Key Takeaway

Available to companies registered in the UK, EEA, or US

Must have a physical business presence in one of these locations

Supported company types include Ltd, PLC, LLP, LP, and partnerships

Sole traders and freelancers are not eligible (they can use Revolut Pro)

Revolut Business is a fully-digital corporate account built to help modern companies move fast, simplify payments and scale internationally. They’ve built a strong reputation as one of the most accessible digital banking platforms for businesses and have attracted over 500,000 business customers worldwide.

In this guide, we’ll show you exactly how to open an account, from checking whether your company is eligible to submitting your application and getting your account approved.

Disclaimer: Information in this article is accurate as of 30 September 2025, but it may be subject to change. We recommend checking Revolut’s official website for the latest details.

| Key Information | Details |

|---|---|

| Eligible countries and regions | Over 30 countries and territories, including the UK, most countries in Europe, and the US. Companies must be registered with a physical presence in one of these locations. |

| Eligible company types | • Private Limited Company • Public Limited Company • Limited Liability Partnership • Limited Partnership • Partnership |

| Account opening fee (including company search fee) | GBP 0 and doesn’t require an initial deposit. |

| How long does it take to complete the application? | Within 10 minutes |

| Average opening time | Not specified. |

| 100% online application | ✅ |

Eligibility Requirements

Revolut Business accounts are only available to incorporated companies that can prove a physical presence in the UK, the EEA, or the US. The applicant (business owner or authorised person) must also reside in a supported country.

For Companies Registered in the UK or EEA

You can apply if the applicant resides in:

- The UK and any EEA country

- Australia, India, Singapore and the United States

- Supported territories: Gibraltar, Guernsey, Isle of Man, Jersey, Åland Islands, Azores, Madeira, and Mayotte.

For Companies Registered in the US

You can apply if the applicant resides in one of the following supported countries:

- The United Kingdom or any EEA country

- Australia, New Zealand, Singapore, India, Israel, Japan

- Canada, Mexico, Brazil, United States

- Supported territories: Åland Islands, Azores, Madeira, Mayotte

If Revolut is not yet available in your country, your application will be added to a prioritised waiting list, and Revolut will notify you as soon as it becomes available.

Relevant: Check out our Revolut Business Account Review for comprehensive details about Revolut features, fees, and alternatives.

Eligible Company Types

- Private Limited Company (Ltd)

- Public Limited Company (PLC)

- Limited Liability Partnership (LLP)

- Limited Partnership

- Partnership

Sole traders and freelancers are not eligible to apply for Revolut Business, but they can use a Revolut Pro account to manage their business finances.

See the list of other unsupported company types

Additionally, your business must not be related to unsupported or high-risk industries to be eligible for Revolut Business.

See the list of industries that Revolut doesn’t support

Note: You can open up to 3 business accounts with Monzo, but each must be for a different business.

What Documents Do You Need?

To open a Revolut business bank account, you’ll need to provide documents that prove your identity, your company’s legitimacy, and the nature of your business activity. The key requirements include:

- Identity verification: A valid national ID, passport, full driving licence, or residence permit. (Short-term, tourist, and student visas are not accepted.) You’ll also be asked to complete a video selfie.

- Proof of operating address: For example, a rental agreement of at least 6 months, a utility bill, or a bank statement from a physical bank. PO boxes and virtual addresses are not accepted.

- Proof of business activity: Evidence showing what your company does, such as a link to an active website or online sales platform, a recent (within 6 months) client contract, proof of regulation, or supplier invoices.

- Company registration documents: Certificate of incorporation or business registration, plus supporting documents like the Articles of Association, Partnership Agreement, or Audited Annual Report.

- Ownership details: A document listing all directors and shareholders with more than 25% ownership.

Revolut may request additional information depending on your business type or industry. Any extra requirements will appear directly in your application menu, with guidance from an onboarding agent if needed.

Steps To Open a Revolut Business Account

Opening a Revolut Business account is a 100% online process that can be done within 10 minutes through the website or the Revolut app. While the process is straightforward, here’s an overview of what to expect.

Step 1 - Sign Up

The first step is to head to the Revolut Business page and click "Sign up" or “Get Started”.

Alternatively, you can get the Revolut Business mobile app from the App Store or Google Play Store. Make sure to download the Revolut Business app (with a black background), not the personal one (with a white background).

