Features

Fees

Account Opening

User Reviews

Airwallex is a global fintech platform that helps businesses manage cross-border payments, multi-currency balances, and company spending from a single online account. It is commonly used by startups and SMEs that operate internationally and want an alternative to traditional banks for day-to-day payments.

In Singapore, Airwallex offers a multi-currency business account with local account details, Visa debit cards, and built-in expense management tools. The platform is fully online, with relatively fast onboarding, and pricing that scales as teams grow. However, it also comes with trade-offs, particularly around cash access, advanced FX tools, and customer support.

In this Airwallex review, we break down how the platform works in practice for Singapore-based businesses. We cover fees, features, onboarding, real user feedback, and who Airwallex is —and isn’t — a good fit for, so you can decide whether it suits your business needs.

Airwallex Singapore offers 3 pricing plans: Explore, Grow, and Accelerate. Explore is free, while Grow costs SGD 79 per month and Accelerate costs SGD 399 per month. All prices are listed in SGD, and GST may apply.

The Explore plan covers core needs such as a multi-currency business account, free local transfers, batch payments, and basic expense tools. For most startups and small teams, this is sufficient for day-to-day operations.

The Grow plan adds approval workflows, automated bill processing, and higher card limits. It becomes relevant once spending controls and internal oversight are required.

Accelerate targets larger or multi-entity companies. It includes deeper controls and central policies that help standardise processes across teams.

In practice, higher-tier plans make sense only when a business has formal approval structures or a dedicated finance function. Many early-stage companies can start with Explore and upgrade later as complexity increases.

Below is a quick look at the main fees when using Airwallex Singapore.

| Fee Type | Amount (SGD) |

|---|---|

| Receive transfers |

0.4% for PHP transactions 0.6% for KRW and VND transactions 0% for all other currencies |

| Send local transfer | Free |

| Send international transfer | $20–35 |

| FX rate | Based on interbank rates |

| FX markup |

0.4% for USD, EUR, GBP, HKD, SGD, AUD, CNY, JPY, CAD, CHF, and NZD 0.6% for all other currencies |

| Company cards | Free |

| Employee cards | Free |

| Expense management |

Includes 5 cardholders $5 per additional cardholder per month |

For detailed pricing information, please refer to Airwallex’s Fee Schedule.

Airwallex Features

Airwallex combines multi-currency accounts, cards, and expense tools into a single dashboard. You can hold money in multiple currencies, pay and get paid across borders, and control team spend in one place.

Global Accounts & Multi-Currency Wallet

You can hold funds in more than 20 different currencies in one place instead of opening separate accounts at different banks. So customers can pay you by local rails like ACH or SEPA instead of SWIFT, which means lower fees. You can also run batch payments (up to 1,000 payments). Pay multiple suppliers in one go and track the status on one screen.

Visa Corporate Debit Cards

Airwallex offers company and employee debit cards that enable you to spend directly from your account balance. You can create and get virtual cards quickly from the dashboard as well as order physical ones, which will be shipped to your company address within 12 business days.

You can set per-card limits, pick who approves, and freeze or unfreeze a card instantly. This helps with SaaS, ads, and travel, where small leaks add up.

However, Airwallex cards cannot be used at ATMs at the time of review. If your business still needs cash access, you will need another account alongside Airwallex to cover that gap.

Expense Management Tools

Airwallex helps businesses manage expenses more easily. Team members can pay with company cards, upload receipts, and have details such as the merchant, date, amount, and tax automatically captured. All expense claims appear in one place for review and approval.

Expenses can be synced with accounting software such as Xero or QuickBooks. You can map expense categories to your chart of accounts, allowing transactions and receipts to be sent across automatically. This reduces manual work and keeps records organised.

More advanced features, including multi-level approvals, automation, and multi-entity support, are available only on paid plans. These make sense once you have defined workflows.

Airwallex Account Opening

You can apply online to open an Airwallex account in Singapore. The application usually takes about 20 minutes to complete. Most reviews typically take 3 business days, but timing depends on your structure and documents, and additional information may be requested.

After approval, you get a default collection account in Singapore that is held under Airwallex’s name. If you want payers to see your company name on the account, turn on Global Accounts for each currency you plan to use. That gives you local account details in your company name, where available.

Who Can Open?

