Zempler Bank works for basic business needs, but it may not offer the flexibility or features that a growing business in the UK might require.

If you are using Zempler Bank, then you will find that it’s a solid starting point for handling everyday GBP payments. However, as you grow and take on international clients or need better tools for managing teams, you will start to feel the limits of Zempler Bank's options.

In this guide, we compare 5 alternatives that offer more flexibility, better tools, and support for businesses that are scaling or going global.

What Makes a Good Alternative to Zempler Bank?

So, what should you look for if you’ve outgrown Zempler?

The best alternatives won’t just offer more features, they’ll make it easier to manage your money, support your team, and help you stay in control as your business grows. And they should do that without making things more complicated than they need to be.

Here’s what to look for in a Zempler Bank alternative:

- Multi-currency support – hold, send, or receive in GBP, USD, EUR, and more

- Integrated tools – invoicing, accounting, or bulk payments built in

- Team access – issue cards, set limits, and manage roles easily

- International transfers – lower FX fees or access to local payment rails, faster payments through local methods

- Customer support – fast responses via live chat, phone, or a dedicated manager

- Scalability – flexible pricing plans as your needs evolve, features that grow with your business, like user access, higher limits, or automation

With that in mind, here are our top 5 alternatives to Zempler Bank, and who they’re best for:

| Provider | Best For | Key Advantage Over Zempler Bank | Notable Features |

|---|---|---|---|

| Starling Bank | UK-based businesses wanting full banking features | Overdrafts, cheque deposits, and 24/7 live support | Free UK transfers, FSCS protection, loans |

| Tide | Startups and freelancers needing admin tools | More advanced invoicing, expense tracking, and team features | Instant setup, expense cards, accounting sync |

| Wise | SMEs and freelancers managing international payments | Multi-currency account and low-cost FX transfers | 40+ currencies, mid-market FX, batch payments, no monthly fee |

| Monzo | Sole traders looking for smart budgeting | Streamlined UX and budgeting pots built for mobile | Free UK transfers, invoicing, app-based support |

| Revolut | Scaling teams with international needs | High card limits and multi-currency team management | 34 currencies, role-based access, API tools |

All providers listed support mobile apps, making it easy to manage your business account on the go.

Disclaimer: Information in this article is accurate as of 15 May 2025, but it may be subject to change. We recommend checking each provider’s official website for the latest details.

1

Starling Bank

Founded in 2014, Starling Bank is a fully licensed UK bank offering a digital business account with no monthly fees. It’s a strong option for UK-based sole traders and limited companies looking for a modern banking experience backed by traditional protections.

Business accounts come with FSCS protection up to £85,000, fee-free UK transfers, and the ability to deposit cash or cheques at Post Office branches. The app also provides smart tools like real-time payment alerts, spending categorisation, and budgeting “Spaces.” While Starling supports international payments from a GBP balance, EUR and USD accounts are currently unavailable to new applicants.

Key Services Offered by Starling Bank

- Free GBP business account with Faster Payments and Direct Debits

- International payments in 17 currencies from a GBP balance

- Deposit cheques and cash via the mobile app or Post Office branches

- Optional EUR and USD accounts, currently paused for new applicants

- Invoicing and VAT tools available via the Business Toolkit (£7/month)

- Integrates with Xero, QuickBooks, and FreeAgent for easy bookkeeping

- Lending available, including overdrafts and business loans (subject to approval)

Starling Bank Fees

| Fee Type | Amount |

|---|---|

| Account Setup Fee | Free |

| Send Payments | UK: Free International: £5.50 + 0.4% FX fee |

| Receive Payments | Free for domestic GBP SWIFT: 0.7% (min £0.30, max £5.50) |

| Cash Deposits | £3 or 0.7% per deposit (whichever is higher) |

| Add-Ons | Business Toolkit: £7/month Bulk Payments: £7/month |

| ATM Withdrawals (UK) | Free |

| Card Spending Abroad | Free (uses Mastercard® exchange rate) |

For a detailed breakdown, visit Starling Bank’s business account fee schedule.

Pros and Cons of Starling Bank

✅ No monthly account fee and free UK payments

✅ FSCS protection up to £85,000 as a licensed bank

✅ 24/7 support via app, phone, and email

✅ Optional Toolkit adds useful invoicing and VAT features

✅ Integrates easily with top accounting software

❌ EUR and USD accounts currently paused for new users

❌ Only directors listed at Companies House can access the account; no custom user roles for team members.

