Company Registration in Singapore - The Complete Guide 2026

Thinking of incorporating a company in Singapore? You’re in the right place.

With its strategic location, low corporate tax rate (capped at 17%), strong intellectual property protection, and a suite of government grants for startups and SMEs, Singapore continues to be one of the world’s most business-friendly economies.

In fact, over 53,000 new business entities were registered in 2024, an average of more than 4,400 new companies formed every month. It’s no surprise that Singapore ranks among the top globally for ease of doing business.

While the registration process appears digital and efficient, first-time founders—especially those from overseas—often encounter unexpected hurdles such as appointing a local director, securing a registered address, and understanding what to do after incorporation.

That’s why I’ve created this guide to provide practical, step-by-step instructions to make your Singapore company setup as smooth as possible.

You’ll discover:

✅ What documents and requirements are actually needed

✅ How to complete the company registration process from start to finish

✅ What post-incorporation tasks to handle to stay compliant

Let’s dive in and get your business off the ground in Singapore, with clarity and confidence.

Content

What You Need to Know Before Registering a Company in Singapore

Before jumping into the registration process, let’s start with the key requirements. Whether you're a local entrepreneur or an overseas investor, being well-prepared will save you time, reduce paperwork issues, and ensure your application is processed smoothly.

The Main Requirements (For Local and Foreigners)

To register a company in Singapore, you need the following:

- At least one local director - At least one director must be a Singapore citizen, a permanent resident, or someone holding an eligible work pass, such as an EntrePass, or an Employment Pass or S Pass with a Letter of Consent to act as a director. Pass holders must also have a permanent address in Singapore. If neither you nor your business partner meets these criteria, it's common to appoint a nominee director to fulfil the local directorship requirement.

- A local registered address - This must be a physical address in Singapore. P.O. Boxes are not allowed.

- A local company secretary - You must appoint a company secretary within six months of incorporation. The secretary must be a Singapore resident.

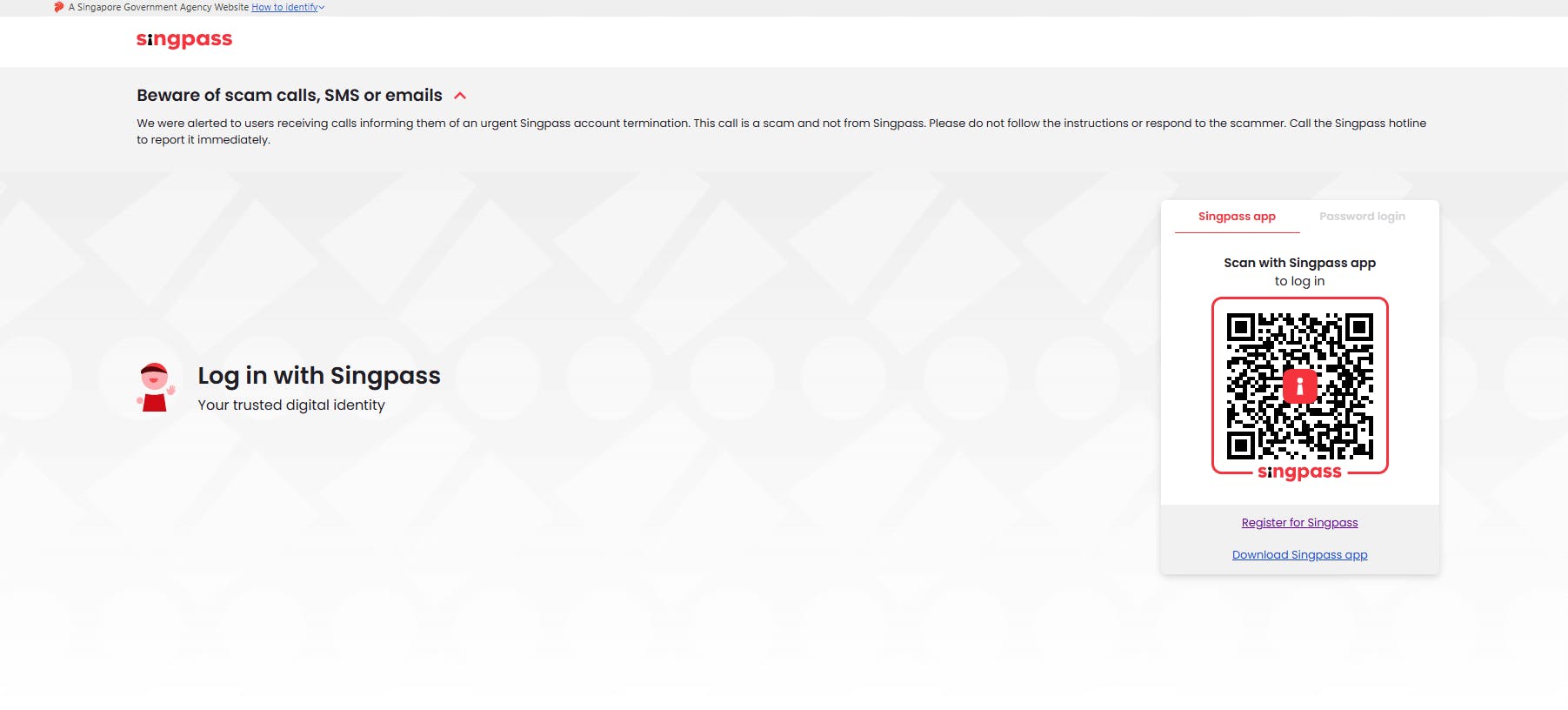

- Singpass - Singpass is Singapore’s official digital identity, used to access a wide range of government services. You must have a Singpass to incorporate your company online; otherwise, you will need the assistance of filing agents or professional incorporation services to handle the company registration on your behalf. If you have an Entrepass, you can apply for a Singpass.

- At least one shareholder - You can have up to 50 shareholders, and they can be individuals or corporate entities.

- Minimum paid-up capital of SGD 1 - or equivalent in any currency

Note: According to the Singapore Accounting and Corporate Regulatory Authority, If any position holder is a foreigner, it is mandatory to appoint a corporate service provider to handle the business registration.

What to Prepare

Here are the necessary documents and information you will need for Singapore company incorporation.

- A Company Name: Your approved business name and transaction number from the name reservation. During the company registration process, your company’s details, including its legal entity and business activity, will be automatically imported from this reservation.

- Details of the Proposed Directors and Officers: This includes the name, residential address, ID numbers, and type of identification documents such as an NRIC for local directors or a passport for foreigners.

- Share and Shareholder Details: Information on the company’s share structure, including the currency, class of shares (such as ordinary or preference shares), any subclasses, details on share payables, and identification details of individual or corporate shareholders (name and identification number or UEN).

- Registered Office Address Details: Provide your company's registered office address, including the postal code and working hours. The normal working hour in Singapore is 9 a.m. to 6 p.m.

- Company Constitution: A company constitution is a document outlining the rules governing the company’s operations, including management structure and shareholder rights. It is formerly known as the Memorandum and Articles of Association (M&AA). You can choose to use the model constitution or upload a customised one.

In Singapore, company registration can be done exclusively online through Bizfile, which is the online platform provided by the Accounting and Corporate Regulatory Authority (ACRA). In-person applications are not accepted.

Insight: Its strategic location, various SME grants and low corporate tax rates and top reasons why people set up companies in Singapore.

Applying for Business Licences

Before you register a company in Singapore, you need to know if your business will require licences and permits to operate. This matters because it can affect how you set up your company, including how you determine your paid-up capital. For instance, registered travel agents must have a minimum paid-up capital of SGD 50,000 for Niche Licences or SGD 100,000 for General Licences.

Here are some of the common sectors where licenses and permits apply.

Building & Construction

Financial Services

Fundraising & Charity

Dormitory Services

Food & Beverage

Hotel

Education

Healthcare

Travel Agency

Environmental Services

Logistics

Some industries require businesses to meet specific conditions before a licence can be granted. This may include having a minimum paid-up capital. For instance, registered travel agents must have a minimum paid-up capital of SGD 50,000 for Niche Licences or SGD 100,000 for General Licences.

