B2B Payments 101

B2B payments, or Business-to-Business payments, refer to financial transactions between two or more businesses that take place locally and across borders.

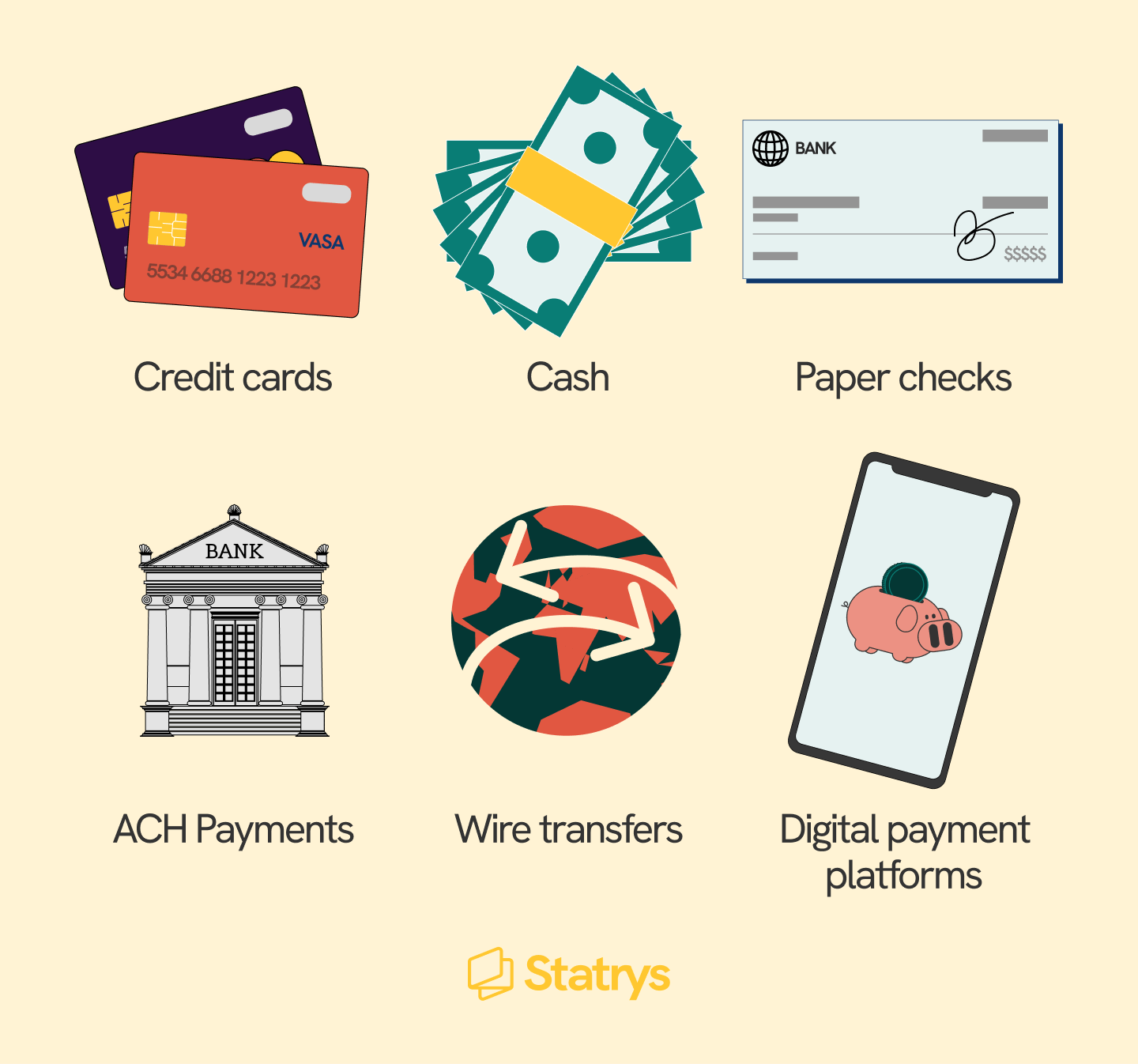

Some popular types of B2B payments are credit cards, cash, paper checks, ACH payments, wire transfers, and digital payment platforms.