Once downloaded, simply click on "Sign up" within the app.

Step 2 - Fill out a Short Online Application Form and Create a Password

After clicking "Sign up," you'll be prompted to choose your country of incorporation and your corporate structure.

Following that, either enter your email address or sign up using your Google or Apple account and provide your phone number for a six-digit verification code.

After verifying your phone number, then set up your account password.

Step 3 - Provide Your Personal Information

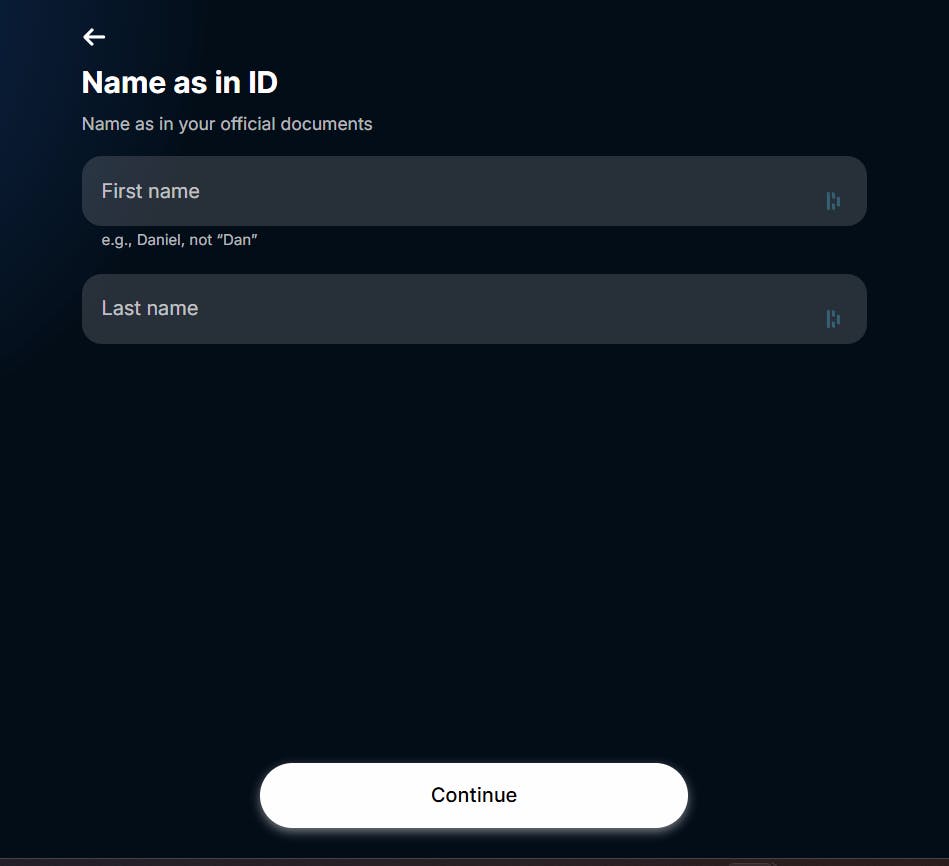

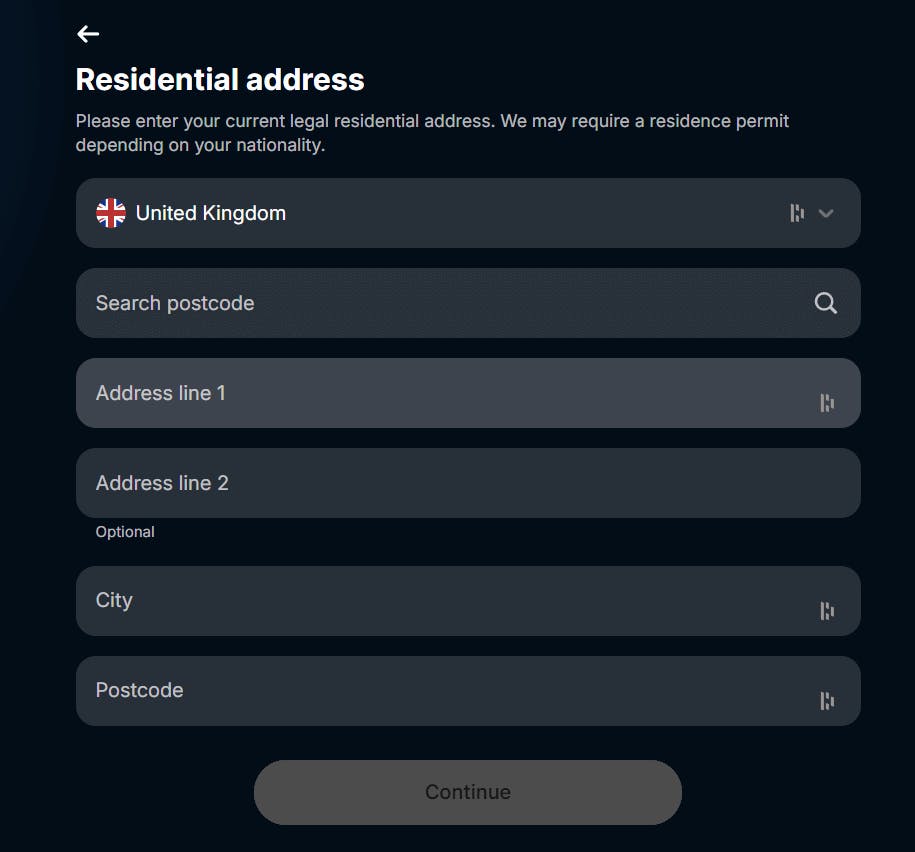

Next, Revolut will ask you to provide the following information:

- Your full name

- Your date of birth

- Your residential address

Tip: If you already have a Revolut Personal account, you can use the same email, and Revolut Business will automatically retrieve your personal details.

Step 4 - Provide Business Information and Fundamental Documents

In this step, share your company details, such as the registration number and tax address. Revolut requires you to upload specific documents to activate your business account, including a personal ID, business plans, and incorporation documents.

Not a director or shareholder? You’ll need proof of authorisation to open an account on behalf of the business.

Step 5 - Join a Short Queue and Provide Additional Documentation

After submitting your application, you will enter a brief queue. Revolut will review your application, typically within 24 hours. However, approval times may vary depending on the complexity of your application and any additional documents required.

Revolut will contact you if there are any additional steps or requests for documents.

H3: Step 6 - Receive Account Details

Once your application is approved, you should be able to access your new business account and start using the Revolut Business app.

Revolut Business account holders registered within the UK should have access to the following accounts:

- A GBP account details with a sort code and account number for GBP payments