After successfully incorporating your Singapore business, you can apply for the necessary licences. The GoBusiness Singapore website offers a complete list of licences you can apply for, along with those for renewal or amendment.

How Much It Costs to Incorporate a Company

If you have a local director and a registered address ready, incorporation costs typically range from SGD 600 - 1,500 depending on entity type and other mandatory fees, such as for local company secretary, and business license fees (if any).

If you do not have a local director or registered addresses, costs can rise to SGD 5,000 to 8,000 or more, as you'll need to pay for those services.

Government Fees

- Name Application Fee: SGD 15

- Company Registration Fee: SGD 300 (Private company, Public Company)*

- Certificate of Incorporation: SGD 50

Total Initial Government Fees: SGD 365

Note: After the first year, an Annual Filing Fee of SGD 60 applies. This is not included in the initial incorporation cost but it is a recurring yearly expense after that.

Registered Office Address

Every company must have a local registered address, which cannot be a PO Box. Options include:

- Physical Office Rental: Costs for renting an office in Singapore vary based on location and size, with the average costs ranging between SGD 3.80 to 15.00/sqft monthly. According to listings on CommercialGuru, a major commercial property platform in Singapore, office spaces in recommended locations generally range from SGD 20,000 to 30,000 per month.

- Virtual Office Services: Businesses that don’t require a physical space can choose virtual offices instead. Costs for Singapore virtual office services is usually about SGD 5 - 200+ per month.

Approximate Annual Office Rental: SGD 600 to 2,400

Other Mandatory Fees

- Company Secretary: Every registered company in Singapore must have a company secretary. Most corporate secretary services offer quote-based pricing, typically ranging from SGD 200 to SGD 1,200 annually. This depends on the level of services they provide. Be aware that many providers increase their fees based on the number of shareholders, so companies with more shareholders may face higher charges.

- Nominee Director: If there isn’t a resident director, companies may need to appoint a nominee director, costing between SGD 1,500 and SGD 5,000 per year. There is also an additional security deposit of SGD 1,000 to 2,000.

- Business Licences and Permits: Costs vary depending on the type of licence required. For example, the General Travel Agent Licence costs SGD 400 and has minimum financial requirements of SGD 100,000.

- Company Auditor: Unless exempted, companies must appoint an auditor. Fees for this service generally range between SGD 1,000 and SGD 5,000 per year, depending on the business size. Although audit fees are not technically the initial setup costs, the requirement arises quickly, as an auditor must be appointed within three months following incorporation; therefore, it is important to be aware of the typical fee.

How Long It Takes to Incorporate a Company

The total time to incorporate a company can range from 2 days to over 2 months, depending on your industry and company structure. This estimate does not include the time you spend preparing your application and documentation.

- If your company structure is simple and you’re in a low-risk industry, incorporation may take as little as 2 - 3 days.

- If you're in a regulated or high-stakes industry—such as real estate, educational service or legal services—or your company structure is complex with multiple layers, it could take up to 2 months or more.

Below is a breakdown of why the timeline varies:

| Step | Simple Company | Complex Company / High-Stakes Industry |

|---|---|---|

| Name Check | Approved soon after payment | 14 days to 2 months |

| Application Filing | 10–20 minutes | 10–20 minutes |

| Application Approval | Soon after payment | May take up to 15 working days |

Understanding the Type of Companies in Singapore

Choosing a type of business entity for your company is extremely important, as it affects your registration requirements and your company’s operations. The common business structures in Singapore include

- Private Limited Company (Pte Ltd): A private limited company can have a maximum of 20 shareholders. This is the most common structure for businesses in Singapore, offering tax advantages and limited liability protection as shareholders are only liable for the company’s debts up to their share capital. It is also the most flexible type of business entity.

- Limited Liability Partnership (LLP): An LLP combines the benefits of a partnership and a company. It allows partners to operate as a partnership while having limited liability protection, meaning each partner is not personally liable for the business debts or the actions of other partners.

- Sole Proprietorship: A sole proprietorship is the simplest business structure. It is owned and operated by one individual who has full control of the business but is also personally liable for its debts and obligations. Only a Singapore Citizen, permanent resident, or eligible Foreign Identification Number (FIN) holder can register as a sole proprietor.

While this guide covers the essentials of registering a business in Singapore, we focus mainly on private limited companies. Other types of business entities may have specific requirements, so it’s important to check the guidelines that apply to your chosen business structure.

6 Steps to Register a Company in Singapore: A Quick Summary

To register a company in Singapore, you’ll need to follow six essential steps. These steps ensure that your company is legally compliant and properly set up to operate. Here’s a quick overview:

Submit your proposed company name to ACRA for approval. The name must follow specific guidelines.

Decide on the number of directors and shareholders. At least one director must be a Singapore resident. You must also determine your company’s share capital and confirm shareholder details.

While not strictly required at the time of registration, you must appoint a company secretary within six months of incorporation. The secretary must be a resident of Singapore and meet eligibility requirements. The secretary handles key compliance duties, and having one early helps keep your company on track.

Your company’s FYE determines the deadlines for tax submissions and annual filings. This must be set during registration and can follow a 12-month or 52-week cycle.

All companies in Singapore must have a physical address where official correspondence can be delivered. This address must be operational during business hours and cannot be a P.O. Box.

Once everything is ready, submit your application online through Bizfile using a Singpass. If you don’t have a Singpass, you’ll need to engage a professional filing agent. After submission, ACRA will send the necessary documents to the appointed directors, shareholders, and company secretary. All parties must sign the documents within 60 days.

Let’s look at the details below.

Step 1: Choose and Reserve Your Company Name

All new company names must be submitted to and approved by ACRA before registration.

You can either reserve the name first or register it at the same time as your company. If you choose to reserve the name first, make sure to keep the transaction number. You’ll need it when registering your company. Once approved, the name will be reserved for 120 days. If you don’t register your business within that period, the name will become available to others.

Here are the key points to help you choose and reserve your company name successfully, and to avoid unnecessary delays or fees.

How to Name Your Company

The proposed name for your company should follow ACRA guidelines, which include:

|

Do

Don't

|

Note: Registering a company name with ACRA is not the same as registering a trademark. Company name registration does not give you exclusive or intellectual property rights over the name. To protect your name and have exclusive rights, you must submit a separate trademark application to the Intellectual Property Office of Singapore (IPOS).

