What Is the Difference Between an Invoice and a Receipt?

The main difference between an invoice and a receipt is their purpose of issuing. While invoices are used to collect outstanding payments, receipts are issued after the transaction is completed.

As a business owner, both invoices and receipts are a pivotal part of managing your finances and tracking sales records efficiently. Having an organized receipt and invoice management helps you identify how much your business is owed and what has been paid.

Without these documents, it would be challenging to maintain accurate accounts, manage cash flows, work out taxes due, estimate business budgets, and keep track of how your business is performing. Understanding the differences between an invoice and a receipt is a crucial skill for a business owner to utilise each of them effectively.

Whether you just started issuing these two documents or your customers requested them, you might have questions like: What are the differences between an invoice and a receipt? Can an invoice be used as a receipt? How do you format a receipt?

This article will cover the key differences between receipts and invoices, including how to create each and how to use them effectively to boost your business's performance.

What Is an Invoice?

An invoice is a document that companies issue to collect customer payment for the goods or services rendered. It provides details of the purchase, including product description, price, payment terms and conditions, payment method, due date, and more.

Apart from being used as a formal request for payment, an invoice is pertinent in the accounting process as a tangible record of sales.

Invoices are:

- Used to request payment

- Used to inform the amount that is due to be paid for the purchase

- Issued after the delivery and before the payment

- Not necessary in every type of sales transaction

- Not to be used as evidence of payment confirmation

There are several types of invoices that can be issued in different industries and for different purposes.

For example, a pro forma invoice can only be used to inform the customers of the agreed purchase details to get a correct order confirmation. Unlike an official invoice, a pro forma invoice is sent before the manufacturing process or the delivery. It also holds no legal status as a request for payment document but does give the buyer an idea of the costs of the goods or services.

Another example is a commercial invoice, which is an essential document for customs clearance and is commonly used by businesses in international trade. It is one of the most important documents for international shipping, import, and export.

⚠️ Caution: Although sometimes used interchangeably, there are differences between an invoice and a bill. A bill would normally request immediate payment and for a less complex transaction.

When to Use an Invoice?

An invoice is used when collecting payment after the product is delivered or the service is completed.

It can be issued once the seller and the buyer have made an agreement for the sale of goods or services so that the seller can accurately record the inventory. If an order has been made for goods, an invoice may be issued before the goods are received by the buyer or at the same time. If a service is rendered, an invoice is commonly issued just before or directly after the service is completed.

The seller can issue an invoice and send it with the product or send a digital copy through an invoice email. However, sometimes, the physical copy is mandatory for accounting purposes.

How to Write an Invoice?

There are no official standards on how to format an invoice template. However, to get paid on time, you should follow best invoicing practices and keep a consistent invoice template.

Here is some mandatory information about the transaction that must be included in the document in order to ensure straightforward payments.

- Business and customer's name and address

- Unique invoice number

- Date of issue

- Payment due date

- Detailed breakdown of goods or services sold

- Total amount due, including taxes and fees

- Payment terms and accepted methods

- Seller's bank account details

💡 Tip: Using invoicing software to manage, create, and issue invoices is an efficient way to streamline your invoicing management and minimize errors that can cause disputes or payment delays.

What Is a Receipt?

While an invoice is sent to collect payment, a receipt serves as proof of the transaction and a record of the sale, which is essential for both the customer and the business. This is particularly important during tax season, as receipts support the entries in your books and tax returns.

It is also commonly referred to as a payment receipt, receipt of payment, or a sales receipt.

Receipts can be written by hand using a receipt book, automatically issued at a POS machine, or generated digitally. Regardless of the payment method, whether cash, card, or online payments, the vendor should issue a receipt confirming that the payment has been received.

Receipts are:

- Issued after payment has been made

- Used by a business or customer as proof of payment or to verify a purchase has been made from another business

- Mandatory in some countries for every purchase above a certain purchase price

- Usable as evidence in legal proceedings as a record of sale

One of the main purposes of a receipt is payment verification. For instance, receipts can be used as proof of a complete purchase when requesting a refund or return or filing for a warranty claim.

They are also important documents for accounting and legal purposes. Generally, the most important details on a receipt are the date, amount paid, and product information.

