The US ecommerce revenue is forecast to grow $490.4 billion from 2023 to 2027, underscoring the importance of online business in the region.

If you are an online business owner in the US or are targeting US customers, accepting digital payments is non-negotiable.

In particular, you should prioritize offering the preferred online payment methods in the US, which include credit cards, digital wallets, and Buy Now Pay Later (BNPL).

This article will explore the best payment gateways for US businesses and provide tips on choosing the right one.

What Is a Payment Gateway?

A payment gateway is a secure channel that connects online stores to payment processors. The gateway validates customers’ financial details, confirms fund availability, and handles the money transfer when they shop online.

Once the gateway finishes reviewing the information, it will approve or deny payment. If approved, the money is transferred to the merchant account; if not, it's returned to the payers.

In this way, both the merchants and the customers are safeguarded during the transaction.

📖Tip: Discover payment basics in our guide on payment gateways and payment service providers.

Next, let’s cover the best payment gateway in the US!

| Best Feature | Notable Accepted Payment Methods | Fees | |

| Backed by Visa, ensuring top-tier security | Cards - Visa, Mastercard®, JCB, Amex, Discover Digital wallet - Apple Pay eCheck PayPal |

0.75% - 2.9% or 10¢ with 10¢ daily batch |

|

|

Global reach | Cards - Visa, Mastercard®, JCB, Amex, Discover, Maestro Digital wallets - Google Pay, Apple Pay QR Code PayPal |

1.9% - 3.49% + fixed fees based on currency |

|

Single integration that allows for one account to sell globally |

Cards — Amex, Diners, Discover, JCB, Mastercard, Visa |

Custom pricing available |

|

| Customizable payment processing | Cards - Visa, Mastercard®, JCB, Amex, Discover, Diners, UnionPay Digital wallets - Google Pay, Apple Pay, Link Buy Now Pay Later - Affirm, Afterpay Bank transfer and other additional payment methods |

0.8% or 2.9% + 30¢ Plus 0.5% - 1.5% for manual entry, international card, and currency conversion, if any |

|

| Most suitable for small businesses Tailored for retail, restaurant, and beauty industry |

Cards - Visa, Mastercard®, JCB, Amex, Discover, and UnionPay intl Digital wallets - Apple Pay, Google Pay, Samsung Pay Buy Now Pay Later - Afterpay |

2.6% - 6% plus 10¢ - 30¢ | |

| A number of Buy Now Pay Later options Omnichannel solution |

Cards - Visa, Mastercard®, JCB, Amex, Discover, Diners, Maestro, UnionPay Digital wallets - Apple Pay, Google Pay, Samsung Pay, Cash App Pay, Alipay, WeChat Pay, Amazon Pay Buy Now Pay Later - Affirm, Afterpay, Zip ACH direct debit PayPal |

USD 0.13 processing fee plus 3%- 3.95% or Interchange ++ |

Note: All information provided is dated 18 September 2023 and may have been updated since. Please check each payment gateway’s website for the latest information.

1. Authorize.net

Now a subsidiary of Visa Inc., “Authorize.net, A Visa Solution” is a major payment service provider that allows merchants to accept various payment methods through its platform. This includes solutions for ecommerce, mobile payments, eCheck, virtual point-of-sale, and billing.

Authorize.net has provided payment processing solutions to over 445,000 merchants and small businesses, handling $149 billion in annual transaction volume.

Authorize.net Key Offerings

- Accepting payments through online channels, telephone, and physical retail locations

- Automated Recurring Billing™ (ARB) feature

- Customer Information Manager (CIM) feature, allowing repeat customers to checkout fast without reentering details

- Digital invoicing with responsive design and report, no integration required

- Creating a simple checkout by copying and pasting their customizable code

- Native iOS, Android, and SDK support

- One of the best APIs, guaranteed by the “Best API Integration" award

- 24/7 Support via Authorize.net support center, chat, call, and form (except on major holidays)

- Support currencies based on business location, including the United States, Canada (USD, CAD), United Kingdom, and Europe (CHF, DKK, EUR, GBP, NOK, PLN, SEK, USD) and Australia (AUD, NZD, USD)

