Fees

Features

Account Opening

User Reviews

Wise Business is a global multi-currency account designed for companies that work with clients, suppliers, or partners across borders. It allows businesses to hold, send, and receive money in more than 40 currencies, while offering local account details in major markets such as the UK, Europe, the United States, Australia, and Singapore.

The account focuses on practical tools for international transactions, including batch payments, accounting integrations, and competitive foreign exchange rates. Wise Business operates in most major regions, although some features depend on where the company is registered.

Key Highlights

Local account details in major markets

Businesses can receive payments like a local in 23 countries, including the UK, US, EU, and Australia.

Multi-currency wallet built for global payments

Wise supports holding and exchanging more than 40 currencies with clear fees and competitive FX based on the mid-market rate.

No monthly fees and quick online signup

Account opening is entirely online and often completed within a day. There are no ongoing monthly charges.

Customer support can be inconsistent

Wise offers 24/7 support, although available channels depend on your country and whether you are logged in. Most queries begin in the Help Centre before reaching a live agent.

Some features are limited by region

Cards, investment tools, and interest-earning balances are not available everywhere, which may be restrictive for certain businesses.

✅ Who Wise is ideal for

- Companies handling frequent international payments:

Wise supports more than 40 currencies and offers local account details in major regions such as the UK, US, EU, and Australia. This setup helps businesses reduce transfer fees and receive payments faster from overseas clients and partners. - Ecommerce sellers and freelancers paid in multiple currencies:

Local account details in key markets make it easier to collect payments from marketplaces like Amazon or freelance platforms without maintaining separate local bank accounts. - Small teams that want a low-maintenance, online account:

Wise charges no monthly fees, and the digital onboarding process is typically faster than opening an account with a traditional bank.

🚫 Who Wise is not ideal for

- Companies that need credit or traditional banking services:

Wise does not offer loans, overdrafts, cheque facilities, or other traditional banking services. Businesses that rely on these tools may need to pair Wise with another provider. - Teams that need flexible access to money (cash or multiple cards):

Wise is fully digital, so there’s no way to deposit cash, and ATM withdrawals come with monthly limits and extra fees. Card flexibility is also limited: business users only get one physical card each, and digital cards aren’t available in every country. If your team relies on multiple virtual cards or broad region-wide card access, Wise may feel restrictive. - Businesses that expect direct relationship support:

Support is available 24/7, but most enquiries start in the Help Centre and require logging in before reaching a specialist. This may not suit teams that prefer immediate, hands-on assistance.

Wise Business Fees

Wise keeps its pricing simple, with no monthly fees and a one-time setup fee of £45. For everyday use, costs stay low because sending money starts from 0.33% and receiving local payments is free.

Where businesses should look more closely is SWIFT deposits, currency conversion, and wallet top-ups, because this is where you’re most likely to notice the fees start to add up.

| Fee Category | Fee |

|---|---|

| Account setup fee | £45 one time |

| Account monthly fee | Free |

| Sending money | From 0.33% |

| Receiving local payments | Free |

| Receiving international payments |

Depends on currencies, such as: • USD SWIFT and wire payments – $6.11 • GBP SWIFT payments – £2.16 • EUR SWIFT payments – €2.39 |

The fees listed in the table apply to UK businesses. For the latest pricing and full details for all regions, see the official Wise Business pricing page.

SWIFT fees are low per transaction, but if clients pay you this way often, the charges add up over time. Currency conversion also starts from 0.33%, which is fair, but frequent or larger transfers make the totals feel heavier.

It’s also worth keeping an eye on the 2% fee for topping up external e-wallets. If your business frequently transfers money between platforms, this can add up quickly.

ATM access is another area with limits. Only £200 per month is free. Once you go past that, each withdrawal costs £0.50, and anything above the free allowance also comes with a 1.75% fee.

Wise Business Features

Wise Business works best for companies operating across borders, helping you receive payments, hold multiple currencies, and move money internationally with less hassle.

Local Account Details

One of the strongest features is how easy it is to receive payments like a local. Wise gives you account details such as a US routing number, EU IBAN, GBP account number, and other regional account details covering more than 20 currencies, depending on your location.

