Features

Fees

Account Opening

User Reviews

ANNA Money is a UK-based business account built for sole traders, freelancers, and small companies that want simple banking and admin tools in one place. It works as a current account with a UK sort code and account number, supporting domestic GBP payments and letting you send money in a few major currencies, although it does not hold foreign currency balances. Since ANNA is only available to UK-registered businesses, it is generally most useful for small business owners who operate primarily within the UK.

The platform focuses on practical tools for day-to-day business management rather than traditional banking depth. ANNA brings together payments, invoicing, receipt capture, expense management, and light bookkeeping inside the ANNA app, along with automated VAT and tax estimates and optional add-ons for full tax filing and payroll. It connects with popular accounting software and ecommerce platforms and provides 24/7 in-app support.

Key Highlights

Built-in admin and bookkeeping tools

ANNA combines payments with invoicing, receipt capture, expense tracking, and light bookkeeping features inside one app.

Automated VAT and tax estimates

The platform calculates VAT automatically and provides real-time tax estimates, with optional add-ons for Self Assessment, Corporation Tax filing, and payroll.

Virtual and physical cards for team spending

Businesses can issue multiple cards with spending limits and track transactions directly in the app.

Limited multi-currency capabilities

ANNA supports sending international payments in GBP, EUR, USD, and CHF, but does not hold foreign currency balances.

Usage-based fees on incoming payments

The Pay As You Go plan has no fixed monthly charge, although fees such as the 0.95% commission on incoming payments may increase overall costs for high-volume users.

✅ Who ANNA is ideal for

- Sole traders and small businesses that want admin and banking in one place:

ANNA brings together invoicing, receipt capture, expense tracking, and VAT calculations, reducing the need to manage multiple apps. - Startups that want support staying compliant:

Real-time tax estimates, reminders, VAT filing tools, and optional add-ons for Self Assessment and Corporation Tax help new businesses stay on top of obligations. - Teams that need simple card management:

Virtual and physical cards with spending controls make it easy to manage day-to-day expenses across a small team.

🚫 Who ANNA is not ideal for

- Businesses with frequent cross-border needs:

ANNA does not support foreign currency balances and only lets you send payments in four major currencies, which limits international flexibility. - Companies with high transaction volumes:

The Pay As You Go pricing can become expensive for businesses that receive a large number of incoming payments due to the 0.95% fee. - Businesses looking for full-service banking features:

ANNA does not provide loans, overdrafts, cash deposits, or cheque handling. It operates under electronic money regulations rather than offering full UK banking services.

ANNA Business Fees

ANNA uses a three-tier pricing structure: Pay As You Go, Business, and Big Business.

The Pay As You Go plan has no monthly fee, which helps keep fixed costs low for new or low-volume businesses. The paid plans include higher allowances for local transfers, card usage, and ATM withdrawals.

This is also where real cost differences start to show. If your business gets a lot of payments or uses multiple cards, the cheaper plans can run out of free allowances sooner than you might expect.

| Fee Type | Pay As You Go | Business | Big Business |

|---|---|---|---|

| Monthly fee | £0 | £19.90 + VAT | £49.90 + VAT |

| Domestic transfers | Receiving: 0.95% Sending: Free |

Receiving: 0.95% Sending: 60 free per month, then £0.20 each |

Receiving: Free Sending: Free |

| Send International payments | 1% FX conversion fee | 2 free per month, then £5 each | 4 free per month, then £5 each |

| Currency conversion fee | 1% | 1% | 0.5% |

| Expense cards | Unlimited free cards | Up to 5 free, then £3 per card per month | Unlimited free cards |

| ATM withdrawals | Free | 3 free per month, then 1% with £1 minimum | Free |

📌 Extra fees that may apply

See the official ANNA Business pricing page for full fee details.

For businesses that get paid often, the Pay As You Go plan can become expensive because every incoming payment is charged a 0.95% fee. Companies with predictable monthly revenue might find the Business plan a better value because the fixed fee can cost less overall than paying per transaction.