❌ Cash deposits incur a £3 or 0.7% fee

❌ Not ideal for international businesses needing multi-currency holding

Starling Bank vs Zempler Bank

| Feature | Starling Bank | Zempler Bank |

|---|---|---|

| FX Transfers | £5.50 per transfer + 0.4% FX fee (GBP only) | No FX support; card FX fee is 2.99% on free plan |

| Multi-Currency Support | ❌ Not supported (EUR/USD paused) | ❌ Not supported |

| Business Lending | ✅ Overdrafts and loans (subject to approval) | ✅ Overdrafts and credit builder included |

| Support Channels | 24/7 live agents (chat, phone, email) | Phone (Go), in-app chat (paid plans), no branches |

| Access & Controls | Limited to company directors (Companies House) | Available to sole traders and limited companies |

| Cheque Deposits | ✅ Supported via mobile app and Post Office | ❌ Not supported |

Tip: Want more details? Check out our full Starling Business Account Review for a closer look at features and fees.

2

Tide

Like Zempler, Tide is ideal for UK sole traders and small businesses, but with more advanced invoicing and expense tools built in. It caters to freelancers, sole traders, and limited companies with features like receipt capture, tax tracking, and easy payment categorisation built into the app.

Launched in 2015 and regulated by the FCA as an electronic money institution, Tide partners with ClearBank to safeguard client funds, offering FSCS protection up to £85,000. While Tide supports SEPA transfers in euros, it doesn’t offer multi-currency accounts, so it’s most suitable for businesses operating mainly in GBP.

Key Services Offered by Tide

- GBP business account with UK sort code and Mastercard® debit card

- Fast online setup with no credit checks required

- Built-in admin tools for invoicing, receipt capture, and expense tracking

- SEPA transfers supported, with EUR auto-converted to GBP

- Integrates with Xero, QuickBooks, FreeAgent, and Sage

- Optional expense cards and cashback on higher-tier plans

- Business loans and savings products via third-party providers

Tide Fees

| Fee Type | Amount |

|---|---|

| Monthly Fees (by plan) |

Free: £0 Smart: £12.49 + VAT Pro: £24.99 + VAT Max: £69.99 + VAT |

| Send & Receive Payments |

Free: 20p per UK transfer Smart: 25 free/month, then 20p Pro & Max: Unlimited free UK transfers |

| Expense Cards |

Free: £5/month Smart: 1 free card Pro: 2 free cards Max: 3–5 free cards |

| ATM Withdrawals (UK) | £1 per withdrawal (all plans) |

| Cash Deposits (UK) |

Post Office: £2.50 + 0.5% per deposit PayPoint: 3% per deposit (min £3) |

| International Transfers (EUR) |

£1 per SEPA transfer + ~0.5% FX fee (Pro & Max may include reduced or waived fees) |

Pricing may vary slightly by plan. Visit Tide’s official pricing page for full details.

Pros and Cons of Tide

✅ No monthly fee on the Free plan, fast onboarding

✅ Handy admin tools like invoicing and receipt capture

✅ Tiered pricing gives access to advanced features as you grow

✅ Expense cards available across all plans

✅ FSCS protection through ClearBank

❌ No multi-currency accounts; EUR is auto-converted to GBP

❌ No SWIFT support for non-SEPA transfers

❌ Per-transaction fees apply on the Free plan

❌ Advanced features are gated behind higher-tier plans

Note: For a deeper dive into Tide’s tools, strengths, and pricing tiers, check out our complete review.

Tide vs Zempler Bank

| Feature | Tide | Zempler Bank |

|---|---|---|

| FX Transfers | SEPA only (EUR auto-converted to GBP, ~0.5% FX fee) | No FX transfers; card FX fee 2.99% on free plan |

| Multi-Currency Support | ❌ Not supported | ❌ Not supported |

| Cheque Deposits | ✅ Yes (via mobile app) | ❌ Not available |

| Admin Tools | Invoicing, tax tools, credit tracking (Pro & Max only) | Invoice generator, savings pots, company registration add-on |

| Team Features | Expense cards, spend controls (paid plans) | Basic access; no full role-based team management |

| Business Lending | ✅ Via third-party partners | ✅ Includes overdraft, credit builder, and travel cards |

3

Wise

Wise (formerly TransferWise) was founded in 2011 and is well known for its international money transfers. Its business account offers a practical option for UK-based SMEs with cross-border payment needs.

While it’s not a full-service bank, Wise supports global transactions with local account details in 23 currencies, access to mid-market FX rates, and no monthly fees. It’s particularly relevant for freelancers, e-commerce sellers, and startups managing international clients or suppliers.

