Key Takeaways

A past due invoice is an invoice with an unpaid outstanding amount past its due date.

35% of invoices are paid more than 30 days past due. Keeping track of outstanding invoices with automated invoicing software prevents invoices from going overdue.

The effective way to handle past due invoices is to send reminder emails that include the invoice number, total amount due, and clarification of payment terms and late fees.

Getting invoices paid on time is crucial for businesses to maintain a healthy cash flow and a smooth operation.

Unfortunately, according to statistics, 35% of invoices are paid way past the due date. Chasing past due payments is an unpleasant task, so knowing the most effective way to get paid as soon as possible and avoid spending unnecessary extra time and costs is important.

In this article, we will explain what a past due invoice is, when an invoice is considered past due, and how to handle it professionally. We also gather the common reasons for late payments and tips to get paid on time so that you can avoid past due invoices in the first place.

What Is a Past Due Invoice?

When the seller creates an invoice, they will include a due date by which the client has to pay the outstanding amount. For instance, a net 30 payment term indicates that the client has to pay the invoice in 30 days from the invoice date of issue.

When the customer fails to pay the outstanding balance on time, the invoice is referred to as a past due or overdue invoice.

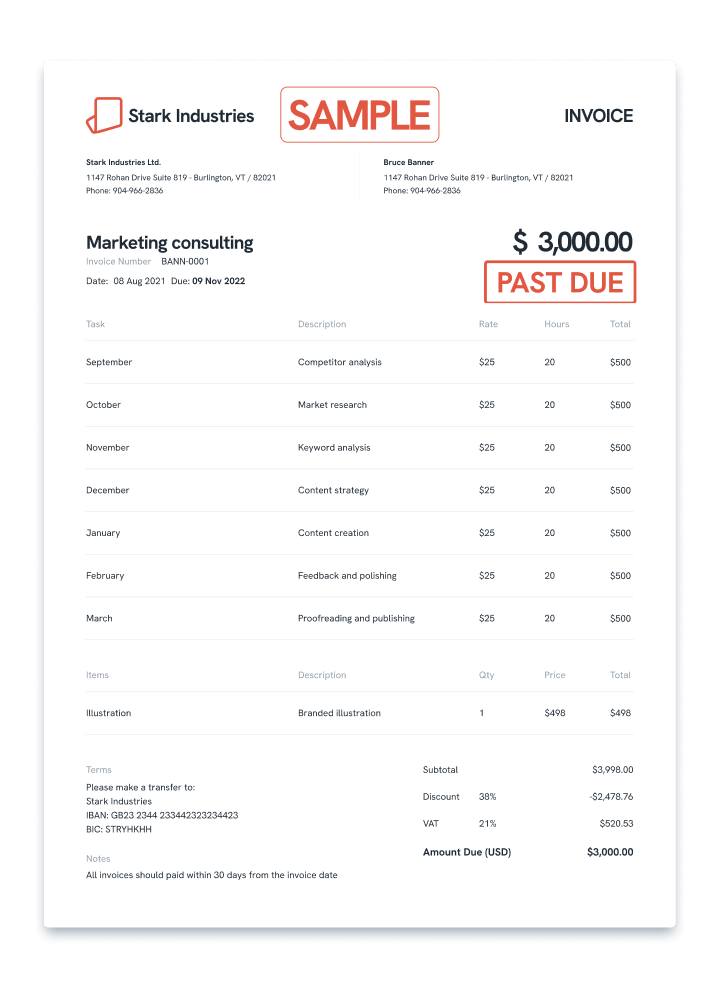

If the due date has passed, but the outstanding invoice amount remains unpaid, the seller may send a copy of the original invoice stamped with “overdue” or “past due” to notify the clients of the overdue payments. For example:

What Is the Difference Between Past Due vs Outstanding Invoices?

An outstanding invoice is an invoice that is received and waiting to be paid by the client. Fundamentally, every invoice is outstanding before the client pays, which could be within the payment period.

On the other hand, an invoice becomes past due once the due date already passed, but the client still has not yet made the outstanding payment.

💡 Tip: Typically, a past due invoice refers to invoices that are slightly past the due date. If the delay exceeds 30 days, it is commonly referred to as an overdue invoice. However, these terms can be used interchangeably.

While both refer to unpaid invoices, outstanding and past due invoices are at different stages. An outstanding invoice is one that has been issued but is not yet due; it's within the agreed payment terms. On the other hand, a past due invoice has exceeded those terms and is now overdue.

Can you explain what a past due invoice is?

Certainly. A past due invoice is a bill that has not been paid by the due date specified on the invoice. This means the payment is late, and the invoice is now overdue. This often triggers late fees or interest charges.

What are the consequences for a past due invoice?

How can businesses handle past due invoices professionally?

Are there any best practices to prevent past due invoices?

