Choosing the right payment service provider is one of the most crucial decisions you can make when setting up your business.

To help you make the most informed decision, we’ve created this in-depth review about one of your possible choices - Neat, A Rapyd Company.

Neat is also often called Neat Commerce - that’s because of their domain name, or Neat bank - although they are not a bank as we will explain below.

We’ll help you learn more about what Neat offers while answering all the hard-hitting questions related to eligibility requirements, how to set up an account, pricing, FX capabilities, and the kind of support you’ll have access to if you hold a Neat “bank account”.

We’ll also make some comparisons with other payment providers, so you can assess if Neat is the best fit for your needs. Now, let’s start with the Neat review.

🔍 Tip: Want to skip to see how Neat compares with Statrys? Read our detailed comparison.

What is Neat?

Neat is a Hong Kong-based fintech company founded in 2015. It was acquired in 2022 by Rapyd, a United Kingdom (UK) based payment processing company.

Neat provides business customers with multi-currency wallets (if you are not clear about what is a wallet, don’t worry we will come back to that in detail below), corporate cards, and Hong Kong company incorporation services. [ 1]

Note that this review will only focus on Neat’s payment services.

Before we jump into how you can apply for one of Neat’s products, let’s clarify what is the regulatory status of Neat.

Like many new players in the payment industry, Neat may commonly be referred to as a digital bank, and therefore called a Neat bank. However, legally speaking, Neat is not a bank and it is not supervised by the Hong Kong Monetary Authority - i.e., the authority in charge of supervising traditional banks in Hong Kong.

Still, Neat is a regulated financial institution and it holds various registrations, licenses, and authorizations to offer its services under applicable electronic money regulations.

Specifically, Neat’s Hong Kong arm is licensed as a Money Service Operator and a Money Lender. Its UK arm is a registered agent of PayrNet Limited which is an Electronic Money Institution authorized by the Financial Conduct Authority.[ 2]

Now that we’ve covered the legal stuff, let’s focus more on what exactly Neat has to offer and the key things you need to know to open an account with Neat.

What are the requirements to open a Neat business account?

Neat started its business in 2015 by offering personal accounts. However, after a few years, the company decided to terminate this line of business. It then shifted its focus to business accounts to help entrepreneurs with their business finances.

So, today, Neat Commerce does not offer a personal account to individuals anymore, and to become a Neat Commerce customer, you are going to have a registered business.

On this note, Neat services are available to Hong Kong customers registered as limited companies, sole proprietorships, and partnerships. Other registered businesses are also eligible to open an account with Neat depending on their corporate form and place of registration, as follows: [ 3]

- Australia: Limited companies

- New Zealand: Limited companies

- British Virgin Islands: Limited companies

- Cayman Islands: Limited companies

Eligibility for an account is also subject to certain other restrictions that are often met in the banking industry:

- The nationality and place of residence of the directors, shareholders, and account users must be in certain countries only. And so, for example, any connection with sanctioned countries is prohibited. See below the full list of accepted countries and places of residence [ 4]

- The business must not fall within a list of prohibited industries that are not supported by Neat, including but not limited to ethnically or racially offensive material, illegal drugs, tobacco products, pornographic products or services, animals and livestock, counterfeit goods, weapons, ammunition or explosives, and gambling services - see below the full list of prohibited industries [ 5]

Finally, your monthly sales revenue must not be over USD 10 million. Anything more, and the Neat business account isn’t for you [ 6]

How to register for a Neat business account

Signing up for a Neat business account is completely online. This process should take around 15 minutes to do if you have organized your documents before starting the process. [ 7]

Here are the different steps to fill in the online application form for a Neat business account:[ 8]