You can open an account with Airwallex Singapore if your business meets the following criteria:

- Your company is registered and active in Singapore, India, Thailand, the Philippines, Fiji, or Costa Rica.

- Your business doesn’t operate in restricted activities (i.e., gambling, pharmaceuticals, charities, and investment firms).

- Your business is not on any sanctions lists and is not a shell bank or bearer-share entity.

If your company is registered outside these jurisdictions, you may still be eligible to open an Airwallex account in another location. You can refer to their list of supported countries for details. Please note that certain features, such as yield accounts, may not be available in all locations.

Required Documents

You will need to provide standard KYC information about your company, its owners, and the person completing the application. The exact documents vary depending on your structure and industry, but most businesses should expect to prepare the following documents:

- Company documents, such as an ownership structure chart, partnership declaration (if applicable), or an authorisation letter if the applicant is not a director or shareholder.

- Personal documents, including ID cards and address proof for directors, authorised persons, and any ultimate beneficial owners holding 25% or more.

- Industry-specific questionnaires, which may be required for financial institutions, investment businesses, online marketplaces, or live-streaming activities.

- Supporting forms, such as source-of-wealth declarations or onboarding questionnaires, depending on your business model.

Airwallex may request additional documents if the ownership structure is complex or if more information is needed for the compliance review. Files must be clear and readable. Accepted formats include PDF, JPG, JPEG, PNG, or BMP. The maximum size is about 10 MB per file.

For the full list of required documents and questionnaires, you can refer to Airwallex’s Document Required for Companies in Singapore page.

Airwallex from Real Users

To understand the full picture of Airwallex, it helps to look at what users say on independent review platforms. We use Trustpilot and G2 because they are third-party sites with a large number of reviews, giving a clearer idea of real user experiences and what customers can expect when using Airwallex.

Trustpilot Reviews

Based on reviews on Trustpilot, Airwallex has an average rating of 3.5 out of 5 based on 2,100+ reviews. This is higher than many traditional banks listed on the platform, but lower than several fintech competitors. For example, Statrys has a stronger Trustpilot rating of 4.4 out of 5.

Feedback is highly mixed. Some users are very satisfied, while a significant number report serious issues with reliability and support.

What customers like:

- Easy to use for cross-border and multi-currency payments.

- Smooth onboarding, quick transfers

- FX costs are seen as cheaper than those of traditional banks

Common complaints:

- Accounts are paused or closed with limited explanation, and funds are sometimes held

- Slow or templated support replies on payment issues

- Long KYC followed by unclear rejections

- Blocked or delayed payments, missing deposits, fees on failed transactions, and occasional plugin issues, such as Shopify

In summary, Airwallex has a strong functionality for routine cross-border payments. Service appears uneven when a payment needs escalation. If fast, hands-on support matters to you, weigh this risk before committing.

G2 Reviews

On G2, Airwallex has 48 reviews with a strong 4.4 out of 5 rating. The tone is more positive than Trustpilot, but the sample is much smaller.

What customers like:

- Easy-to-use dashboard

- Fast international transactions and good multi-currency features.

- Helpful integrations with accounting and ecommerce platforms.

Common complaints:

- Delayed or blocked transaction

- Support that can be slow or unclear under load

Overall, product experience and integrations get high marks. Support and approval friction still appear, similar to Trustpilot. With a smaller sample, treat the high score as encouraging, not conclusive.

Best Airwallex Singapore Alternatives

If Airwallex is not the right fit for your company, here are some alternatives to consider instead:

