Airwallex and Aspire have both made bold claims when they compared themselves against each other. They’re highlighting what they do best, downplaying their weaknesses, or even not mentioning them.

That’s fair game in marketing, but that’s not helping business owners who are trying to make a real decision.

This comparison aims to give you an unbiased view of where these platforms deliver and where they fall short. We’ll lay out the numbers, the features, and the user experiences in plain terms so you can judge for yourself which provider is better for your business.

Disclaimer: The information in this article is accurate as of 18 September 2025. Please note that these details are subject to change. We recommend checking with Airwallex and Aspire for the latest information.

At a Glance

To save you time, here’s a snapshot of the key takeaways to help you decide.

Choose Airwallex If:

- You’re expanding internationally and need to manage payments in many currencies.

- You run an ecommerce or online business collecting from customers abroad.

- You prefer simple pricing with no monthly fee

Pros of Airwallex

✅ Wide global reach with 20+ supported currencies

✅ Free local transfers in 100+ countries

✅ Strong integrations for global ecommerce

Cons of Airwallex

❌No payroll for local staff

❌No ATM card access

❌ No phone line

Choose Aspire If:

- You primarily operate in Singapore or Southeast Asia and require PayNow support.

- You want to manage staff spending with unlimited cards and cashback.

- You’re growing a lean business and prefer predictable costs.

Pros of Aspire

✅ No monthly account fee

✅ Unlimited cards with 1% cashback

✅ Built-in payroll and PayNow support

Cons of Aspire

❌ Only supports SGD, USD, GBP, and EUR

❌ No dedicated account manager

Business Account Features Comparison

| Features | Airwallex Singapore | Aspire Singapore |

|---|---|---|

| Main Product Offering | A platform combining multiple local accounts, with advanced business tools. | Business account with expense management tools. |

| Supported Currencies in the Accounts | 20+ currencies, including GBP, HKD, AED, AUD, CAD, CHF, EUR, JPY, NZD, SGD, and USD | 4 currencies: SGD, USD, GBP and EUR |

| Send Funds | To 200+ countries (local + SWIFT networks) | To 130+ countries |

| Receive Funds | From 180+ countries | From 130+ countries |

| PayNow | Beta phase | ✔️ |

| International Payments | ✔️ | ✔️ |

| Payment Acceptance Tools | No-code payment gateway, payment links, and invoices | Payment links and invoices |

| Batch Payment | ✔️ Up to 1,000 payees | ✔️ Up to 1,000 payees |

| FX Features | ❌ | ❌ |

| In-house Payroll Processing | ❌ | ✔️ |

| Integration | Xero, Sage, QuickBooks, NetSuite, Amazon, Lazada, Shopify, and more | Xero, QuickBooks, NetSuite, Amazon, TikTok, Shopee, Stripe, PayPal and more |

If you’re growing into new markets and need to manage many currencies, Airwallex is the stronger choice. If you mainly need to pay staff, manage suppliers in Singapore, and keep daily finances organised, Aspire’s built-in tools would be your better fit.

Tip: Looking for a deep dive into Aspire App? Check out our review of Aspire Singapore.

Business Account Fees Comparison

| Fees | Airwallex Singapore | Aspire Singapore |

|---|---|---|

| Account Opening Fee | Free | Free |

| Account Monthly Fee |

Explore: SGD 0 Grow: SGD 79 Accelerate: SGD 399 |

Free |

| Receive Local Payments |

0.6% for KRW and VND payments 0.3% for PHP payments Free for others |

Free |

| Send Local Payments | Free (to 100+ countries) | Free for SGD payments only |

| Receive International Payments (SWIFT) |

0.6% for KRW and VND payments 0.3% for PHP payments Free for others |

SGD 35 (collected in SGD account) USD 8 (collected in USD, EUR and GBP accounts) |

| Send International Payments (SWIFT) |

SGD 20 (SHA) SGD 35 (OUR) |

USD 15 (SHA) USD 30 (OUR) |

| FX Fee |

0.4% above interbank rate (major currencies) 0.6% above interbank rate (other currencies) |

From 0.22% (for instant conversion) From 0.23% (when sending payments) From 0.7% (when receiving payments) |

If your business sends or receives large volumes internationally, Airwallex’s pricing may be more cost-effective. If most of your payments are local and you prefer to avoid monthly fees, Aspire would be a better fit for you.

