Quick Answer Box

An Ultimate Beneficial Owner (UBO) is an individual or entity that ultimately owns or controls a company or organization, regardless of who is listed as the legal owner.

Knowing who the UBO is can be important for anti-money laundering and anti-corruption efforts, as well as for corporate governance and risk management.

UBO is particularly important in tax havens (i.e., BVI, Singapore) where businesses and people may employ complex legal frameworks to conceal assets and evade taxes.

There is one question a bank will definitely ask when reviewing the application made by your company for a business bank account: Who are the Ultimate Beneficial Owners of your company?

An Ultimate Beneficial Owner is a natural and legal person, who is not necessarily recorded as a shareholder of the company but who has actual power and authority to direct the company and reap its profits.

Before we find out why a UBO is important, let's dive into what a UBO is.

What Is an Ultimate Beneficial Owner (UBO)?

The concept of “Beneficial Ownership” was first developed in the 1933 U.S. Securities Act in relation to the ownership of securities (such as shares in a company).

This concept was then adopted by several national and international laws and is now applied not only to the ownership of securities but to the ownership of all sorts of other goods whose ownership is subject to registration in legal records (for instance, real properties and vessels).

As the name suggests, an Ultimate Beneficial Owner (UBO) refers to the individual or entity that ultimately benefits from the ownership of a business or organization.

So, what does a UBO look like?

It could be a single individual or a group of individuals, depending on the ownership structure of the company. They may have a direct or indirect interest in the company, such as through a trust or a nominee arrangement.

According to the Money Laundering Act (GwG), a beneficial owner is a person who:

- Owns more than 25% of the company's equity (shares),

- Has more than 25% of the voting rights and can exercise, directly or indirectly, such voting rights at the general meeting of shareholders of the legal entity,

- Or who can similarly exercise significant control over the company.

On this particular point, it is worth mentioning that banking practice goes beyond legal and regulatory requirements here. When identifying UBOs, banks will indeed retain a 10% threshold as opposed to the 25% one provided by the regulations.