1st Choice

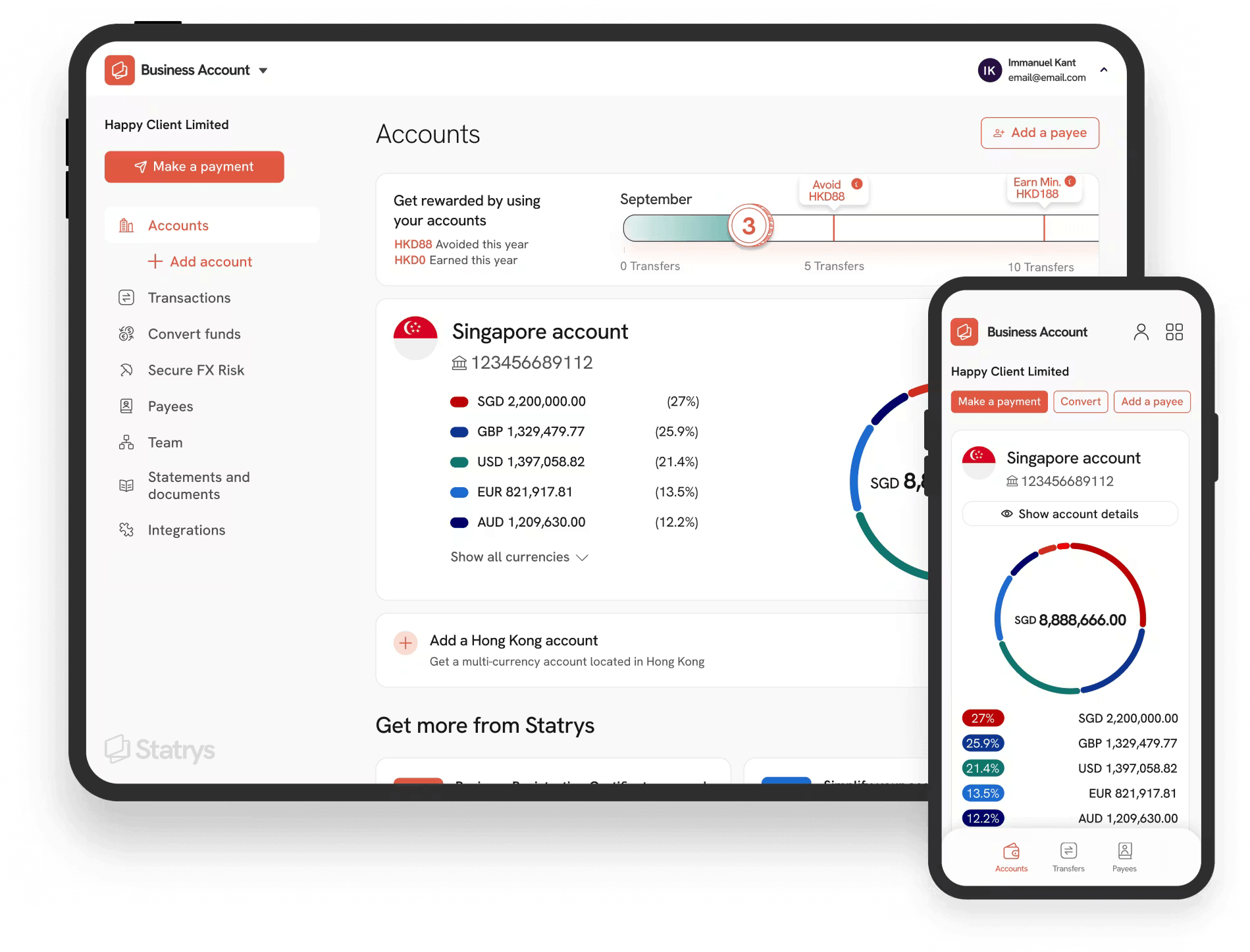

Multi-currency business account supporting 11 major currencies with FX fees as low as 0.1%

2nd

Wise

Business account that supports up to 40 currencies and comes with multiple debit cards.

3rd

OCBC

Multi-currency business bank account with full banking services.

Why Statrys?

While Airwallex offers a wide feature set, many users report slow response or unclear communication. Statrys takes a different approach. We assign a dedicated account manager to every account, so you always speak with someone who knows your business instead of dealing with template replies. Our FX fees start from 0.1%, which helps keep your conversion costs low.

For SMEs that need a simple multi-currency account and value personalised support, Statrys is a stronger option.

Read more:

Airwallex VS Wise: Which Is Better for Businesses in Singapore? [2025]

Was this article helpful?

Yes

No

FAQs

Is Airwallex approved by MAS?

Yes, Airwallex is licensed and regulated by the Monetary Authority of Singapore (MAS) as a Major Payment Institution (MPI) under the Payment Services Act (PSA). This allows Airwallex to provide cross-border payment services and foreign exchange transactions in Singapore.

Is Airwallex a bank?

What is the best Airwallex alternative in Singapore?

What are the drawbacks of Airwallex?

Disclaimer

Statrys competes directly with Airwallex in the Hong Kong and Singapore payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.