Fees

Features

Account Opening

User Reviews

Currenxie is a multi-currency business account designed for SMEs that operate across different countries. It allows companies to receive payments like a local in major markets using virtual account details and hold up to 15 currencies, such as USD, EUR, GBP, HKD, JPY, and AUD. Businesses working with regional suppliers may also benefit from Currenxie’s payout coverage across markets, including Thailand, Indonesia, Vietnam, Malaysia, India, and mainland China.

The account focuses on practical tools for international operations, including local transfers, SWIFT payments, foreign exchange, and integration with platforms like Xero. Currenxie supports most major regions, although certain features, such as its Visa Business Card, are available only to companies registered in Hong Kong.

Currenxie Business Fees

Currenxie does not charge setup or monthly fees for most businesses. This means your main costs come from sending payments, receiving payments, and converting currencies.

Companies registered in offshore jurisdictions or certain higher-risk sectors may face additional checks and fees based on partner bank requirements.

| Fee Category | Fee |

|---|---|

| Account setup fee | Free |

| Monthly account fee | Free |

| Collecting local payments | USD 0.75 per transfer |

| Sending local payments | USD 3 per transfer |

| SWIFT payment (send & receive) | USD 8 per transfer |

| FX conversion |

Tier 1 (USD, EUR, GBP): 0.35% Tier 2 (AED, CZK): 0.40% Tier 3 (THB, IDR, INR): 0.50% Tier 4 (MXN, MYR, SAR): 0.60% Tier 5 (USD⇆HKD): 0.10% |

| Card subscription fee | Free |

| Team card subscription fee | HKD 50 per month for up to 5 cards, then HKD 15 per additional card |

These fees apply to Currenxie Global Account users. For the latest pricing and full details, visit the official Currenxie pricing page.

For most SMEs, everyday costs stay predictable because local transfers have fixed fees and FX commissions are clearly tiered. The areas where costs tend to rise are SWIFT transfers at USD 8 each and higher-tier FX conversions, which range up to 0.60% for currencies like MYR or MXN.

Businesses in certain jurisdictions or industries may also incur additional review fees, depending on the registration type and overall risk profile.

Currenxie Business Features

Currenxie covers the core needs of cross-border SMEs: receiving payments, sending money abroad, and managing multiple currencies without opening separate accounts in each country.

Here is how it works in practice.

Local Account Details

Currenxie gives you virtual local account details in major markets, including the United States, the United Kingdom, the European Union, Hong Kong, Japan, Australia, Canada, and Mexico. These work like domestic bank details, so clients and platforms can pay you using the same methods they would use for local businesses.

For many SMEs, this simplifies international work because you do not need separate bank accounts overseas just to get paid.

International Payments

You can send money through local payment networks when they are available or use SWIFT for countries and currencies that do not support local transfers. Currenxie allows payments across Asia, Europe, North America, and other major regions.

Local transfers are usually faster and cheaper, and SWIFT is the option used when local transfer methods are not available.

Multi-currency Support

The Global Account lets you hold and manage up to 15 currencies, including USD, EUR, GBP, HKD, JPY, and AUD. You can keep money in different currencies and convert only when needed using Currenxie’s FX system.

This setup enables SMEs to bypass repetitive currency conversions and offers greater flexibility when transacting in multiple markets.

