Key Takeaways

A commercial invoice is a legal document issued by the seller to the buyer in international sales transactions. It is a primary document for the customs declaration process.

Essential details in a commercial invoice include exporter and importer details, HS code, incoterm code, product description quantity, price, delivery, and payment terms.

Businesses in international trade need a commercial invoice to comply with customs regulations when exporting and importing goods.

One of the most important documents for international shipping is the commercial invoice.

If you want to ship your products internationally, it is important you have a comprehensive understanding of commercial invoices. With shipping costs rising steadily over the last decade, perfecting your commercial invoices can save you significant time and money.

This article will walk you through the essential information about a commercial invoice for international shipping, including what it is, why it is important, and what to include. Continue reading to learn practical tips on mistakes to avoid when creating commercial invoices to streamline your international trade operations.

What is a Commercial Invoice?

A commercial invoice is an essential document that accompanies international shipment. It provides information about the purchase, including the detailed list of goods and price agreed upon between the seller and an international customer.

It is a legal document primarily used in the international trade and shipping industry and is crucial in the customs clearance process. A commercial invoice enables customs officers to assess the appropriate and accurate customs duties based on the true value of the imported goods.

In addition to collecting payments from clients, a commercial invoice serves as an essential document for customs declaration, particularly for calculating import duties. Businesses should always attach commercial invoices to comply with foreign trade regulations when doing sales transactions involving shipping across international borders.

The commercial invoice is a vital document for international trade, serving as a contract and a proof of sale between the buyer and seller. It's indispensable for customs clearance because it provides important information about the transaction, the goods being transported, their value, and the parties involved.

Can businesses ship their goods without commercial invoices?

Shipping without a commercial invoice is generally not recommended as it would likely result in delays or refusal at customs.

What are the challenges with commercial invoices? And how did you solve them?

Are commercial invoices important for the exporters too?

Can businesses ship their goods without commercial invoices?

Shipping without a commercial invoice is generally not recommended as it would likely result in delays or refusal at customs.

What are the challenges with commercial invoices? And how did you solve them?

Are commercial invoices important for the exporters too?

Can businesses ship their goods without commercial invoices?

Shipping without a commercial invoice is generally not recommended as it would likely result in delays or refusal at customs.

What are the challenges with commercial invoices? And how did you solve them?

Are commercial invoices important for the exporters too?

How Is a Commercial Invoice Different From a Standard Invoice?

Like other types of invoices, a commercial invoice is fundamentally used to request payment from customers for goods or services purchased. However, the main difference between commercial and standard invoices is the usage context.

While businesses issue standard invoices to collect payments in domestic sales transactions, commercial invoices are primarily used to request payments from international clients and serve as customs documents.

In short, commercial invoices contain more details to comply with international shipping regulations that are not typically required in standard invoices.

🔍 Tip: Most customs authorities require the commercial invoice to be written in English or have a translated copy attached.

Why Is a Commercial Invoice Important?

A commercial invoice is a crucial document in cross-border trade as it details the goods being exported and imported across international borders.

Some of the key importance include:

- Customs clearance: Customs authorities use commercial invoices to determine the value of goods, assess duties and taxes, and ensure compliance with import and export regulations.

- Proof of Transaction: A commercial invoice is a legal document containing details about the sales transaction, including the product descriptions, quantity, and price.

- Record keeping: A commercial invoice provides a record for both parties involved in the transaction that is useful for accounting and auditing purposes. It can also be used as evidence in disputes.

- Logistics management: A copy of a commercial invoice facilitates the shipping process, providing necessary details about the packages for the shipping agents.

When Is a Commercial Invoice Issued?

Typically, businesses issue a commercial invoice when shipping internationally so customs authorities can accurately assess taxes and duties. It is not needed for domestic shipping.

One exception to this rule is that shipments between European Union (EU) countries do not require a commercial invoice due to its single market policy, which facilitates the free movement of goods. Nevertheless, a commercial invoice is required for shipments to countries outside the EU, for example, from France to Singapore.