Like e-invoices, digital receipts are becoming more popular, especially among ecommerce businesses, as they make receipt management more convenient and easier to store and keep track of. Electronic receipts are usually sent to a customer's email, through an online messaging service, or through in-app notifications.

When to Use a Receipt?

Receipts are only issued after a payment has been made and completed.

In brick-and-mortar businesses, receipts are issued on the spot and handed over to the customer once a customer pays. Sometimes, receipts can be issued periodically as a part of an agreement between the seller and the vendor if the payment is made in installments. For example, if a payment plan is set up with either variable or fixed amounts due on different dates.

In these types of agreements, a receipt should be issued after every payment has been received and cleared. This arrangement is similar to direct debit payment, commonly used in subscription-type services. If this type of payment is agreed on, digital or electronic receipts will be issued around the prearranged payment schedule date.

How to Write a Receipt?

A receipt can be formatted in many ways with no official standard. It is less detailed than an invoice, but there are necessary details that need to be provided to verify the purchase.

A receipt should include:

- Business name and logo

- Contact information

- The exact date of a sale or service

- A list of the sold products and services

- The prices of each product or service sold

- Applicable discounts, coupons, or promotions

- The total amount paid

- Any added or included sales or service taxes

- Any additional fees, such as service charge

- The confirmation status of the transaction (approved, declined, not authorized, authorized)

💡 Tip: Although a POS can automatically generate receipts, learning how to fill out a receipt book correctly can equally help manage inventory and keep track of incomes effectively.

What Are the Key Differences Between an Invoice and a Receipt?

The main difference between an invoice and a receipt is their purpose of issuing. While invoices are used to collect outstanding payments, receipts are issued after the transaction is completed.

- Invoice: Requests payment; issued before payment.

- Receipt: Confirms payment; issued after payment.

However, there are several factors that make receipts and invoices different.

Invoice

- Used to request payment

- Sent to the customers before payment, after the purchased goods or services are delivered

- Not required in every business industry or sales transaction

- Cannot be used as payment confirmation

- Cannot be used to record sales as finalized income in accounting

Receipt

- Used to confirm payment

- Issued to the customer after the seller received the payment

- Should be issued for every purchase

- Can be used to verify the purchase as proof of payment in case of refund or warranty requests

- Can be used to record sales as income in accounting

To run your business efficiently, make sure to keep an organized record of invoices and receipts, as they are important documents not only to track sales history but also for accounting and tax purposes.

💡 Tip: Despite the differences, both receipts and invoices can be used to record sales transactions.

Do You Need Both an Invoice and a Receipt?

Having a systematic invoice and receipt management process makes it more practical and easier to keep track of your business's finances, as both documents are essential in business-to-business and business-to-customer transactions.

A receipt is significant for both the buyer and the seller, as it is issued after the seller receives the payment and finalizes the purchase. The seller can keep a copy of the receipt to record income, while the buyer can keep it to record expenses.

On the other hand, an invoice may not always be needed, such as in retail shops that normally require immediate payment. Whether you need to issue both invoices and receipts depends on the type of sales transactions in your business.

However, even if your business does not issue invoices, you might still have to pay your suppliers. Learning how to manage invoice payments and submit payments on time is important.

Can an Invoice Be Issued as a Receipt?

No, invoices are not interchangeable with payment receipts.

In cases where the payment is made following an invoice, despite the matching information, such as product details and the amount due, an invoice cannot replace a receipt as proof of payment that confirms that the vendor has received the money.

This is because while a receipt confirms that the seller received the payment and the sale is completed and settled; an invoice only notifies the buyer of an outstanding debt.

Invoice and Receipt Examples

To illustrate the differences between the format of an invoice and a receipt, let's take a look at some examples of what each of them looks like.

