Company Registration

8 Steps to Register a Company in Hong Kong Online [2025]

Hong Kong is one of the easiest places in the world to start a business, especially when you know the steps to take.

Having helped hundreds of entrepreneurs and business owners successfully incorporate their companies in Hong Kong, I’ve seen how easy it is to get caught up in the paperwork and local requirements. Without the right guidance, these processes can quickly eat up valuable time, time that’s better spent building your business.

This is why I put together this step-by-step guide to give you a clear, practical roadmap. It covers everything you need from the first step all the way to post-incorporation, including documents, costs, timelines, and even tax exemptions.

Content

What You Need to Start a Company in Hong Kong (For Locals and Foreigners)

100% Foreign Ownership Possible: Non-residents can establish a local limited company in Hong Kong. There is no specific restriction on foreign investment, which means 100% foreign ownership is possible. There is also no requirement for a local director.

Same Rules for Foreigners and Locals

The process to set up a company is the same for both residents and non-residents. Here’s what you need:

- Appointing at least one director and one shareholder, both of whom can be of any nationality and can be the same person.

- Every company must appoint a company secretary who is a Hong Kong resident or a licensed Hong Kong Trust and Corporate Service Provider (TCSP)

- Every company must have a physical address in Hong Kong.

- At least HKD 1 for share capital

8 Steps to Register a Company in Hong Kong - A Quick Summary

Here's a quick overview of the 8 essential steps you’ll need to follow:

, as this can affect how you set up.

Most choose a Private Limited Company (Ltd.) for its liability protection and flexibility.

by appointing at least one director and shareholder, and deciding on share capital.

Choose a company name that follows Hong Kong rules and isn’t already taken or trademarked.

who is a Hong Kong resident to handle compliance tasks.

Get a registered address in Hong Kong. PO Boxes aren’t allowed.

Prepare documents like ID, proof of address, Articles of Association, and the incorporation form.

Submit your application online through the Companies Registry, upload your documents, and pay the fee.

Approval typically takes 1–5 business days. Once approved, you’ll receive a Certificate of Incorporation and Business Registration Certificate, enabling you to officially start operating in Hong Kong.

Let’s break down each step in detail.

Step 1. Check If You Need a Business License

Depending on the industry and the nature of your business, a business licence may be required. You can apply for the licence after your company has been successfully incorporated with the Company Registry, but it is advisable to explore which business licences you may need before incorporating your company, as some licences have specific requirements that may influence how you plan for the incorporation process. For instance, if you operate a travel agency, the company’s paid-up share capital must be at least HKD 500,000.

Common industries that require business licences in Hong Kong include:

Employment Agencies

Travel Agencies

Educational Institutions

Agricultural Drugs

Cosmetics and Medicines

Restaurants and Food Services

Retail Businesses Involving Import and Export

Trading Companies

Professional Services, such as Accounting or Legal Services

Electrical Equipment and Machinery

You can browse the full list of business types that require a licence using the Hong Kong Business Licence Information Service page.

Step 2. Define Your Type of Companies in Hong Kong

In Hong Kong, companies are usually incorporated as private limited companies (Ltd.), which offer limited liability protection to shareholders.

Here are the common types of companies under the Companies Ordinance in Hong Kong:

Private Limited Company (Ltd.)

Also known as private companies limited by shares, this type of entity allows up to 50 shareholders. Shareholders' liability is limited to the amount they have invested.

Private Unlimited Company

In this structure, shareholders have unlimited liability, meaning they are jointly and severally liable for the company’s debts.

Public Limited Company (PLC)

Also known as public companies limited by shares. It is listed on the Hong Kong Stock Exchange, allow public trading of shares through stocks or bonds.

Public Unlimited Company

Members of this company type have unlimited liability for the company's debts. It is often used by professional organisations to facilitate the return of capital to shareholders.

Company Limited by Guarantee

Typically used by non-profit organisations, this structure does not involve share capital.

This guide focuses on companies limited by shares, one of the most common types of companies many business owners establish in Hong Kong.

For other business entities in Hong Kong, such as sole proprietorships, partnerships, branch offices, and representative offices, refer to our guide below:

Step 3. Define Your Company Structure

To establish a limited company in Hong Kong, you need to appoint at least one director and one shareholder.

Here are the key requirements:

Directors in Hong Kong

- Minimum Requirement: At least one director is necessary to form a limited company in Hong Kong. There is no limit to the number of directors that can be nominated. Directors must be at least 18 years old.

- Who Can Be a Director: Both natural persons and corporate entities can act as directors. If a private company is not part of a larger group that includes a listed (publicly traded) company, it can have a corporate body (eg. another company) as a director. However, at least one director must be a natural person.

- Nationality: There are no restrictions on the nationality of directors; individuals from any country can serve as a director in a Hong Kong company.

Shareholders in Hong Kong

- Minimum Requirement: At least one shareholder is necessary to form a limited company in Hong Kong. Shareholders must be at least 18 years old.

- Who Can Be a Director: Shareholders can be either individuals or corporate entities.

- Nationality: There are no nationality or residency restrictions.

Tip: A single individual can fulfil both roles of director and shareholder, as long as at least one director is a natural person (not a company or organisation).

Set the amount of share capital

There are no minimum or maximum share capital requirements in Hong Kong, except for certain regulated industries, such as finance.

The minimum share capital can be as low as HKD 1 or its equivalent in any currency. Additionally, there is no requirement to deposit this capital into a company bank account. However, bearer shares are not allowed.

Step 4. Choose and Verify Your Company Name

Selecting an appropriate Hong Kong company name and checking its availability is an important step that can save you a lot of time. This is because if the name isn’t suitable, your application could be rejected, meaning you’ll have to start the process all over again. The lodgement fee is also non-refundable.

Here is some guidance on Hong Kong company name:

|

Abbreviations, spaces, punctuation, articles, and capital letters are treated as the same. For example, "Hong Kong," "Hongkong," and "HK" are equivalent, as are "and" and "&." "The ABC Limited" is the same as "ABC Limited”, "A-B-C Limited" and "a b c Limited."

Grammatical variations also do not make a name unique. Words like “trade” and “trading” are treated as the same, and simply adding an “s” or “es” (such as “solution” vs. “solutions”) does not make the name different.

Cultural and Linguistic Considerations: It is advisable to consider the meaning and pronunciation in Cantonese, as some terms may carry offensive or inappropriate connotations. For instance, "PK" can be a euphemism for "puk gai" (踣街 or 仆街; pūk gāai), which is a curse word in Chinese. Names deemed offensive or culturally inappropriate will be rejected by the Companies Registry.

To check if your chosen name is available:

- Search for company names for free using the Companies Registry’s e-Search services.

- Use the public online search system provided by the Hong Kong government to check the Trademark Register.

I recommend checking name availability right before filling out the registration application, as names cannot be reserved and their availability may change rapidly from one day to another. It’s a good idea to prepare three backup name options in case your first choice is taken.

Words that require permission before usage:

The company name must not suggest affiliation with the government unless there is a legitimate connection, permission has been obtained, and proof is provided. Additionally, certain restrictive words are prohibited unless the Hong Kong Companies Registry grants special permission. These words include but are not limited to:

For guidance on creating a suitable name, please refer to our guide on the dos and don'ts of Hong Kong company names and insights into naming trends in Hong Kong.

Step 5. Appoint a Company Secretary

In Hong Kong, every company is legally required to have a local company secretary.

Who can be a company secretary in Hong Kong?

- A natural person who is a Hong Kong resident and ordinarily resides in Hong Kong.

- A corporation with a registered office or place of business in Hong Kong that is licensed as a Trust and Corporate Service Provider (TCSP). You can check if a provider is licensed as a TCSP using this TCSP Registry.

- If a company has multiple directors, one of its directors can serve as its company secretary.

- If there’s only one director in a company, that person cannot also be the company secretary.

- A company with one director cannot appoint another company as its secretary if both companies share the same sole director. In other words, the company secretary cannot already be serving as a director of another company.

What do company secretaries do?

- Liaise with government agencies like the Inland Revenue Department and Companies Registry.

- Ensure compliance with local laws and the Hong Kong Companies Ordinance, including maintaining statutory books, submitting annual returns, filing financial statements on time, and more.

- Manage share allocations and transfers.

- Organise board meetings, prepare minutes, and draft resolutions.

Typically, a company secretary in Hong Kong is hired year by year. You can change your company secretary if you want to. To do so, your company must hold a board resolution to appoint the new secretary, and then notify the Companies Registry by submitting Form ND2A.

There are no legal restrictions on changing the company secretary in Hong Kong, provided that the company always maintains a valid appointment for the position.

Step 6. Get a Registered Address in Hong Kong

Every Hong Kong company is required to have a registered business address located in Hong Kong.

This registered office address must be a physical location where government notices and legal documents can be delivered, and where your company secretary can access these documents. The purpose is for your company secretary to receive, keep, sign, or stamp these important documents before returning them to the relevant government authorities. PO boxes are not permitted.

How to get a registered address in Hong Kong

If you have a local address in Hong Kong, you may use it as your registered business address. If you're based outside Hong Kong, setting one up can be more challenging. In that case, you have two main options:

1. Use a service provider

You can use a service provider that offers registered address services, along with mail scanning or forwarding. For example, Statrys provides a comprehensive company registration service that includes a company secretary, a registered address, and mail scanning and forwarding services. This ensures that your legal documents are securely handled and not lost.