For foreign founders, this removes a major barrier. You do not need to open a bank account in every market because clients and platforms can pay you as if you were based in their country.

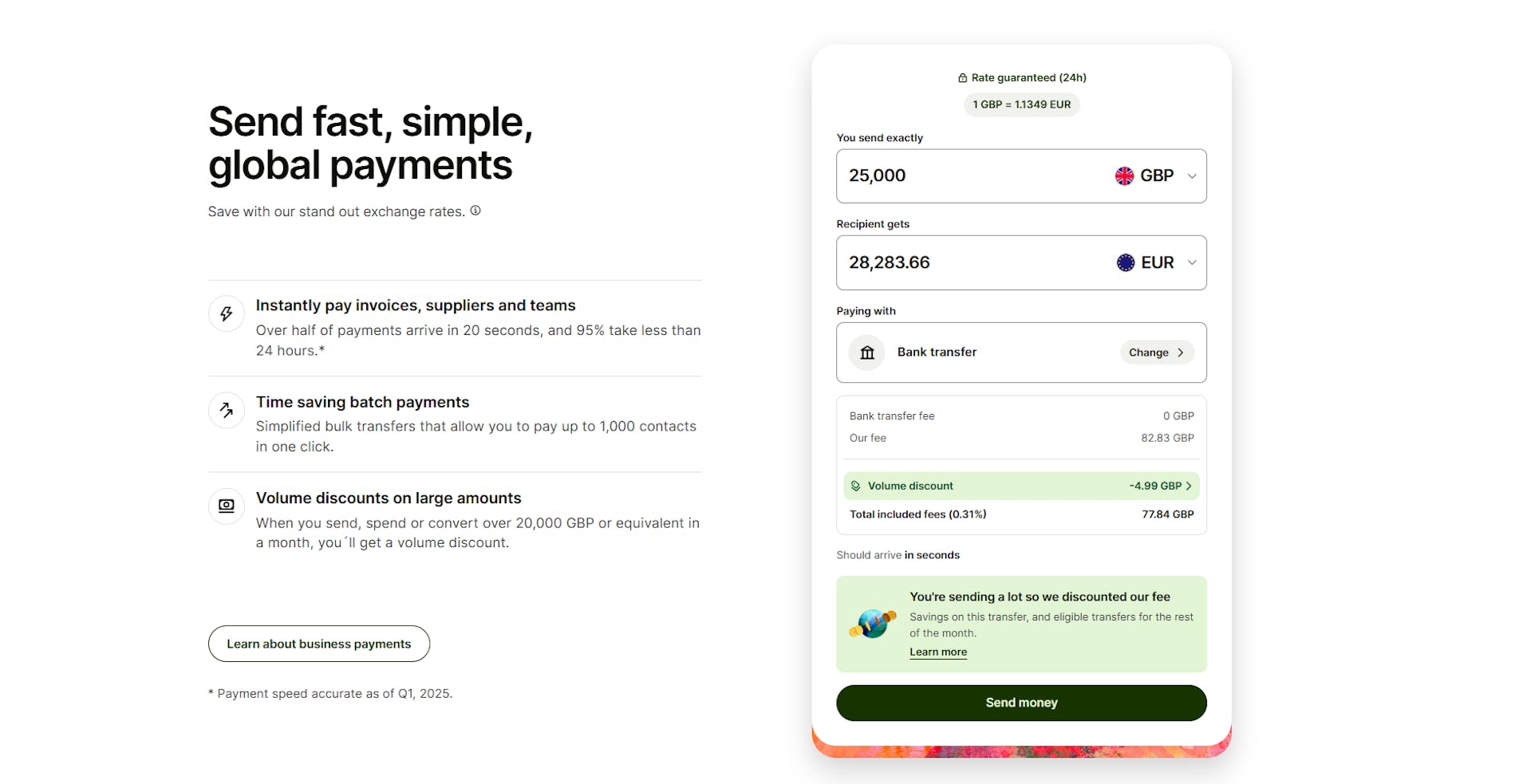

Fast International Transfers

Cross-border transfers are quick, and Wise uses the mid-market rate, which removes the hidden markups that many banks add on top. It works well for paying suppliers, contractors, or invoices in different currencies, especially if you rely on predictable FX costs.