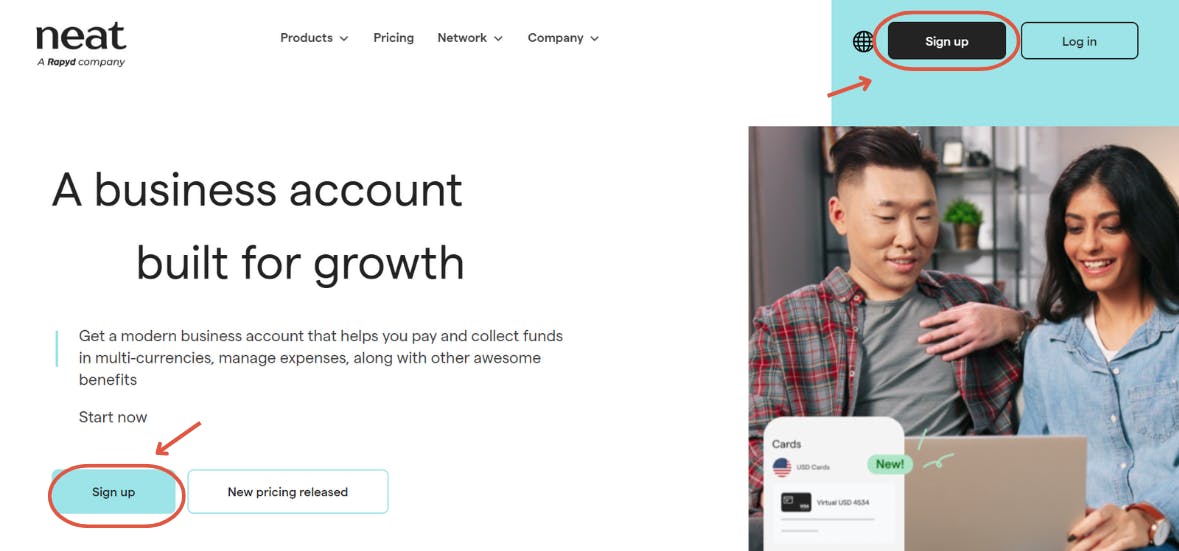

Go to the Neat home page and click “ Sign Up” (at the moment online applications cannot be made on Neat Mobile App)

Please pick “ Sign up for a Neat Account”