Tip: Read our in-depth Airwallex Singapore review to learn more.

Card Features and Fees

| Card Features | Airwallex Singapore | Aspire Singapore |

|---|---|---|

| Card Type |

Company card: Virtual Visa debit card Employee card: Physical and virtual Visa debit card |

Virtual and physical Visa debit cards |

| Card Base Currency | 11 currencies, including AUD, SGD, HKD, GBP, USD, EUR, JPY, CAD, NZD, CHF, and ILS. | SGD and USD |

| Number of Cards |

Company cards Explore: max. 10 Grow: max. 50 Accelerate: Unlimited Employee cards: Not specified |

Unlimited virtual and physical cards |

| Payment Limit | Default limit of USD 50,000 or equivalent (adjustable) | USD 250,000/day (adjustable) |

| ATM Withdrawal | ❌ | ✔️ ATMs outside Singapore only |

| ATM Withdrawal Limit | N/A | USD 500/day |

| ATM Withdrawal Fee | N/A | USD 5 (processing fee may apply) |

| Card FX Fee | Based on Visa’s FX fee | 1.5% |

| Monthly Card Fee | Free up to 5 active users Then SGD 5/user/month |

Free |

| Apple and Google Pay | ✔️ | ✔️ |

| Cashback | ❌ | 1% on eligible transactions |

Airwallex works best if managing international spending is your priority. Aspire is better if your focus is on daily team expenses and earning rewards.

Account Eligibility and Setup Comparison

| Criteria | Airwallex Singapore | Aspire Singapore |

|---|---|---|

| Business Type Eligibility | All business types | All business types |

| Eligible Countries | Available in 50+ countries, including Hong Kong, China, Singapore, the US, the UK, and Australia | 19 countries, including Singapore, Hong Kong, Australia, New Zealand, China, Japan, and Taiwan |

| Registration Channel | 100% online application via website | 100% online application via website |

| Approval Time | Within 3 business days | Within 3 business days |

If your company is registered outside Asia, Airwallex offers broader eligibility, while Aspire mainly focuses on Singapore and nearby markets.

Customer Support

| Support Type | Airwallex Singapore | Aspire Singapore |

|---|---|---|

| Dedicated Account Manager | Available only on the Accelerate plan | ❌ |

| Communication Channels | Help centre, contact form, email, chatbot, regional phone lines (China only) | FAQ pages, in-app chat, email, phone, WhatsApp |

| Working Hours | 9:00–18:00 CST (for China-based customers) | 9:00–21:00 (UTC+8), Monday to Sunday |

Aspire provides you with additional ways to reach support, including phone access. Airwallex offers dedicated account managers, but only for customers on the top-tier plan.

User Reviews & Ratings

| Rating & Reviews | Airwallex Singapore | Aspire Singapore |

|---|---|---|

| Trustpilot Score | 3.6/5 (2,088 reviews) | 4.2/5 (127 reviews) |

| Common Praise | Helpful customer support, competitive fees, and an easy-to-use platform. | Responsive support, fast onboarding, and 1% cashback on eligible transactions. |

| Common Complaints | Unclear communication on pricing changes. | Removal of the IDR accounts (limited currency support) |

Airwallex has a much larger pool of reviews, but with mixed feedback, especially around pricing changes. Aspire’s ratings are higher and more consistent, though based on a smaller number of reviews.

