Statrys is taking a significant leap forward with the introduction of 'SWIFT Payment Tracking.' This innovative feature, built on the robust framework of SWIFT gpi (Global Payments Innovation), is designed to address the unique challenges our customers face in managing cross-border payments.

What is SWIFT gpi and How Does Statrys Enhance It?

While SWIFT gpi itself revolutionized international payments with its launch in 2017, Statrys' 'SWIFT Payment Tracking' takes this innovation a step further. We've tailored SWIFT gpi's capabilities to suit the specific needs of our customers, focusing on real-time transaction visibility, streamlined financial operations, and digitized proof of payment.

![]()

Key Features of SWIFT Payment Tracking for Statrys Customers:

- Real-Time Transaction Visibility: Track your incoming and outgoing payments, giving you a comprehensive view of your financial operations.

- Streamlined Financial Operations: Our feature enhances your ability to forecast and manage cash flows, mitigating uncertainties often associated with international transactions.

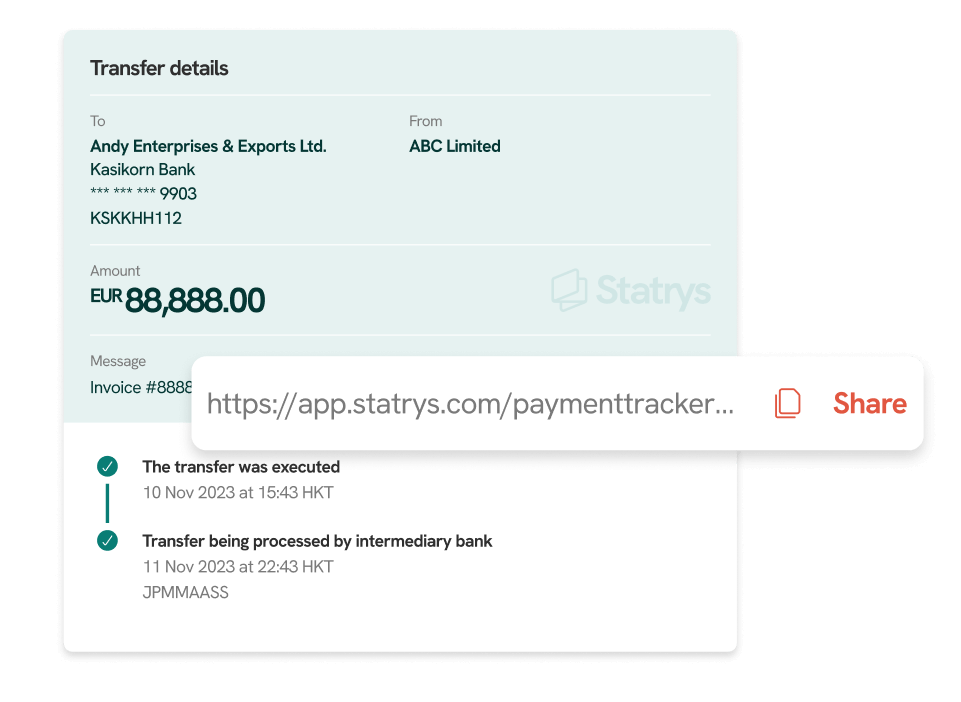

- Digitized Proof of Payment and Shared Tracking: A novel aspect of our service is allowing clients to share a tracking link for outgoing payments, enhancing transparency and simplifying international transactions.

Benefits for Global Businesses:

- Enhanced Efficiency: Know exactly where your funds are and when they will arrive, which is crucial for businesses operating on tight margins or with complex logistics.

- Empowered Decision-Making: Real-time insights provided by the feature enable more informed and proactive financial planning.

- Ease of Use: Integrated seamlessly into the Statrys platform, the feature is user-friendly and accessible.

Statrys' Payment Link Sharing Function

One of the most distinctive functions is its innovative shareable tracking link, offered through the 'SWIFT Payment Tracking' system. It allows customers to provide their payees with real-time, transparent updates on transaction status.

It simplifies cross-border transactions by reducing the need for manual communication and fosters trust in global business relationships.

For detailed guidance on utilizing the full potential of SWIFT Payment Tracking, be sure to visit our FAQ section.

FAQs

How does 'SWIFT Payment Tracking' enhance traditional SWIFT transactions?

It provides real-time tracking and greater transparency, tailored to the needs of Statrys customers.