- PCI DSS compliance

- Top-tier fraud detection using Advanced Fraud Detection Suite™ (AFDS)

Authorize.net Accepted Payment Methods

- Credit and debit cards - Visa, Mastercard®, JCB, American Express, Discover

- Digital wallet - Apple Pay

- eCheck

- PayPal

Authorize.net Key Usage Fees

| Fee Type | Amount |

| All-in-One Plan | |

| Set up fee | |

| Monthly fee | USD 25 |

| Transaction fees | 2.9% plus 30¢ |

| Payment Gateway Only | |

| Set up fee | |

| Monthly fee | USD 25 |

| Transaction fees | 10¢ |

| Daily batch fee | 10¢ |

| Other Fees | |

| eChecks transaction fees | 0.75% |

| Contract fee | |

| Early termination fee | |

💡 Tip: If you process over USD 500K/year, you can contact Authorize.net or call 1-888-323-4289 for tailored pricing

Authorize.net Pros & Cons

- Backed by Visa, ensuring high credibility

- Top-tier APIs

- Supports fewer countries compared to competitors

- Does not support PIN-based debit cards. (Only debit cards with logos of accepted card types like Visa or Mastercard® accepted.)

2. PayPal

PayPal is another popular payment gateway that is used by over 400 million people worldwide.

PayPal for Business offers a dedicated suite of merchant services. It comprises financial services where you can apply for cards and loans, business operation products where you can access risk management tools and shipping tools, and payment products where you can securely accept payments online via various channels.

PayPal Key Offerings

- Support 200+ markets and 25 currencies

- Payment links, where customers don't need a PayPal account to make a payment

- Custom online checkout

- Installment payment with the “PayPal Pay Later” feature

- Donation feature

- Invoicing feature

- POS system with “PayPal Zettle,” supporting contactless in-person payment and one-time QR code payment

- Customizable and filterable reports

- Dispute management feature

- Integration with top ecommerce platforms such as Shopify, Bigcommerce, Woocommerce, GoDaddy, Opencart, and Wix

- PalPal’s buyer and seller protection

- PCI DSS compliance

PayPal Accepted Payment Methods

- Credit and debit cards - Visa, Mastercard®, JCB, American Express, Discover, Maestro

- Digital wallets - Google Pay, Apple Pay

- QR Code - Venmo, PayPal, and Third-party integration QR Code

- PayPal

💡 Tip: Need to withdraw sales from PayPal? Check out our guide on how to withdraw money from PayPal.

PayPal Key Usage Fees

| Fee Types | Amount |

| Standard credit and debit card transaction | 2.99% + plus fixed fees based on currency (USD 0.49 for US dollar) |

| QR Code for transactions equal to or below USD 10.00 | 2.4% plus QR code fixed fees based on currency (USD 0.05 for US dollar) |

| QR Code for transactions over USD 10.00 | 1.9% plus QR code fixed fees based on currency (USD 0.10 for US dollar) |

| QR code through third-party integrator | 2.29% plus USD 0.09 |

| PayPal checkout, and all other commercial transaction | 3.49% plus fixed fees based on currency (USD 0.49 for US dollar) |

| Additional percentage for international commercial transaction | 1.50% |

Please refer to PayPal Merchant Fees page for full details.

💡 Tip: Use PayPal Fee Calculator to estimate the fees you may have to pay when invoicing clients through PayPal

PayPal Pros & Cons

- Global reach, with large market and currencies

- Compatible across all top ecommerce platforms

- Complex fee system

3. BlueSnap

BlueSnap’s Global Payment Orchestration Platform allows customers to optimize their global payment processing and use modular value-added services to their benefits. This platform is designed to provide businesses with more control over important aspects of their end-to-end payment stack, allowing functionality to be turned on or off as needed. All of this is available through a single integration to BlueSnap’s Payment API or Hosted Payment Page. Businesses can take advantage of BlueSnap’s global payment capabilities and their Invoicing & Billing solutions to get paid faster or even embed payment functionality directly into their software platform.

A great choice for mid-market and enterprise organizations, BlueSnap’s platform easily integrates with many popular eCommerce platforms, accounting software, and CRM and ERP systems. It also offers a robust feature set, including fraud prevention, unified analytics and reporting, and payment optimization tools built-in.