What Is Included in a Commercial Invoice?

Depending on the regulations of the customs authorities in each country, businesses may have to format the commercial invoice differently. Still, there are three types of essential details that must be included in every commercial invoice template.

Details about the Exporter and Importer

A commercial invoice should contain details of both the exporter and the importer to identify the businesses or individuals involved in the transaction. These details should be provided at the top of the commercial invoice.

A commercial invoice should include:

- A business logo: If applicable, include a logo or name of the issuer in the header of the commercial invoice.

- Contact details: Include the names, addresses, emails, and phone numbers of both the seller/exporter and the buyer/importer.

- Tax IDs: Include the tax identification numbers or country-specific equivalents of both the seller/exporter and the buyer/importer.

- The notify party’s information: Include the details of who gets notified once the goods arrive at the destination. Usually, it is the forwarding or shipping agent.

Details of the Transaction

Commercial invoices should provide detailed information about the purchase to ensure a smooth customs process and to facilitate customs officials in assessing accurate taxes and duties.

Here is the information that should be declared on the commercial invoice:

- Invoice number: Include an invoice number in the header section of the document.

- Date of issue: Include the date that the invoice was issued.

- Order number: Provide an order number for easy identification.

- Total sale amount: State the total value of the shipped goods.

- Payment terms: Provide the payment terms, including payment methods, currency, and due date. Net 30 accounts can help businesses establish business credit by allowing them to defer payments for 30 days while tracking payment history.

Details about the Shipment

As an important customs document, a commercial invoice must provide additional details relating to the shipping process of the goods. When exporting and importing products, it is crucial to include these pieces of information:

- The Bill of Lading number

- Details of the forwarding agent

- HS Code: Use a 6-digit HS code (Harmonized System code) to identify which commodity group the goods fall under to facilitate the process of determining import tariffs

- Incoterm code: Identify who (exporter or importer) is responsible for the costs of transport and possible risks during the shipping process with a standardized 3-digit code.

- Details of goods: Include detailed information about the goods, including product description, quantity, unit price, and total weight.

- Country of origin: Specify where the goods are shipped from.

- Insurance costs: Clarify if any insurance covers the shipment.

- Shipping date: Include the date that the goods were shipped.

- Signature of the exporter: Sign to verify the document. If you are sending as a business, include your position in the company as well.

- Additional details: You may include other details, such as the reason for export and the means of transport.

💡 Tip: Some countries may require additional details to be included on the commercial invoice. It is always necessary to check each country’s requirements when you are shipping internationally.