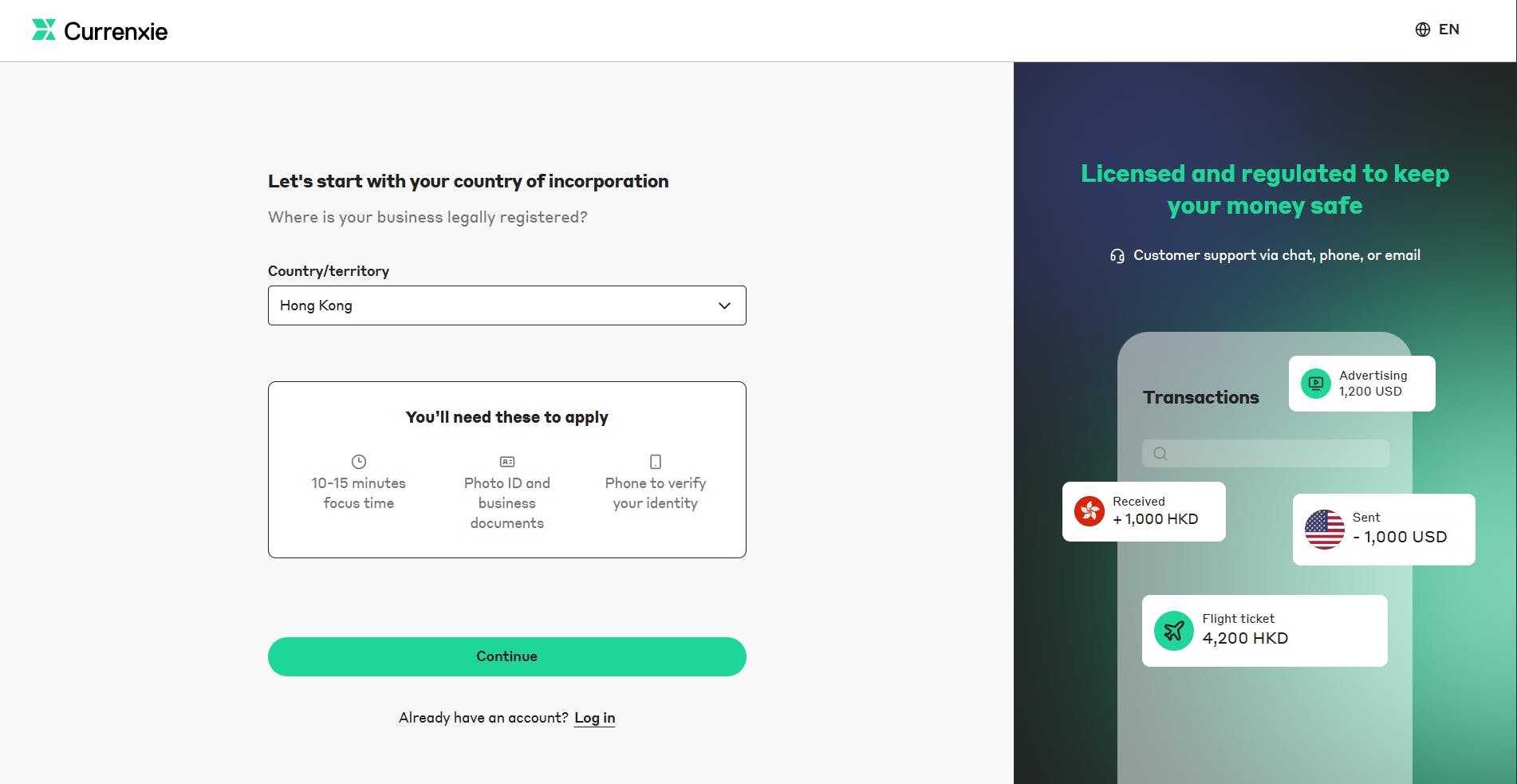

Currenxie Business Account Opening

Opening a Currenxie Global Account is fully online. You start by selecting your company’s country of incorporation, which determines eligibility and whether any extra checks or fees apply.

If your business is supported, you register with an email, verify your phone number, and complete the company information form.

Currenxie shows the required documents before you begin, including accepted ID types and the need for a mobile device for verification.

Once approved, you can activate your virtual local account details and start receiving payments in supported markets.

Who Can Open?

Currenxie accepts businesses from many countries, but it does not publish a full list of supported jurisdictions. In most cases, your company will be eligible unless it is based in a sanctioned or high-risk country.

You will see right away whether your jurisdiction is supported, because the application page confirms this at the first step.

Supported business types:

- Limited companies

- Partnerships

- SMEs and ecommerce sellers

- Online platforms and SaaS businesses

Not supported:

- Sole traders

- US-incorporated businesses

- Companies in sanctioned or high-risk jurisdictions

If your business is based in an offshore jurisdiction, expect that Currenxie might run extra checks or charge additional fees depending on their banking partners.

Required Documents

Currenxie asks for standard business verification materials, such as:

- Government-issued ID for directors and beneficial owners

- Proof of residential address

- Certificate of incorporation or business registration

- A verified mobile number for security checks

- Details about business activities and expected transaction types

Currenxie might request extra documents, like contracts or invoices, if they need more information about your activity. Reviews also tend to take longer for companies with more complex ownership structures.

