Key Takeaways

A receipt book is a collection of receipt templates that businesses could use to fill out details of the purchase and give to their customers as proof of purchase.

A receipt book can be used to track transactions and as evidence in case of disputes, as it includes essential information such as transaction date, product purchased, and price.

Consistent record-keeping and properly filled-out receipt books help businesses operate smoothly and efficiently.

With digital solutions on the rise, you might think that receipt books are outdated. Although it is convenient to issue e-receipts or e-invoices for your customers, keeping a receipt book is still an efficient way to keep track of your business's financial records.

For some industries, a digital receipt is not sufficient for accounting or tax purposes, and it is crucial to know how to fill out a receipt book correctly.

Whether you are thinking of setting up a new business or are an existing business looking to change your receipt handling processes, this article will guide you through everything that you need to know about receipt books, including the what's on a receipt book template, how to fill out one, and tips to make it easy.

What Is a Receipt Book?

A receipt book is a book filled with detachable receipt templates. The vendor can fill out a receipt when a customer pays for goods or services as proof of payment.

Usually, receipts in a receipt book would have pre-assigned receipt numbers and headings so that the vendor could simply fill out the details of the items purchased.

On average, one receipt book contains between 50-200 receipts, and each page in the receipt book includes both paper and carbon copy forms. The colors for the copies vary between yellow and blue, while the original receipt would be white. Each color differentiates which receipt the vendor would keep, while the other is for the customer. Typically, the customer would get the original white copy.

💡 Tip: To keep track of your sales efficiently, you should consistently retain the exact version of the copy from the receipt book, whether colored or white, to ensure organized accounting.

Why Is It Important to Keep a Receipt Book?

A receipt book is a handy way to manually keep track of your business's sales and expenses, especially if you're running a small business.

For example, if you are selling multiple items per day, using a receipt template from a receipt book helps in recording the items and quantities sold. The formatted receipts also make accounting and inventory management easier and more organized.

For many industries, including retail and service-based businesses, a receipt book is a practical way to record transactions and to provide customers with physical proof of purchase directly after they have made a payment. It could help the seller to confirm that they are charging the right amount and the buyer to check the details of their payment.

Apart from providing proof of purchase, a receipt book is a useful tool for seamless financial management. It allows businesses to track not just sales but also payments received, expenses, and additional charges such as taxes or service fees. This detailed tracking is essential for creating accurate financial statements and calculating taxes. By maintaining a well-documented receipt book, businesses can ensure financial clarity and accountability.

Where Are Receipt Books Commonly Used?

With the advancements in Point of Sale (POS) systems and other receipt processing technologies that can automatically generate receipts, immediate manual receipt entry in receipt books is no longer necessary for most businesses.

However, for small businesses such as retail stores, food stalls, and coffee shops, or service-based businesses like maintenance services, event planners, and hair salons, a handwritten receipt is still a primary way to record transactions.

As receipt books help companies track business expenses and incomes, they are useful for tax and accounting purposes. Receipt books are also a convenient choice for businesses that need to issue receipts on the spot without relying on electronic systems or printers.

What Are the Differences Between an Invoice and a Sales Receipt?

The main difference between an invoice and a receipt is when and why it is issued. An invoice requests payment from the customer for goods or services purchased, while a receipt is written proof that the purchase has been completed and paid.

| Invoice | Receipt | |

| Purpose | Request payment | Acknowledge and confirm payment |

| Timing | Issued before payment | Issued after payment |

💡 Tip: Understanding how to make an invoice is also an important key to efficient accounting management.

Legal Implications of Receipt Books

While receipt books are a practical tool for recording transactions, they also have significant legal implications. In many jurisdictions, businesses are required by law to provide a receipt for every sales transaction. These receipts serve as proof of purchase for customers and are essential for tax purposes, and businesses can face legal penalties if they intentionally avoid providing receipts of payments.

How to Fill Out a Receipt Book?

As receipt books provide pages of blank receipts, it is crucial to understand how to write a receipt or fill out a receipt book in order to ensure that the records are accurate.

Here's the essential information you need to include when filling out a receipt book:

Step 1: Date of the Transaction

The first crucial step is to write the exact transaction date to keep a record of the payment made or received. The date should be clearly visible on the top corner of the receipt.

Step 2: Contact Information

If you don't have your company name, address, and company phone number pre-printed on the receipts in the book, make sure to include this information on the receipt. You can also include the same details about the customer.