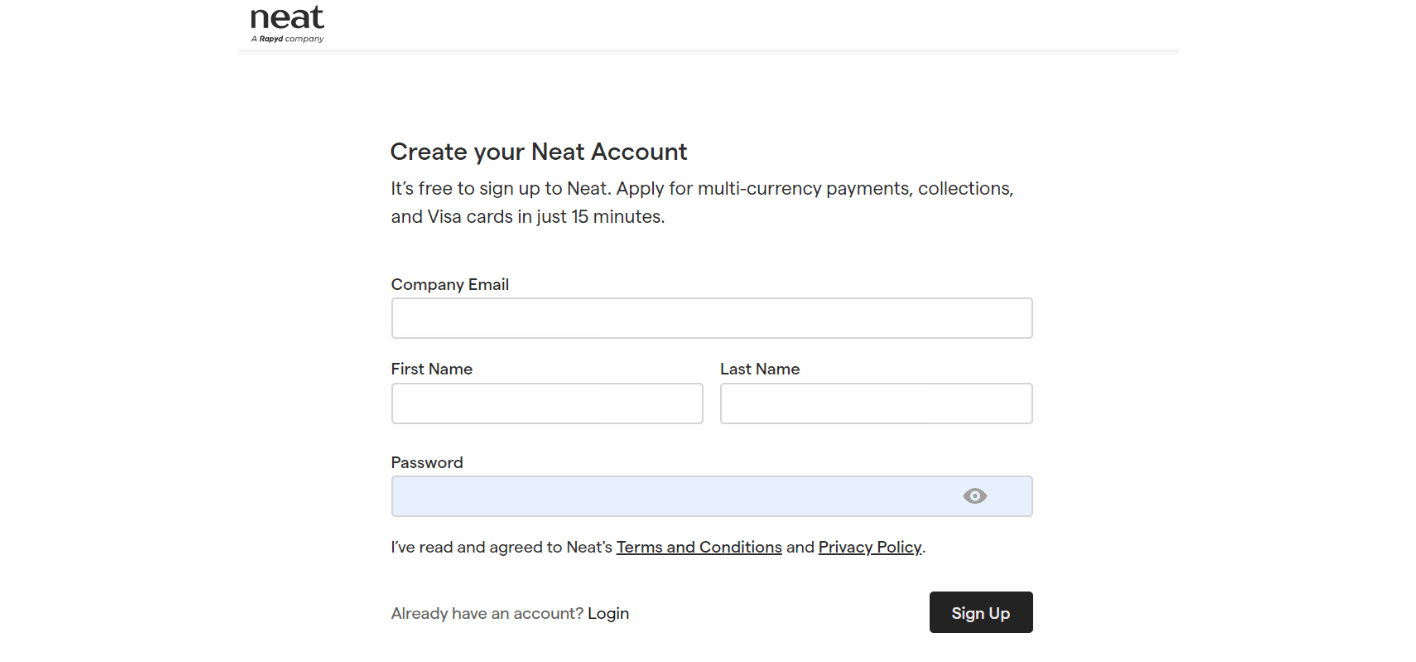

You will be asked for some basic information to create your account

Verify your email, and you will need to submit the information related to your business.

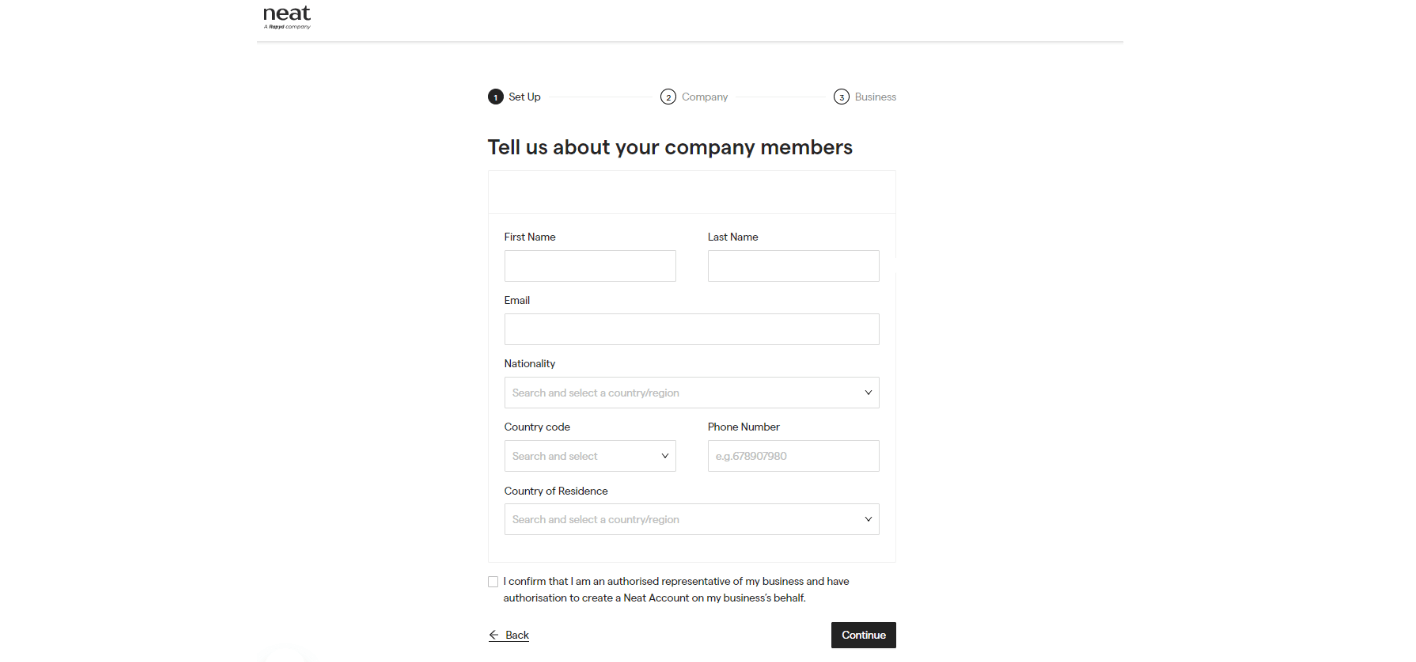

Complete your application in just a few steps.