To ensure business-to-business payment solutions are done right, consider factors such as using a business account, choosing the right payment portals, and complying with bank rules.

Making a business-to-business payment doesn't have to be as time-consuming and complex as it was many years ago.

In the modern era, paying for goods or services online or making international transfers has never been more convenient. Thanks to the advancement in financial technology, many businesses are exposed to numerous options for faster and more secure payments.

Electronic payments such as digital wallets and ACH transfers offer a better solution to make business transactions locally or across borders with lots of benefits. Yet, with a few different options, how will you determine which solution is right for your business?

In this guide, you will learn all about B2B payments, how it works, and see which types of B2B payments and trends are among the global payment system today.

Let's dive in!

What are B2B Payments?

B2B payments, also known as Business-to-Business payments, refer to financial transactions between two or more businesses. B2B transactions can be local or international and often involve larger payment amounts. Most companies tend to automate these transactions when a payment is made for goods or services to another business with streamlined payment processes.

Popular Types of B2B Payment Methods

There are many types of B2B payment and each type works differently. Below are the popular types of B2B payment methods in 2023.

Credit Cards

Credit cards are considered to be one of the most popular types of B2B payments. Given that every credit card company offers services for individuals and businesses, the payments can be tracked through the electronic statement, which can also be based on a monthly, quarterly, and yearly basis.

In the US, there is a 1.2% increase for businesses in the Credit Card Issuing industry from 2022, proving to be an ongoing trend that supports more startup businesses.

This method of business-to-business payment not only provides a cost-effective solution for businesses, but it is also one of the most convenient ways for many businesses to hold credits while keeping the cash flow efficient without paying instantaneously.

Cash

Cash may feel traditional to some businesses today, however, it is still one of the best and most effective methods for B2B transactions.

For many businesses worldwide, cash remains a solid option due to some of its huge benefits, including no-fee options (such as annual fees for credit cards) and direct payment without any extra charges. Thus, it is a payment method that helps businesses minimize costs effectively.

Nevertheless, there are also some drawbacks when it comes to using cash for business payments. For instance, if your business is low on cash it may hurt your cash flow management. Another reason is that if you're transferring large funds regularly, using cash may be harder to manage than using new, innovative solutions.

💵 Looking for a better way to manage cash for your business? Try these 10 practical tips to help manage your cash flow effectively

Paper Checks

These are considered traditional methods of using electronic payments. Paper checks are still widely used in many businesses today due to their direct approach to making requests for payments from one business to another.

Paper checks require one bank to request payments from another bank when the deposit is made. The two parties involved are the buyer and the seller.

ACH Payments

Also known as Automated Clearing House payments. It is a form of electronic payment that is being used between businesses on a common basis.

According to the National Automated Clearing House Association report for 2022, almost 6 billion business payments were transferred for a total value of $52.53 trillion.

ACH payments are preferred by businesses due to their versatility in managing daily cash flow, streamlining reconciliation, and automation, such as recurring payments.

Wire Transfers

A wire transfer is when a business transfers money electronically for the goods or services purchased or simply makes a deposit to another business. This type of B2B payment is often considered a high-value transaction made between businesses with large amounts.

Wire transfers work differently as there are two main types of transfers: domestic and international payments. For domestic wire transfers, the payment requires information such as the phone number, account number, and personal details of the recipient, whereas for international wire transfers, the two required components are the IBAN and SWIFT/BIC Code.

🔍 Want to know when your money will arrive? See how long a wire transfer takes for a domestic and international transfer.

Digital Payment Platforms

If you have business customers looking for the most convenient way to make B2B payments, digital payment service platforms may be the ideal option.

This type of business transaction enables real-time payments to be made using smart devices with a secure authentication process to make electronic payments.

Here are examples of popular digital payment platforms in 2023:

- PayPal

- Stripe

- Apple Pay

- Alipay

- Venmo

In 2023, using these payment platforms and others will become a popular option for many businesses. Not only do they offer the most convenience, but they are also fast, secure, and efficient for small businesses.

Let's take a look at the trends of B2B payments to help you better understand how global payment systems work, which would be beneficial for your business.

B2B Payments Trends in 2023

Throughout 2020–2021, the world of business payments changed drastically. This is primarily due to the COVID-19 pandemic outbreak.