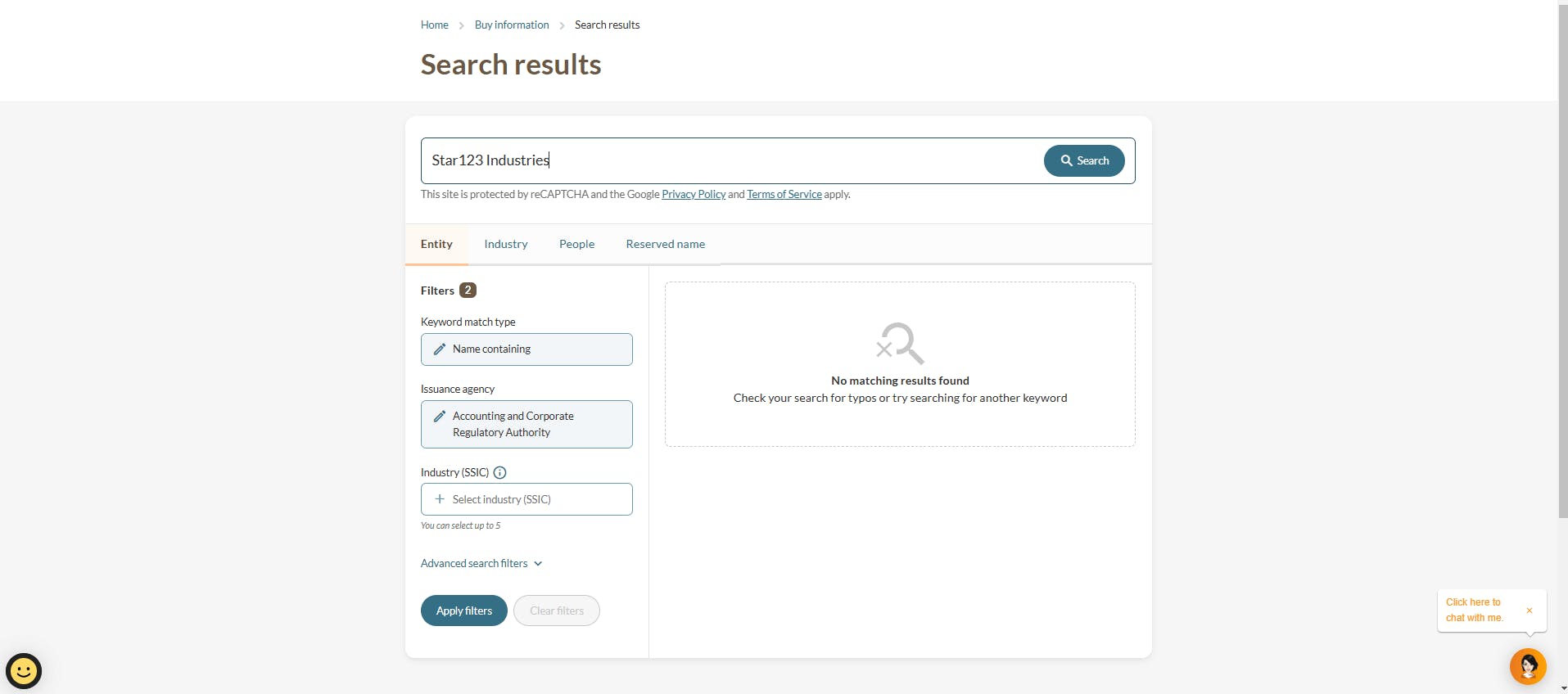

Checking Name Availability

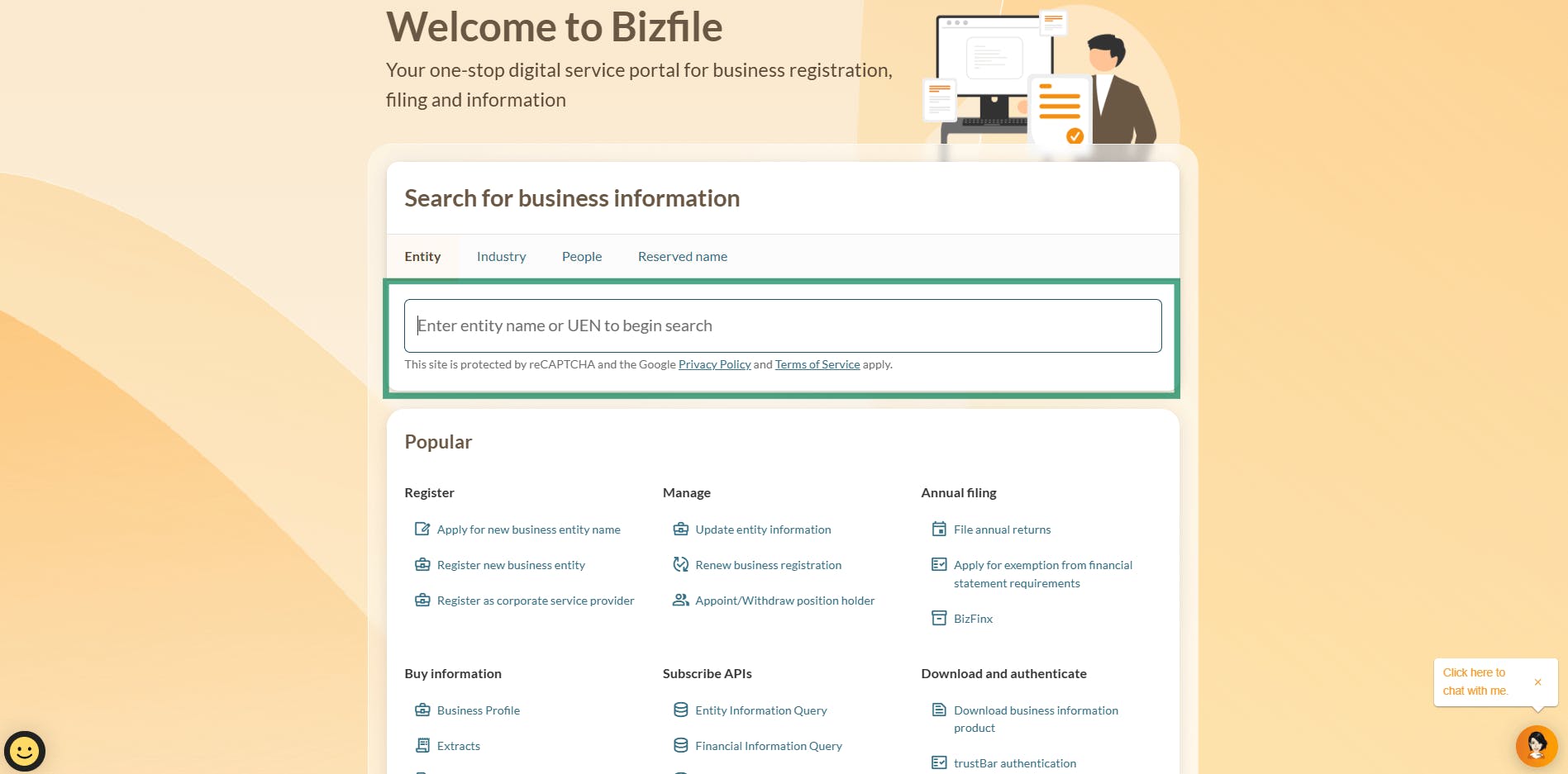

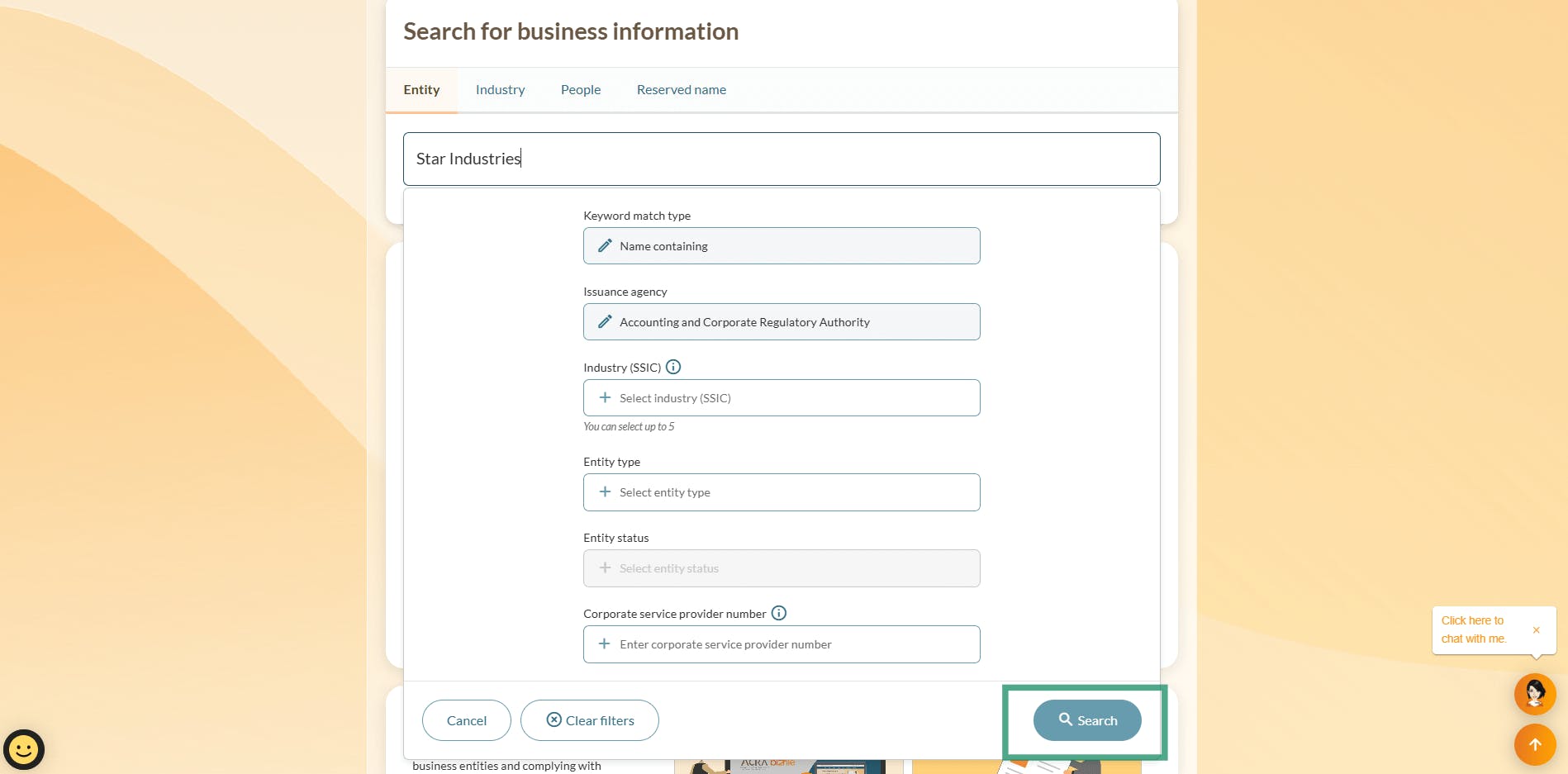

You can check if the name you have in mind for your business is available on Bizfile. To do so, simply follow these steps:

Visit Bizfile and type your proposed company name in the search bar.

You will be redirected to the search tool. Click on the “Search” button.

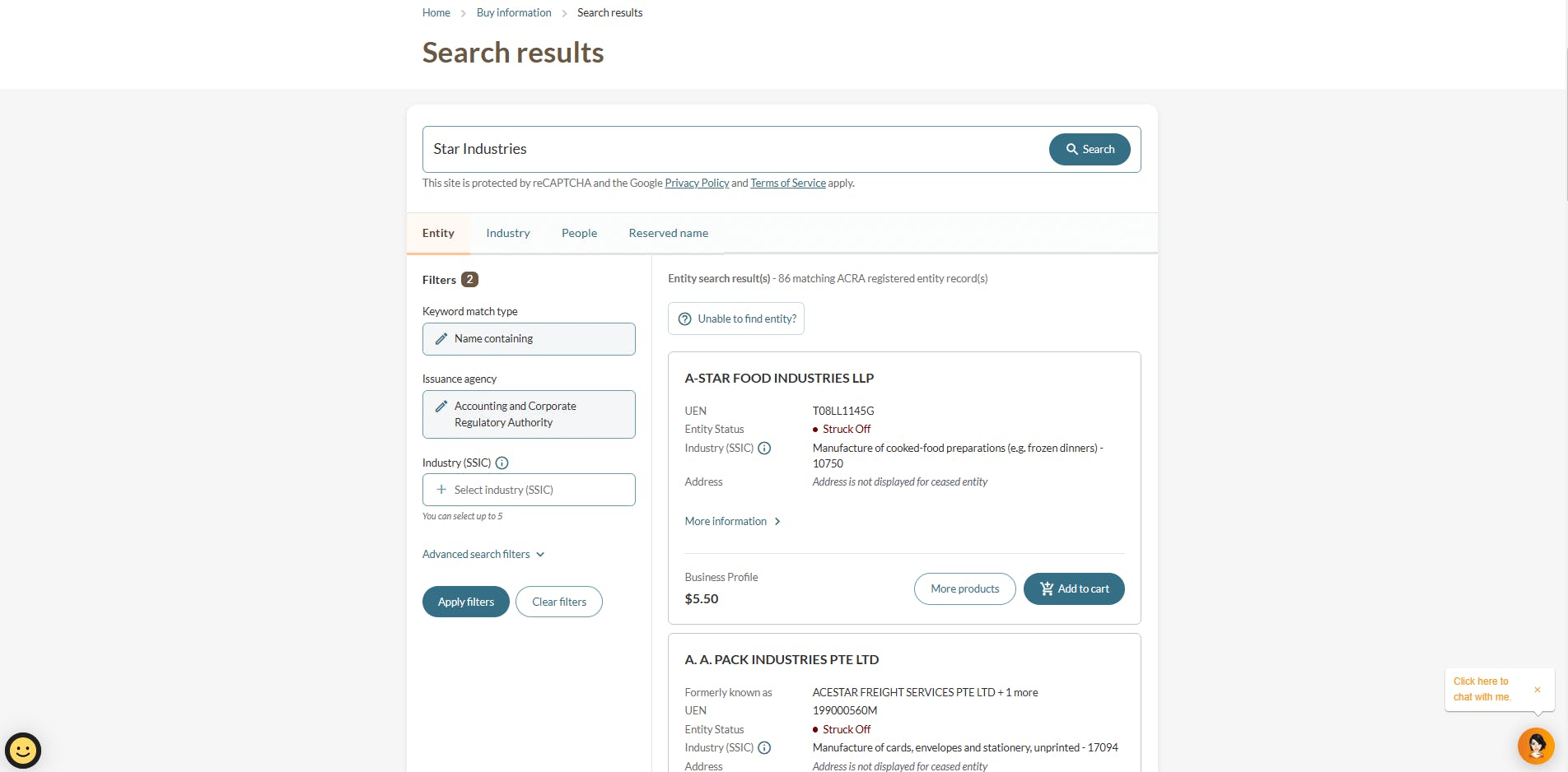

The results will show whether the business name, or a similar one, is registered, along with the company’s status.

If it says “No matching record,” there is no registered company with this name, meaning you can proceed with registering it.

If the company name you want is already registered, try choosing alternative names or adding words to make your proposed name different. However, some words don’t actually make a difference in distinguishing your name. These words are listed below.

Words Disregarded in Identical Name Check

The following words are not sufficient to make the proposed company name unique if there’s a registered entity with a similar name.

For example, if there is an existing business called “Star Solutions,” an application to register a new business as “The Star Solutions” or “Star Solutions South East Asia” would be rejected.

How to Register a Company Name

Once you’ve checked that the name you have in mind is not taken, you can proceed to register it. However, you will need a Singpass to access the service on your own. If you’re using a corporate service provider, they will typically handle this step for you as well.

During your company name registration, apart from your proposed company name, you will also have to provide the following:

1 - SSIC Code

When registering your business name, you need to provide a code that describes your main business activity. This is called the Singapore Standard Industrial Classification (SSIC) code.

