Features

Fees

Account Opening

User Reviews

Founded in 2014, SingX is a Singapore-based fintech company that helps individuals and businesses send money overseas at clear, upfront fees. The platform offers international transfers at the live interbank rate, aiming to remove the hidden charges often added by traditional banks.

SingX serves consumers who need to send money, top up mobile phones, or pay utility bills across borders, as well as SMEs and larger companies handling supplier payments, payroll, or regular overseas transfers.

In this review, we look at how SingX works in practice, covering its fees, transfer options, supported countries, and typical use cases, to help you decide whether it suits your needs.

SingX Fees

SingX doesn’t publish its fees or FX costs on the website. There is no public pricing page, and details such as transfer fees, FX markups, or minimum charges are only available after contacting their team.

For businesses comparing cross-border payment providers, this lack of upfront information makes evaluation harder. Without clear pricing, it becomes difficult to estimate your true payment costs, calculate margins, or benchmark SingX against alternatives that openly display their fees. This might slow down your decision process, as you can’t quickly assess whether SingX fits your budget or payment volume.

If transparent and predictable pricing matters for your business, this is a crucial point to consider.

SingX Features

SingX offers products that simplify cross-border transactions for individuals and businesses. However, this review will focus on the features that are tailored to businesses.

Global Bank Account

The SingX Global Bank Account helps businesses manage international payments and collections without relying on multiple banks or constant currency conversions. Companies can receive, hold, and send funds in 15 major currencies, which makes it easier to match payments in the same currency and avoid FX losses.

With local payouts in over 50 countries and SWIFT access to more than 180 countries, businesses can pay suppliers or receive client funds from almost anywhere. The account also supports bulk payments to up to 1,500 recipients and transfers of up to SGD 1 million, making it practical for handling recurring or large overseas payouts.

SingX Business Account Opening

SingX provides a straightforward online application process for opening a business account. After submitting your company details (such as business name and business registration number), a SingX business manager will contact you to guide you through the verification process. According to SingX, the company takes up to 2 business days to review and approve your application.

Who Can Apply?

According to SingX, they accept applications from companies registered in most jurisdictions. SMEs, startups, and larger corporates can apply as long as their business activities fall within SingX’s compliance guidelines.

Required Documents

SingX doesn’t publish a detailed list of required documents on its website. However, based on common industry standards for cross-border payment providers, businesses can typically expect to prepare:

- Certificate of incorporation

- Business registration or business profile documents

- Identification and proof of address for all directors and major shareholders

- A brief description of business activities

- Recent bank statements or financial information (if requested during review)

These documents may vary depending on your company’s structure, jurisdiction, and risk profile.

SingX from Real Users

SingX holds a strong 4.5 out of 5 rating based on more than 2,000 Google reviews.

Many long-term users highlight competitive exchange rates, low fees, and generally fast transfers as the main reasons they continue using the platform. Customer support is also frequently praised, with several reviewers mentioning specific staff members who helped resolve issues or guide them through transactions.

At the same time, feedback is mixed in a few areas. Some users report delays in remittances that were expected to arrive the same day, as well as occasional issues with the mobile app, login errors, or OTP verification. Several reviewers also note that exchange rates are less competitive than before and that certain processes feel slower or less stable over time.

Overall, SingX receives positive ratings for cost savings and customer support, but user experiences with transfer speed and platform reliability can vary. Businesses handling time-sensitive or large cross-border payments may want to factor these points into their decision.

Best SingX Alternatives

If SingX is not the right fit for your company, here are some alternatives to consider instead:

1st Choice

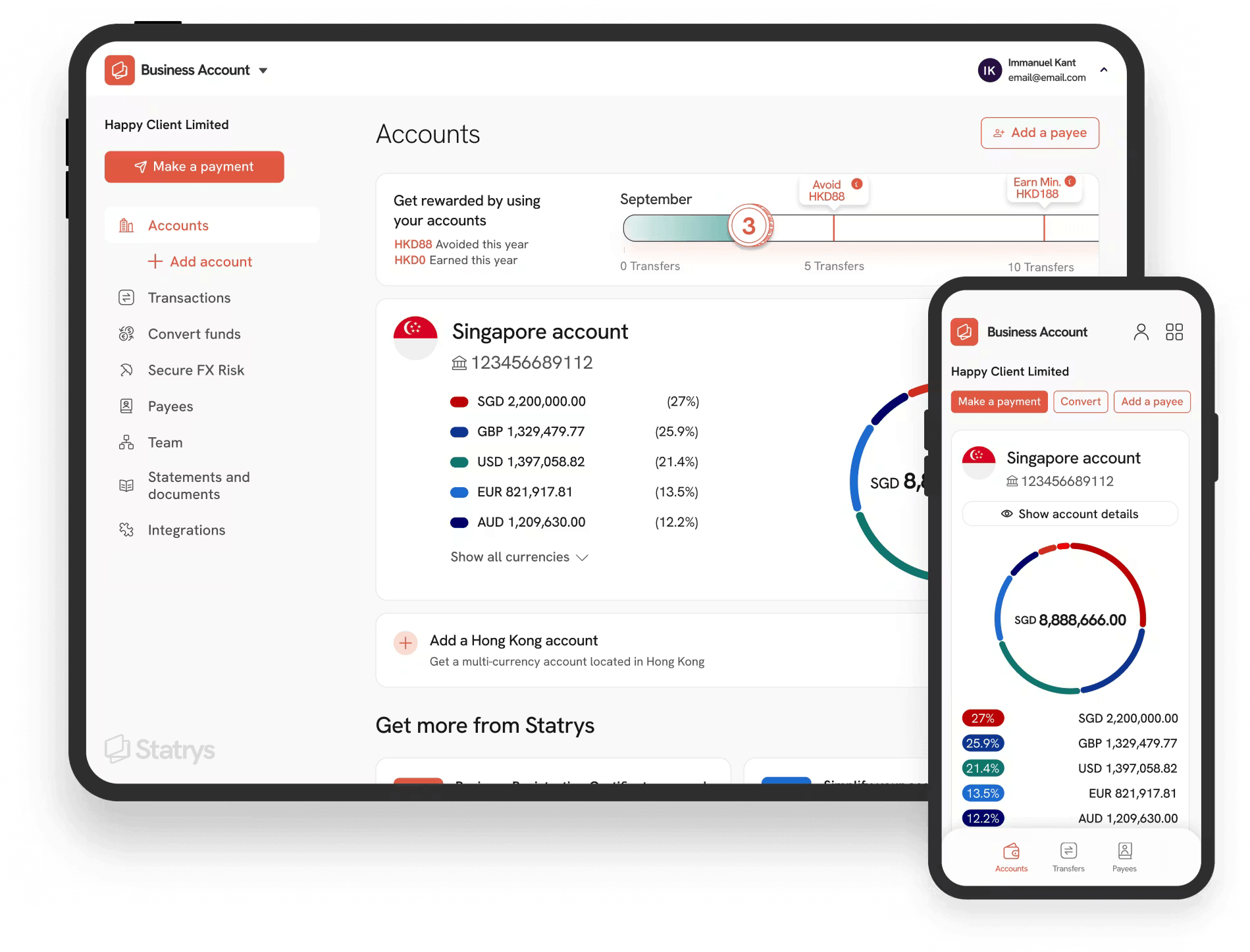

Multi-currency business account supporting 11 major currencies with FX fees as low as 0.1%

2nd

Business account that supports up to 40 currencies and comes with multiple debit cards.

3rd

Multi-currency business account with extensive business management tools.

Why Statrys?

If you prefer clear pricing and real human support, Statrys is a better option. Our fees and FX rates are fully published, so you can check your costs anytime without waiting for replies or guessing what a transfer will really cost. Every client also gets a dedicated account manager who knows their business and can step in quickly when payments or compliance questions arise.

Was this article helpful?

Yes

No

FAQs

Is SingX a bank?

SingX is not a bank, but it is a regulated Major Payment Institution under the Monetary Authority of Singapore (MAS). It is also licensed as a Money Service Operator in Hong Kong and holds an Australian Financial Services License issued by ASIC in Australia.

How does SingX work?

Is SingX trusted?

How long does it take to complete a transfer with SingX?

Who founded SingX?

Disclaimer

Statrys competes directly with SingX in the Hong Kong and Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.