You can send money overseas, but ANNA is not built for regular cross-border use. Because it cannot hold foreign currency balances, you will pay conversion fees every time, which gets expensive fast if you work with overseas clients often.

Most key features are available across all plans, so choosing the right tier mainly depends on your monthly activity. Once you know how often you get paid and how you use the ANNA Money Business Account, picking a cost-effective plan becomes much easier.

ANNA Business Features

All three offer similar core features, but the difference lies in how much you get included for free and what you’re charged extra for.

ANNA is designed for small UK businesses that want banking and admin tools in one place. Instead of switching between different apps for invoicing, expenses, or tax work, ANNA combines these tasks so you can manage day-to-day operations from a single dashboard.

Admin and Tax Automation

ANNA focuses heavily on reducing routine admin. The platform captures receipts, categorises expenses, provides real-time VAT estimates, and generates basic business reports. Optional add-ons cover VAT filing, Corporation Tax, Self Assessment, and payroll.

For many small teams, this setup cuts down on manual work and reduces the need for separate accounting software or extra expense management tools.

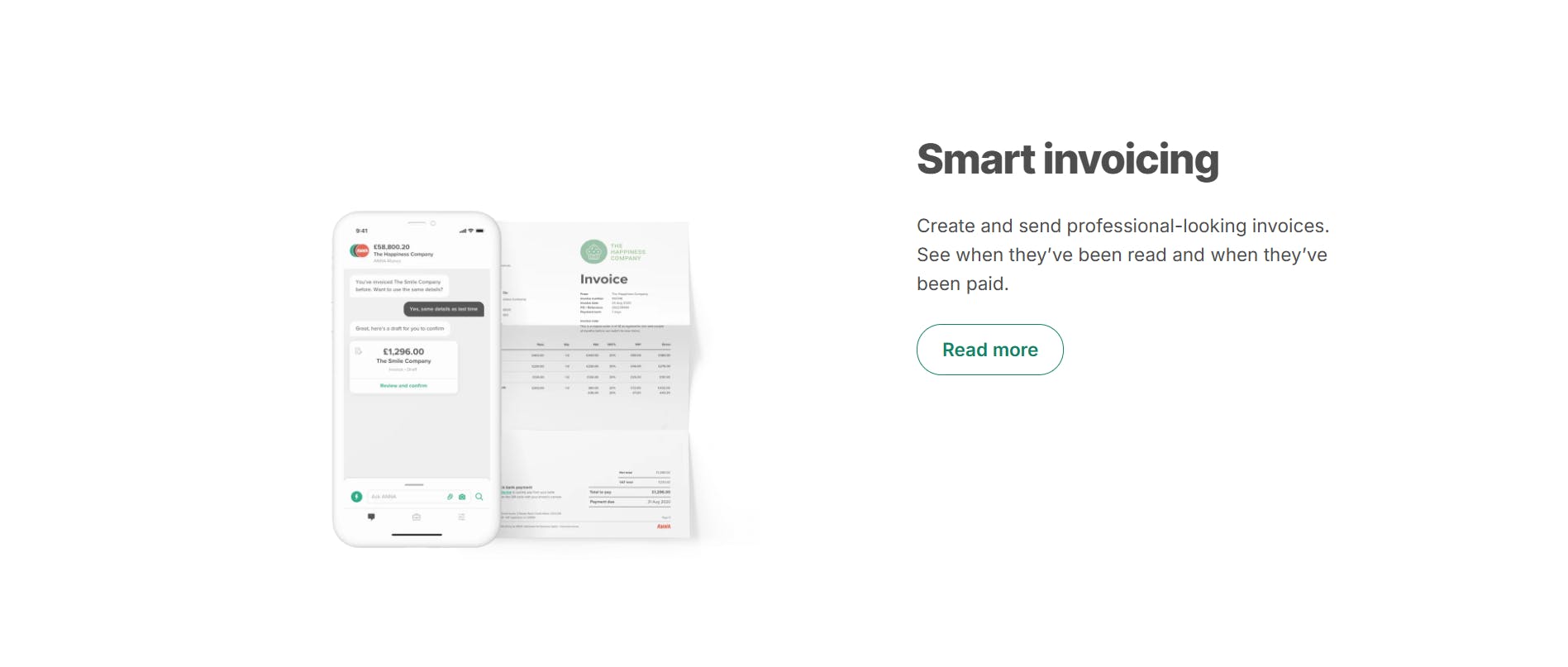

Invoicing and Payments

The invoicing tools are simple to use and integrate smoothly with ANNA’s payments system. You can create invoices, track what’s been paid, and move money into pots for things like taxes or upcoming expenses.

