What is a Pro Forma Invoice?

A pro forma or proforma invoice is a preliminary bill of sale that provides an estimate to the clients before the goods are delivered.

A pro forma invoice is a useful document for businesses in international trade as it outlines shipping details that can be used to estimate duties.

For other businesses in general, a pro forma invoice is an efficient way to ensure the client confirms the correct details of the purchase order.

To become a successful entrepreneur, it is essential that you have a thorough understanding of the accounting side of your business. You might have encountered different types of invoices when finalizing a deal with a client, such as a sales invoice, a tax invoice, a commercial invoice, or even a retainer invoice, which are all commonly issued at the end of a sales process.

But what can you provide to your customers to inform the provisional details of the sales agreement when the transaction is not yet settled? This is when you need a pro forma–or proforma–invoice.

This article will guide you through what a proforma invoice is, how it differs from other invoices, why you should use it, and how to create one.

What Is a Pro Forma Invoice?

A pro forma invoice is a preliminary bill of sale issued by a seller before delivering goods or services. It provides an estimate of the purchase, including pricing, quantity, and shipping costs.

"Pro Forma" means "for the sake of the form," and it is also commonly referred to as "proforma invoice." In terms of function, it is more similar to a quote than an invoice, as it is mainly used to inform and confirm purchase details and cannot be used for accounting or legal purposes.

A pro forma invoice is particularly essential in international trade that deals with exporting and importing goods, as it normally includes important information needed for customs clearance.

Pro Forma Invoice vs. Sales Invoice

If you're a business owner, you're probably most familiar with a final sales invoice, which is sent to collect payments from your customers after they've received their purchased services or goods. A pro forma or proforma invoice, on the other hand, is a non-binding preliminary invoice that is issued in advance of the delivery. A pro forma invoice would include the interim terms of the transaction that is subject to change.

Here are some other differences:

Pro Forma Invoice

- Issued when the order is placed

- Includes provisional terms of the agreement

- Not legally binding

- It does not include all fees (VAT charges, taxes, etc.)

- Cannot be used for accounting purposes

Sales Invoice

- Issued at the time of or after delivery

- An official document requesting payment

- Legally binding

- All charges are final

- Includes all fees and taxes

- It can be used for accounting

Pro Forma Invoice vs. Commercial Invoice

A pro forma invoice is also different from a commercial invoice, which you might be familiar with if your business is importing or exporting goods internationally. While a pro forma outlines estimated costs and terms of the sale, a commercial invoice verifies the purchase and is a payment request.

As a shipping document, a commercial invoice must provide substantial details of the purchase that are essential for customs clearance, such as the information of the exporter and importer, the products, and the value and quantity of the goods in shipment.

A pro forma invoice, on the other hand, might contain fewer details but still enough for the client to estimate and calculate duties or make an arrangement to import the goods accordingly.

💡 Tips: For international shipping to the US, it is possible to use a pro forma invoice for customs, although the commercial invoice is still required and needs to be provided within 120 days.

Pro Forma Invoice vs. Quote

Technically, a pro forma invoice functions as a service quote in the format of an invoice. However, there are three significant differences:

- The relationship between the seller and the customer: A customer could gather quotes from several companies to decide who to choose. A pro forma invoice is issued after the customer has agreed to buy from a specific seller, meaning that the seller expects payment with this document.

- The details of the transaction: A quote usually doesn't include details like delivery dates or taxes, while a pro forma invoice does.

- The format: Pro forma invoices follow the same general format as a final invoice, while quotes can look significantly different.

So why would you need a pro forma invoice if you've already provided a quote to your customer?

Why Use a Pro Forma Invoice?

As pro forma invoices provide preliminary details about the purchase, they can be used to get an order confirmation from the buyer to seal the deal. After the client confirms that the details are correct, the seller can process the order and then forward a final invoice to the client with minimum or no mistakes.

If payment will be required upfront for any goods or services, a pro forma invoice also informs the buyer about the pricing details of the forthcoming transaction.

At the time when a pro forma invoice is issued, not all the details of a deal might be finalized yet. Because of this, a pro forma invoice allows the buyer to negotiate the terms with the seller, and the seller can ensure that the details of the purchase are correct.

In short, using a proforma invoice streamlines the sales process for your business. Although it is not legally required for businesses to issue a pro forma invoice, it is a helpful document that helps the seller and buyer communicate effectively.

💡 Tips: A crucial aspect of pro forma invoices is clarity. Using a clear and concise pro forma invoice helps minimize the risk of misunderstandings between buyers and sellers, especially for international businesses with complicated transactions.

Benefits for Businesses

Pro forma invoices offer several advantages for businesses, making them a handy tool for both buyers and sellers. Some key benefits include:

- Improved Cash Flow Management: By providing buyers with a precise estimate of costs upfront, pro forma invoices help businesses plan and manage their cash flow more effectively, same as the buyers.

- Minimized risks: Clear and transparent pro forma invoices reduced the risks of miscommunications that can cause disputes and payment delays.

- Enhanced Professionalism: Utilizing pro forma invoices demonstrates professionalism and commitment to transparency in business dealings.

When Is a Pro Forma Invoice Issued?

A pro forma invoice should be issued before finalizing a sale and delivery. Once more, it functions as a preliminary bill that includes details previously discussed between the buyer and seller.