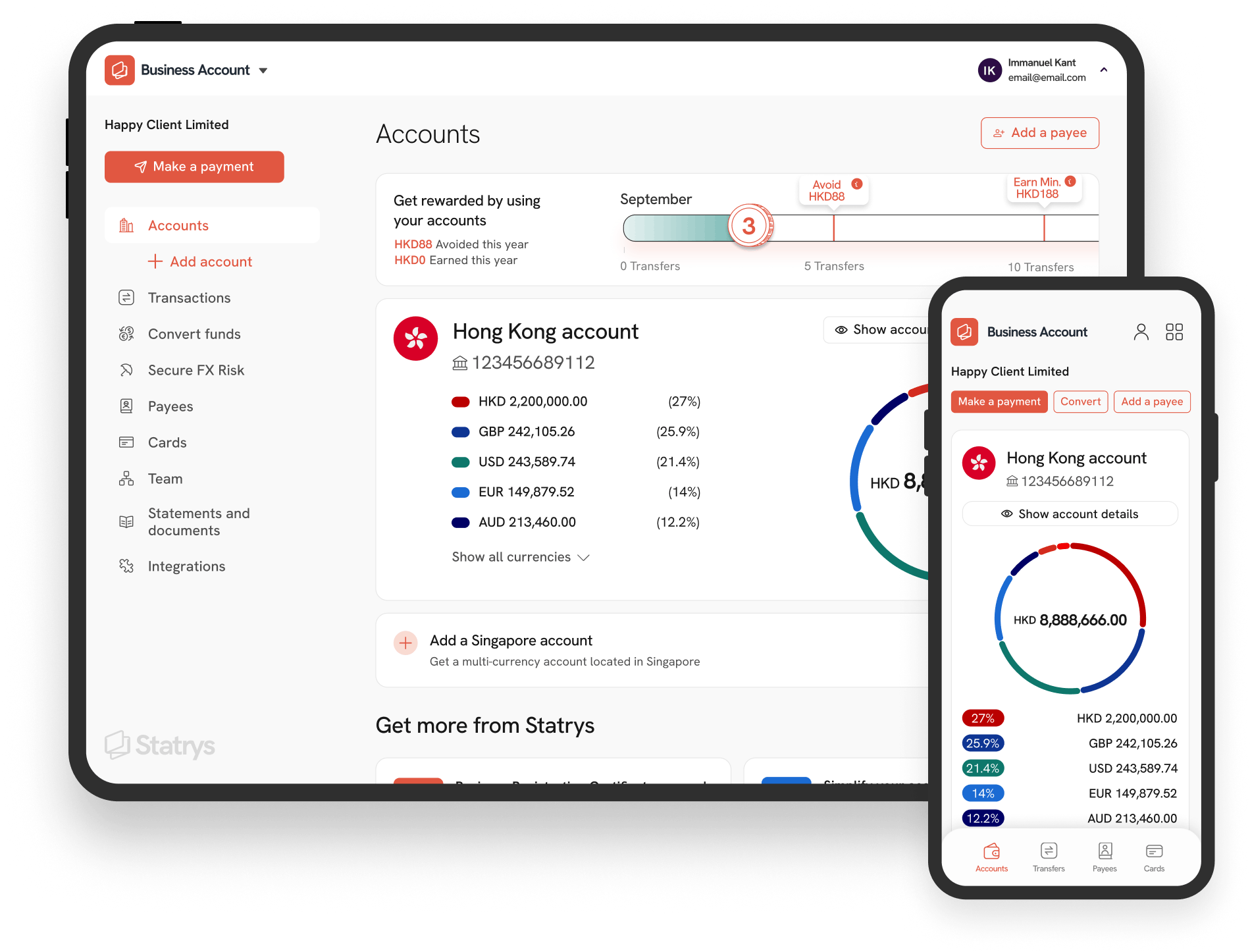

Alternative Solution: Statrys

If Airwallex or Aspire doesn’t fully match your needs, Statrys is a viable alternative to consider.

Founded in 2019, Statrys is a Money Service Operator in Hong Kong that aims to simplify global payments for SMEs. Statrys’ offerings include:

- Multi-currency accounts covering 11 major currencies

- Local payment capabilities in 12 currencies, including SGD, HKD, USD, EUR, GBP, and CNY

- Competitive FX fees starting from 0.1% above the mid-market rate.

- Dedicated account manager for every account.

Trusted by over 5,000 businesses worldwide, Statrys has helped companies simplify their cross-border finances and focus on growth.

FAQs

What is the difference between Airwallex and Aspire?

Airwallex offers a global solution with multi-currency accounts, local bank details, and international payments for businesses scaling globally. Aspire is more regionally focused, offering expense management and payroll solutions primarily for Southeast Asian SMEs.

Is Airwallex better than the Aspire App?

Do both Airwallex and Aspire App provide business debit cards?

Disclaimer

Statrys competes directly with Airwallex and Aspire in the Hong Kong payment industry, but we're committed to providing an unbiased, thorough review to help you make an informed choice.