Key Services Offered by Wise

- Multi-currency account with local details in 23 currencies, including GBP, USD, EUR, AUD, and SGD

- Send and receive payments in 70+ countries with low, transparent FX fees

- Batch payments via CSV and integration with Xero, QuickBooks, and FreeAgent

- Virtual and physical debit cards with 0.5% cashback (UK only)

- Secure user access controls for team management

- Fast, fully online account setup and verification

Tip: Read our Wise Business Account Essentials to understand key requirements, limitations, and what to prepare before applying.

Wise Fees

| Fee Type | Amount |

|---|---|

| Account Setup Fee | £45 (one-time) |

| Monthly Fee | None |

| Sending Money | From 0.33% (varies by currency) |

| Receiving Local Payments | Free |

| Receiving SWIFT Payments | Varies by currency (e.g. $6.11 for USD) |

| Debit Card | Free for first card; £3 per additional |

| ATM Withdrawals | Free up to £200/month; 1.75% + £0.50 after |

| Currency Conversion | From 0.33% |

For the most accurate rates, visit Wise’s pricing page.

Pros and Cons of Wise

✅ Multi-currency payments in 70+ countries with mid-market FX

✅ No monthly fee; pay only for what you use

✅ Local account details in 23 currencies

✅ Batch payments and accounting integrations built in

✅ Role-based user access for team management

❌ No support for cash or cheque deposits

❌ No lending or credit services

❌ No live support unless logged in; response times can vary

❌ Some features (like cards or cashback) limited by region

Need more details? Read our Wise Business Account Review for a deeper look at features, fees, and how it compares to other providers.

Wise vs Zempler Bank

| Feature | Wise | Zempler Bank |

|---|---|---|

| Multi-Currency Support | ✅ 40+ currencies, local details in 23 | ❌ Not supported |

| FX Transfers | Mid-market rates, low transparent fees | No FX tools; card FX fee 2.99% on Go plan |

| Local Account Details | GBP, USD, EUR, etc. | GBP only |

| Lending & Credit | ❌ Not available | ✅ Overdraft and credit builder options |

| Support Availability | ❌ No live support unless logged in | ✅ Phone and in-app support (paid tiers) |

| Cash & Cheque Deposits | ❌ Not supported | ✅ Supported at Post Offices (fees apply) |

4

Monzo

For UK-based sole traders and small teams who want a fast, app-first experience, Monzo provides a streamlined way to manage business finances from anywhere.

Founded in 2015 and backed by FSCS protection, Monzo combines a clean interface with tools like budgeting “pots,” real-time alerts, and integrations with major accounting software. While it’s well-suited for domestic operations, it lacks multi-currency support, international transfers are processed via Wise.

Key Services Offered by Monzo

- GBP business account with free UK transfers and Mastercard® debit card

- “Pots” for budgeting and earning interest (1.6% AER on up to £100,000)

- Invoicing and tax automation available on Pro and Team plans

- Integrations with Xero, QuickBooks, and FreeAgent

- Cash and cheque deposits via Post Office or PayPoint

- Mobile payment tools (payment links, QR codes, Tap to Pay)

- 24/7 in-app chat and phone support

How Monzo’s “Pots” Support Smarter Budgeting

Monzo Fees

| Fee Type | Amount |

|---|---|

| Monthly Fees (by plan) |

Lite: £0 Pro: £9/month Team: £25/month + £5 per user after 6 |

| Send & Receive Payments | Free for all plans (UK bank transfers, Direct Debits, standing orders) |

| Expense Cards | Included (physical and up to 5 virtual cards on Team plan) |

| ATM Withdrawals |

Inside UK/EEA: Free Outside EEA: 3% after £200/month |

| Cash Deposits | Post Office or PayPoint: up to £1,000 every 6 months |

| International Transfers |

Sent via Wise: £0.50–£2.68 + up to 1.3% FX fee Receiving: 1% FX fee (capped at £1,000) |

You can view a full list of current fees and plan details on Monzo’s pricing page.

Pros and Cons of Monzo

✅ User-friendly mobile experience with fast setup

✅ Transparent UK pricing and no fees for UK transfers

✅ Budgeting features like pots and scheduled payments

✅ Accounting integrations and invoicing on Pro/Team plans

✅ FSCS protection up to £85,000 for eligible deposits

❌ No support for multi-currency accounts

❌ International transfers rely on third-party integration (Wise)

❌ Business eligibility restricted by industry type

❌ No physical branches for in-person service

Tip: Most Monzo business accounts are opened within a day. For details on eligibility and features, see our Monzo Review or Account Opening Guide.