With this impact, low- to middle-income economies, except China, have seen over a 40% increase in the use of digital payments.

Despite B2B payments being on the rise in the year prior, this represents a higher number of users in online transactions on an overall global scale. However, other interesting trends have emerged as well.

Let's dive into those trends and see how they benefit businesses with global payment systems.

1. Instant Global Secure Payments for Businesses

As cross-border payments present many opportunities for businesses, global payment system trends have changed drastically due to the instant payment systems that enable businesses to transact on a global scale.

Real-time payments not only connect businesses and consumers by using top financial institution payment options, but they also offer an instant and secure way for businesses to make and receive payments online.

Benefits for B2B transactions: as the payment options become more secure and future-proof, payments can be settled more quickly.

2. Decline Paper Checks Usage

As more and more business payments become globally connected, digital and electronic payment platforms are the preferred choice for consumers. Likewise, the decline in the use of paper checks is also becoming a trend for businesses across the globe.

AFP's payment survey has predicted that nearly 60% of consumers will shift towards electronic payment options instead of paper checks in the B2B space. thus providing merchants and suppliers more flexibility in B2B transactions.

Benefits for B2B transactions: Consumers and businesses will benefit most from this scenario as more payments are made online with transparency and security. This will also enable more efficiency between businesses making regular payments, whether locally or internationally.

How does B2B Payment Processing Work?

There are several ways in which B2B payments can be processed. In businesses today, cross-border payments have become one of the primary options through virtual payment platforms.

In essence, two of the most common methods for B2B transactions are wire transfers and global ACH payments.

Let's take an example of how businesses can automate cross-border payments via ACH payments. Here are some steps to keep in mind.

Step 1 - Align with local payment regulations

For every cross-border payment option, each country may have a unique code. For this reason, it is crucial that before processing your payment through the ACH Network, you check for the specific requirements of the country you're making the transaction.

For instance, making a transaction to European countries may require an International Bank Account Number (IBAN), whereas if your transfer is to banks in the UK, you will require the bank's sort code.

💡Tip: Consider verifying the applicable payment rules for your automated ACH payments to ensure every transaction is viable for your international transfer.

Step 2 - Identify your business transactions frequency

Are you sending money across borders with more than one transaction regularly? If this is the case, it may be essential for you to consider saving the time to make each transaction and instead opting for a recurring payment option.

The global payment networks you use will offer you discounts, typically from 1–10% depending on the amount you send each time and how fast you make those transactions. Make sure to prioritize your transactions to ensure your business pays on time and with efficiency.

Step 3 - Use tools to automate your payments

For every business-to-business transaction, creating an invoice is an important part of the process. Not only does this help to ensure that your business payments are on track, but it is also essential that the business you deal with is aligned on the payment terms and due diligence.

Another option would be to implement a tool that automates this process for your business or use a professional invoice template, as this would ensure that every invoicing and billing process is done precisely.

Factors to Consider for B2B Payment Solutions

Understanding how to process B2B payments will help your business find solutions to ease up the process and ultimately automate the way you handle global payments.

Essentially, you will also need to understand some of the factors affecting your B2B payments. Here are factors to consider for B2B payment solutions:

- Banking rules: rules for each bank within each country can vary differently. Thus, understanding what needs to be complied with will help you to align your payment processing systems without fail.

- Payment portals: for whichever entities you may be making a payment to, being aware of the types of B2B payments they support will enable your business to smoothen the transactions.

- Virtual business account: Consider using a business account to save more on transfer fees with large transfers. For example, Statrys Business Account provides local payment transfers like ACH Payments, Telegraphic Transfer, and SWIFT with support for multi-currency.

Bottom Line

B2B payments have evolved significantly in recent years, offering businesses a wide range of options for faster, more secure, and more convenient transactions.

As the trends in 2023 have indicated, real-time payment systems connect businesses and consumers, providing immediate settlement of payments.

When considering B2B payment solutions, it is important to take into account different essential factors. The advancements in B2B payments, evolving digital economy, and emerging trends will be key to your business's ability to thrive and enhance overall operational efficiency.

FAQs

What are B2B payments?

Business-to-Business payments are transactions conducted between two businesses for particular activities. B2B transactions can be done in the form of goods purchased or payments made from one business to another.