Features

Fees

Account Opening

User Reviews

Founded in 2015, TranSwap is a cross-border fintech platform designed to help SMEs manage global payments more easily. The company operates from offices in Singapore, the UK, Hong Kong, and Indonesia, offering business accounts, international transfers, and both virtual and physical Mastercard® cards.

This review covers everything you need to know about TranSwap, including key features, pricing, account setup, and suitability for different types of businesses.

So, let’s get started.

Key Highlights

Manage Up to 34 Currencies

TranSwap allows you to hold and manage 34 different currencies in one place, which is particularly helpful for businesses working with overseas partners.

Local Account Details in 4 Markets

You can get local account details in Singapore, Hong Kong, Indonesia, and the UK, making it easier to receive payments and reduce reliance on SWIFT.

Unlimited Virtual Cards

Businesses can issue unlimited virtual Mastercard® cards, making it easy to assign budgets, separate spending categories, and manage subscriptions.

No Public Pricing Page

TranSwap doesn’t publish its fees or FX rates online. You’ll need to contact the team directly to understand your total cost structure.

No Accounting Integrations

TranSwap doesn’t integrate with accounting tools like Xero or QuickBooks, so businesses will need a separate solution for bookkeeping and reconciliation.

Limited Independent User Reviews

TranSwap has no listings on Trustpilot, G2, or app stores, making it harder to assess real user experiences.

✅ TranSwap is a good fit for

- SMEs managing multiple currencies.

Holding 34 currencies and accessing local details in major markets is practical for cross-border operations. - Teams that need flexible card control.

Unlimited virtual cards allow companies to allocate spending across teams, projects, or subscriptions. - Businesses that prefer fast online onboarding.

The entire application process is online with no in-person meetings required.

🚫 TranSwap isn’t a good fit for

- Businesses that prioritise fee transparency.

With no public pricing page or FX breakdown, cost-sensitive SMEs may find it difficult to predict and compare fees. - Companies that rely on accounting automation.

Without integrations like Xero or QuickBooks, reconciliation and reporting require a separate process or tool.

TranSwap Fees

TranSwap doesn’t provide a public pricing page, and most of the fee structure remains unclear. If you want to know exactly what you’ll pay for payments, FX, or account services, you’ll need to contact them directly.

The only clearly stated fee is for card services. There are no monthly fees and no minimum balance requirement for using their business cards. Beyond that, expect to ask for a breakdown before making any commitments.

TranSwap Features

TranSwap’s Global Account focuses on giving SMEs the tools to manage cross-border payments.

Business Accounts

TranSwap’s Global Account is designed for SMEs that need to hold, receive, and send money in multiple currencies.

You can manage up to 34 currencies and open local virtual accounts in various countries and regions, including Singapore, Hong Kong, Indonesia, and the UK. Each comes with local account details, which are practical for collecting payments or paying partners in those markets.

However, TranSwap doesn’t offer a full list of countries with local accounts, so you might need to contact support to confirm.

Local and International Payments

TranSwap supports global transfers through both local rails and SWIFT payments to over 100 countries. For regional operations, the availability of account details helps reduce reliance on SWIFT for every transaction.

Payment Cards

TranSwap offers both virtual and physical Mastercard® payment cards, all linked to your business account. You can issue unlimited virtual cards, which is useful for separating expenses by team, department, or subscription category. Physical cards are also available for online and in-person spending.

TranSwap Business Account Opening

Opening a TranSwap business account is fully online. You can apply through the TranSwap website or using the mobile app. The process involves submitting your company details, verifying identities, and uploading the required documents. Once everything is submitted, TranSwap typically reviews and approves applications within 2 working days.

Who Can Open?

Companies registered in Singapore, Hong Kong, Indonesia, and the United Kingdom can open TranSwap business accounts. They may also open multiple accounts under the same entity by using separate email addresses or by requesting assistance from a TranSwap account manager.

Required Documents

TranSwap requires businesses to submit company registration documents, constitutional documents, and verification details for directors and ultimate beneficial owners (UBOs). Requirements vary by country, and additional documents may be requested depending on your structure.

Required documents vary by country, but generally include:

- Certificate of incorporation or equivalent company registration documents

- Company registration or business profile showing directors and shareholders

- Valid ID and proof of address for ultimate beneficial owners and key signatories

- Key contact information

For a full list of required documents, you can refer to TranSwap’s Help Centre.

TranSwap from Real Users

TranSwap does not currently appear on major third-party review platforms such as Trustpilot, G2, or the iOS and Android app stores. This means there’s limited independent feedback on the platform’s reliability, customer service, or day-to-day user experience.

The only testimonials available are those published directly on TranSwap’s website.

If you’re considering TranSwap, try reaching out to their support team for clarity on features and fees. A quick call or message during the evaluation stage can help you assess whether the platform fits your needs.