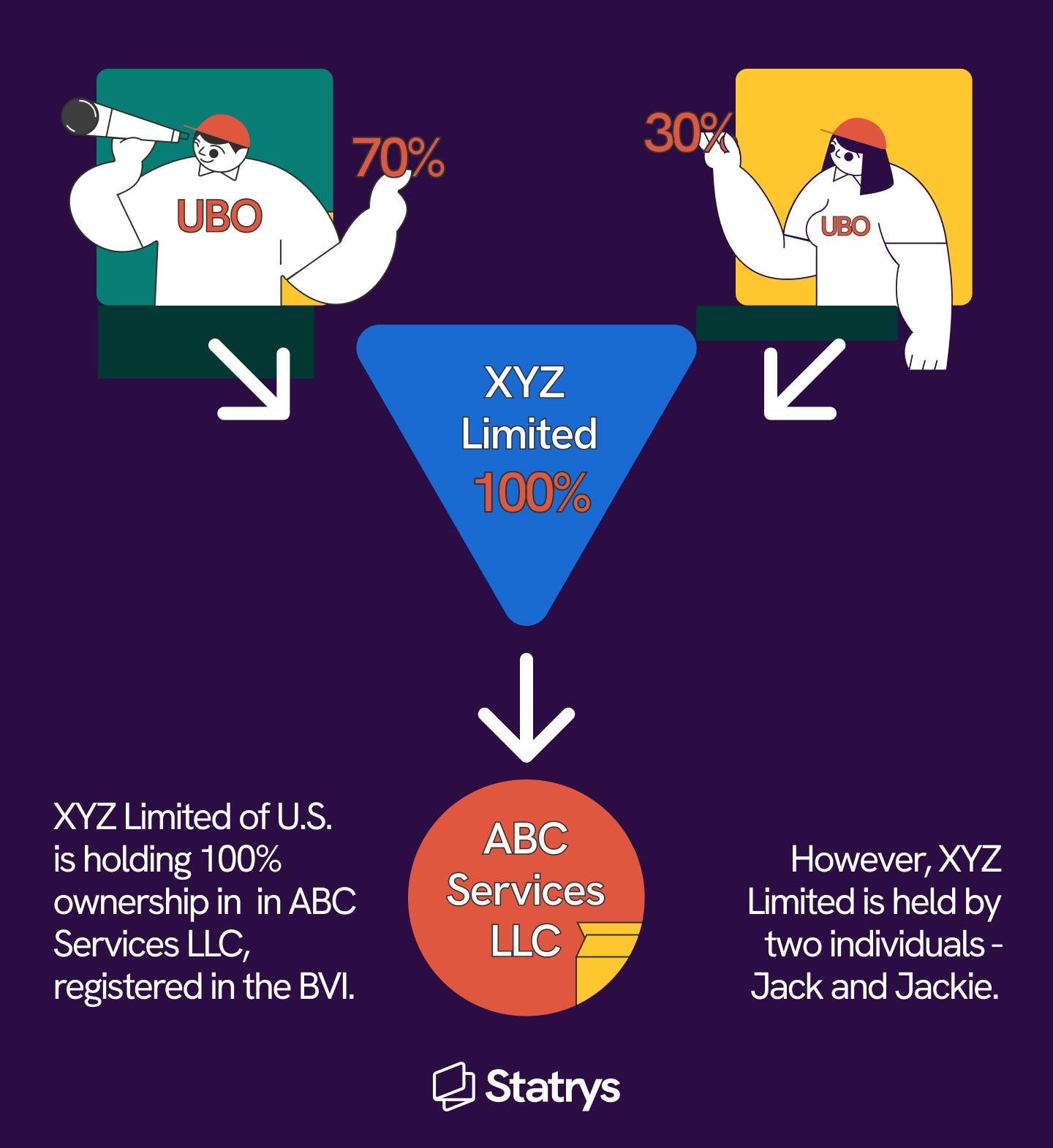

The example below, which presents more than 1 UBO for a company, indicates that owning more than 25% of the company's stake makes Jack and Jackie an Ultimate Beneficiary Owner.

In some cases, identifying the UBO's identity can be a complex process, as it may involve tracing ownership through multiple layers of ownership and control.

So, beneficial ownership refers to an individual who enjoys the benefit of the ownership and can exercise ultimate effective control of real-estate property, security, or some other good without being registered as the proprietor on the relevant records.

Why Is Ultimate Beneficial Ownership Important?

Banks require beneficial ownership information because ever since the turn of the century, money laundering and terrorist financing crimes have been on a constant increase.

The UBO is an important concept in the context of financial regulation, as it helps to identify potential risks and prevent financial crimes such as money laundering and terrorist financing. By identifying the UBO, financial institutions can better understand the structure and ownership of the companies they do business with and reduce the risk of these crimes taking place.

In practice, financial crimes often use complicated networks of companies to mask their illegal financial activities. To tackle this, governments and international organizations have enforced much firmer regulations to enforce financial transparency surrounding company structure and ownership.

As a direct consequence, the identification of all ultimate beneficial owners of a legal entity is part of the AML compliance duties imposed on financial institutions.

To understand this issue more, we have created an article, in which we explore what the UBO legislation is, the reasons for its existence, as well as how it applies in the practical context of a bank account opening.

📉 Statistics: The estimated amount of money laundered globally in one year is 2 - 5% of global GDP, or USD800 billion - USD2 trillion in current US dollars.

What Is UBO Legislation?

Companies are required to report information about their ultimate beneficial owners to relevant authorities, including financial institutions and government agencies, under UBO legislation.

This act is intended to increase the transparency of firm ownership arrangements and prevent financial crimes, including money laundering and terrorism.

Various nations have their own UBO laws, but in general, they require firms to identify and disclose the individuals or entities who ultimately own or control them. This can include information such as the UBO's name, address, and ownership %.

In many instances, UBO information must be provided to a central register or database that may be viewed by the appropriate authorities.

As part of their anti-money laundering (AML) and know-your-customer (KYC) responsibilities, financial institutions like banks are obligated to collect UBO information from their customers.

The following practices and situations have led to the rise of the Ultimate Beneficiary Owner legislation:

1. To Respond to Problems Surrounding Money Laundering

Money laundering is the illegal process of making money that was generated by criminal activity that appears to have come from a legitimate source.

This money is made through unlawful activities such as the sale of drugs or weaponry, human trafficking, tax evasion, and prostitution, to name a few.

The aim for individuals who launder money is to hide these sums of cash and their provenance by covering up how they inject them back into the economy.

Money laundering consists of three main measures:

- Depositing: the first stage involves the launderer bringing illegal sums of money into the financial system. To do so, the amount is divided into smaller sums and then deposited into various accounts.

- Concealing: from those accounts, different amounts of money are moved into new accounts. Most commonly, these accounts will be abroad, in countries different from the one where the money was made. This is done in an attempt to conceal any trace of the sums of money and usually involves multiple overseas company structures.

- Integrating: in this final stage, the illegally made money reenters the legal economic system through a series of investments. This involves investments in property, or high-end luxury goods, to name a few.

2. To Respond to Issues Surrounding the Financing of Terrorist Groups

Terrorists need money and other assets to run their organizations (travel, accommodation, weapons, training, etc) and set their attacks into motion.

Disrupting financial transactions that are terrorism-related will directly prevent future attacks by cutting their finances. Countering terrorist financing is, therefore, an essential part of the fight against terrorism crimes worldwide.

Terrorism financing is different from money laundering in three ways:

- Its purpose is to hide the final use of the sums of money, as opposed to where they come from and how they were made.