Step 3: Description of Products

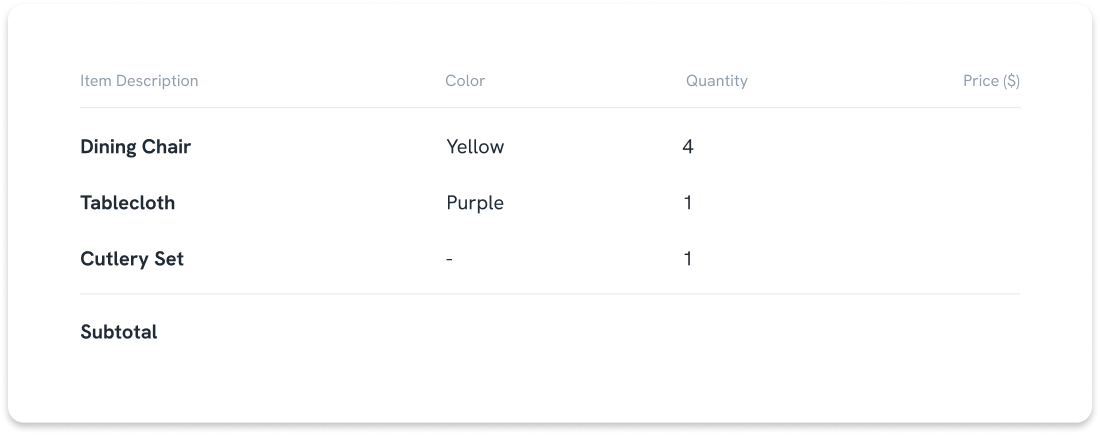

Provide details of the products that your customer purchased, including size, quantity, color, and more, if relevant. The items should be listed separately in the table provided in the receipt, like the example below:

Step 4: Price

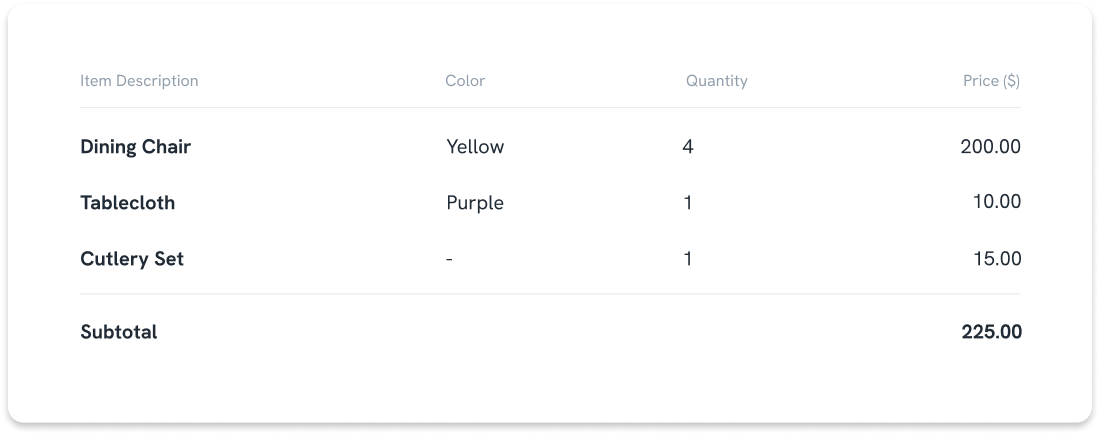

It is crucial to include the price on the receipt when filling out a receipt book, as this information is essential for accounting purposes. If you sell more than one of the same items, you'll have to multiply the unit price by the quantity sold to calculate the total.

You can see an example below:

For example, the price per unit of a dining chair is $50. You've sold 4 chairs, making the total cost $200.

