payment processing schemes, including:

- SEPA Credit Transfer (SCT)

- SEPA Instant Credit Transfer (SCT Inst)

- SEPA Direct Debit (SDD Core)

- SEPA Direct Debit Business-to-Business (SDD B2B)

- One-Leg Out Instant Credit Transfer (OCT Inst)

SEPA Credit Transfer (SCT)

SCT is a payment initiated by a payer to a beneficiary. This scheme is used mainly by Payment Service Providers (PSPs).

They can be used for one-time or recurring payments, and require both the payer and recipient’s BIC and IBAN. This payment scheme is particularly used for a business procedure, such payroll deposit to employee accounts, or one-time payments when making a direct transfer.

Transfer limit: With SCT, your transfer has a maximum limit of €999,999,999.99, which is one cent less a than a billion euros.

SEPA Instant Credit Transfer (SCT Inst)

SCT Inst is a payment scheme used to facilitate a secure and cashless instantaneous transactions, and is available for 24/7. This is often used between a buyer and a seller, especially for ecommerce payments.

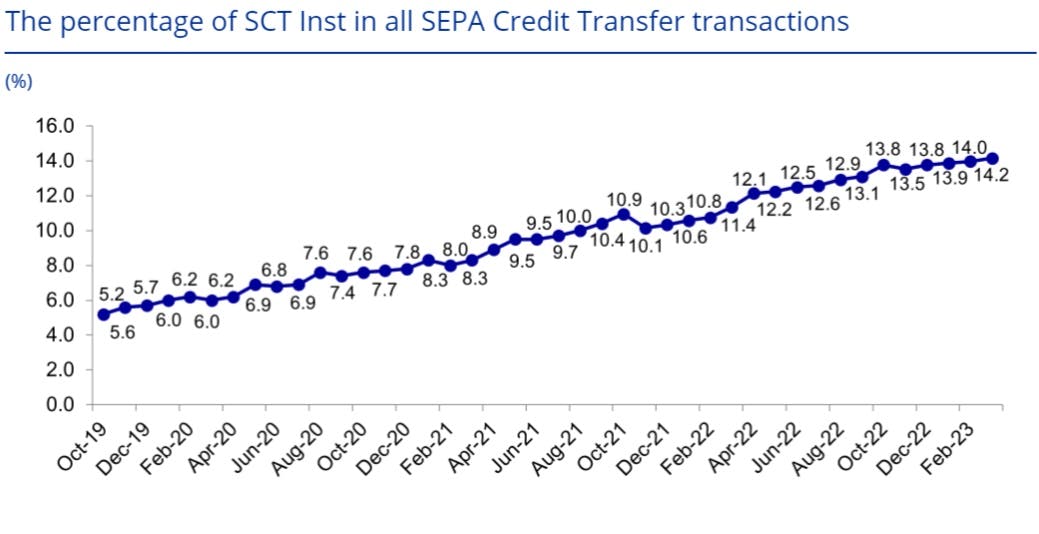

Source: ECB - Instant payments statistics.

The chart above shows that digital instantaneous payments are becoming popular and is increasing exponentially with the use of SCT Inst.

Transfer limit: SCT Inst offers a transfer limit of €100,000 per transaction.

SEPA Direct Debit Transfer (SDD)

SDD transfers are based on bank-to-bank transfers, which do not involve any card services like other SEPA payment schemes. Similar to how ACH payments work in the US.

This type of SEPA payment is commonly used for automated payments and is not an instant payment, such as bill payments in SEPA countries. It is pull-based, meaning that when the customer requests the transaction, the merchant initiates the payment.

Note that SDD is conducted only in Euros, which means that if either the corresponding bank involved in a transaction is not using the same currency, there can be additional fees due to the currency exchange rates, and the payee is also required to maintain your IBAN to collect the SEPA payment.

Transfer limit: SDD has no fixed transfer limit, as most transfers depend on the agreement made between the sender and receiver.

💹 Learn how you can avoid currency exchange rate risks when you make international transfers.

SEPA Direct Debit Business-to-Business (SDD B2B)

Similar to how SDD functions, SDD B2B is only available between businesses, as well as participating banks within the SEPA scheme and PSPs. This payment scheme is often used by businesses to facilitate fast and secure cross-border transactions with 13 months to dispute unauthorized transactions.

Transfer limit: SDD B2B has no specific transfer limit, as most transfers depend on the agreement made between the businesses.

SEPA One-Leg Out Instant Credit Transfer (OCT Inst)

OCT Inst is somewhat similar to how SCT Inst functions, which offers immediate credit transfers between banks in SEPA-selected countries. Users can initiate payments with real-time transfers at their disposal 24/7.

Transfer limit: OCT Inst offers a transfer limit of €100,000 per transaction.

How Long Does a SEPA Transfer Take?

SEPA transfers may offer different schemes, but the time it takes to make a transfer can depend highly on the types of SEPA payment options you use.

- SEPA Credit Transfer (SCT): Usually takes 24 hours, or the equivalent of one business day.

- SEPA Instant Credit Transfer (SCT Inst): Instantaneously, which can be anywhere from 5 to 10 seconds to receive a transfer or less.

- SEPA Direct Debit (SDD Core): Can take up to 3 to 5 business days. However, in some cases, such as transfer delays, it can take up to 14 business days.

- SEPA Direct Debit Business-to-Business (SDD B2B): Similar to SDD Core, SDD B2B transfers can take a minimum of 3 business days up to 14.

- One-Leg Out Instant Credit Transfer (OCT Inst): Similar to the SCT Inst, the OCT Inst is available 24/7 and takes a few seconds for the transfer to complete.

Are There Any SEPA Payment Charges?

SEPA transfer fees will cost you similarly to how you make a local bank transfer. The difference that SEPA payments offer is a "shared costs" payment method (SHA), which can be beneficial for some local receiving banks as the additional charges are shared between a payer and payee.

However, you should always be aware that your local banks may charge you additional fees in cases where multiple currencies are involved. This can sometimes incur bank charges due to the difference in currency and conversions.

Learn how a multi-currency account works and how to take advantage of your bank transfers.

Benefits of SEPA Payments

If your transfers involved Euros, you can take many distinct advantages from SEPA payments. Here are some of the benefits of SEPA payments:

- Transfer time: SEPA processed payments faster than the traditional cross-border payments. Depending on the SEPA payment schemes you choose, your payments are done instantaneously where most schemes also offers a flexible option depending on your circumstances.

- Convenience: SEPA payments are convenient to use from anywhere in Europe, even if your country is not on EU list. It supports 36 European countries and is alternatively a better option compared to traditional banks.

- Cost-efficient options: Apart from making transfers from different types of payment schemes SEPA offers, it is offers cost-efficient options whether you're a business or an individual.

- Secure transfers: The payments made using SEPA payment options are highly secure through the use of encrypted technologies, which can be beneficial in reducing any payment risks or fraudulent activities.

🔍 Do you have a business in Hong Kong looking to make a SEPA transfer to Europe? Check out our SEPA Payments Guide to learn more about how to make a transfer.

Conclusion

All in all, SEPA payments help both businesses and individuals streamline payments efficiently while also saving costs along the way. It offers many different payment options, known as payment processing schemes, which are flexible and highly functional in every case.

SEPA payments are quite common for European countries to use as well as other non-EU countries like the UK for fast and secure transactions.

Using SEPA enables you and your business to ensure that payments are convenient, secure, and received on time, anytime.

FAQs

What is the SEPA payment method?

SEPA stands for Single Euro Payments Area, which is a transaction system of the European Union that facilitates cashless payments between countries in European Union states.