You can use the SSIC Search tool on Bizfile to find the appropriate code for your business.

For example, if your business sells designs, you would use the SSIC code “74192,” which stands for Art and Graphic Design Services. You also need to include a brief description of your business’s primary activity, like “Selling of graphic designs.”

2 - Details of the Owner or Authorised Representative

You will also have to provide the information of the business owner, authorised representative, or nominee or trustee, which includes:

- Date of Appointment

- Name

- Identification Type and Number

- Nationality

- Date of Birth

- Local Fixed Line and Mobile Numbers

- Email Address

- Residential Address.

3 - In-Principle Approval

If your proposed company name includes certain words, like “legal” or “school”, it will need approval from specific government authorities. If you’ve already received this approval (called an In-Principle Approval), you must upload the approval as an attachment.

Once you’ve filled in all the information, review and confirm your application, then click submit. You will then need to make a payment of SGD 15 to complete the process. This fee is non-refundable.

In most cases, your company name will be approved immediately. However, if your name includes certain words or falls under specific business categories, your application may need to be further reviewed by a government agency. In that case, the process can take 14 days to 2 months.

For example:

- If your name includes words like “legal” or “law,” it will be referred to the Legal Services Regulatory Authority.

- If you're starting a real estate agency, your application will be sent to the Council for Estate Agencies (CEA).

Step 2: Define Your Company Structure

You’ll need at least one director and one shareholder to incorporate a local company in Singapore. Here are the eligibility requirements.

