Features

Fees

Account Opening

User Reviews

Aspire is a fintech company launched in 2018 with the goal of providing SMEs across Southeast Asia with a modern alternative to traditional banking services for businesses.

Today, Aspire offers a wide range of financial services that cater to the needs of start-ups and SMEs, leveraging its ability to integrate modern financial tools, such as real-time spend tracking and cashback rewards, into a unified platform.

This review examines how Aspire works for SMEs, covering its pricing, key features, and account opening requirements. We also look at real user feedback and outline which types of businesses Aspire is and isn’t best suited for.

Key Highlights

Free Local SGD Transfer

FAST, PayNow and GIRO payments are free, making Aspire cost-efficient for SMEs handling payroll, supplier payments, or frequent domestic transactions.

Local USD, EUR, and GBP Account Details

Aspire offers local account details in SGD, USD (ACH), EUR (SEPA), and GBP (Faster Payments), which helps reduce SWIFT fees when receiving or sending money in these regions.

Built-In Expense Management

Virtual and physical corporate cards, spending limits, approval flows, and real-time tracking are built in. This removes the need for a separate business expense tool for many SMEs.

Limited Multi-Currency Coverage

You can only hold SGD, USD, EUR, and GBP. All other currencies must be converted, which may lead to forced conversions and higher costs.

Chat-Only Support

Customer support is available only through chat, which may be restrictive for businesses that prefer phone assistance for urgent matters.

✅ Aspire is a good fit for

- SMEs that mainly operate in SGD

Free local transfers make Aspire cost-efficient for businesses with mostly domestic payments. - Businesses working with the US, UK, or EU

Local USD, EUR, and GBP account details reduce SWIFT fees when invoicing or paying overseas partners. - Founders who prefer fast, app-driven operations

Aspire suits founders who want everything handled online without an in-person meeting.

🚫 Aspire isn’t a good fit for

- Businesses operating in diverse currency markets

If you receive or pay in currencies other than SGD, USD, EUR, and GBP, you may find forced conversions to be inefficient and difficult to manage. - Business Owners who are not comfortable with app-only support

If you rely on phone assistance or face-to-face assistance, Aspire’s chat-only support may not meet expectations. - SMEs that still rely on cash or cheque workflows

Traditional businesses that deposit cash or handle cheque payments will need a different solution, since Aspire doesn’t support either.

Aspire Fees

Aspire has two pricing plans: Basic (S$0 per month) and Premium (S$15 per month). Both give you access to the platform’s core features, but the Premium plan adds a few extras that matter if you handle more payments.

With Premium, you get five free outbound international transfers each month, up to 300 virtual payment cards for your team, and 0% FX fees on the first S$13,000 you convert each month.

Below are the key fees you should know:

| Fee Type | Amount |

|---|---|

| Account Opening Fee | SGD 0 |

| Monthly Fee | Basic: SGD 0 Premium: SGD 15 |

| Yield Account Annual Fee | Basic: 0.50% Premium: 0.25% |

| Local Transfers | Receive: SGD 0 Send: SGD 0 |

| International Transfers | Receive via SWIFT: SGD 35 (SGD account) / USD 8 (other accounts) Send via SWIFT: USD 15 (SHA) / USD 30 (OURS) |

| Bulk Transfers | Within Singapore: SGD 0 Others: SGD 0.3 |

| GIRO Salary Payments | SGD 0 |

| FX Fee | Send: From 0.23% Receive: From 0.34% |

| Card FX Fee | 1.5% |

| ATM Withdrawal Fee | SGD 5 per withdrawal (excluding bank fees) |

For the most up-to-date information on Aspire’s fees, please refer to their official pricing page.

Aspire’s fee structure is relatively light compared to traditional banks.

Many banks still charge monthly or fall-below fees, which can increase costs for SMEs making regular overseas payments. Aspire avoids these fixed charges on the Basic plan, and local SGD transfers remain free. For international payments, SWIFT is still used, but the fees and margins are generally lower than typical bank rates (3%-5%). Having local USD, EUR, and GBP account details can reduce SWIFT fees when you collect funds or make payments in those regions.

Premium becomes relevant only if your business frequently sends international transfers or converts currency, as the added benefits primarily benefit companies with higher cross-border volumes.

Aspire Features

Aspire’s feature set focuses on everyday business needs. Below is a breakdown of the main features available.