2. Rent an office in Hong Kong

Alternatively, you can rent an office space in Hong Kong. Common options are private offices, virtual offices, or coworking spaces, each with its own unique advantages and disadvantages.

Let’s take a look at each option:

- Private Office Space: This option provides a dedicated, private area, but it comes with limited space at a high cost, largely due to Hong Kong's expensive real estate market, driven by high demand and limited supply.

- Virtual Office: Typically more affordable than private office space, a virtual office address can be used as a registered address if it meets certain requirements—such as being a physical address that can receive mail rather than a P.O. box. However, not all businesses in Hong Kong can operate from a virtual address; for instance, food-related businesses are not permitted to use a virtual office as their registered address.

- Coworking Space: Coworking spaces provide a shared office environment and can be a great alternative for startups and small businesses. However, they charge monthly fees and may impose restrictions on document handling, which can affect their suitability as a registered business address because important mail like tax notices or legal documents might be delayed, missed, or refused. Like virtual offices, certain businesses cannot operate from coworking spaces.

Step 7. Prepare the Document

Below are the essential documents required for incorporating a company:

- Directors, Shareholders, and Company Secretary Identification Documents: Hong Kong ID cards (HKID), People's Republic of China identity cards or passports certified by a CPA, a notary public or solicitor in Hong Kong, a licensed trust or company service provider, or a consular officer.

- Proof of Address: Documentation confirming the residential addresses of directors and shareholders. Proof of address accepted by the Hong Kong Company Registry includes utility bills from water, electricity, gas, or mobile phone service providers. The document must be issued within the last three months prior to the incorporation application date.

- Articles of Association: This legal document outlines a company’s rules and structure. It includes details such as the company’s purpose, member liability, initial capital and shares, member regulations, and general meeting details. You can use a sample of Model Articles or customise them to fit your needs. The document must be clearly organised with numbered paragraphs.

- Incorporation Form: These documents, obtainable from the government website, is an application form that requires you to provide details about the nature of the business, a registered company address, share capital, initial shareholdings, and information about the directors.

- NNC1 Form: Required for companies limited by shares.

- NNC1G Form: Required for companies not limited by shares.

- IRBR1 form: A notice to the Business Registration Office, mandatory for all types of companies.

For online applications, simply enter the required details directly into the e-registry portal, and then the NNC1, NNC1G, and IRBR1 forms will be auto-generated. You only need to prepare the identification documents, proof of address, and Articles of Association.

Step 8. Fill Out the Online Application

Once everything is in order, you can start the incorporation process. A limited private company can complete the process entirely online, except when the corporate shareholder is not a Hong Kong company, in which case the documents must be submitted physically.

The online application process is divided into two main steps: creating a user account and completing the application.

Create a user account

To submit forms and documents to the Companies Registry (CR) via the e-Services portal, the forms must be signed by a natural person authorised by the company. This person must first subscribe to e-Filing Services using their e-Services account and link the account to the company.

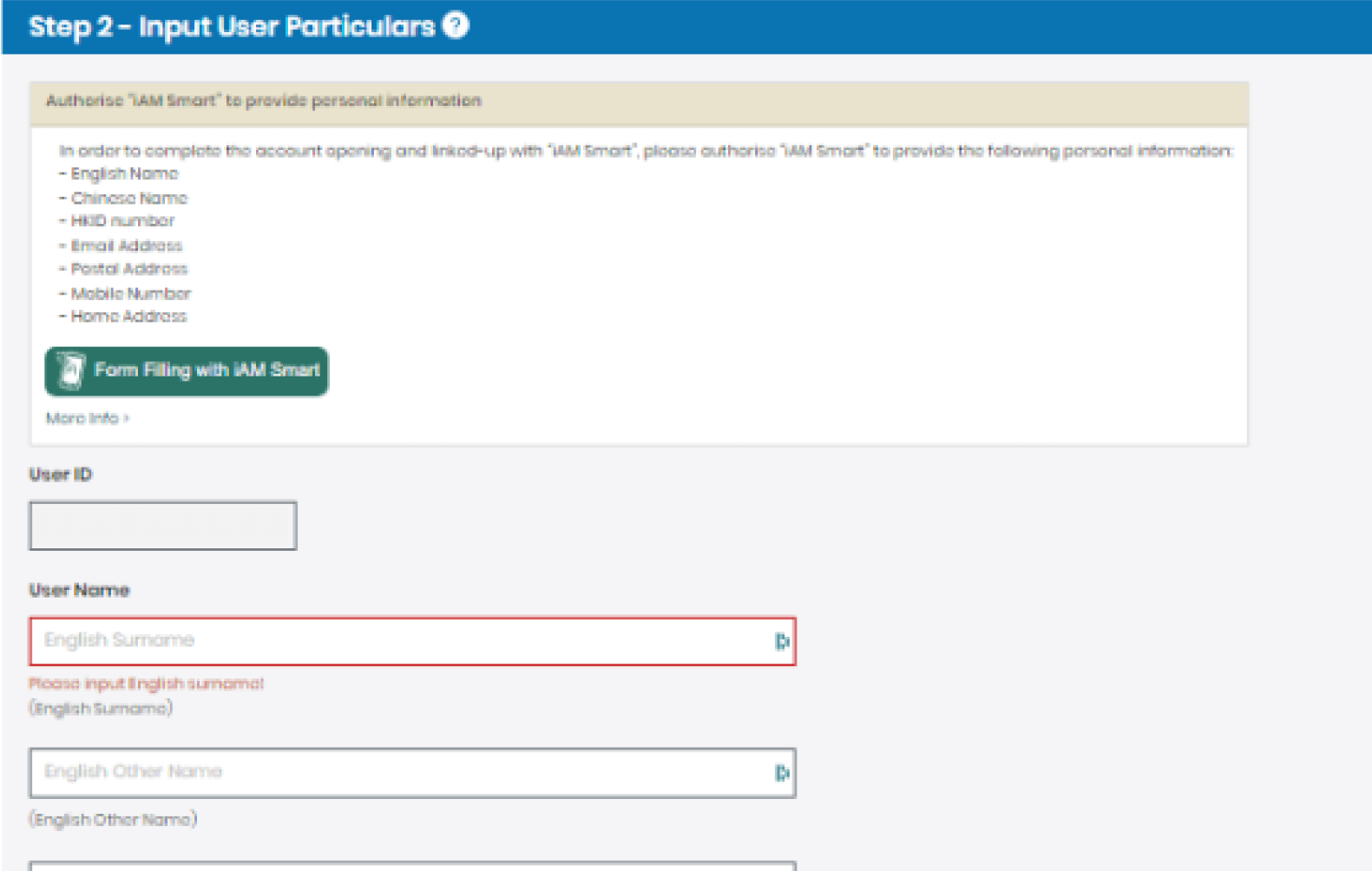

This means a director must first register as a user to be able to initiate and sign the application. Here’s how:

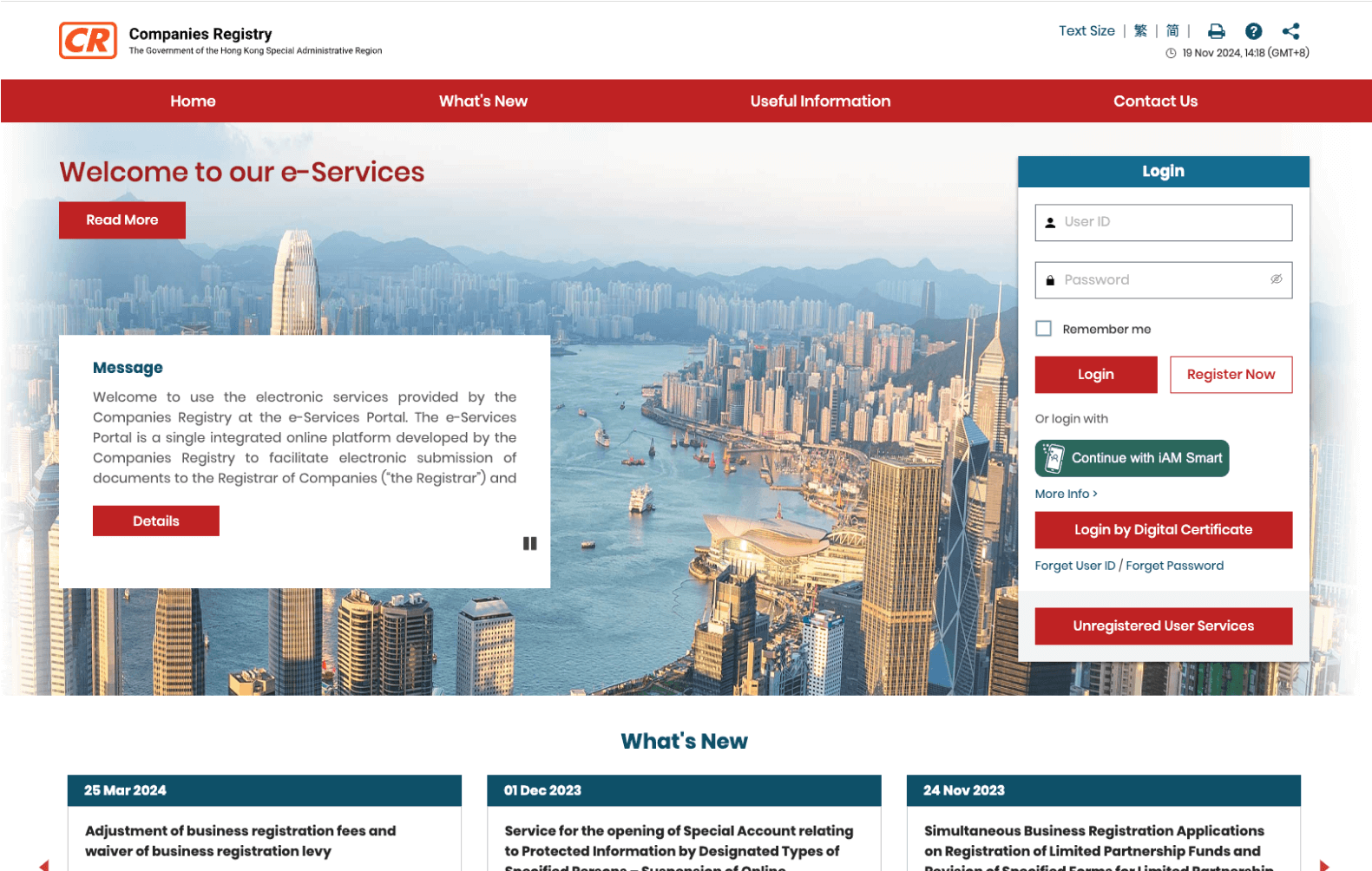

Go to https://www.e-services.cr.gov.hk/ and click “Register Now” to be directed to the User Registration Page

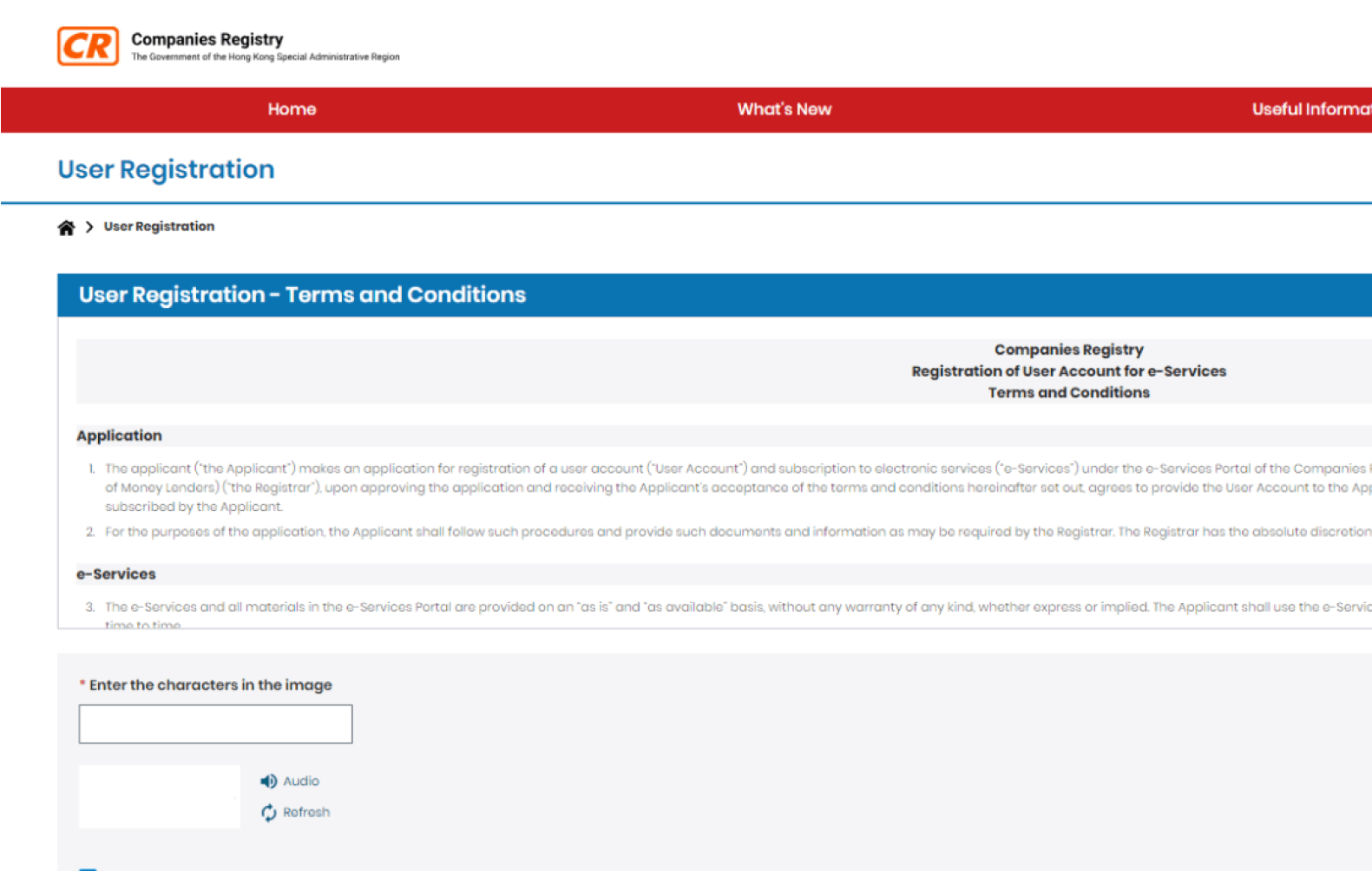

You’ll find the terms and conditions that you need to agree to before continuing.

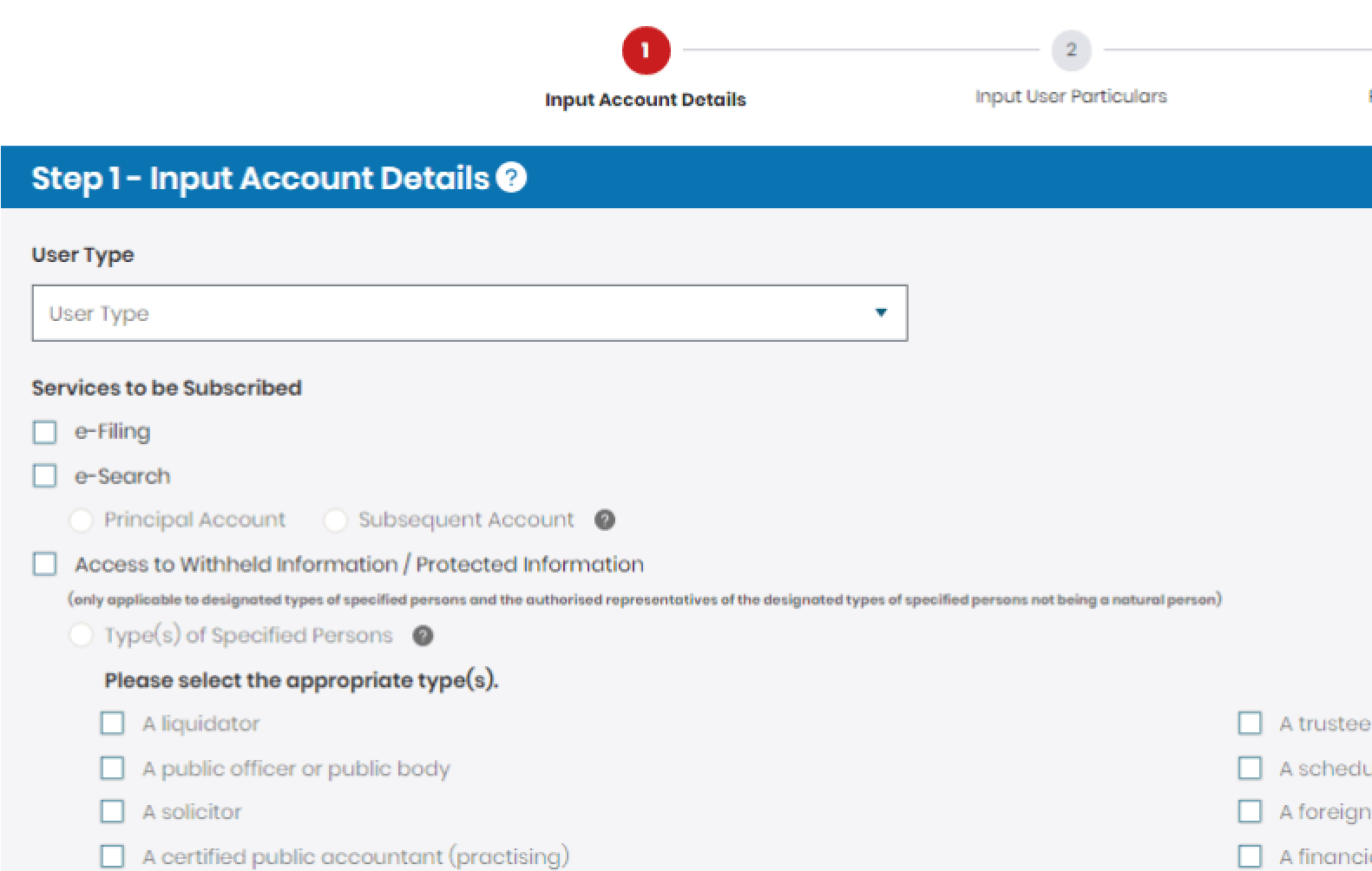

Fill in account details, including what services you want to subscribe to, and create your user ID and password.