Directors

At least 1 director of the company must be a Singapore resident. This includes Singapore citizens, Permanent Residents (PR), and holders of an EntrePass or Employment Pass (EP) who have a permanent address in Singapore. Other qualifications for the local director include:

- Must be at least 18 years old.

- Must be of full legal capacity.

- Must not be disqualified from acting as a director or have a criminal conviction involving fraud.

- Employment Pass holders must have a Letter of Consent (LOC) from the Ministry of Manpower (MOM) to be appointed as a company director.

- Foreign Identification Number (FIN) holders must check with relevant government agencies or authorities regarding their eligibility to be a company director.

The director may have to provide proof of address in Singapore.

It’s also a legal requirement that at least one local resident director remains on the management board at all times while the company is operating.

In case you cannot find a suitable candidate to act as a local director, you may appoint a nominee director who does not have actual executive authority in the company but can fulfil this requirement.

Tip: Choose your nominee director carefully, as their actions affect your company. Likewise, they are legally accountable for the company’s actions. Due to this risk, their fees are usually around SGD 2,400 and can go as high as 5,000 per year.

Shareholders

Singapore allows 100% foreign ownership, meaning all shareholders can be foreign nationals. The shareholder requirements will depend on the company type, for example:

Exempt Private Company

Maximum 20 shareholders; must not include any corporate shareholders.

Private Company Limited By Shares

Maximum of 50 shareholders; can have corporate shareholders.

Public Company Limited by Shares

Can have more than 50 shareholders

Set the Amount of Share Capital

The minimum paid-up capital for incorporating a company in Singapore is SGD 1, and it can be issued with or without full payment from shareholders. Share capital can be increased after incorporation, but you need to provide this information when registering.

Tip: The company automatically becomes a member of the Singapore Business Federation (SBF) if its paid-up share capital exceeds SGD 500,000.

Step 3: Appoint a Company Secretary

Unlike when registering a company in Hong Kong, you are not required to have a company secretary at the time of registering a company in Singapore. However, you must appoint one within six months from the date of incorporation.

Even though the appointment is not immediately required, it's included here in the registration steps because it’s strongly recommended to find one early. A company secretary is responsible for core compliance tasks and can offer valuable guidance on early decisions. Having this support from the start helps keep your company organised and on track from day one.

A company or corporate secretary in Singapore is also responsible for:

- Keeping important statutory company records.

- Filing annual returns and ensuring the company meets all deadlines to remain in good standing.

- Ensuring good corporate governance is in place.

- Preparing annual general meetings (AGM) with the company’s directors, usually within six months after the financial year ends.

Who Can Be a Corporate Secretary for Your Company?

A company secretary must be a natural person whose primary residence is in Singapore. The company’s sole director cannot also serve as its company secretary.

A secretary for a public company must also meet at least one of the following requirements:

- Worked as a corporate secretary for at least 3 out of the last 5 years before becoming the secretary of a public company.

- Qualified under the Legal Profession Act.

- Registered as a public accountant according to the Accountants Act.

- Is a member of the Institute of Certified Public Accountants of Singapore.

- Is a member of the Singapore Association of the Institute of Chartered Secretaries and Administrators.

- Is a member of the Association of International Accountants.

- Is a member of the Institute of Company Accountants, Singapore.

Note: The role of corporate secretary must be filled within six months; otherwise, the directors could incur a penalty of up to SGD1,000.

Step 4: Decide on a Financial Year-End (FYE)

The Financial Year-End (FYE) is the final day of your company’s accounting period. Deciding on the FYE is essential, as this information is required when filling out the company registration form. Deciding on your company’s Financial Year End (FYE) is also important because it sets the deadlines for your mandatory annual filings and tax submissions.

The FYE also determines several compliance responsibilities, including:

- Corporate filings and taxes

- The Annual General Meeting (AGM) must be held within 6 months after the FYE for private companies.

- For private companies, annual returns must be filed within 7 months after the FYE.

The FYE can be 12 months or 52 weeks:

- 12-month accounting periods: If you decide to start on 1 April, the FYE will fall on 31 March of the following year. This is a standard calendar-based period that covers exactly 12 months.

- 52-week accounting periods: Alternatively, if you choose to start on 1 April, the 52-week period will end 364 days later, on 30 March of the following year.

To change the FYE, you must inform the Registrar. Companies can adjust the FYE for the current or most recent financial year only if statutory deadlines for holding the AGM, filing the Annual Return, and distributing financial statements have not yet passed.

Tip: According to ACRA, the common FYE are 31 March, 30 June, 30 September, and 31 December.

Step 5: Get a Registered Address

Every registered business in Singapore must have an actual office address to receive official correspondence from government authorities. This address cannot be a P.O. Box.

Additionally, the registered office must be open to the public for at least three hours during ordinary business hours on weekdays to facilitate the delivery of legal documents and ensure authorities' accessibility. Failure to comply with these requirements can result in fines of up to SGD 5,000.

How to Get a Registered Address in Singapore

- Use a Virtual Office Service Provider

If your operation does not require a physical office, choose to use a virtual office service. Virtual offices provide an official address for your company, and some providers offer meeting rooms as well. However, it’s essential to ensure that the provider is qualified and accepted by ACRA. Additionally, be sure to check whether virtual office providers offer mail handling and phone answering services - Rent an Actual Space in Singapore

For businesses needing a physical office for daily operations, renting an actual office space in Singapore is an option. - Home Office Scheme

Small-scale business owners can apply for approval under the Home Office Scheme to use their residential addresses as their registered office addresses. This approval must be done before submitting the company registration application. - Use a Corporate Service Provider

You can also work with a licensed corporate service provider. These professionals often include a registered office address as part of their business setup packages.

Tip: Companies and directors must ensure the business has a registered address; failure to comply may result in a fine of up to SGD 5,000.

Step 6: Fill Out the Online Application

Now that you have everything ready, including your approved company name, you can proceed with incorporating your company.

In Singapore, all company registration applications must be submitted online through the Bizfile system, which you can only do so with a Singpass.

If You Have a Singpass

If you have a Singpass, then you can register a company by yourself by following these steps.