The reasons for issuing a pro forma invoice vary based on a customer’s needs and are commonly used in manufacturing and international imports and exports. Let’s look at a few examples.

Manufacturing Industry Use Case

A manufacturer receives a bulk order for customized machinery from a client. Before production starts, they create a pro forma invoice detailing the machine specifications, costs, and delivery terms. The client reviews and approves it, allowing both parties to agree on terms and ensuring a smooth production process.

International Trade Industry Use Case

An international trading company is importing electronics from a supplier overseas. To comply with customs regulations, they prepare a pro forma invoice that includes product descriptions, quantities, and prices. This document helps customs authorities assess duties accurately and facilitates the clearance of imported goods, ensuring a hassle-free international trade process.

How To Create a Pro Forma Invoice

Creating a pro forma invoice is a critical step in ensuring smooth transactions between the seller and the buyer. Here are the essential details that must be included:

- The term "Pro Forma Invoice" or "Proforma Invoice": This is to ensure that the client is aware that this document is not the final invoice.

- Invoice number: You could include a unique per forma invoice number, but it should be different from a final sales invoice number.

- Buyer and seller information: Include the name, address, and contact information of both the buyer and the seller.

- Dates and validity: The issuing and expiration date should be specified, as well as the expected dates for payment and shipment.

- Details of the purchase: Describe the products or services being supplied comprehensively, including quantities, specifications, and relevant technical information such as product weight and dimension. The price per unit should also be stated for each item.

- Shipping and delivery information: It is crucial to include the shipping details, including shipping costs, insurance, and expected shipping and delivery date, especially for international exports.

- Payment terms: Specify when the final payment is due and the preferred payment method, whether VAT is applicable, and if there are early payment discounts or late payment penalties.

- Terms of sales: Include any additional terms and conditions of the transaction, such as return policies or warranties.

- Total amount and currency: Sum up the total cost and clearly mention the currency for the transaction.

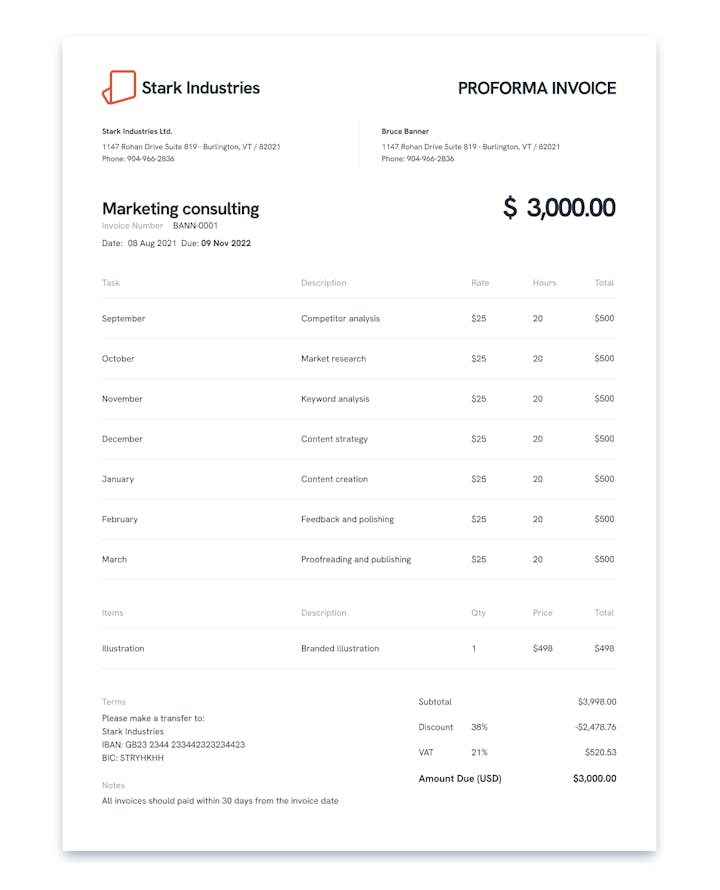

Here's an example of how a pro forma invoice should look like:

By including this information, you can create a pro forma invoice that not only follows the industry standards but also provides clarity and transparency for your customer. With a correct template and details, you can use a pro forma invoice to minimise misunderstandings or miscommunications and streamline the purchasing process efficiently.

📌 Important: It is crucial to state on the invoice that it is a "pro forma" (or "proforma"). A pro forma invoice must also declare that " This is not a tax invoice" to ensure that the invoice will not be used for a purpose it's not intended for and to differentiate it from commercial or final sales invoices.

No matter if you're regularly sending out invoices to clients or if you're expanding your business, it is a good idea to create your own pro forma invoice template that you can use anytime to reduce time and cost. Alternatively, using invoice management software where you can create and share your invoice through email or messenger apps is also an efficient way to manage invoicing.

Using the correct form of an invoice with complete and accurate details, you can avoid unnecessary payment and order confirmation delays. Try Statrys Invoicing Software today to save hours on invoicing and get paid faster.

FAQs

Is a pro forma invoice a contract?

A pro forma invoice isn’t a contract and it is not legally binding. This invoice type does not hold any weight when it comes to proving an agreement has been made.