Provide information on your name, address, and Hong Kong numbers.

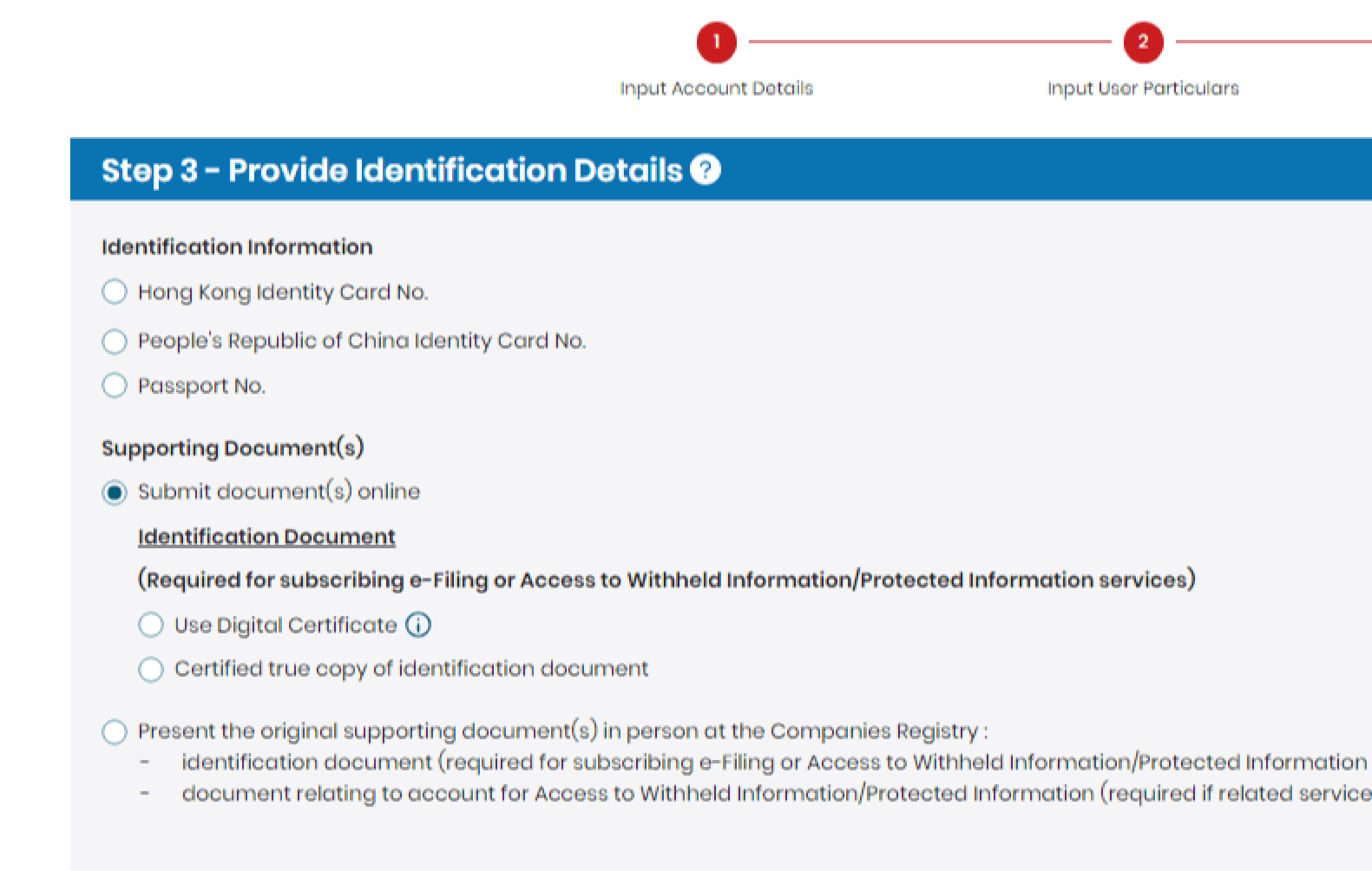

Submit an identity document, either an HKID, People's Republic of China identity card, or a passport. If submitting a Hong Kong passport, an HKID is mandatory. For passports from other countries, an HKID is not required.

The passport must be a certified true copy by a Hong Kong notary public, a certified public accountant under the Accounting and Financial Reporting Council Ordinance, an authorised court officer, a professional company secretary in Hong Kong, or a licensed trust or company service provider under the Ordinance Cap. 615, or a consular officer of the applicant’s home country for non-Hong Kong residents.

In the next steps, review your application and submit it. Approval typically takes half a day to 2 days. You will then receive a link to activate your user account.

Once your account is activated, you can log in and proceed to fill out the company incorporation application.

Fill out the application

To fill out the application, start by visiting https://www.e-services.cr.gov.hk/ and log in with your account.

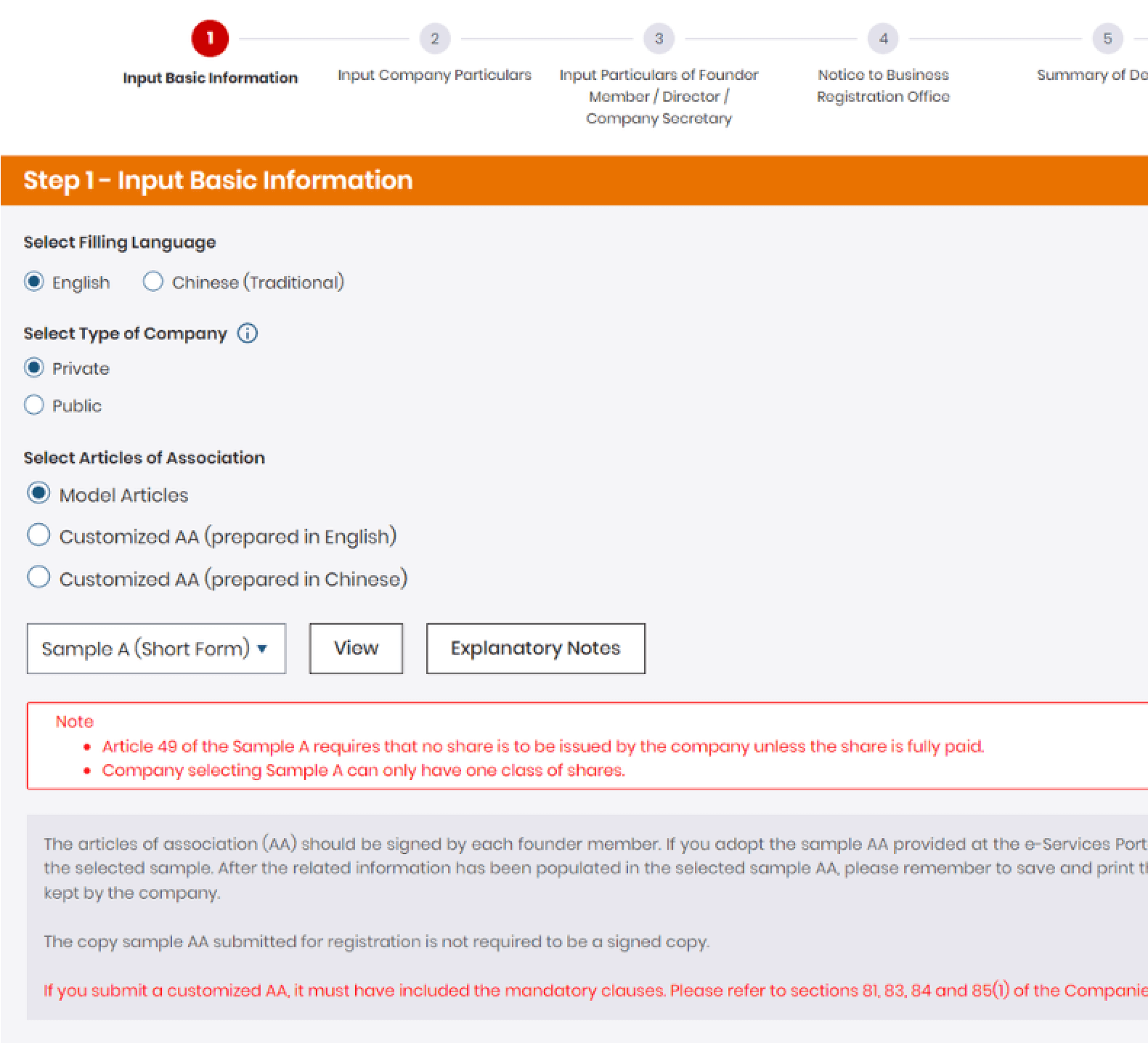

After logging in, choose "Incorporation" and select the type of company you want to incorporate. In this example, we’re using a local company limited by shares. You will then need to complete these 5 steps.

Enter basic information, including the filing language (English or Traditional Chinese), and attach the Articles of Association (AA). The AA must be signed by each founder and a signed copy must be kept by the company. The version submitted for registration doesn't need to be signed.