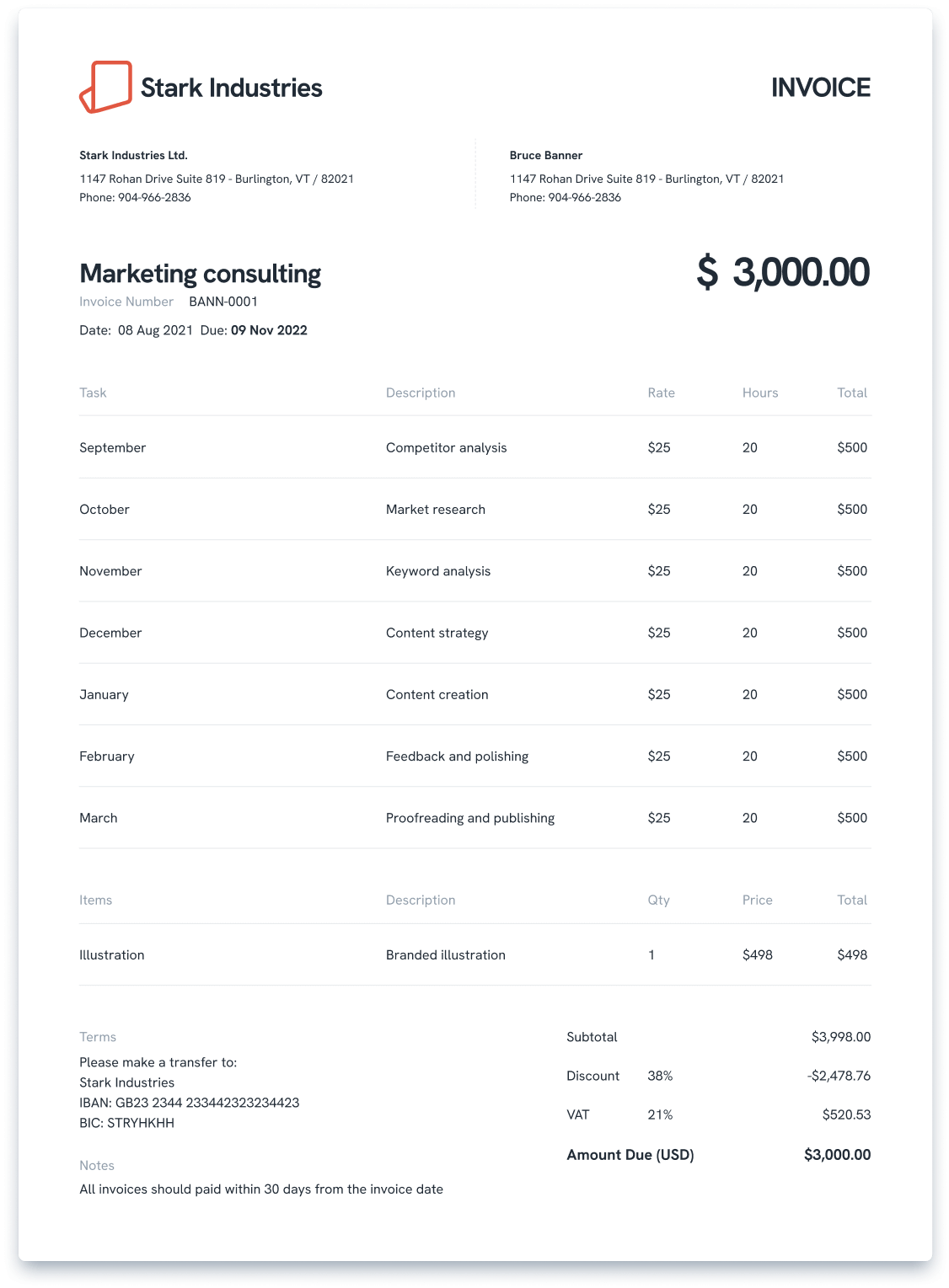

Here’s a graphic example of an invoice:

You can see that it provides information like an invoice number, price breakdown, payment due date, and payment terms ("Please transfer to the Bank Account...").

You can format your invoice in multiple ways, but the details should be clear and straightforward. The payment due date and terms should always be placed where they wouldn't be missed.