Domestic GBP payments work well, and ANNA also supports international transfers in a few major currencies. However, the account cannot hold foreign currency balances, so it works better for occasional overseas payments than regular cross-border activity.

Cards and Spending Controls

ANNA lets businesses issue virtual and physical expense cards with individual spending limits. These work much like a business debit card, helping teams manage spending without relying on personal cards.

Transactions show up in the app immediately, which keeps records tidy and reduces the need for separate expense software. The instant visibility also helps owners stay on top of account limits and team spending as the business expands.

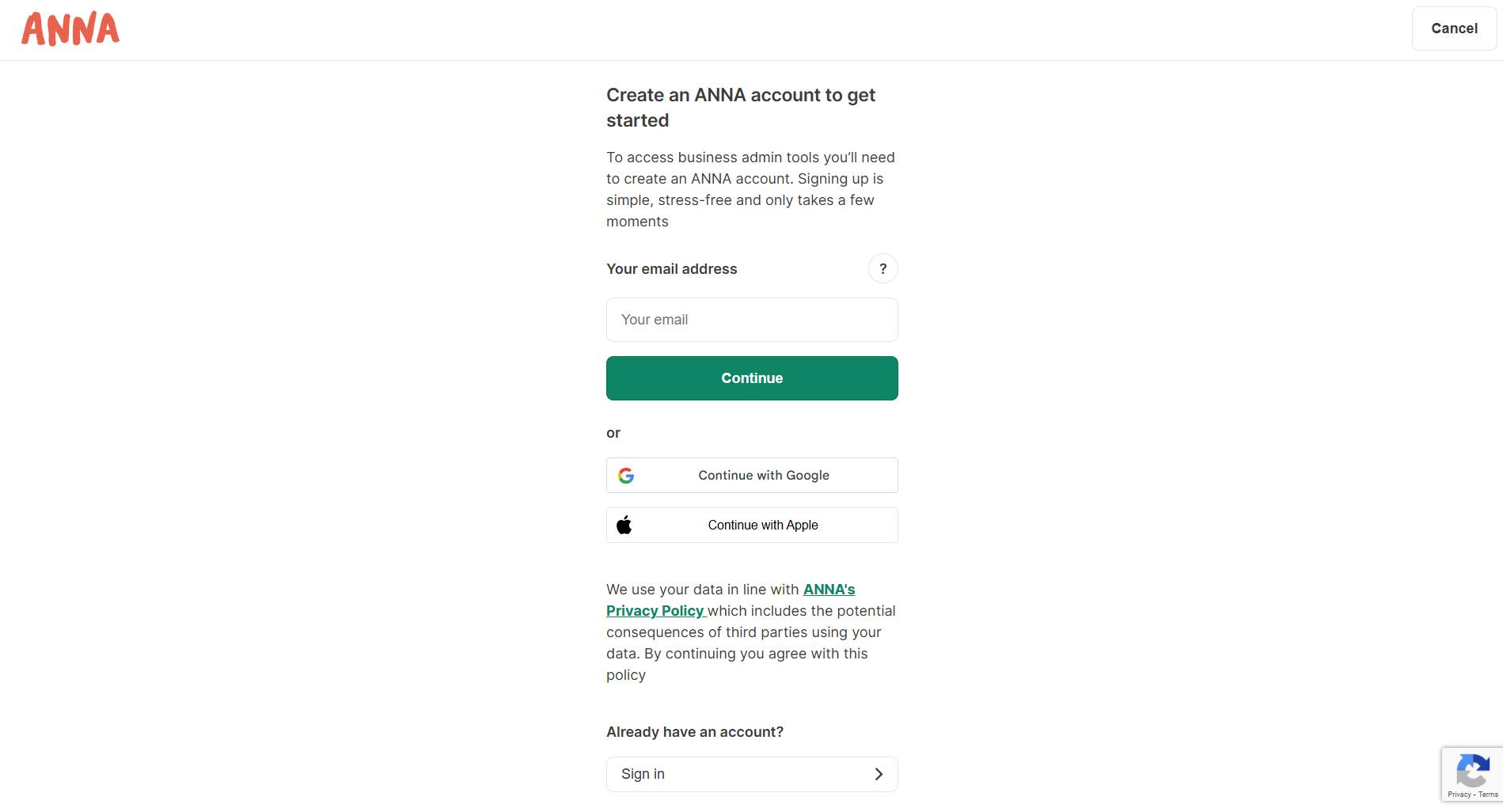

ANNA Business Account Opening

Opening an ANNA Business account is a simple, fully online process. You can sign up through the ANNA app or the website, and most people get through the basics in about ten minutes.

After you enter your business details, verify your identity, and upload a couple of documents, ANNA typically issues your account number and sort code shortly after approval. The physical Mastercard® usually arrives within five working days.

Who Can Open?

ANNA is available to most small UK businesses.

To open an account, you must:

- Live in the UK with a UK residential address

- Be at least 18

- Run a UK-registered business (sole trader, limited company, or LLP)

Some sectors are not supported, including charities, gambling, adult entertainment, cannabinoids, and precious metals.

Also, if your type of business is brand new or operates in a regulated area, ANNA may ask for a bit more information, like a website link, sample invoices, or contracts. This is usually just to clarify how your business works.

Required Documents

The documents you need are simple and depend on your business structure. Most applicants provide:

- A valid passport or UK driving licence

- Proof of address from the last three months

- Basic business details

Additional documents vary by structure:

- Sole traders: UTR letter or another HMRC document

- Limited companies and LLPs: Companies House registration number

- Partnerships: Partnership agreement or a solicitor’s confirmation letter

ANNA may request an extra document later if something needs clarification, but in most cases, approval is quick, and you can start using the account soon after applying.