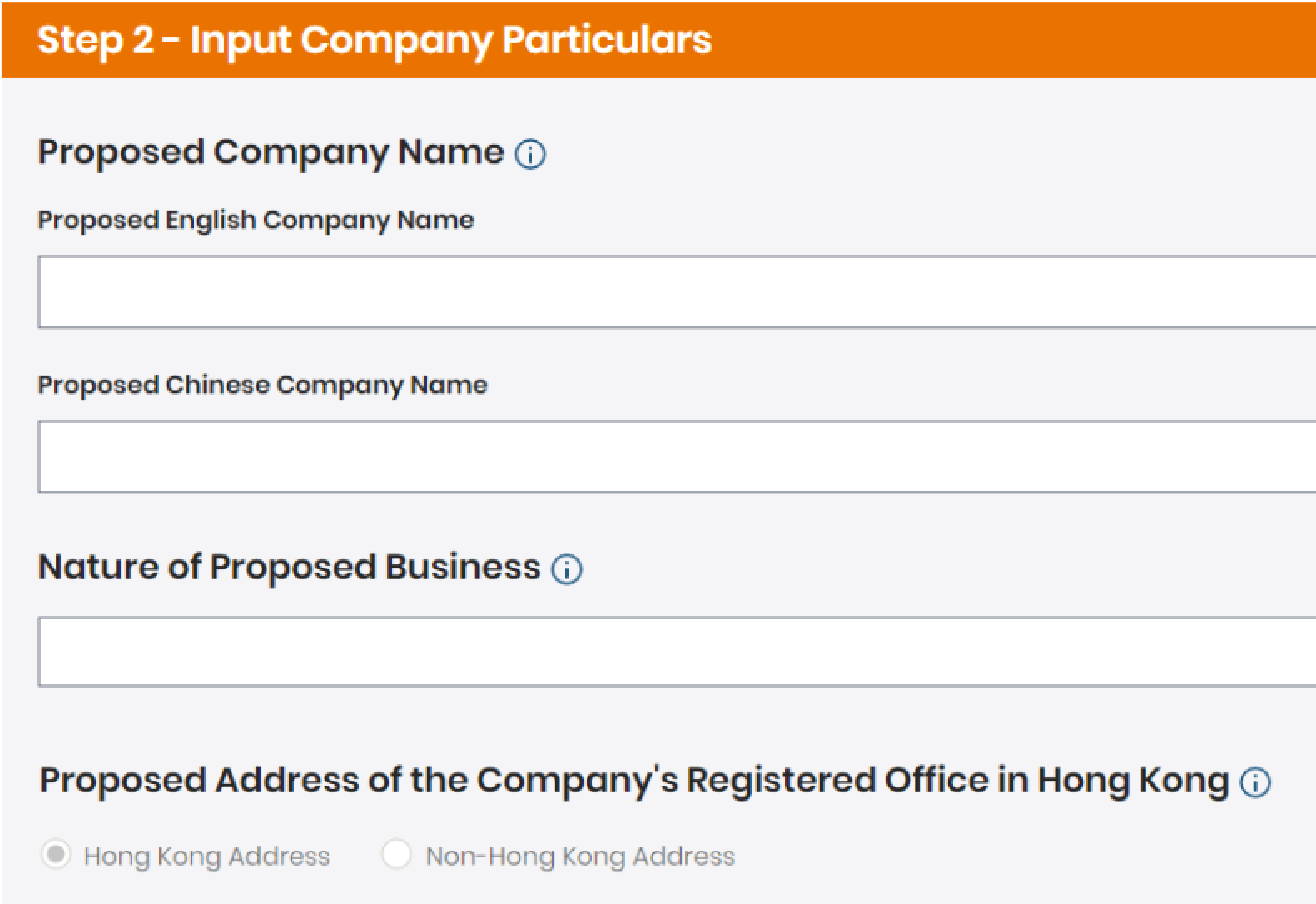

Enter company details, including the proposed company name, business nature, proposed registered address (must be a Hong Kong address), and contact information (email and Hong Kong phone number). Also, enter share capital and shareholding information.

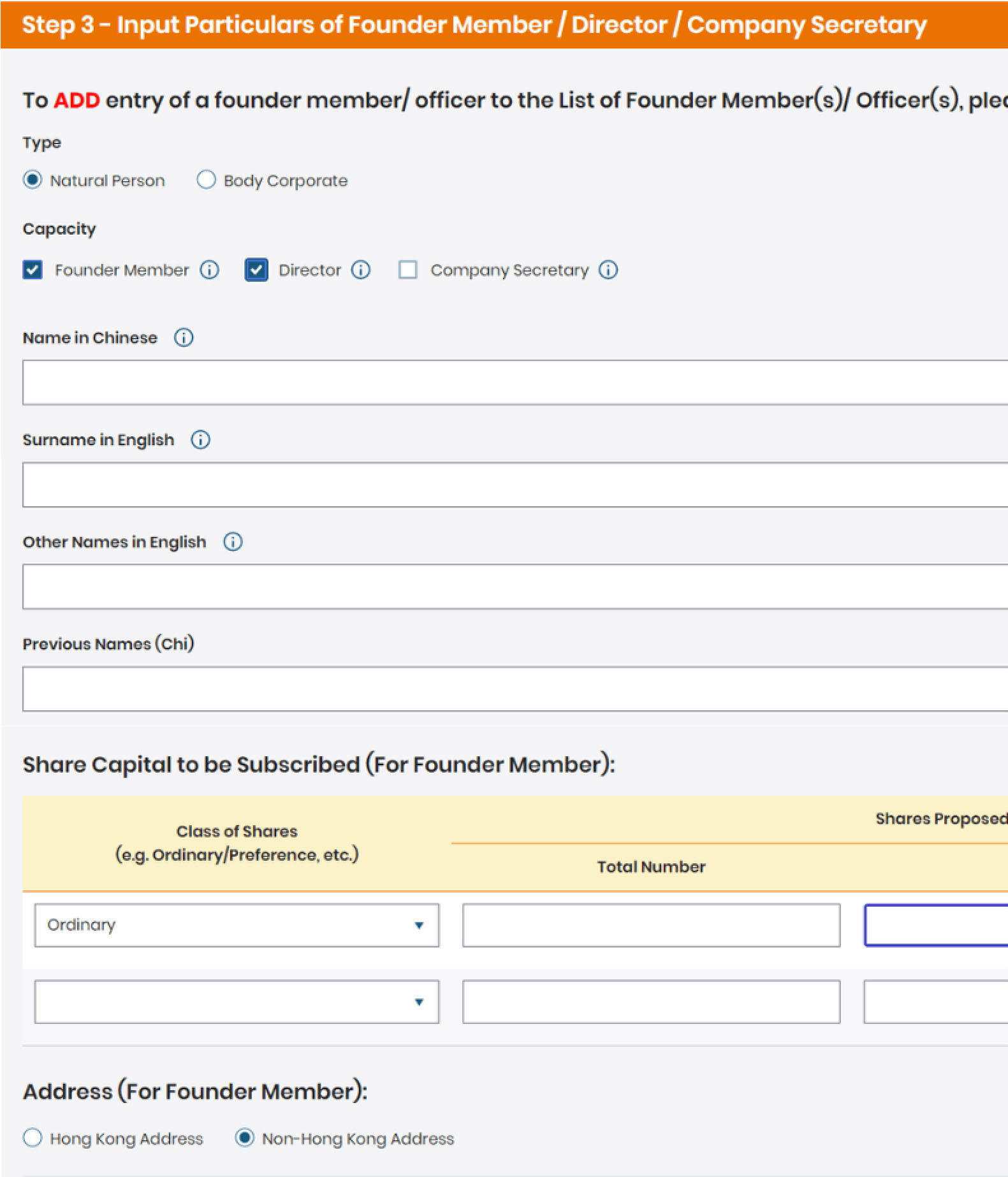

Provide details for the initial shareholder (also known as the founder member), directors, and company secretary, including names, shares, addresses (which can be in Hong Kong or outside Hong Kong), and identification documents (HKID or passport). Enter "Nil" for any fields that do not apply.

When adding a director, tick the consent box to allow electronic signing. If not, you will need to submit Form NNC3 within 15 days of incorporation.