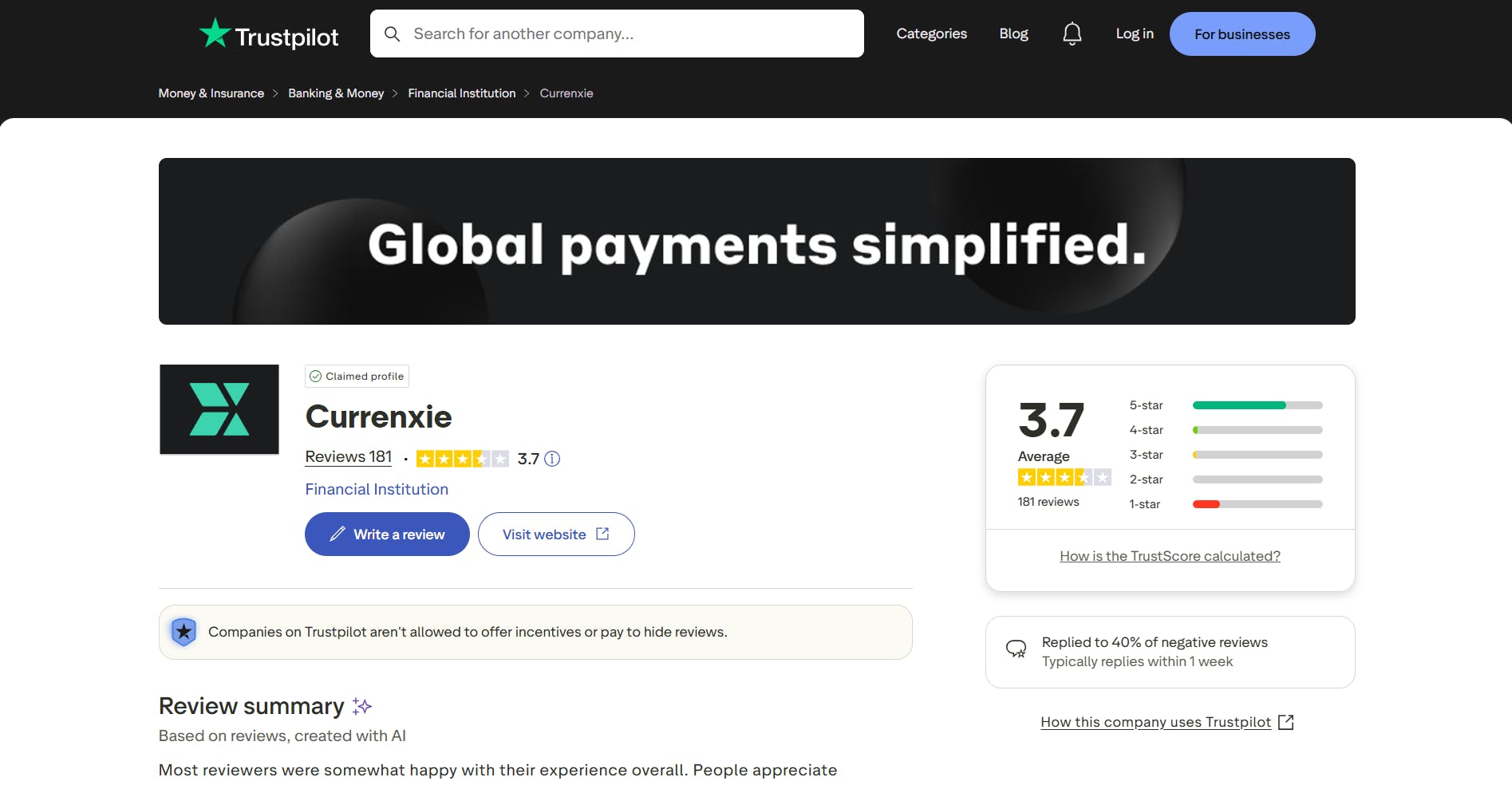

Trustpilot Reviews: Currenxie

Currenxie is rated 3.7 out of 5 on Trustpilot, and the feedback is very mixed. Some users really like how it works, while others talk about problems they did not expect.

On the positive side, many reviewers highlight how easy the platform is to use. People mention clean navigation, fair FX rates, and simple multi-currency payments once everything is set up. Several SMEs say onboarding was quicker than they expected, and a few note that support staff followed up by phone when needed, which left a good impression.

Most of the negative reviews cluster around two areas. The first is response time. Some users say replies slow down during payment checks, and they want clearer updates while partner banks review transactions. A few also mention delays with incoming transfers or fixed fees on returned SWIFT payments, which feel heavy if the transfer amount is small.

The second concern appears in fewer reviews but is still relevant. Some users report their accounts being closed with little explanation. This is something you see with many regulated fintechs, but the lack of detail still leaves people uneasy. A few also point out that once a transfer is sent, it cannot be cancelled immediately.

Overall, most users agree on a few points: Currenxie is strong for global payments, FX, and general ease of use, but support speed and payment investigations are where experiences vary.

Best Currenxie Business Account Alternatives

1st Choice

2nd

Low-cost transfers with strong multi-currency support.

3rd

Global account built for fast onboarding and advanced FX tools.

Why Statrys?

Statrys focuses on what small businesses usually need most. You get predictable FX fees from 0.1%, 11 currencies in one account, and local payouts in major markets. Every business works with a dedicated account manager who provides clear guidance whenever you need it. We also support smooth onboarding for companies with foreign directors or more complex structures, making it easier for SMEs to get started and operate confidently.

Read More:

Top 5 Currenxie Alternatives in 2025 (and What They Do Better)

Currenxie VS Statrys: Which Is Better in 2025?

Airwallex vs Currenxie (Hong Kong) - Which Is Better in 2025?

Was this article helpful?

Yes

No

FAQs

Is Currenxie a bank?

No. Currenxie is not a bank. It operates as a licensed financial services provider and holds regulatory approvals in markets such as Hong Kong, Canada, Australia, South Africa, and the UK. Its services follow the rules that apply to payment institutions, not banks.

Where is Currenxie based?

How much does it cost to open and maintain a Currenxie account?

What payment card options does Currenxie offer?

Does Currenxie charge fees for international payments?

Disclaimer

Statrys competes directly with Currenxie in the payment industry, but we are committed to providing an unbiased and thorough review. Click More info to read the full disclaimer on our review.