- Company Information - Verify your company’s legal information

- Company Members - List all members of the company

- Your Business - Describe the nature of your business

Some required documents that you’ll need to submit in the course of the account opening process include [ 9]

- For companies registered in Hong Kong: valid business registration certificate issued by the Inland Revenue Department

- For companies not incorporated in Hong Kong: valid registration documents issued by the competent authorities of the country of incorporation

- For any the director(s), ultimate beneficial owner(s), and account user(s):

- Photo of an identity document (Hong Kong identity card is not accepted); and

- Selfie holding the identity document

Upon completion of the online application, Neat may follow up if their team needs further information to satisfy their due diligence. it usually takes one week for Neat to make its decision to approve or reject the account application.

Neat Products

Neat offers a variety of payment products to help Small and Medium Enterprises (SMEs) with their business finances.

Below we’ll introduce each of these products based on the information available as of the date this review is published. Products may change at a moment's notice, so always check the Neat website for up-to-date information.

1. Business Account

The Business Account is Neat’s core product. On their website, Neat also refers to it as the “Modern Business Account”, the “Smart Business Account” or the “Global Account”. They also use the terms “Neat Wallet” or “multi-currency wallet” to describe what they offer.

All this may be a bit confusing so let’s dig out and find what is under the hood.

What is clear is that the Business Account is not a traditional bank account (see our section “What is Neat?” above).

So, in practice, Neat has partnerships with different financial institutions (traditional banks but also other Fintech companies) to offer a series of business accounts, as detailed below [ 10], [ 11] & [ 12]. Please note that each of these business accounts has its account details.

A Multi-currency Business Account in Hong Kong

Neat refers to this business account as the “HKD Wallet” and the “USD Wallet”. Let’s call it the HK Business Account to simplify things. The characteristics of the HK Business Account are detailed below:

- The HK Business Account only supports two currencies: Hong Kong Dollars (HKD) and US Dollars (USD). In case a payment is made to the HK Business Account in a currency other than HKD or USD, the incoming funds are automatically converted into HKD

- The HK Business Account can be used to receive and make payments locally in Hong Kong and internationally. More specifically, payments from/to the countries listed in the footnote [ 4] below are accepted by the HK Business Account.

- Any currency exchange is made at spot rates. No information is available on how the spot rates are determined by Neat - i.e., the spread with the mid-market rate. You will have to ask for this information if you want to know the foreign exchange commission charged by Neat.

A EURO IBAN Account

Neat refers to this business account as the “EUR Wallet”. The characteristics of the EURO IBAN Account are detailed below:

- The EURO IBAN Account can be used to receive and make payments in EURO only

- The payments to/out of the EURO IBAN Account shall come from/be made to countries in the SEPA zone only. The SEPA zone includes all 27 EU countries, Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Iceland, Liechtenstein, Norway, Poland, Romania, Sweden, Switzerland, United Kingdom, Guernsey, Jersey, and the Isle of Man.

- SWIFT payments, even in EURO, are not supported by the EURO IBAN Account.

A GBP IBAN Account

Neat refers to this business account as the “GBP Wallet”. The characteristics of the GBP IBAN Account are detailed below:

- The GBP IBAN Account can be used to receive and make payments in GBP only

- The payments to/out of the GBP IBAN Account shall come from/be made to countries in the SEPA zone only. The SEPA zone includes all 27 EU countries, plus Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Iceland, Liechtenstein, Norway, Poland, Romania, Sweden, Switzerland, United Kingdom, Guernsey, Jersey, and the Isle of Man.

- SWIFT payments, even in GBP, are not supported by the GBP IBAN Account.

Specific restrictions in the use of the Business Account [13]&[14]

- Monthly incoming limit: Neat sets a maximum amount you can receive in your Neat business account per calendar month

- Total balance limit: Neat sets a maximum amount you can have in your Neat business account at any time

- Funds holding: your Neat business account can not be used to store funds - meaning that incoming payments s hould be moved in no longer than 90 days to other accounts.