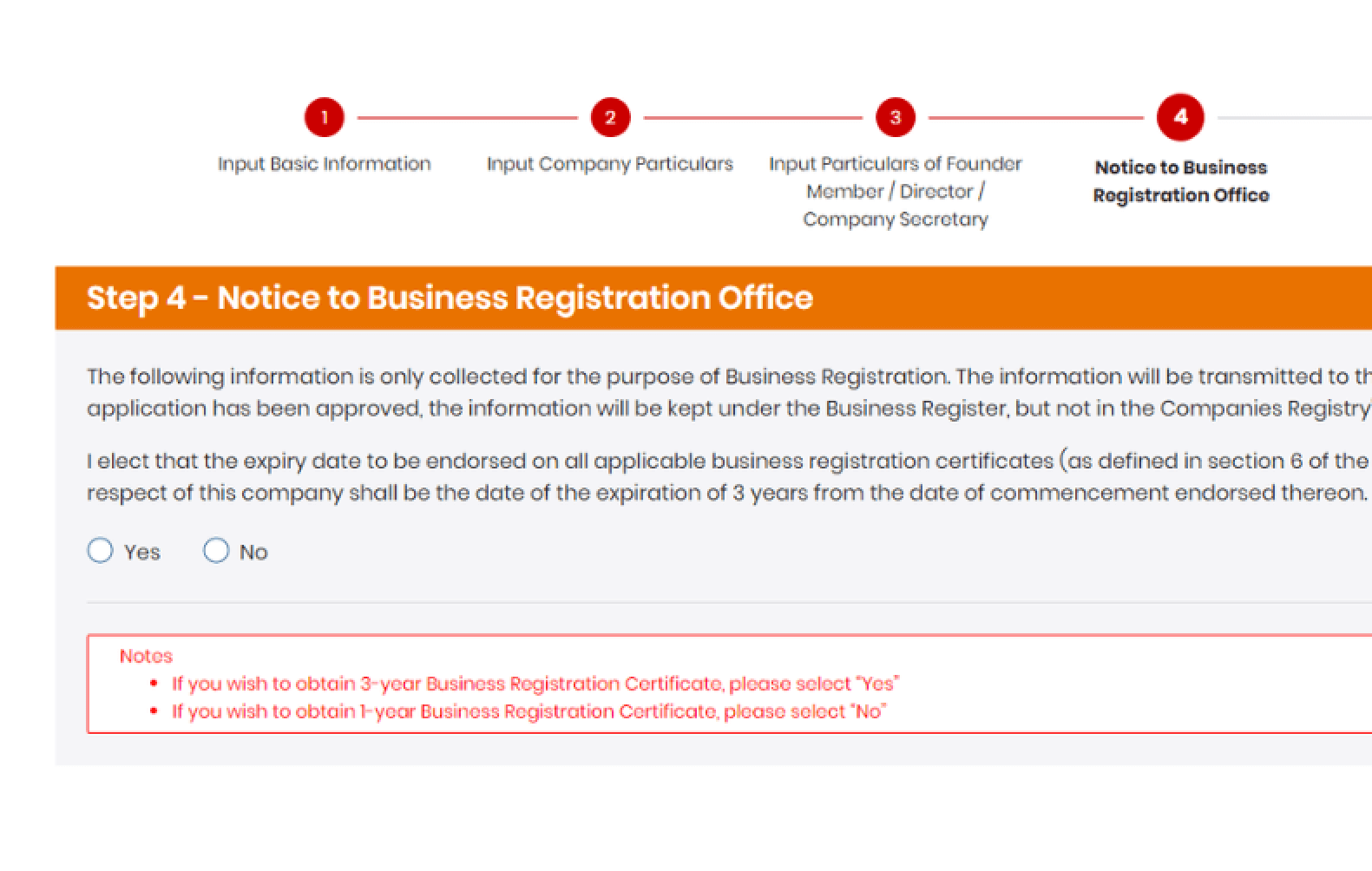

Tick the box agreeing to send a notice to the Business Registration Office, which is mandatory. Choose the business registration certificate (BRC) period: tick "Yes" for a 3-year period or "No" for 1 year.

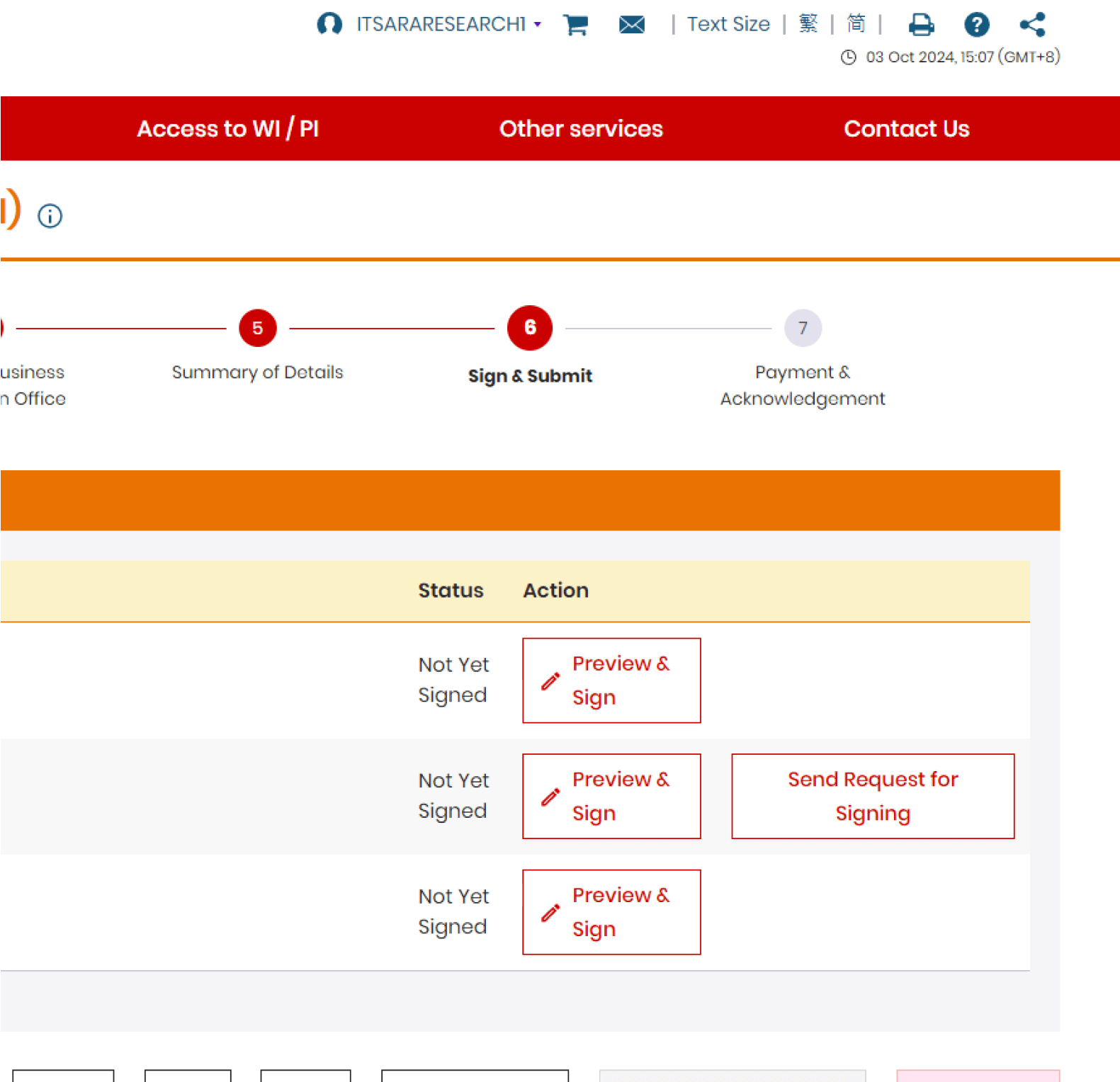

Review your details for accuracy, then sign and submit electronically. The easiest way to sign is with your user ID, though you can also use a digital certificate or the iAMsmart app.

Once submitted, pay the fee via credit card, PPS Shop and Buy, FPS, Google Pay, Apple Pay (Safari), or bank transfer. Payment details will be provided on the webpage.

It’s recommended to pay the fee immediately after submission. This is essential because if another person submits an identical company name and pays before you, you will not be able to use your preferred name.

After payment, your application should be verified within 1 to 5 days, or around 7 days if corporate shareholders are involved.

To track progress, log in to your account and check message notifications. You will also receive a PDF version of the certificate of incorporation and business registration certificate through this channel.

Alternatively, users can complete the process offline by downloading the specified forms. After filling out the completed form, submit it along with the necessary documents at the 14th floor, High Block, Queensway Government Offices, 66 Queensway, Hong Kong.