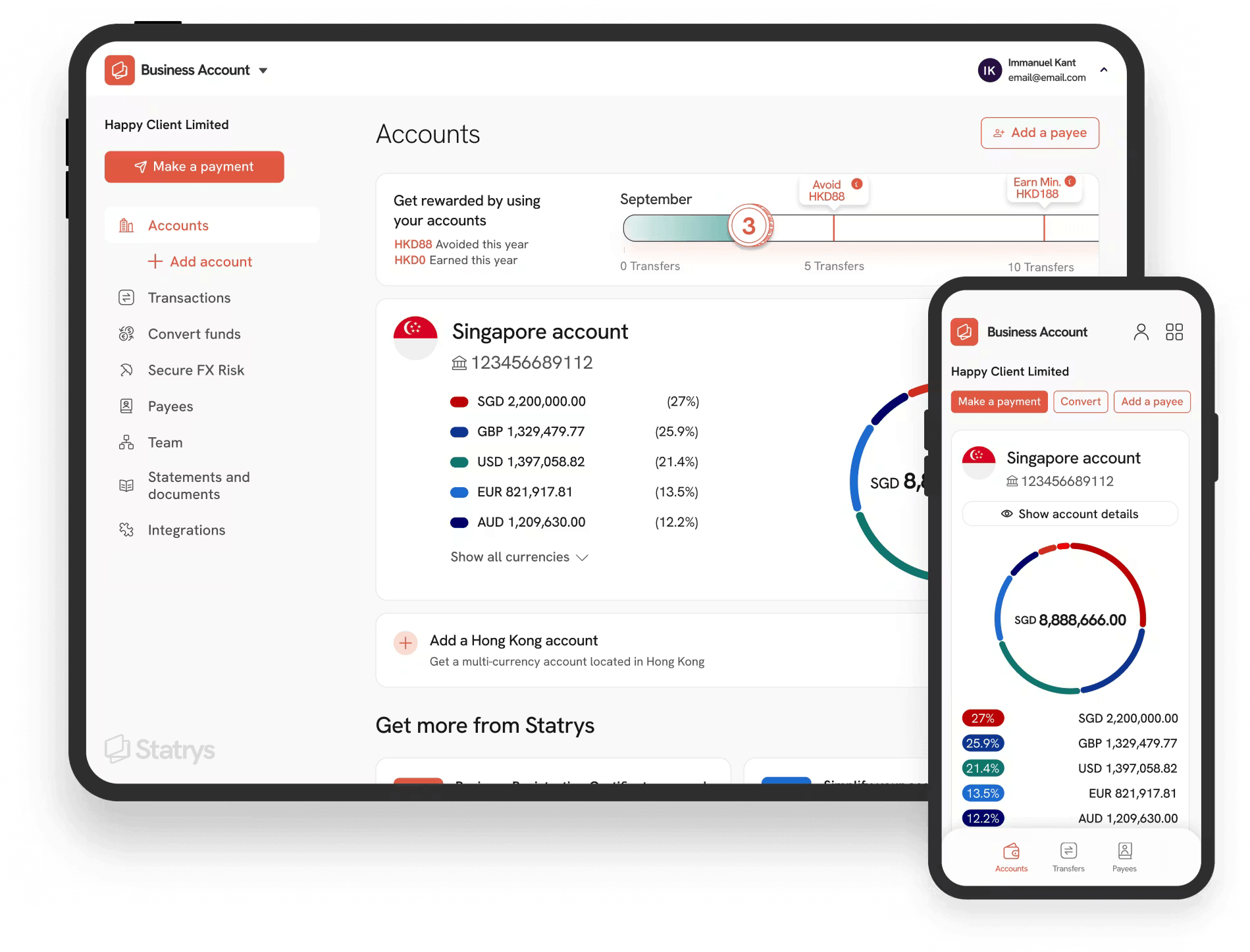

Business Accounts

Aspire provides an SGD business account and allows businesses to open separate local accounts in USD, EUR, and GBP. Each of these accounts comes with its own local account details, so companies can receive and send payments through the relevant local payment networks (ACH for USD, SEPA for EUR, and Faster Payments for GBP).

All accounts are managed from the same dashboard, where companies can view balances, track activity, and manage user access.

Local and International Payments

For domestic payments, Aspire supports FAST and GIRO, allowing businesses to make free payments to suppliers, staff, and service providers in Singapore. Payments clear quickly, and everything can be scheduled or tracked directly in the dashboard.

For overseas payments, Aspire processes transfers through the SWIFT network. Fees and FX margins vary by corridor, starting from around 0.4%, which is typically lower than the rates banks apply to small businesses. Currency conversions are handled within the platform, and businesses can review estimated fees before confirming a transfer.