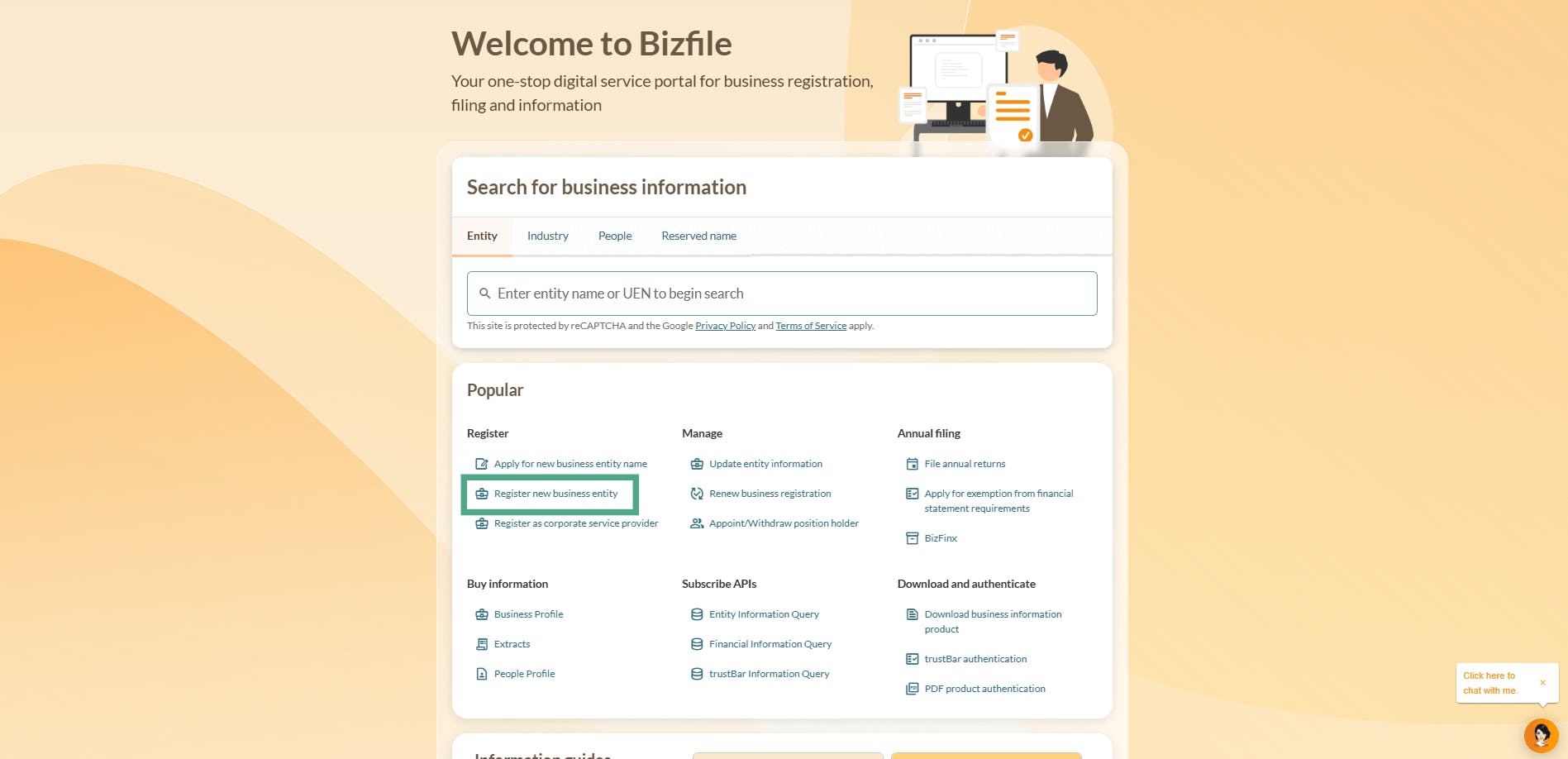

Visit Bizfile via https://www.bizfile.gov.sg, then click on “Register new business entity,” which can be found under “Register.”

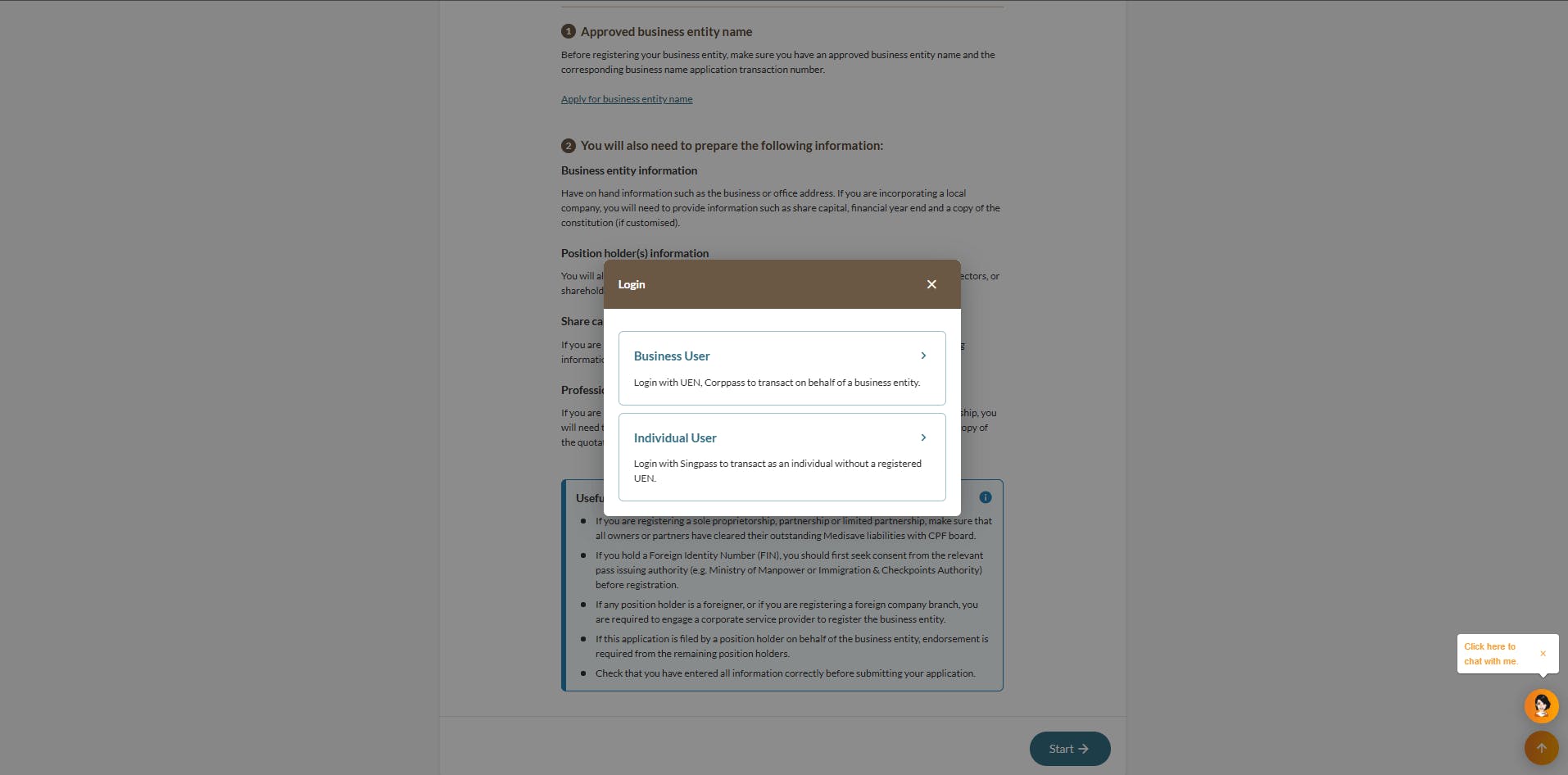

Once you click “Start,” you will be asked if you will log in as a business or individual user. Generally, you should log in as an individual, since the business user option is generally meant for corporate service providers or entities managing filings on behalf of other businesses.

If you are an individual user, you will be redirected to log in using your Singpass.

Enter the transaction number of the approved business name application, then proceed to the next step.

Fill in the information about your company and upload the required documents, including:

- Financial Year-End (FYE) and Financial Year Period

- Additional officers or shareholders

- Share capital, allotment, and shareholder information

- Registered office address and working hours (at least 5 hours during ordinary business hours or at least 3 hours but less than 5)

- Company Constitution

Pay the company registration fee using a credit or debit card (Visa, Mastercard®, or American Express), PayPal, Apple Pay, or Google Pay.

If You Don’t Have a Singpass

If you do not have a Singpass, you must partner with a third-party filing agent or professional company incorporation service to register the company on your behalf. These professional agents are familiar with Bizfile and Singapore’s business registration requirements, so they can help ensure that your application is complete and compliant.

Most professional services will assist you with the following:

- Name checking and reservation

- Document preparation

- Compliance with local requirements, including appointing a local resident director or nominee director if needed

- Registered address service

Using a company incorporation service isn’t limited to those without a Singpass. If you’re managing a small business, these services can help you stay on track and save time if they meet your budget.

Tip: It typically costs between SGD 2,350 and SGD 3,500 to incorporate a company in Singapore using incorporation services that cover most or all essentials.

Documents Upon Successful Application

Once your application is submitted and approved, the appointed officers, including the directors, shareholders, and company secretary, will receive an email requesting their endorsement. All appointed officers must confirm their roles in Bizfile within 60 days of the email date, or the application will be cancelled.