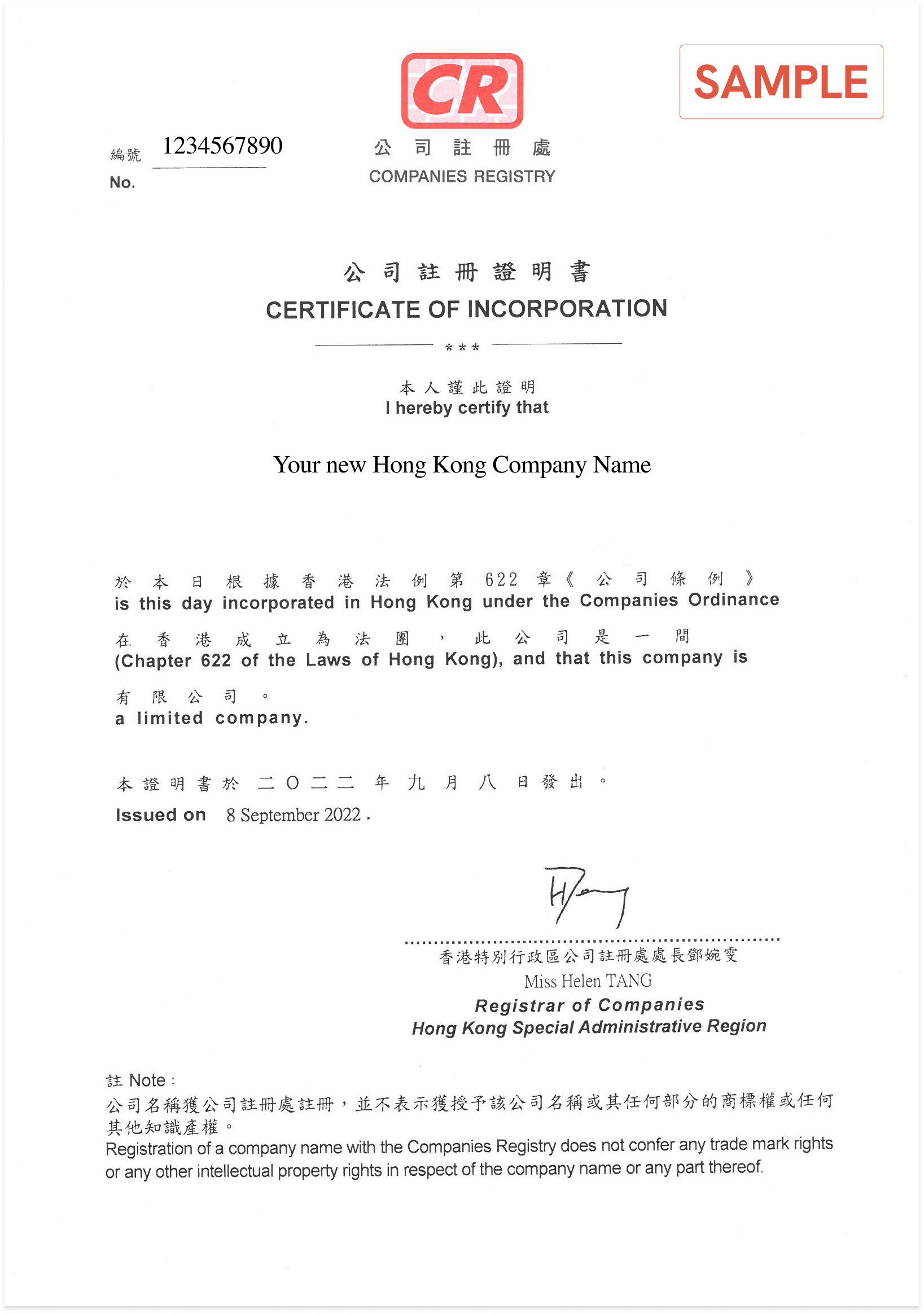

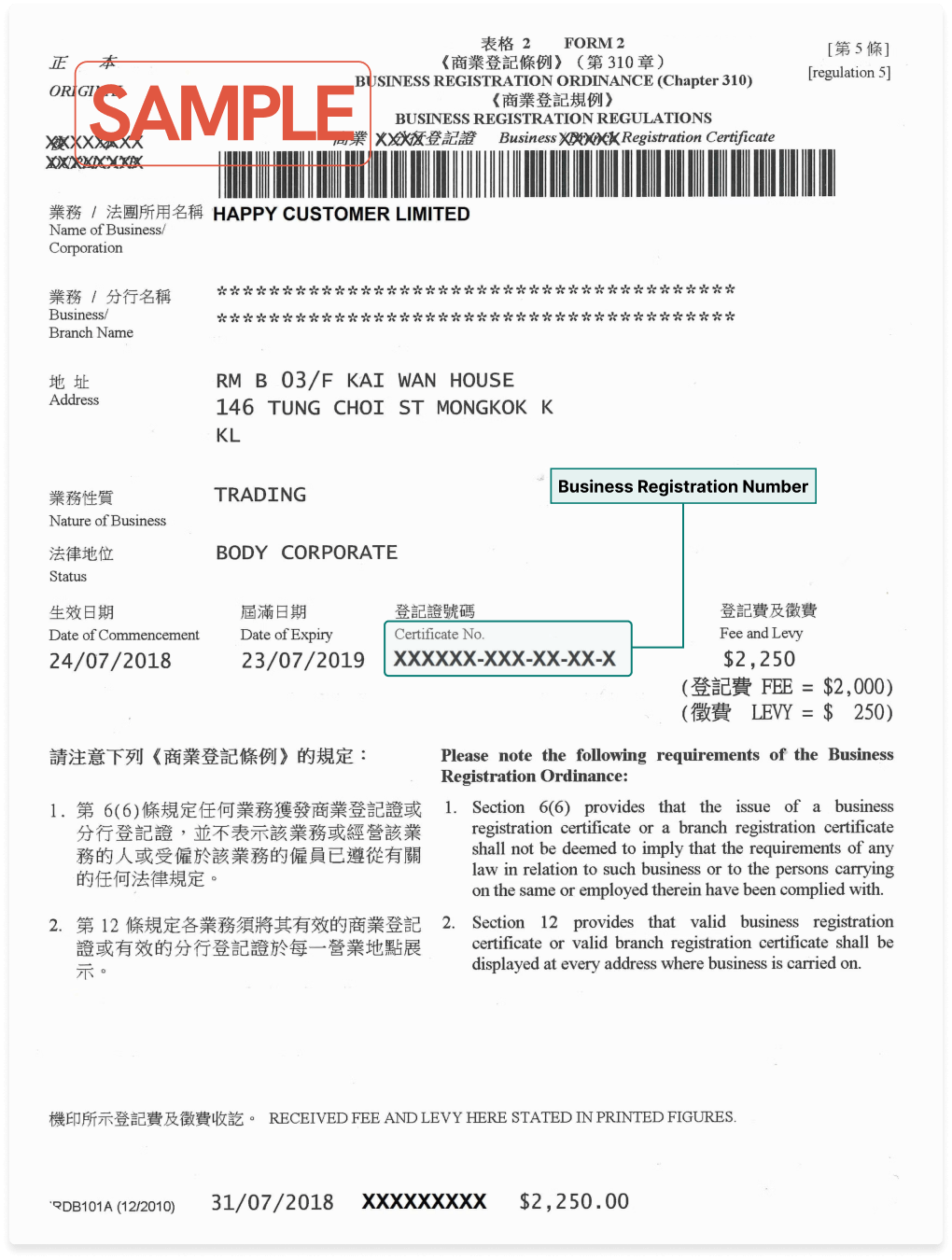

Documents Upon Successful Application

If you have successfully registered your Hong Kong company, you should receive two documents from the government : Certificate of Incorporation and the Business Registration Certificate. These two documents are important to have to operate legally in Hong Kong.

For online registrations, these certificates are issued as PDF files and hold the same legal status as paper versions. If needed, certified paper copies can be requested from the Company Registry and IRD websites and will be mailed to your registered address.

Certificate of Incorporation (CI)

The Certificate of Incorporation proves the company's legal registration. It includes an 8-digit company registration number, the official company name, the incorporation date, and the certificate type.

Available in both English and Traditional Chinese, this certificate can be accessed publicly via the Companies Registry e-services portal (Formerly the Integrated Companies Registry Information or ICRIS).

Business Registration Certificate (BRC)

The Business Registration Certificate (BRC) verifies a company's legal right to operate and serves as an identifier for tax purposes.

The BRC contains the business name, physical address, type of business and the nature of its activities, the date operations began, the Unique Business Identifier (UBI), which was formerly known as the Business Registration Number (BRN), and is usually used as the tax identification number, as well as the expiry date of the certificate.

You can choose a BRC with a validity of either 1 year or 3 years, and you'll need to renew it accordingly—every year or every 3 years—to continue operating legally.

Post-Incorporation Documents

Once your company is incorporated, you should receive key documents from the company secretary, including:

- Share Certificates: Official documents that verify an individual’s ownership of shares in the company.

- Register of Members: A comprehensive record of all shareholders, including their personal information and the number of shares they hold.

- Register of Directors: A list of all current directors of the company, including their personal details.

- Register of Company Secretaries: A document that maintains the records of company secretaries.

- Board Resolutions: This document is a written decision made by a company's board of directors. It serves as a record of decisions taken during a board meeting and ensures that important actions and policies are officially approved and documented.

- Significant Controllers Register: A document detailing individuals or entities with significant control over the company. It also identifies the designated representative, who is authorised to act on behalf of the company and is responsible for preparing the significant controllers register.

It's important to keep these documents for your records, as the Companies Registry (CR) may request them for inspection at any time. Additionally, you may need them when applying for a business account.

Open a Business Account

Opening a business account is one of the first essential steps after your company has been registered.

In Hong Kong, traditional banks often require a certified true copy of company documents and, in many cases, your physical presence to open a business bank account.

This can be challenging, particularly for remote or international businesses. However, there are options, such as with virtual banks or payment service providers.

If you incorporate a company with Statrys, we can assist you in applying for a Statrys multi-currency account (subject to approval) immediately after incorporation in Hong Kong.

A Statrys account is not a bank account; instead, it is a business account that gives you access to 11 major currencies and local and international payments, FX options, and more.

How Much Does It Cost to Register a Company in Hong Kong?

Based on the responses from a survey of 120 companies, conducted by Statrys, the average Hong Kong company incorporation cost is HKD 9,053.

The cost range that we found is a minimum of HKD 4,000 to a maximum of HKD 20,000. Note that the mandatory government fees start at around HKD 3,800, so the minimum cost of HKD 4,000 likely does not include a registered address or a company secretary.

Entrepreneurs who use a Hong Kong company registration service generally pay between HKD 6,000 and up to HKD 12,000.

Below is the cost breakdown:

Government Fees

Company Registration Fee: A one-time fee to the Companies Registry.