Step 5: Applicable Taxes or Fees

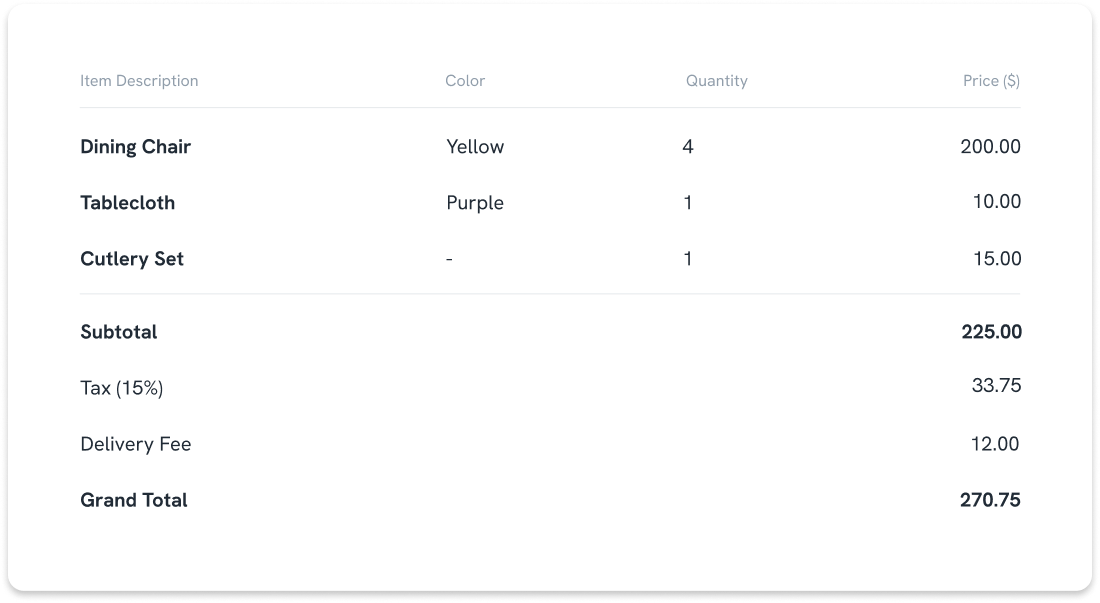

After filling out all the details, it is essential to include other additional expenses, such as applicable taxes, fees, or discounts, then calculate the grand total, which is the amount the customer has to pay. It is also optional to record the payment method.

Make sure to write down the subtotal amount separately from the grand total to avoid confusion and to ensure your customers know the details of their payments.

Let's take a look at what a complete receipt page should look like.

Who Gets Which Copy From a Receipt Book?

After filling out the receipt, you should detach it from the book and give it to the customer. Typically, the customer receives the original receipt, which is the white paper on top, while the business keeps the duplicate or carbon copy, usually printed on colored paper. For the carbon copy, you could store it within the book to prevent misplacement.

There are also carbonless receipt books that have been specially treated to transfer the contents of the first page onto the second page.

💡 Did You Know? Different industries might use different types of receipt books.

For example, a rent receipt book is more widely used in the real estate industry. Instead of the product details, it contains information such as payment date, payment method, and rent amount.

Tips for Filling Out a Receipt Template

Writing receipts from a receipt book requires more caution than automatic receipts generated with a POS system. Although there are chances for errors, they are avoidable.

Let’s review some useful tips to fill out a receipt template efficiently.

- Always make two copies when a customer makes a purchase. One will be for you to keep as a sale record, and the other is a customer copy for the customer as proof of purchase.

- Always fill out receipt book pages with black or blue ink pen; do not use pencils or ink that are erasable.

- Make sure each manually filled-out detail is legible. Always make the details of the transaction clear for you and your customers.

- Always sign each copy to make the receipt official.

- Avoid common mistakes such as leaving out the date or receipt numbers, as these are crucial information for payment tracking and providing transaction transparency.

If you don't have a receipt book at hand, you can make your own one by creating a receipt template with software such as Microsoft Excel. But usually, you can purchase one at any office supply store or online.

In case you create receipts by yourself, make sure to print out another copy for your business to keep as well.

Don’t Miss These Details

For a professional-looking receipt, you could include the following information, which you might notice is included in most digital receipts:

- Company name and company logo

- Company phone number or email

- Payment date and time

- Receipt number

- Additional fees or sales tax

- Brief description of the product/s or service description

- Payment method (cash, cheque, or credit/debit card)

Streamline Your Receipt Book Process

In today’s digital age, integrating technology into your receipt management can streamline your business’s operations. You could try digital receipt apps and software to automate receipt generation and simplify sales and expense tracking.

How Detailed Should a Receipt Template Be?

The details you should include on a receipt template vary depending on what goods or services your business provides. For example, for non-refundable, one-time purchases, receipt templates will only need to include the basic details of the purchased items, such as quantity and price, to be valid.

💡 Tip: If you’ve made minor mistakes, such as misspelling on your receipts, you could make corrections and initial them. But for major errors, it is better to create a new receipt and mark the old one as void.

Bottom Line

It is crucial for businesses to know how to correctly fill out receipt book pages because it is a valuable document that provides customers with detailed proof of purchase. Additionally, receipt books help businesses track transactions and sales.

FAQs

Are receipt books still relevant today?

Yes, receipt books are still used and relevant today, even with the advancements in invoicing and POS systems. It is always good for a business with a brick-and-mortar setup to have a receipt book handy in case any of its receipt processing technology fails.