Monzo vs Zempler Bank

| Feature | Monzo | Zempler Bank |

|---|---|---|

| Multi-Currency Support | ❌ GBP only | ❌ GBP only |

| FX Transfers | Via Wise (fees apply, capped FX rates) | No FX transfers; card FX fee 2.99% on Go plan |

| Cash & Cheque Deposits | ✅ Supported via Post Office/PayPoint and app | ❌ Cheque deposits not supported |

| Admin Tools | Invoicing, pots, accounting tools (Pro/Team plans) | Savings pots, invoice generator, tax tool, company registration add-on |

| Support Availability | 24/7 in-app chat + phone support | Phone (Go), in-app chat (Extra/Pro), no phone on Pro |

| Business Eligibility | Sole traders and Ltd companies (with exclusions) | Broader eligibility including various sole traders |

5

Revolut

If your business is scaling or operating across borders, Revolut offers more advanced features than a typical UK business account, especially for managing teams and multi-currency payments in one place.

Launched in 2015, this UK-based fintech supports role-based access, 34 currencies, and real-time spend controls. Just note that advanced tools like bulk payments and FX forwards are only available on higher-tier plans, and there’s no free tier.

Thinking of applying? Follow our step-by-step guide to opening a Revolut Business Account.

Key Services Offered by Revolut

- Hold, send, and receive in 34 currencies with interbank FX rates

- Local account details for GBP and EUR; international transfers via SWIFT

- Role-based team access, spend limits, and approval workflows

- Integration with Xero, QuickBooks, FreeAgent, Shopify, and more

- 3 physical cards and up to 200 virtual cards per user (metal cards available on higher plans)

- Payment links, QR codes, Tap to Pay, and card reader support

- Optional FX tools (forward contracts and limit orders on higher plans)

Spending Solutions for Scaling Startups

Revolut Fees

| Fee Type | Amount |

|---|---|

| Monthly Fees (by plan) |

Basic: £10/month Grow: £30/month Scale: £90/month |

| Send Payments |

Local: 10–1,000 free per plan (£0.20 after limit) International: £5 per SWIFT transfer |

| Receive Payments |

Local (GBP/EUR): Free Other currencies: 1% FX fee (capped at £1,000) |

| FX & Currency Conversion |

Interbank rate (allowance varies) +1% outside market hours |

| Cards & ATM Withdrawals |

3 physical + 200 virtual cards/user ATM: 2% fee after limit |

Revolut’s four business plans come with varying limits and features. See the full breakdown on their official pricing page.

Pros and Cons of Revolut

✅ Wide multi-currency support and transparent FX rates

✅ Strong spend control tools for teams and departments

✅ Seamless integration with accounting and ecommerce platforms

✅ High card issuance limit per user

✅ 24/7 in-app support in multiple languages

❌No free tier; all business plans require a monthly subscription

❌ Key features (bulk payments, FX forwards) locked behind higher tiers

❌ 2% ATM fee after free monthly allowance

❌ Not suitable for businesses in unsupported industries (e.g. MSBs, high-risk sectors)

Revolut vs Zempler Bank

| Feature | Revolut | Zempler Bank |

|---|---|---|

| Multi-Currency Support | ✅ Yes, 34 currencies | ❌ Not supported |

| FX Rates & Transfers | Interbank FX (plan-dependent) + £5 SWIFT fee | No FX tools; card FX fee 2.99% on Go plan |

| Local Account Details | GBP and EUR (IBAN); others via SWIFT | GBP only |

| FSCS Protection | ❌ No (safeguarded under e-money licence) | ✅ Yes, up to £85,000 |

| Cash Deposits | ❌ Not supported | ✅ Supported at Post Offices (fees apply) |

| Team Access & Controls | ✅ Role-based permissions, approval workflows | ❌ No granular team permissions |

| Pricing Flexibility | Paid tiers only (Basic to Enterprise) | Free and paid options available |

Tip: Curious about how Revolut compares in the market? Read our Revolut Business Account Review for key insights.