Multi-currency Support

You can hold money in 40+ currencies and convert only when the rate suits you. For businesses that earn in one currency and spend in another, this setup helps reduce unnecessary conversion fees and gives you more control over timing.

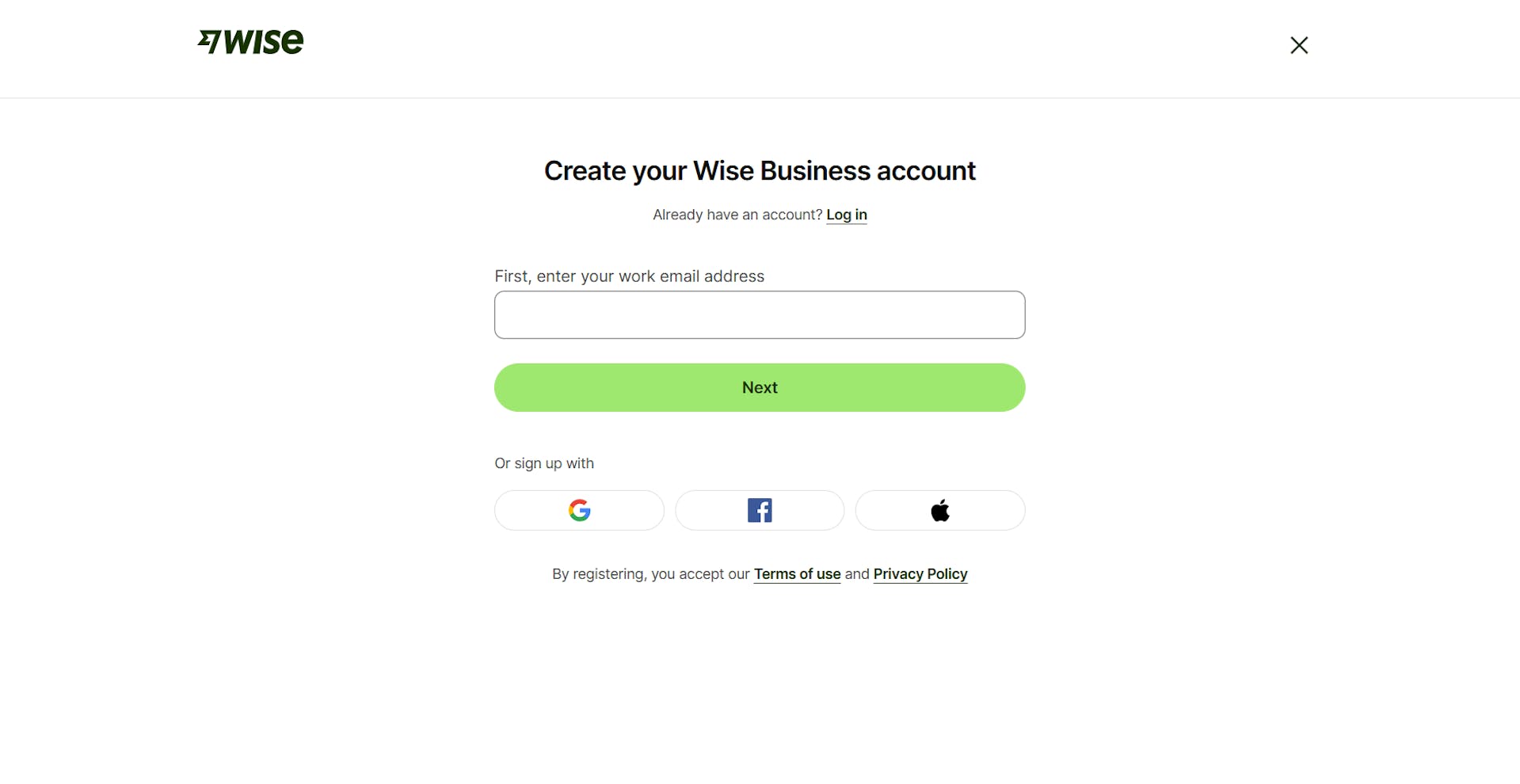

Wise Business Account Opening

Opening a Wise Business account is fully online and generally quick. You start by creating an account with your email, verifying your phone number, and entering basic business details. This part only takes a few minutes.