BlueSnap Key Offerings

- Accept payments worldwide with preferred global payment methods and currencies.

- Pre-built Integrations with major platforms and popular software, including BigCommerce, Chargebee, Sage Intacct, Oracle NetSuite, Zuora and many popular technologies

- Local card acquiring in 50 countries to reduce cross-border fees

- Single integration with one contract and one account to sell globally

- Customized, real-time reporting and payment analytics

- Avalara tax solution to ensure compliance with local requirements

- A built-in, award-winning fraud prevention solution from Kount, an Equifax company

- Peer-to-peer support

- PCI DSS compliance

BlueSnap Accepted Payment Methods

- Credit and debit cards — American Express, Visa, Mastercard, Discover, JCD, China Union Pay, Diners Club, Argencard, BC Card, Cabal, Cartão MercadoLivre, Cartes Bancaires, Cencosud, Dankort, DinaCard, ELO, Hipercard, Interswitch Card, Maestro, Mercury, Nativa, RuPay, Troy, Tarjeta

- Digital wallets — Alipay, Apple Pay, Click to Pay, Google Pay, PayPal

- Bank transfer, including ACH, BECS Direct Debit, Pre-Authorized Direct Debit and SEPA direct debit

- Additional payment methods include Splitit, Boleto Bancário, paysafecard and Skrill

BlueSnap Key Usage Fees

| Fee Types | Amount |

| Quick-start pricing transaction fees | 2.9% to 3.9% + 30¢ |

| Custom pricing | Refer to our pricing page or contact us for more information |

BlueSnap Pros & Cons

- Single integration for one contract and one account to sell globally

- Local card acquiring in 50 countries

- Ability to accept preferred global payment types and currencies

- Built-in tax solutions to ensure compliance with local requirements

- May not be well-suited for startups and small businesses

- Works best for multi-entity businesses

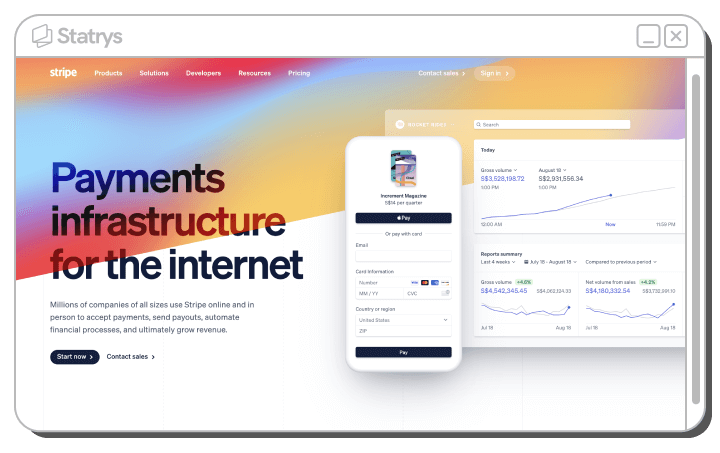

4. Stripe

Stripe enables millions of global businesses, from startups to Fortune 500s, across industries to securely accept payments and manage online operations through its APIs and software.

With a global presence, Stripe has processed hundreds of billions of dollars annually for clients. Big names like Google and Amazon have also used its services.

Stripe provides over 10 different solutions to address various use cases, from ecommerce and subscription business to marketplace and platform.

Stripe Key Offerings

- 135+ currencies

- Over 40 payment methods are readily available without the need for extra integration.

- Generating and managing payment links

- Pre-built and dynamic payment page

- Customizable payment with rich UI building blocks

- Coupons system

- Customizable in-person payment service

- “Stripe connect,” a product designed for platform and marketplace integration.