Expense Management

Aspire offers a suite of tools to help startups and SMEs manage and track company expenses. Businesses can issue virtual or physical cards to employees, set spending limits, and review transactions in real-time.

Receipt uploads and simple approval steps help keep records organised, while category tagging makes it easier to prepare expenses for bookkeeping. Aspire also connects with accounting software (i.e., Xero and QuickBooks), allowing transaction data to be synced or exported so finance teams spend less time on manual reconciliation.

Yields

Aspire’s Yield feature lets businesses place idle SGD and USD balances into money market funds managed by Fullerton Fund Management. There is no minimum amount, and no lock-in period. Withdrawals are typically available on the next business day.

Yield is only available to Singapore-incorporated businesses that qualify as active Non-Financial Entities, with a default combined limit of SGD 100,000 across SGD and USD Yield Accounts.

Warning: An annual fee of 0.5% will be charged monthly based on the average daily net asset value in your Yield account.

Aspire Business Account Opening

Opening an Aspire business account is a fully online process. You start by entering your company details, verifying your identity, and uploading the required documents. Most applicants can complete the form in under 10 minutes.

Once submitted, Aspire typically reviews and approves accounts within 5 to 7 business days, though timelines may vary depending on your company structure and the documents provided.

Who Can Open?

Aspire currently accepts applications from companies incorporated in Singapore, Australia, China, Hong Kong, India, Indonesia, Malaysia, Maldives, Mongolia, the Philippines, South Korea, Sri Lanka, Taiwan, Thailand, the United States, and Vietnam.

Eligible business types generally include private limited companies, partnerships, and companies limited by guarantee. Charities and NGOs registered with a recognised authority can apply, but may be limited to specific account types. The applicant must be a director or someone formally authorised by the company.

Required Documents

In general, Aspire requires your company registration records, identification for key individuals, and basic ownership information.

Most applicants will need to provide:

- Company registration documents showing director and shareholder details

- ID for the person opening the account and at least one registered director (passport or national ID)

- Proof of address for the applicant if it is not shown on the ID

- A letter of authorisation if a non-director is opening the account on the company’s behalf

Businesses with shareholders owning 25% or more may also need to submit IDs and basic information for those shareholders, along with a simple shareholder structure chart.

Companies from certain countries may be required to provide additional documents to meet local regulatory requirements. For example, Indonesian companies must provide the Akta Pendirian, SK Kemenkumham, and related registration records. You can refer to Aspire’s account opening guide for companies registered in other countries for more details

All documents must be uploaded in digital format. Aspire may request further information depending on your industry or risk profile.

Aspire from Real Users

Aspire is rated 4 out of 5 on Trustpilot from 141 reviews, with feedback split between very positive and very negative experiences.

What users like:

- Quick onboarding: Many say setup is fast and straightforward.

- Easy interface: The app is clean, simple, and intuitive for SMEs.

- Useful tools: Real-time expense tracking, virtual cards, and multi-currency features get strong praise.

Common complaints:

- Unclear compliance decisions: Some applications or transactions are rejected with vague “risk appetite” explanations.

- Transfer delays: Several users report missing or slow SWIFT payments and long refund times.

- Inconsistent support: Some receive great help; others face slow replies or generic answers.

- Unexpected fees or changes: Non-Singapore users report different pricing, and some features (like IDR accounts) were removed without clear notice.

- Technical issues: A minority mentions app glitches, card blocks while travelling, and UX frustrations.

Aspire works well for everyday local payments and expense management. However, businesses that rely on seamless cross-border transfers should be aware of mixed reports regarding payment delays and inconsistent support.

Best Aspire Alternatives

If Aspire is not the right fit for your company, here are some alternatives to consider instead:

1st Choice

Multi-currency business account supporting 11 major currencies with FX fees as low as 0.1%

2nd

Virtual business account with an extensive payment network

3rd

Multi-currency account with expense management tools

Why we recommend Statrys

Statrys is a better fit than Aspire for SMEs that trade internationally and need more than just SGD, USD, EUR, and GBP. With Statrys, you can hold, receive, and pay in 11 major currencies (including HKD and CNY) and get access to real human support for payment or compliance issues, not just chat. If smooth cross-border payments and responsive, human service matter to your business, Statrys is the stronger choice.

Was this article helpful?

Yes

No

FAQs

What currencies can I manage with an Aspire App business account?

You can hold and manage funds in SGD, USD, EUR, and GBP. You can also send and receive payments in 31 currencies via the SWIFT network and make local payments in 18 currencies.

What are the fees for using an Aspire business account?

Is Aspire safe?

Disclaimer

Statrys competes directly with Aspire in the Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.