After the business is successfully registered, you will receive the following:

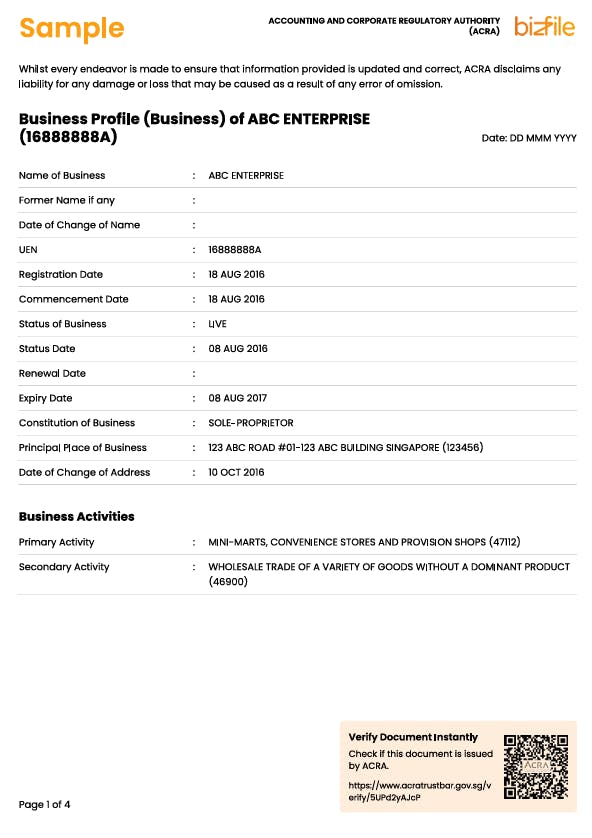

Business Profile

A Business Profile is like an identity card for your Singapore business. It contains details such as the company name, Unique Entity Number (UEN), and business activities. An email with instructions on how to download the free Business Profile will be sent to the email address of the person who filed the registration. This free Business Profile must be downloaded within 30 days; otherwise, it will expire and you may need to purchase a new one for SGD 5.50.

You can view samples of the Business Profile for different types of business on the ACRA website.

Unique Entity Number (UEN)

A Unique Entity Number (UEN) is an identification number for your business, which can be found in the Business Profile. Typically, ACRA automatically generates a 9-10 digit UEN for newly incorporated companies.

However, you can also purchase a preferred UEN from a reserved list for SGD 3,000 (Tier 1), which includes numbers with consecutive identical digits or the number ‘8’, or for SGD 1,000 (Tier 2), which includes repeating patterns or numbers ending in triples like ‘222’. These numbers are easier to remember and are often associated with prosperity.

UEN number must always be quoted in business letters, statements of account, invoices, and other official correspondence, along with the company’s name.

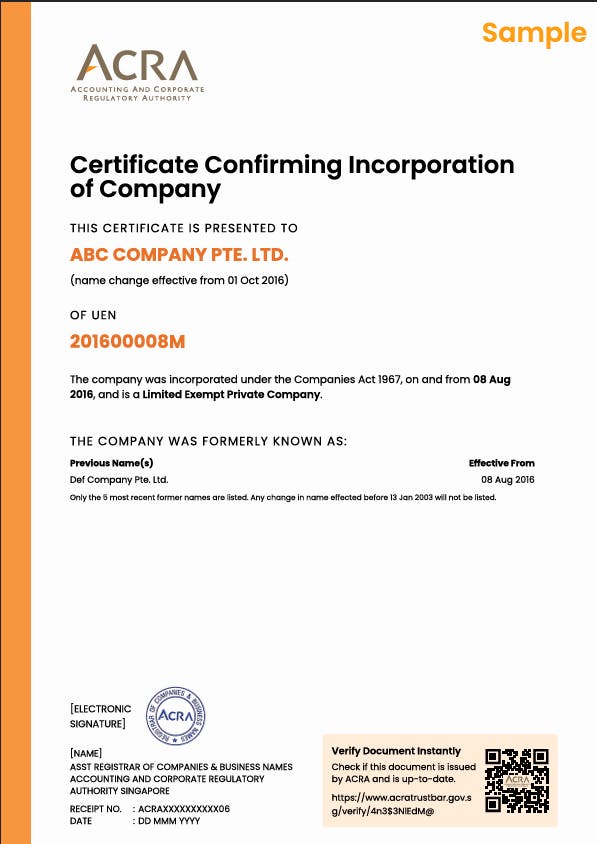

Certificate of Incorporation

In addition to the Business Profile, you can purchase a Certificate of Incorporation for SGD 50. This document certifies that the company is registered with ACRA in Singapore and may be required when opening a corporate bank account or engaging with government agencies.

You can also purchase other certificates, such as the Certificate of Good Standing, directly from ACRA. It’s important to note that ACRA only provides electronic copies of these documents, not hard copies.

Post-Incorporation Steps

Registering your business is only the beginning. To operate legally and smoothly in Singapore, it’s essential to keep your company information accurate, follow obligations such as annual filing, and consider these additional post-incorporation steps.

Appointing an Auditor

Private limited companies are required to have their financial statements audited by an auditor or a registered public accountant at least once a year. Directors must appoint an auditor within three months of incorporation unless the company qualifies for an exemption as a small company.

To be qualified for the exemption, the company must meet at least 2 of the following over the last two consecutive financial years:

- Have an annual revenue of SGD 10 million or less;

- Have total assets of SGD 10 million or less;

- Have 50 or fewer employees

Once the company qualifies as a small company, it will keep this status in subsequent financial years until it no longer meets the criteria or ceases to be a private company during the financial year.

Annual Filing

Incorporated companies are required by the Singapore Companies Act to hold an Annual General Meeting (AGM) and file annual returns with ACRA to ensure the company’s information is up to date.

All companies, including inactive and dormant ones, must file annual returns, even if exempted by IRAS from filing an income tax return. The annual returns must be filed within 7 months after the end of the company’s financial year. However, you can apply for an extension of time for the AGM or an annual return of SGD 200.

Register for Corppass

Singapore Corporate Access (Corppass) is an authorisation system for business entities to allow employees and third parties to perform corporate transactions with government agencies online, such as the IRAS (the Inland Revenue Authority of Singapore, which is the government body responsible for taxes) digital services.

After you have registered your company, you can set up and manage your company’s Corppass account on the Corppass website.

Register for Goods and Services Tax (GST)

If your business’s taxable turnover exceeds SGD 1 million at the end of the calendar year or is expected to be more than this amount in the next 12 months, you must register for Goods and Services Tax (GST).

GST-registered businesses are required to charge and account for a 9% GST rate on all sales of goods and services in Singapore unless exempted.

To apply for GST registration, you can visit and follow the steps on the IRAS website. The process varies by the type of business, and you can check whether you need to register for GST with the IRAS beforehand.

Business Registration Renewal

Sole proprietorships and partnerships must renew their business registration before the expiry date or up to 60 days prior. Renewal can be done for either 1 year or 3 years at a cost of SGD 30 per year.

Both requirements can be done online through Bizfile.