- It does not always revolve around large sums of money as opposed to money laundering. It can actually comprise relatively small amounts of money, but that can still have a substantial impact in terms of destruction and disruption on civilians and society.

- Although terrorist groups support their activities through crime, lawful money can be found to be stolen and misused to financially provide for terrorist acts.

3. To Prevent and Fight Fraud

Fighting fraud, especially commercial scams and tax evasion is a significant problem in today’s global economic system.

Large-scale fraud is often assimilated with the unlawful use of businesses and commercial systems.

Organized fraud is usually concealed by international company structures, which are created in order to prevent the identification of the criminals involved and their network inside the firm.

Which Organizations Have the Obligation to Identify the UBO?

Anti-Money Laundering and Anti-Terrorist Financing regulations state which organizations have the obligation to identify Ultimate Beneficial Owners and their business relationships.

This obligation is part of a more general “Know Your Customer” or "KYC" compliance process whereby certain organizations must find out information on their clients.

All financial organizations are obligated to check UBO, including:

- Commercial and investment banks;

- Insurance firms;

- Brokerages and investment firms; and

- All companies that handle money, such as credit unions, money transfer businesses, and payment gateways.

Such organizations must identify the UBOs of their customers as soon as they start a business relationship with them.

Also, as long as the business relationship remains active, financial institutions must verify from time to time that the UBOs of their clients have not changed.

That explains why a bank will require to know who the UBOs of your company are when you apply for a business account and then ask you to confirm their identity on a regular basis.

Once provided with the UBO information, banks will check if this is consistent with public information available at companies’ registries.

In case such public information is not available, they will require a confirmation from you in the form of a certificate of incumbency issued by a qualified third party.

How to Identify the Ultimate Beneficial Ownership?

Identifying the Ultimate Beneficial Owner (UBO) of a company can be quite the puzzle, especially in organizations with intricate structures. Here’s a structured approach:

- Gather Company Credentials: Start by collecting essential information about the company, such as its registration number, address, and key management personnel.

- Research Ownership Chain: Investigate who holds shares or interests in the company, and whether this ownership is direct or indirect.

- Identify and Verify the UBO(s): Determine the individuals who ultimately have a significant share or control over the company. This might involve looking beyond the immediate shareholders to those indirectly influencing the company.

- Conduct AML and KYC Checks: All identified UBOs must undergo Anti-Money Laundering (AML) and Know Your Customer (KYC) checks to ensure compliance and legitimacy.

Specific Considerations by Business Structure

- Sole Proprietorship: The sole proprietor is the UBO, as they have full control over the business.

- Partnerships: Here, the UBOs are those who control the partnership's decisions, as outlined in the partnership agreement. Analyzing this agreement provides insight into each partner’s voting rights and authority, revealing the UBO.

- Corporations: For corporations, UBO identification involves examining who controls the company through share ownership or voting rights. This process includes analyzing share registers, shareholder agreements, and other relevant documents to trace the ownership structure.

- Trusts: In the case of trusts, the UBO may be the settlor, trustee, protector, or beneficiaries, based on who holds ultimate control over the trust's assets or decisions. This requires a thorough understanding of each party's role and authority in the trust.

In every case, identifying the UBO is more than a regulatory formality – it’s a critical step for ensuring transparency and integrity in business dealings.

💡 Did you know? On average, financial institutions spend USD2,598 to complete one KYC review for a corporation.

What Are the Potential Implications of Incorrect UBO Identification?

Incorrect identification of Ultimate Beneficial Owners (UBOs) can lead to serious repercussions for a company, as underscored by the Panama Papers Leak. This incident revealed how opaque ownership structures can be manipulated for illicit activities, such as money laundering. More importantly, it revealed a critical gap in the due diligence process, prompting government agencies to call for increased transparency.

The consequences of misidentifying UBOs are multifaceted and significant:

- Reputation Damage: A fundamental concern is the potential harm to a company's reputation. Incorrect UBO identification can paint a business as non-compliant and lacking in integrity, eroding trust among stakeholders, clients, and the wider market.

- Financial and Legal Risks: Non-compliance with UBO regulations can lead to significant fines and legal action, which can have a severe impact on core business operations.

- Operational Challenges: Incorrect UBO information can disrupt crucial business functions, such as banking processes, including opening business accounts or securing finance, due to heightened due diligence by financial institutions.

Enterprises must take UBO identification seriously and make sure that the correct information is provided to banking institutions in order to avoid any potential legal or financial repercussions.

Bottom line

Understanding the beneficial owners of a firm and presenting this information to the appropriate authorities is crucial for transparency and accountability within business ownership structures.

As a business owner, you must comply with UBO legislation by identifying and disclosing the ultimate beneficial owner to the appropriate authorities.

FAQs

What do you mean by UBO?

UBO stands for Ultimate Beneficial Owner. It is the person or entity that ultimately owns or controls a legal entity, either directly or indirectly.