2. Corporate Card

Neat offers Visa cards – branded as The Smart Corporate Card.

Only the corporate clients holding a Business Account with Neat can have access to the corporate Visa cards.[ 15] In practice, the Neat corporate cards can be issued to the following individuals:[ 16]

- Any account user - i.e., any person with authority to access and use the Business Account on behalf of the corporate client; and

- Any person invited by an account user.

The main features of the Neat corporate cards include [ 17], [ 18], [ 19] & [ 20]

- Both virtual and physical cards are available

- The base currency for the cards is either HKD or USD - up to the client to select the currency at the time they apply for the Neat card

- Each cardholder can have access to multiple Neat virtual cards and physical cards

- The Neat card can be used everywhere Visa is accepted globally, with 1% cash-back on all vendor payments

- The Neat card supports Alipay but does not yet support Google or Apple Pay.

The Neat cards also come with built-in controls and limits that can help your business to monitor your finances, such as instant card freezing, real-time expense tracking, and monthly spending limits.

Finally, the Neat corporate cards are linked to the client's Business Account, so card repayments are settled automatically from the funds available in the account balance. This means that the maximum card spending limit is determined by the balance in the Business Account. [ 21]

Fees charged by Neat

There is currently no fee for opening a Neat Business Account or receiving the Visa Corporate Cards associated with it. Instead, Neat generates its revenue by charging transaction fees for payments and foreign exchange commissions for currency conversion.

Note, Neat may update the pricing set out below at any time - see the Neat website to check current prices.[ 22] & [ 23]

[Update: 19/1/2023] Following an email announcement to Neat users in December 2022, starting in April 2023, Neat will introduce a monthly fee of $99 USD per month to maintain their business accounts.

|

Payments |

|

|

Receive local payments |

$0 |

|

The pricing applicable to incoming local payments include:

|

|

|

Send local payments |

$0 |

|

The pricing applicable to outgoing local payments include:

|

|

|

Send CHATS payments in Hong Kong |

USD5 or HKD38 |

|

The pricing applicable to outgoing CHATS payments in Hong Kong include:

|

|

|

Receive international payments (SWIFT) |

$0 |

|

The pricing regarding incoming international payments (SWIFT) applies to payments in any currency from an account outside of Hong Kong to the HK Business Account (As a reminder the EURO IBAN Account and the GBP IBAN Account cannot be used to receive international payments) |

|

|

Send international payments (SWIFT) |

USD $5 or HK $38 per transaction |

|

The pricing regarding incoming international payments (SWIFT) applies to payments in any currency from an account outside of Hong Kong to the HK Business Account (As a reminder the EURO IBAN Account and the GBP IBAN Account cannot be used to receive international payments) |

|

|

Foreign Exchange |

Spot Rate |

|

No information is provided on how the spot rates are determined by Neat - i.e., the spread with the mid-market rate - and so how much is actually charged by Neat for currency conversion |

|

|

Cards |

|

|

Card Transactions in the same currency as the card base currency (for example, using the Neat corporate HKD card for a transaction in HKD) |

Free |

|

Card Transactions in a currency different than the card base currency (for example, using the Neat corporate HKD card for a transaction in EUR) |

FX fee based on Visa exchange rate + 1.5% (foreign merchant fees) |

Getting in Touch with Neat

If you need to contact a representative of Neat, you can call, email, or message through WhatsApp and WeChat. More specific contact details can be found on Neat's contact us page.

On the Neat website, you can also access live chat support as soon as you open the page. Once you have an account, you can access instant customer support directly through the Neat dashboard. [ 24]

Best Alternatives to Neat business account

Choosing the right business payment solution is crucial. It creates a strong foundation for your business.

The key to understanding the similarities between Neat and other business accounts depends heavily on your business needs.

Let's look at some alternative platforms that offer similar products and features compared to Neat.

AirWallex

Similar to Neat, AirWallex does not offer individual accounts. But with its business account, AirWallex provides both physical and virtual payment cards among its competitive fees.