Best TranSwap Alternatives

If TranSwap is not the right fit for your company, here are some alternatives to consider instead:

1st Choice

Multi-currency business account supporting 11 major currencies with FX fees as low as 0.1%

2nd

Virtual business account with an extensive payment network.

3rd

Multi-currency account with expense management tools

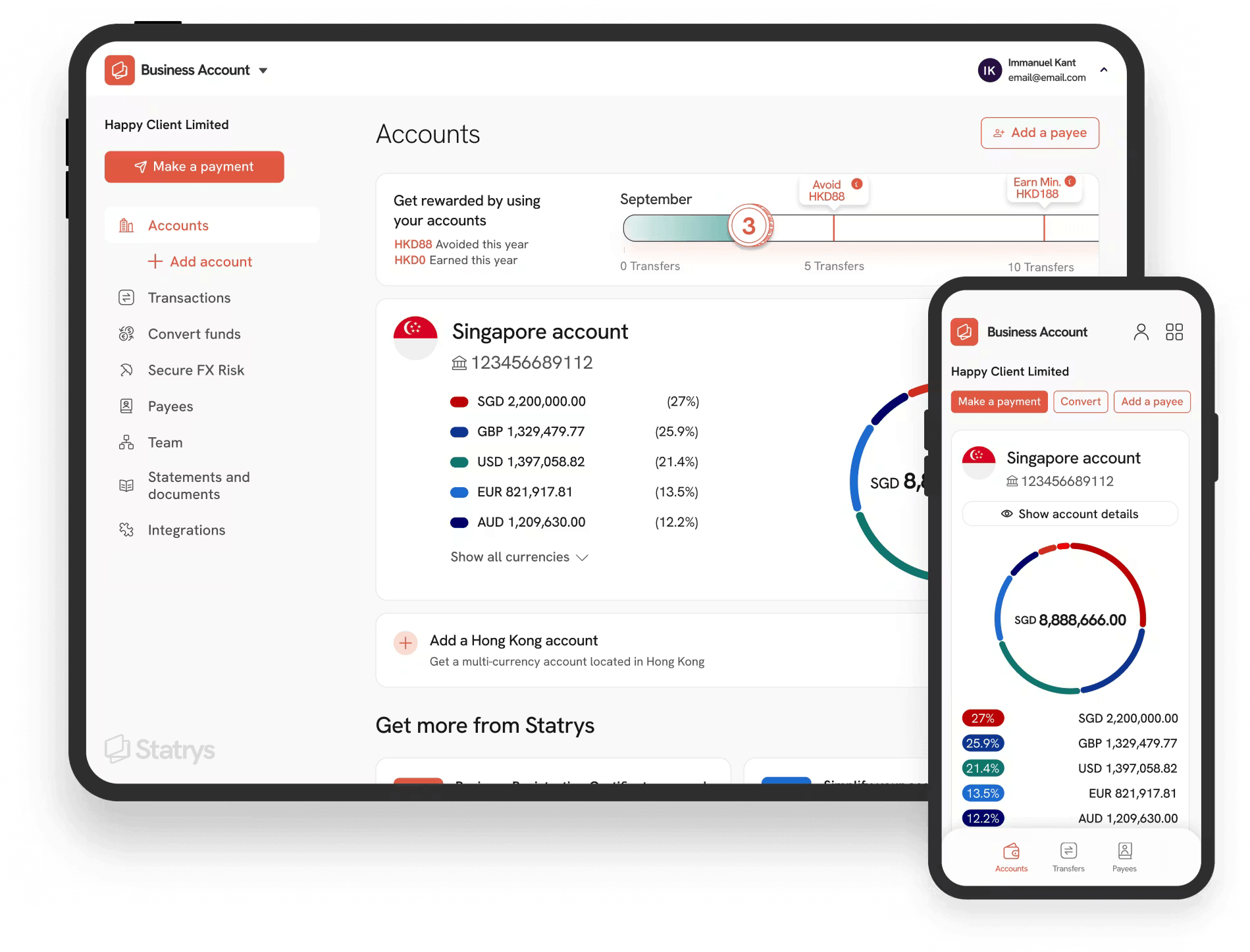

Why we recommend Statrys

Statrys is a stronger option than TranSwap if you care about clarity, control, and support rather than just raw currency count. While TranSwap lets you hold up to 34 currencies and issue unlimited virtual cards, it doesn’t publish its fees, lacks accounting integrations, and has almost no independent user reviews, making it hard for SMEs to predict costs or judge reliability.

If you want a cross-border account where you clearly know what you’ll pay and who to talk to when you need help, Statrys is the recommended choice.

Was this article helpful?

Yes

No

FAQs

What is TranSwap?

TranSwap is a Singapore-based fintech company founded in 2015, specialising in cross-border payment services for businesses. It offers virtual business accounts, payment services, cards, and credit lines in Singapore.

Is TranSwap a bank?

How to contact TranSwap?

Disclaimer

Statrys competes directly with TranSwap in the Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.