- Sales tax and VAT automation

- Libraries, APIs, and SDKs

- PCI compliance

Stripe Accepted Payment Methods

- Credit and debit cards - Visa, Mastercard®, JCB, American Express, Discover, Diners, UnionPay

- Digital wallets - Google Pay, Apple Pay, Link

- Buy Now Pay Later - Affirm, Afterpay

- Bank transfer, including ACH payment

- Additional payment methods - Bancontact, Giroplay, Klarna, Sofort, SEPA payment

Stripe Key Usage Fees

| Fee Types | Amount |

| Cards | 2.9% + 30¢ Plus 0.5% for manual entry Plus 1.5% for international card Plus 1% for currency conversion if any |

| Bank transfers | 0.8% (USD 5.00 cap) |

| Other payment method, like Bancontact, Giroplay, Klarna, SEPA | From 80¢ |

Please refer to the full list of fees on the Stripe Pricing page.

Stripe also offers custom payment solutions for businesses with high transaction volumes or unique business models. To get more information, submit your business details on this Contact Stripe Sales page.

💡 Tip: Use Stripe Fee Calculator to estimate transaction fees when using Stripe to accept payment

Stripe Pros & Cons

- Variety of products and use cases

- Offer tailor-made payment solution

- Some features are currently in beta testing or available by invitation only, including Financial Connections and Corporate card

5. Square

Square offers a suite of small business solutions through software and hardware. This ranges from a website builder to a marketing system.

However, its main offering centers around payment processing products, both online and in-person.

Although it is most well-known for its sophisticated hardware and POS system, it provides products catered to online payment systems as well.

Square is trusted by 4 million sellers worldwide.

Square Key Offerings

- Products designed for retail, restaurant, and beauty business

- Operation management across multiple sales channels and locations.

- Omnichannel commerce tool

- Unique virtual terminal options

- Offer interest-free installment for customers

- “Square Customer Directory,” a CRM software used to retain and grow customer base

- “Square Marketing,” a built-in marketing tool with automated email and text campaigns

- PCI DSS compliance

Square Accepted Payment Methods

- Credit and debit cards - Visa, Mastercard®, JCB, American Express, Discover, and UnionPay International.

- Digital wallets - Apple Pay, Google Pay, and Samsung Pay.

- Buy Now Pay Later - Afterpay

Square Key Usage Fees

| Fee Types | Amount |

| Processing online payment fees | 2.9% plus 30¢ per transaction |

| Buy Now Pay Later processing fees | 6% + 30¢ per transaction |

| POS | 2.6% + 10¢ per transaction |

| Afterpay startup costs |

🔎 Tip: For more details, please refer to Square's Pricing page.

Square Pros & Cons

- Extensive POS hardware options

- Streamlined payment solution for small businesses

- No multi-currency option

6. Adyen

Adyen offers a unified solution that handles all aspects of payment processing, as well as financial management and data analysis, giving customers a single integrated system to meet their payment, data, and financial needs.

It aims to connect everything financial in one place and has offered the system to connect online and offline payment data in one system.

Adyen lists prominent names like Uber, eBay, and Spotify as its clients.

Adyen Key Offerings

- Accepting payment online, web, in-app, and pay by link

- “Unified commerce” featuring cross-channel payment data management

- Smart authentication for a fast payment experience

- Send global payout

- Insight from the “Adyen Customer Area” dashboard

- PCI DSS Compliance

Adyen Accepted Payment Methods

- Credit and debit cards - Visa, Mastercard®, JCB, American Expres, Discover, Diners, Maestro, UnionPay

- Digital wallets - Apple Pay, Google Pay, Samsung Pay, Cash App Pay, Alipay WeChat Pay, Amazon Pay

- Buy Now Pay Later - Affirm, Afterpay, Zip

- ACH direct debit

- PayPal

- PaySafeCard

Adyen Key Usage Fees

| Fee Types | Amount |

| Visa, Mastercard®, Maestro | USD 0.13 + Interchange++* (Variable. Typically 0.3-0.4% in Europe but 2% in the US.) *Interchange++ is a pricing model that closely tracks Interchange rates and scheme fees, allowing you to calculate and view each payment's expenses before completion. |

| American Express | Global 3.95% North America 3.3% + USD 0.10 Australia 3.30% + AUD 0.10 Plus USD 0.13 processing fees |

| JCB | USD 0.13 + 3.75% or Interchange ++ |

| Discover and Diners | USD 0.13 + 3.95% |

| UnionPay, Alipay, WeChat Pay | USD 0.13 + 3% |

| Google Pay, Apple Pay, Samsung Pay | USD 0.13 + defined by card use |

| ACH Direct Debit | USD 0.13 + 0.27 |

🔎 Tip: We recommend visiting Adyen Pricing Page for the full details on price.