- If you trade globally, AirWallex may be the viable choice for your business, as it allows you to track, control, and manage your business expenses at a large scale.

- AirWallex's Direct Billing gives you the ability to make or receive payments of the same currency, where your account will debit the transaction directly into the wallet.

If you're looking to explore business account options for your business, check out our step-by-step guide on how to open an AirWallex account.

Currenxie

If your business operates in several countries, where there are requirements for managing multiple currencies, Currenxie may be one of the options for you to consider.

- The business account supports up to 20 currencies, with primary choices in HKD, EUR, USD, and RMB.

- This alternative also offers payment support for marketplaces, including PayPal, Stripe, Amazon, Shopify, and more.

- Excellent for domestic account setup, and you can get it within 3 business days with Currenxie.

Read our review of Currenxie to understand whether this is the choice that fits your business goals.

Still not sure which one to choose? Explore how Neat is compared to the Statrys business account.

Neat vs Statrys

The best way to understand where a product stands within its market is to compare it to something similar.

So let’s now make some comparisons.

Another option on the market is Statrys and you may wonder which of Stayrys or Neat is the best fit for your business. Actually, there is no clear-cut answer to this question because it really depends on the specific needs of your business.

However, in the process of making your choice, you should always consider at least the following three areas to take a good decision:

Products offering

Neat and Statrys offer very similar products. Some similarities include:

- A multi-currency business account in Hong Kong

- A payment card

- FX services

As you can tell, when it comes to choosing between Statrys and Neat, you are going to have to dig a little deeper to determine your better option.

Let’s give some example comparisons of why one could be a better choice over the other.

- If you have a limited company in Australia or New Zealand, then go with Neat works as you can open a Neat Smart Business account from either of these countries as long as your company fits within their eligibility requirements. Statrys does not offer this possibility.

- If your business is receiving/making international payments in 1 of these nine currencies - EUR, GBP, SGD, CNY, JPY, CAD, AUD, NZD, CHF - then choosing the Statrys multi-currency business account makes more sense. The Neat multi-currency business account does not indeed support any of these nine currencies.

Another example is the limits set for the use of the account: the Neat Business Account is subject to a monthly incoming limit and total balance limit. Those limits do not exist for the Statrys business account

Pricing

The costs of opening the account, maintaining the account, and of course, the cost of transfers will all play an influencing role in which business account is best for you.

In practice, you will have to consider in detail which type of payments are sent or received by your business. Then only, you may identify which of Statrys or Neat may help your business to save costs.

Let’s take another example:

- Statrys charges a monthly fee of HKD 60 for incoming international payments. Neat does not charge any fee for these payments, so Statrys is more expensive on this front.

- Currency exchange conversions with Neat are based on spot rates. Statrys provides advanced FX services based on mid-market rates. So, if your business requires dealing in multiple currencies, Statrys will likely be a cheaper option.

Customer Support

If prompt customer support is important for you, then Statrys should be your preferred solution:

- Statrys is the only Fintech that allocates each client a dedicated account manager

- Your account manager can be reached by email, phone, WhatsApp, WeChat, and Chatbox

- Response time is in minutes. Unheard of from many other financial institutions

We encourage you to check the Trust Pilot reviews left by our clients if you still have doubts that first-in-class customer support makes a difference.

To talk with a customer representative about setting up a Statrys business account, get in touch today

Final Note

Is anything missing in this Neat review? We want to hear it! Drop us a message and we will do our best to make the review even more comprehensive.

Review based on information available on Neat website as of January 2023

FAQs

Is Neat legit?

Although Neat provides business accounts, it's not a bank. In order to offer their services in accordance with applicable regulations, they hold various registrations, licenses, and authorizations with the relevant authorities in Hong Kong and in the UK.

What is Neat Account?

Is Neat safe?

What are the fees for a Neat Business Account?

Sources

Disclaimer

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from Statrys Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date. Neat and the Neat logo are trademarks of Neat Limited, registered in the Hong Kong SAR China and other countries and regions. Rapyd and the Rapyd logo are trademarks of Rapyd Financial Network Limited, registered in the United Kingdom and other countries and regions.