Are there any operational challenges caused by past due invoices?

Can you explain what a past due invoice is?

Certainly. A past due invoice is a bill that has not been paid by the due date specified on the invoice. This means the payment is late, and the invoice is now overdue. This often triggers late fees or interest charges.

What are the consequences for a past due invoice?

How can businesses handle past due invoices professionally?

Are there any best practices to prevent past due invoices?

Are there any operational challenges caused by past due invoices?

Can you explain what a past due invoice is?

Certainly. A past due invoice is a bill that has not been paid by the due date specified on the invoice. This means the payment is late, and the invoice is now overdue. This often triggers late fees or interest charges.

What are the consequences for a past due invoice?

How can businesses handle past due invoices professionally?

Are there any best practices to prevent past due invoices?

Are there any operational challenges caused by past due invoices?

Can you explain what a past due invoice is?

Certainly. A past due invoice is a bill that has not been paid by the due date specified on the invoice. This means the payment is late, and the invoice is now overdue. This often triggers late fees or interest charges.

What are the consequences for a past due invoice?

How can businesses handle past due invoices professionally?

Are there any best practices to prevent past due invoices?

Are there any operational challenges caused by past due invoices?

Can you explain what a past due invoice is?

Certainly. A past due invoice is a bill that has not been paid by the due date specified on the invoice. This means the payment is late, and the invoice is now overdue. This often triggers late fees or interest charges.

What are the consequences for a past due invoice?

How can businesses handle past due invoices professionally?

Are there any best practices to prevent past due invoices?

Are there any operational challenges caused by past due invoices?

When Is an Invoice Past Due?

An invoice is past due when the outstanding balance is not paid past the due date. For example, if the invoice is payable within 30 days and is issued on 10/11/23, it is past due on 11/12/23.

If the payment due date is not specified on the invoice, it is normally a net 30, meaning that the client needs to pay the net amount within 30 days from the invoice issuing date. However, the seller should always include the payment due date in the invoice as a precautionary measure.

💡 Tip: It is best to spell out the date when making an invoice for international clients, as some countries use a different date format.

How Long Can an Invoice Be Past Due?

An invoice can remain past due or overdue until the client makes the outstanding payments.

The period during which the seller can legally chase an unpaid invoice varies by country. In the US, for example, the statute of limitations for debt collection, including past due invoices, is 3-6 years or longer, depending on the state.

How to Handle Past Due Invoices?

The most common but effective way to handle past due invoices is by sending reminder emails to the clients. A polite email reminder at appropriate times allows you to collect past due payments while keeping business connections with the right clients.

However, if the client refuses to pay for an extended period of time, you may have to take legal action.

Here’s how to handle past due invoices professionally.

Send Past Due Invoice Emails

Before sending a past due invoice email, make sure that the client has received the invoice in the first place. After sending the original invoice email, you can send a follow-up email after 2-3 days to confirm that the client has received the invoice.

When writing a past due invoice email, you should repeat and clarify all the essential payment details that the client may have missed.

Follow these steps when writing a reminder email:

- Quote the invoice number in the subject: Your intention should be clear, and quote the invoice number for easy identification. For example, Payment Required: Outstanding Invoice #INV-001 Is Past Due.

- Include a polite and friendly opening: Although it is frustrating to request payment past the due date, it is important that you keep your tone professional when writing a past due invoice email to avoid disputes. You should also refer to the purchase that they have made.

- Refer to the total amount due: Remind the client of the remaining outstanding amount they need to pay.

- Refer to the due date: Inform the client when the invoice is due, and clearly state the adjusted or extended due date by which you require the payment.

- Explain payment options: Describe the available payment methods that the client can use. It is also useful to provide multiple payment options so the client can pay immediately in the most convenient way.

- Clarify your late fee policy: Inform the client if you are charging late payment fees. However, you must also state in the original invoice that you have a policy for late payments.

- Attach a copy of the past due invoice: Include an overdue invoice as an attachment as a reference.

💡 Tip: Always quote the invoice number when contacting the client to ensure that you are referring to the correct invoice.

Let’s look at some examples of past due invoice email templates that you can use to chase unpaid invoices.

Example 1: Recent Due Date

After 1-3 days past the due date, you can send a payment reminder email to the client. At this point, you should keep a calm and friendly tone as the payment may be delayed due to other factors.

Subject: [Company name]: [Invoice number] Past Due

Hi [Client name],

I hope you are doing well and satisfied with [product or service]! I’m sending this email as a friendly reminder that the invoice [invoice number] sent on [date] for the amount of [payment amount] was due on [date]. I have attached a copy of the invoice for your convenience.

If you have already made a payment, please disregard this email and notify me. If you have not, I would appreciate it if you could send the outstanding payment [explain payment method] as soon as possible. I’m happy to help if you are facing any inconveniences.