Adyen Pros & Cons

- A wide range of payment method options

- Stripe’s Capital product, which offers funding, is not available in Singapore.

How to Choose the Right Payment Gateway

Making checkout easy for customers while keeping business costs low and workflows smooth is key. To meet those needs, let's explore what to consider when choosing a payment gateway.

Ensure Robust Security

Security should be the primary concern when handling customer financial data. Look for providers with:

- Strong encryption - Encryption protects sensitive information during online transactions. It turns data, like credit card numbers, into a coded format that only authorized parties can decipher.

- Multiple authentication methods - Authentication is the verification step used to confirm the identity of the customer and the validity of the payment card. This involves entering a password or one-time code, validating the card number, expiration date, CVV, billing address, and issuing bank.

- Active fraud monitoring - Fraud monitoring is the process of analyzing transaction activity, flagging potential fraud patterns, and giving real-time alerts. This can help prevent chargebacks, which are costly and damaging to merchants' reputations.

- PCI DSS standards - PCI DSS stands for Payment Card Industry Data Security Standard, a set of security guidelines encompassing 12 key requirements. PCI DSS aims to protect cardholder data from being stolen.

🔎 Tip: To learn more about securing your ecommerce site, read our article that outlines 11 top security services for protecting ecommerce websites.

The Cost

Selecting a provider that aligns with your budget is crucial for profitability. It’s best to understand all potential costs, such as transaction fees, monthly platform fees, setup fees, chargeback fees, and more.

Among those costs, transaction fees can especially add up over time as payment volume increases, so weigh them carefully against alternatives.

💡 Tip: Get clear quotes for different payment types and always inquire about volume discounts as your business grows.

Verify Compatibility

The best payment gateway needs to be compatible with your existing platforms.

Check if the provider supports the standard integration methods and whether it can be adapted to your payment needs.

To elaborate, you need

- API: The API (application programming interface) allows different software programs to communicate and share data with the platform.

- SDK: The SDK (Software Development Kit) is a code and tools library that developers can utilize to create applications compatible with specific platforms or systems. In this context, it can customize the payment gateway's capabilities.

- Documentation: The documentation comprises guides that explain how to utilize the API and SDK. It’s always wise to review documentation to ensure customization capability before committing to any products.

Having technical assistance and customer support for troubleshooting any unexpected technical issues is also indispensable.

Look for an Intuitive Interface

Around 70% of online shopping carts get abandoned, and one of the reasons people walk away before purchase is a lengthy, complex, eye-sore checkout.

Long story short, you need a clean, intuitive interface and a quick, seamless checkout experience to help ensure a swift process that drives conversion.

A responsive design that works well on different devices and screen sizes will play a role, too, as almost 40% of shoppers are using mobile devices.

At the same time, you want a good user experience and interface in the backend dashboard to be able to easily create a payment page with functionality that matches your vision. That good UX/UI should also make it easy to oversee orders, returns, and reports.

Choose a Provider With Reliable Support

Finally, challenges are a given in payment processing. Expect integration issues, disputes, refunds, unexpected fees, and more.

While avoiding them entirely may not be possible, a capable support team can help you manage these challenges promptly and effectively.

A reliable service provider should provide a knowledgeable and responsive support team accessible through various channels like phone, email, and messages.

Final Thoughts

To summarize our list, Authorize.net takes the top spot, with PayPal, Stripe, Square, and Adyen filling out the top 5 payment solutions.

Regardless of your choice, achieving success in the US market hinges on prioritizing the preferred payment methods. That means accepting major credit card payments and digital wallets, with Buy Now Pay Later (BNPL) options as a valuable addition.

We hope this guide is useful in helping you select the most suitable payment gateway for your business!

FAQs

What are the most popular payment gateways in the US?

Our selection for the most popular payment gateways in the US are Authorize.net, PayPal, BlueSnap, Stripe, Square, and Adyen.