Trustpilot Review: ANNA

ANNA gets solid feedback on Trustpilot, averaging 4.5 out of 5 from over 4,400 reviews. Many users say the app is simple to use and that onboarding is quick, which gives a strong first impression for small businesses trying it for the first time.

Where ANNA gets the most praise is in customer support. Many reviewers talk about getting replies within minutes and chatting with real people rather than automated bots. Many ANNA customers also highlight the built-in invoicing, receipt capture, and tax tools as genuinely helpful for staying organised without extra accounting software, especially for sole traders.

Most of the complaints relate to account reviews. Some users report temporary freezes or slower payments while credit checks or checks are underway, and a few say the updates during these reviews feel unclear. Others found the document requests at onboarding heavier than expected.

Overall, ANNA gets strong feedback for everyday admin and support. The only thing to watch out for is occasional delays during security checks, especially if your business needs fast access to payments.

Best ANNA Business Account Alternatives

1st Choice

2nd

UK business account with free transfers and smart budgeting tools.

3rd

GBP business account with fee-free UK banking and a strong mobile app.

Why trust us?

This list of alternatives is selected independently based on features, pricing, and suitability for small UK businesses. We do not earn commissions from any of the providers mentioned, and there are no affiliate links. The goal is simply to highlight options that may suit different business needs, depending on the features your business prioritises.

Was this article helpful?

Yes

No

FAQs

Is ANNA a good business account?

ANNA is a good fit for sole traders and small UK businesses that want a simple business account with built-in admin tools. Users rate it highly for ease of use and fast, human customer support. It’s less suitable if you need foreign currency accounts or frequent international payments.

Is ANNA a legit and safe company?

How much does an ANNA Business account cost?

How do I open an ANNA Business account?

Does ANNA support international payments?

Disclaimer

Statrys does not directly compete with ANNA because we do not provide business accounts in the UK. We're committed to providing an unbiased, thorough review to help you make an informed choice.