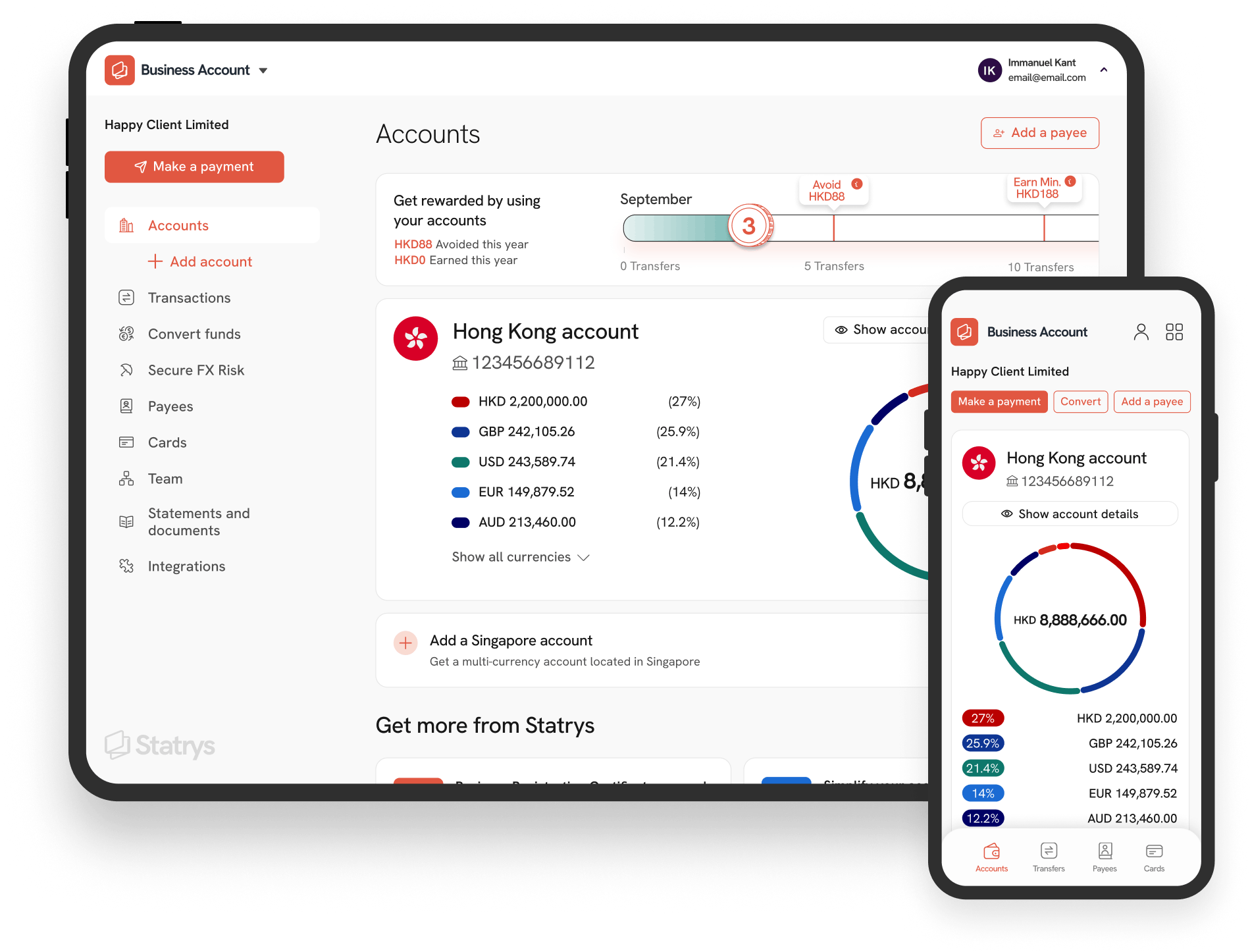

Doing Business in Asia? Consider Statrys

Founded in 2019, Statrys is a licensed payment service provider offering multi-currency business accounts to companies registered in Hong Kong, Singapore, and the British Virgin Islands (BVI).

Unlike most UK-based providers, Statrys supports 11 major currencies, enables local and international transfers, and assigns a dedicated account manager to every client. Accounts can be opened and managed 100% online, with no setup or fall-below fees.

If your business is incorporated outside the UK and needs a reliable solution for managing cross-border payments in Asia, Statrys may be a better fit.

Key services offered by Statrys at a glance:

FAQs

Is Zempler Bank the same as Cashplus?

Yes. Cashplus Bank rebranded as Zempler Bank in July 2024. It continues to operate under the same UK banking licence and regulatory standards.

Can I hold multiple currencies with Zempler Bank?

Is Zempler Bank trustworthy?

What are the best Zempler Bank alternatives?

Disclaimer

Our insights are derived from industry experience and information provided on each provider’s website. While we'd love for you to choose us, what's most important is that you make the decision that's right for you.