Thanks!

[Your name or company name]

Example 2: More Than Two Weeks Overdue

If there is no response from the client in two weeks, call them or send another more straightforward and urgent email. You should also clarify and highlight your policy for late payments.

Subject: [Company name]: [Invoice number] Past Due

Dear [Client name],

I’m sending this email as our records show that you have an outstanding balance of [payment amount] for invoice [invoice number] that has not been settled. This payment was due on [date], and it is now overdue for [number of days]. Please find the attached past due invoice for your reference.

As stated in the original invoice, which was sent on [date], I will be [explain your late payment policy]. For your convenience, here are the updated total amount due and payment options:

[Explain payment options]

If you have any further questions about the payment or any problems I can assist, please do not hesitate to reach out.

Best regards,

[Your name or company name]

Example 3: Final Notice

If the client has missed the payment due dates by 30 days or longer, it is time to take the next step. You can send a firm email with a professional tone explaining your next process to handle this past due invoice.

Subject: [Company name]: [Invoice number] Past Due

Dear [Client name],

This email is to notify you that the outstanding payment for invoice [invoice number] due on [date] has still not yet been received. It is now [number of days] past due and requires immediate payment. The total balance, including late payment fees, is [payment amount]. You can make the payment [explain payment options].

As I have attempted to contact you multiple times regarding this issue, please be aware that your account will be referred to a collection agency if the full payment is not received by [date].

Best regards,

[Your name or company name]

Take Legal Action If the Client Refuses to Pay

If you have been following up on the past due payment for more than 60 days, but the invoice remains outstanding, you may have to take legal action.

To do so, you should first evaluate if the unpaid balance is worth the extra time and money to resolve the issue. You may seek professional advice before proceeding with this approach.

Here are 4 ways to handle unpaid invoices that are long past due:

- Contact a collection agency: Before taking legal action, you can hire a debt collection agency to collect the outstanding balance.

- Contact an arbitrator: You can settle the issue by arbitration without having to take it to court.

- Settle it in small claims court: If the invoice isn’t charging for a large amount of money, you may settle it in small claims court.

- File a lawsuit: If the client owes you a huge amount of money, you may file a civil lawsuit. However, this approach might take time and can be costly.

Why Do Customers Pay Late?

Handling outstanding invoices when they are past due can be stressful and unhealthy for business owners and operations, which is why you may want to get the outstanding amount paid before the due date.

Here are some common reasons why customers pay late and tips you can apply to reduce past due invoices.

Unclear Payment Instructions

More than 60% of delayed payments are results of invoice errors, particularly unclear payment terms.

To avoid overdue payments, ensure that the instructions are straightforward and legible. If you request online payments or wire transfers, review that the account details and the SWIFT/BIC code are correct, especially if you offer multiple payment methods and sell internationally.

Including specific payment due dates is also recommended. Specify the date by which the customer has to pay and highlight the penalties for late payments. You can also include early payment discounts to encourage early payments.

They Did Not Receive the Invoice

When sending invoices only by email, there is a chance that they will be lost in the customer’s inbox. In fact, 11% of clients report never receiving the expected invoice.

Using dedicated invoicing software that helps you create and send invoices to your customers through email and other messaging platforms is an effective way to manage your invoices.

Additionally, you should also schedule follow-up emails or phone calls to confirm that the customer received the invoice and is processing the payment. It also ensures that you have communicated with the client and can resolve problems before the payment end date.

They Have Insufficient Funds

Sometimes, the customer fails to pay because they have insufficient funds as a result of poor cash flow management. To ease this issue, you can offer an installment plan where the customer can pay a portion of the total cost for a certain period.

It is also ideal to send the invoice as soon as possible and ahead of the due date to allow the customer to plan and manage their cash flow accordingly.

They Forgot to Pay

Another common reason for past due payments is simply that the customer forgot to pay.

To prevent this from happening, or if you have a client who regularly forgets to pay, try sending a follow-up email 1-3 days after sending the invoice to make sure they receive it. Then, send a payment reminder again 7-10 days before the invoice due date. If they do not reply to emails, you may also give them a friendly call.

Bottom Line

For business owners, timely invoice payments are essential to maintain healthy business operations. Having to deal with constant past due invoices causes stress and puts your business in challenging financial situations.

Although there are effective ways to chase overdue payments, it is best to prevent invoices from going past due in the first place.

Instead of spending extra time and cost to handle past due invoices manually, use invoice software to streamline your invoicing process. With Statrys invoicing software, you can easily create and send invoices, as well as track outstanding balances and get them paid before it is too late.

FAQs

What is the difference between a past due and an overdue invoice?

Both past due and overdue invoices are invoices that are not paid on time. However, “past due” suggests that the due date has just recently passed, while “overdue” suggests that the invoice was not paid for a long time past the due date.