- An EUR account details with an IBAN number for EUR transfers within the EEA

- A SWIFT account for international transfers.

Once set up, you can begin adding funds to your account!

Need Help During the Process?

Have a Business in Asia? Try Statrys

While Revolut is a great option for businesses focused on the UK and European markets, as your business expands, you may need an additional account that better fits your needs. If you're looking to grow in the Asian market, consider Statrys.

Statrys is a licensed payment service provider in Hong Kong, offering payment solutions to companies in Hong Kong, Singapore, and the British Virgin Islands (BVI). These include multi-currency business accounts, low-cost international payments, and competitive exchange rates to support global business growth.

With Statrys business account, you can:

- Hold and manage 11 major currencies: HKD, SGD, GBP, USD, EUR, AUD, CAD, CHF, RMB, JPY, and NZD.

- Send low-cost international payments to 120+ countries.

- Access a competitive exchange rate with a fee starting from 0.1%

- Issue multiple virtual debit cards for purchases and ATM withdrawals worldwide

- Get personalised support from a dedicated account manager, available via phone, WhatsApp, or WeChat

Unlike Revolut, which relies mainly on in-app support, Statrys ensures every client has personal guidance and responsive service whenever they need it.

FAQs

Can I open a business account with Revolut?

Yes, Revolut offers business accounts for companies registered and operating in multiple countries and regions, including the UK, most European countries and the US.

How Long Does it Take to Open a Revolut Business Account?

How Much Does It Cost to Open A Revolut Business Account?

What is the difference between Revolut and Revolut business?

Can I open both personal and business accounts with Revolut?

Is Revolut a bank?

Disclaimer

Statrys does not directly compete with Revolut because we do not provide business accounts in the UK, EU, or US. We're committed to providing an unbiased, thorough review to help you make an informed choice.