If you already have a Wise personal account, you can link both profiles under the same login.

Who Can Open?

Wise accepts a wide range of business structures, including:

- Sole traders and freelancers

- Limited companies

- Partnerships

- Charities and registered organisations

- Trusts in supported regions

Supported markets include the UK, EEA, US, Canada, Singapore, Hong Kong, Australia, and New Zealand. Some jurisdictions and high-risk industries are restricted, so eligibility depends on where the business is registered.

⚠️ A detail worth noting: if your registered and trading addresses are in different countries, Wise can only offer features available in both locations.

Required Documents

Wise’s documentation requirements are lighter than what most banks ask for, but you should still be ready to provide standard business information.

Most applicants can expect to provide:

- A certificate of incorporation or business registration

- Identification for directors, shareholders, and the account administrator

- Proof of trading address

- A government-issued ID and a selfie for identity verification

- Basic information about your business activities

- Supporting proof such as invoices, contracts, or website links

If the person applying is not a director, an authorisation letter is required.

Verification for straightforward businesses tends to move quickly, while more complex setups can take longer. Once approved, you can start opening currency accounts and receiving payments immediately.

Wise Reviews from Real Users

Before wrapping up, it’s worth looking at what real users say about Wise Business. Trustpilot and Google Play offer a reliable view of how the product performs in everyday use.

Trustpilot Reviews

Wise has built a huge presence on Trustpilot with over 275,000 reviews and an average rating of 4.3 out of 5. Most users agree that Wise is fast, easy to use, and noticeably cheaper than traditional banks for international transfers. People like seeing fees upfront and appreciate that the app feels simple to navigate.

For business users, though, the feedback varies slightly more. Some reviewers mention verification checks take longer than expected, or transfers get paused without clear explanations. A few also say they struggled to receive timely updates from support when issues needed to be escalated.

Overall, Trustpilot suggests that Wise performs very well for day-to-day transfers. However, things can feel less smooth when compliance reviews or unusual situations come up.

Google Play Reviews

On Google Play, Wise scores 4.5 out of 5 based on more than 1.5 million reviews, which says a lot. Users frequently praise fast transfers, straightforward design, and lower fees than banks. Many people refer to it as their “go-to app” for sending money abroad.

That said, users also talk openly about a few recurring pain points. Some run into delays when Wise waits for bank payments to clear, even after the money has already been withdrawn from their account. Others deal with bank connections dropping and having to reconnect through Plaid again (the secure third-party tool Wise uses). When technical issues happen, several users feel the support responses are too scripted to be helpful.

From the Google Play feedback, it’s clear that Wise handles everyday transfers very well. Reliability becomes less consistent when bank connections or verification steps are required.

Best Wise Business Account Alternatives

1st Choice

2nd

Multi-currency account with cards, APIs, and advanced tools.

3rd

Global platform with marketplace integrations and mass payouts.

Why Statrys Often Works Better for SMEs

We prioritise clarity and support. With transparent FX fees, 11 supported currencies, and a dedicated account manager, SMEs get real help instead of going through automated support channels. We also onboard companies with foreign directors and more complex structures. If you want predictable costs and reliable cross-border payments, Statrys offers a straightforward way to keep operations running smoothly.

Read More:

9 Key Things to Know Before Opening a Wise Business Account [2025]

Was this article helpful?

Yes

No

FAQs

Does Wise offer a business account?

Yes, Wise offers a multi-currency business account designed for businesses of all sizes. This account operates like a bank account that allows you to hold, receive and send money in various currencies.

How much does a Wise Business account cost?

Does Wise offer payment cards?

What are the disadvantages of Wise Business?

Is Wise Business a good fit for ecommerce businesses?

Disclaimer

Statrys competes directly with Wise in the Hong Kong and Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.