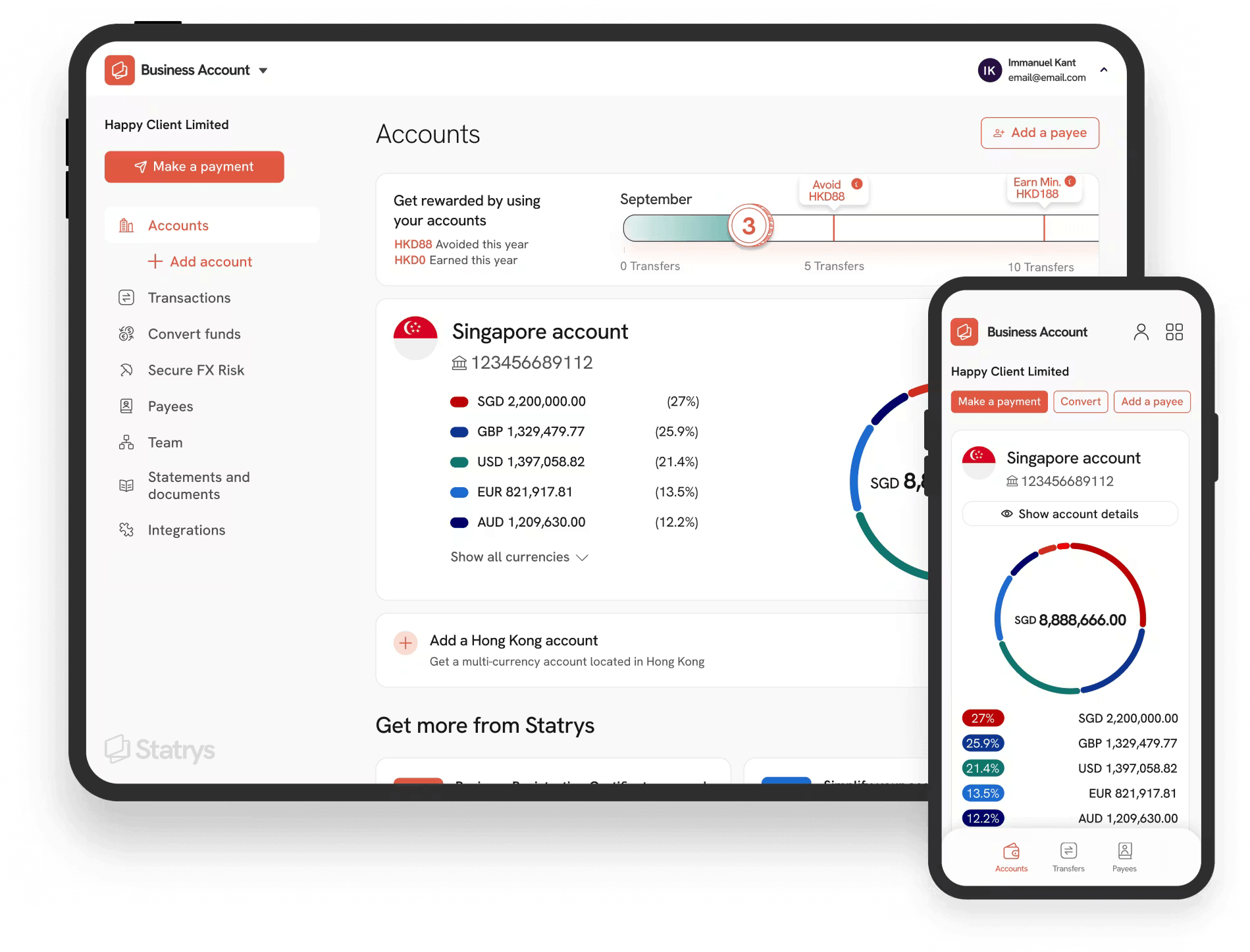

Opening a Business Account

After registering your company, the next important step is opening a business or corporate account. Having a separate account under your company’s name helps keep your finances organized and ensures accurate financial reporting.

When choosing a business account in Singapore, consider the following factors:

- Fees: Check account maintenance fees, transaction costs, and hidden charges, especially for international transfers.

- Account Setup: Traditional banks may require in-person visits, while digital banks and fintech providers often allow 100% online setup.

- Currency Options: Look for multicurrency accounts if your business handles transactions in different currencies. They can reduce conversion fees, give you better control over exchange rates, and simplify receiving payments from international customers or paying overseas suppliers.

- Customer Support: Ensure the bank offers personalised and responsive support.

- Integration: Fintech accounts often offer integration with accounting software, streamlining bookkeeping and financial reporting. Many also connect with online marketplaces and payment gateways, enabling faster fund settlement.

While the account opening process and eligibility requirements typically vary by account plan and bank, major banks in Singapore usually require a Singpass, UEN, and Tax Identification Number (TIN). Traditional banks also often require an in-person interview for business account openings.

When you register your Singapore business with Statrys, we assist you in applying for a Statrys multi-currency business account, subject to approval. This account allows you to hold up to 11 major currencies and make international and local transactions at competitive rates, as well as access personalised support from dedicated account managers.

Taxes in Singapore

Lastly, let’s understand how taxes work for your company in Singapore. The Inland Revenue Authority of Singapore (IRAS) oversees corporate taxes and enterprise disbursement schemes.

Corporate Taxes

In Singapore, all companies, both local and foreign, are taxed at a flat rate of 17%. However, similar to Hong Kong, Singapore operates a territorial tax system which means foreign-sources income is generally not liable to tax unless it is remitted into the country. Additionally, Singapore has Avoidance Double Tax Agreements (DTAs) with other jurisdictions to prevent double taxation on income earned in one jurisdiction by a resident of the other.

Your company is responsible for the annual filing of Corporate Income Tax Returns with IRAS. These include:

- Estimated Chargeable Income (EIC): ECI is an estimate of your business’s taxable profits. You will receive the ECI filing notification before the end of your company’s financial year, starting from the year after the incorporation.

- Form C-S/ Form C-S (Lite)/ Form C: These are types of forms for your company to declare its actual income, depending on annual revenue. Typically, all companies are required to file using Form C and submit financial statements and tax computations along with it. New companies will have to file this starting from the second year of incorporation.

Tax Exemption

To encourage business growth, Singapore offers various tax exemption schemes that allow eligible companies to lower their tax burden, especially for start-ups and SMEs. Here’s a look at the key exemptions available:

Start-up Tax Exemption Scheme

New start-ups are allowed a 75% exemption on the first SGD 100,000 of normal chargeable income and a further 50% exemption on the next SGD 100,000 for their first 3 years of operations.

To qualify for this exemption, the company must:

- Be locally incorporated in Singapore

- Be a tax resident of Singapore for that Year of Assessment (YA)

- The company’s share capital must be held by no more than 20 shareholders, with all shareholders as individuals or at least one individual owning 10% of issued ordinary shares

Companies primarily engaged in investment holding or property development for sale and/or investment are not eligible.

Partial Tax Exemption Scheme

All companies are eligible for partial tax exemption (PTE), which gives a 75% exemption on the first SGD 10,000 of normal chargeable income and a further 50% exemption on the next SGD 190,000.

Tip: For the Year of Assessment 2025, all taxpaying companies may qualify for a corporate income tax rebate of 50%, capped at SGD 40,000. To be eligible, a company must be active and have at least one local employee. Eligibility is determined by IRAS.

Singapore Company Registration Service

Statrys is the partner you need for a quick, hassle-free solution to registering and running your Singapore company smoothly, whether you are a foreign entrepreneur, a new business owner, or simply someone who wants to save time and skip the administrative hassle.

Statrys offers an all-inclusive Singapore company registration package at a single price, covering all the essentials to get your company fully set up. From incorporation filing and company secretary services to a registered address with mail forwarding, which is ideal for entrepreneurs and businesses of all sizes, including those new to Singapore.

Here’s what you will get:

Incorporation Services

- Registration filing with the Accounting and Corporate Regulatory Authority (ACRA)

- Certificate of Incorporation

- Business Profile

- Company Chop

- Constitution of the Company

- Preparation of pre-incorporation documents

- Preparation of post-incorporation documents

Nominee Director

- Provision of a Local Nominee Director (1 year, annual renewal)

Corporate Secretary Services

- Provision of company secretarial services (1 year)

- Annual Return Filing with ACRA for each calendar year

- Holding the Annual General Meeting (AGM) within 6 months after each Financial Year End (FYE) and filing the Annual Return 1 month after the AGM

- Preparation of AGM documents

- Maintenance of the statutory records

- All of your statutory records and compliance documents all in one place, accessible online 24/7

Registered Address in Singapore

- Registered address for one year (annual renewal)

- Scanning and forwarding of mail

Assistance with Opening A Business account & Cards

- Assistance with a multi-currency business account opening (Subject to approval)

- Documents for business account setup

Sources

Here are links to the official government sources referenced in our guide, where you can find additional information.

- https://www.acra.gov.sg/how-to-guides/setting-up-a-local-company

- https://www.acra.gov.sg/how-to-guides/company-related-fees

- https://www.bizfile.gov.sg/ngbbizfileinternet/faces/oracle/webcenter/portalapp/pages/eServicesListing.jspx

- https://www.gobusiness.gov.sg/licences/

- https://www.iras.gov.sg/taxes/corporate-income-tax/form-c-s-form-c-s-(lite)-form-c-filing/overview-of-form-c-s-form-c-s-(lite)-form-c

- https://www.iras.gov.sg/taxes/corporate-income-tax/income-deductions-for-companies/companies-receiving-foreign-income

- https://www.mof.gov.sg/policies/taxes/corporate-income-tax

The wait is over!

Open your Business Account today!

100% online application

No account opening fee, no initial deposit

Dedicated ccount manager