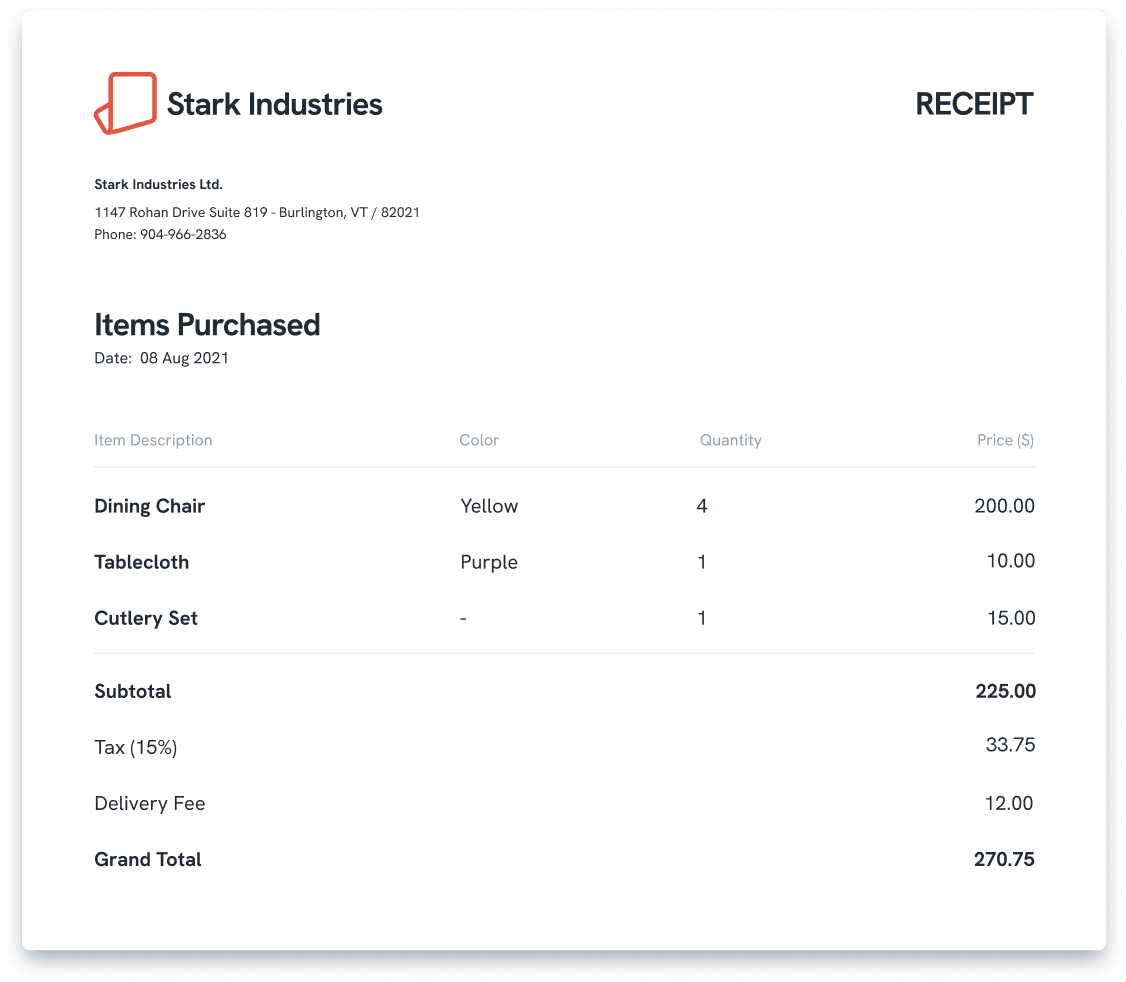

Now, let's look at an example of a receipt:

It is less detailed than an invoice but still needs to include the price breakdown of goods or services purchased to provide transparency. The date of purchase and the total amount paid should be visible on the receipt. If you're handwriting the receipts, make sure that the details are legible.

Bottom Line

Invoices and receipts are equally essential documents in the sales process. Well-structured invoices are useful for collecting outstanding payments while issuing receipts after the transaction eases the accounting process.

To streamline your invoicing process, try Statrys Invoicing Software, which helps you create professional-looking invoices and send, track, and manage your invoices in one place.

FAQs

Can an invoice be used as a receipt?

No, an invoice cannot be used as a receipt. An invoice must always be given to a customer before a customer pays any amount owed.