- Electronic application: HKD 1,545

- Hard copy application: HKD 1,720

Business Registration Fee: Annual fees to the Inland Revenue Department

- 1-year certificate: HKD 2,200

- 3-year certificate: HKD 6,020

Other mandatory fees

- Company Secretary: Required for all Hong Kong companies. The fee varies depending on the level of service provided and is paid annually.

- Registered Address: Every company must have a registered address, with costs depending on the provider and location.

- CPA Certification: Certification of identification documents by a CPA is often required, especially for those using a passport as identification document. This may cost from HKD 350 to HKD 700 per passport.

How Long Does It Take to Incorporate a Company in Hong Kong?

The average time to incorporate a company in Hong Kong is 3 to 5 working days. According to the respondents in Statrys' survey, 91% of the participants completed their company incorporation within a week.

Delays in the incorporation process can often be attributed to the nature of the industry—particularly those deemed high-risk—completion of necessary documents, and the verification time for corporate shareholders, which may take longer than for individual shareholders. Ultimately, the time required for incorporation largely depends on specific circumstances.

Fulfilling Your Ongoing Business Obligations

Once your company is incorporated in Hong Kong, you’ll have ongoing obligations to ensure your business remains in good standing. I’ve outlined these administrative tasks below.

Annual Renewals

Once your company is incorporated, it is essential to maintain it annually. This includes:

- Renewing your Business Registration Certificate (BRC), which may be required every year or every three years, depending on the expiration date of your initial BRC. Upon submitting your application and paying the registration fee, you can choose a BRC validity period of either one year or three years.

- File the Annual Return (NAR1 form) to the Registrar of Companies within 42 days after the company’s incorporation anniversary.

Failure to renew the BRC or file the Annual Return may result in fines, and your business operations could be deemed illegal.

Accounting Requirement

When setting up a company in Hong Kong, managing your accounting is essential to ensure compliance with the Inland Revenue Department (IRD). Even if your company has no financial activity, you’re still required to maintain proper bookkeeping and accounting records and notify the IRD that there has been no financial flow during the period.

In Hong Kong, monthly accounting isn't mandatory. Instead, companies must submit an annual return, which includes the required annual accounting. For newly incorporated businesses, you have up to 18 months to file your first financial report with the IRD, giving you some flexibility to get everything in order.

How to Choose Your Accountant

It’s a good idea to wait a few months before hiring an accountant. This is because most accountants in Hong Kong base their fees on the volume of transactions. If you seek a quote during your first month, the fees might be on the higher end, as they might not yet reflect your typical transaction volume.

For companies registered through Statrys, we can recommend accounting service providers tailored to your business’s transaction volume, business nature, and industry. We’ll provide a list of suitable options with quotes, allowing you to choose the accounting service that best meets your needs.

Annual General Meeting

According to the Companies Ordinance, the company must hold an Annual General Meeting (AGM), where the company's shareholders and board of directors come together to discuss key company matters and financial reports, for each financial year. However, an AGM is not required if all matters are handled by written resolution, if the company has only one member, if all members agree to dispense with the AGM.

In general, a company limited by guarantee or a private company that is not a subsidiary of a public company must hold its AGM within 9 months after the end of its accounting reference period. For all other companies, the AGM should be held within 6 months after the end of its accounting reference period.

Your company secretary should prepare this meeting.

Maintenance of Significant Controller Register

Companies in Hong Kong are required to keep a record of their “significant controllers”, individuals or entities that have control over the company. This includes anyone who owns more than 25% of the shares or voting rights, can appoint most of the directors, or has significant influence over the company’s decisions.

The information must be recorded in a Significant Controllers Register, kept at the company’s registered office or an approved location in Hong Kong, and must be kept up to date at all times. Companies must also appoint someone to assist law enforcement officers with any related inquiries. Typically, your company secretary will handle the maintenance of the Significant Controllers Register.

How Taxes Work in Hong Kong

Once you've established a company in Hong Kong, understanding local tax obligations is essential for compliance. Taxes in Hong Kong are managed by the Hong Kong Inland Revenue Department (IRD).

Hong Kong operates on a territorial tax system, meaning taxes are based on where income or profits are generated.

Let’s explore the key details, particularly those related to business taxes.

Corporate taxes

In Hong Kong, the main corporate tax is called “profits tax”, which applies to income earned within the territory. The profits tax rate follows a flat-rate system, with a progressive structure for smaller businesses.

- Companies are taxed at 16.5% on corporate profits.

- For eligible small businesses, the first HKD 2 million in profits is taxed at 8.25%. Any profits above that are taxed at 16.5%.

- For unincorporated businesses like partnerships and sole proprietorships, the applicable tax rates are 7.5% for the first HKD 2 million and 15% afterward

- No value-added tax (VAT), no capital gains tax, no withholding taxes on dividends or interest income.

However, income from qualifying debt instruments and deposits used to secure loans may still be taxable. Businesses with international income can benefit from double tax treaties, which prevent them from being taxed twice on the same income.

The tax year in Hong Kong spans 12 months, and companies must file their tax returns either online or by paper. The IRD issues profit tax returns every April. The submission deadline depends on the company’s fiscal year, with some allowed extensions until November of the following year.

New business and first-time tax filers benefit from an 18-month grace period for their initial tax filing. Failure to submit tax returns on time may result in penalties and additional assessments.

Offshore tax exemption status

Businesses that generate profits solely from outside Hong Kong can apply for special offshore status to be exempt from profits tax, as offshore income is not subject to taxation.

A common misconception is that setting up a new company in Hong Kong automatically grants offshore tax benefits, but this is not the case. To set up an offshore company and qualify for offshore tax exemption, companies must prove that all profits are generated outside of Hong Kong, and the offshore status must be granted by the Hong Kong Inland Revenue Department.

To apply for offshore tax exemption, a registered company must:

- Be in operation for at least one year.

- Submit an application to the IRD, including a thorough audit confirming no business activities have taken place in Hong Kong.

It’s important to note that if your company has any local operations, such as sales or employees within Hong Kong, it will be treated as an onshore company and subject to the standard profits tax rate.

Your Solution for Hong Kong Company Formation and a Business Account: Statrys

Looking to set up a company in Hong Kong? Statrys offers a straightforward and reliable process for incorporating a Hong Kong company. Just share details about your business and submit the required documents. No need to travel to Hong Kong in person, rent an office or search for a local company secretary. Our team handles everything to get your company set up and ensure ongoing compliance.

Statrys provides all-inclusive Hong Kong company registration services in one package at a single price. The services cover everything required for a hassle-free incorporation process, whether you're a local resident or an international entrepreneur.

As a licensed Trust and Corporate Service Provider (TCSP) in Hong Kong, Statrys ensures compliance with local regulations during the company registration process, offering a seamless and professional experience.

Here's what's included:

Incorporation services

- Verification of company name availability

- Preparation and filing of incorporation documents

- Drafting of Articles of Association

- Certificate of Incorporation

- Business Registration Certificate (1-year)

- Company chops (corporate seals)

- Government fees (HKD 3,970 included)

- 24/7 access to company documents via an online platform

Company secretary services

- Company secretary (1 year)

- Designated representative (1 year)

- Filing of Annual Return (NAR1)

- Automated reminders for filing deadlines

- Maintenance of significant controller register

- Maintenance of statutory records

- Preparation for the Annual General Meeting (AGM)

- 24/7 access to documents

Registered address in Hong Kong

- A registered address (1 year)

- Scanning and forwarding of mail

Business account

- Assistance with a multi-currency business account opening (Subject to approval)

- Documents for business account setup

Accounting

- Recommendation and quote tailored to your revenue and transaction volume.

Sources

Here are links to the official government sources referenced in our guide, where you can find additional information.

- https://www.cr.gov.hk/en/home/index.htm

- https://www.cr.gov.hk/en/faq/local-company/company-name.htm

- https://www.elegislation.gov.hk/hk/cap622

- https://www.cr.gov.hk/en/services/fees.htm

- https://ird.gov.hk/eng/tax/bus.htm

- https://www.gov.hk/en/nonresidents/investinghk/taxinhk.htm

FAQs

Can a foreigner register a company in Hong Kong?

Yes. Hong Kong allows 100% foreign ownership. You don’t need to be a resident or hold a local passport to set up a company.

Do I need a local director to set up a company in Hong Kong?

No. There’s no requirement for a local director. The director can be of any nationality.

Do I need to travel to Hong Kong to register a company?

No. The entire incorporation process can be completed online if your company has only individual shareholders, not corporate shareholders.

Do I need an office in Hong Kong?

You don’t need to rent a physical office, but every company must have a registered address in Hong Kong. You can use service providers for this.

How long does it take to register a company in Hong Kong?

Typically 1 to 5 business days once documents are submitted and verified. It may take longer if corporate shareholders are involved.

How much does it cost to register a company in Hong Kong?

Expect to pay around HKD 6,000 to HKD 12,000 with a service provider. Government fees alone start at around HKD 3,800.

Can I open a business account without travelling to Hong Kong?

Yes. While traditional banks may require in-person visits, fintech providers like Statrys offer remote account applications.

What is the simple way to register a company in Hong Kong?

Use a one-stop provider that handles company setup, registered address, secretary service, and business account support, like Statrys.

Get your Hong Kong business account open in a few days

100% online application

No account opening fee, no initial deposit

Dedicated account manager