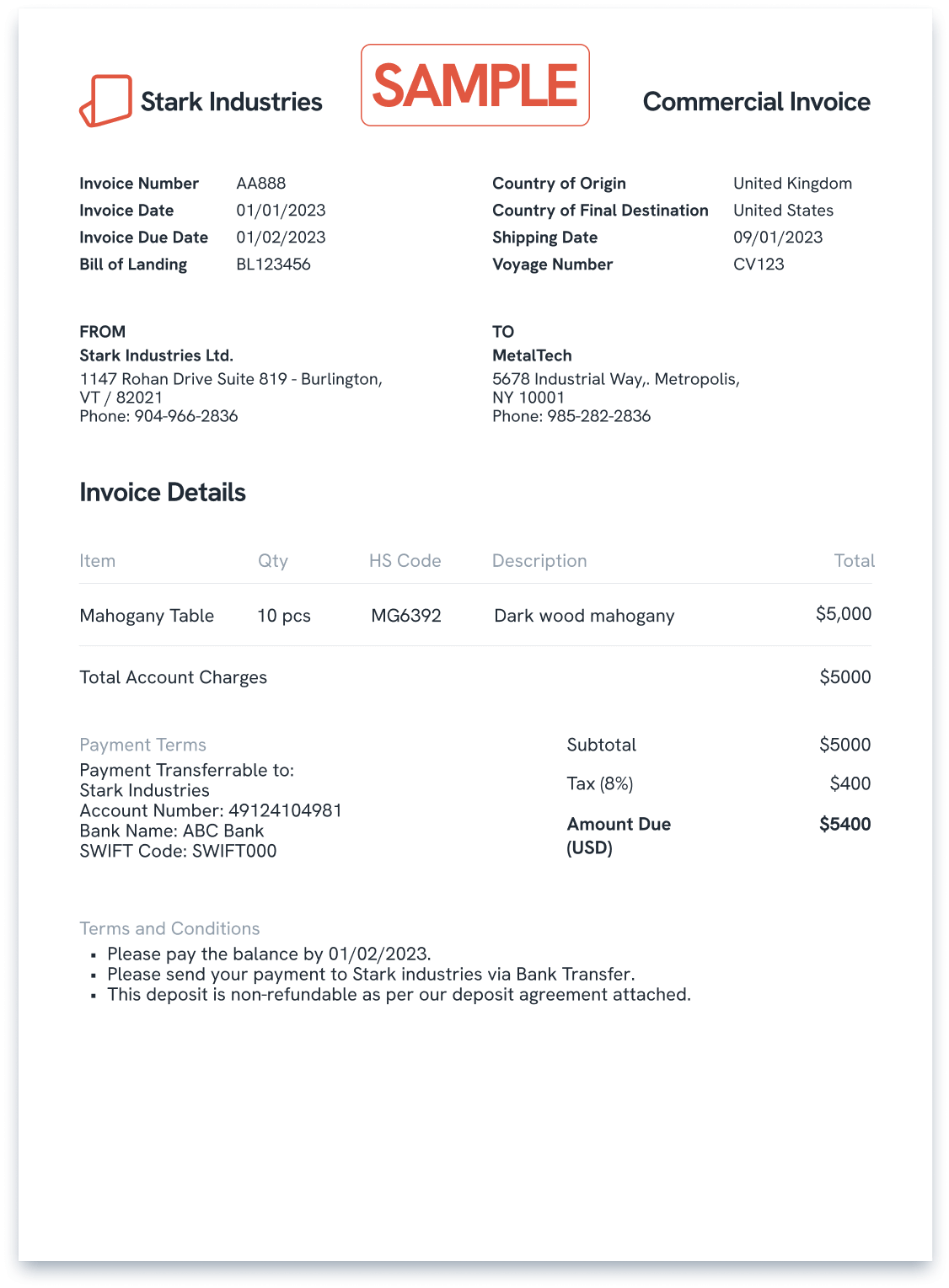

Commercial Invoice Example & Free Templates

As one of the important customs documents, a commercial invoice should have a clear structure to make it easy to process. Always ensure that all the essential details are included and that they are accurate and legible.

Let’s look at an example of a commercial invoice:

Filling in a commercial invoice is not complicated with a suitable template. You can download free commercial invoice templates from websites such as IncoDocs, FedEx, or TNT Express to simplify and streamline the process. You can fill in, save, and print the commercial invoice with these pre-made templates.

A commercial invoice should be attached to the package where customs authorities can see it.

⚠️ Caution: Always check with your forwarding agent, as some shipping services, such as USPS, have a specific form for commercial invoices.

Are There Other Documents Related to a Commercial Invoice?

Yes, there are other documents involved in the shipping process between countries. Apart from a commercial invoice, a pro forma invoice, a bill of lading, and a packing list are also important documents in international customs procedures for import and export.

Let’s look at each of them in detail.

Pro Forma Invoice

A pro forma invoice is another type of invoice that is commonly used in import and export transactions. It is also referred to as a proforma invoice, and the seller typically sends it to the buyer before issuing a commercial invoice.

Pro forma invoices do not hold the same legal validity as commercial invoices, nor can this document be used for accounting or customs purposes or to request payment. However, the customers can use pro forma invoices to estimate duties or taxes and can plan the import process accordingly.

In short, although both are widely used in international trade, a pro forma invoice is different from a commercial invoice. While a pro forma invoice provides estimated costs before shipment, a commercial invoice specifies the actual finalized costs charged or to be charged.

💡 Tips: For international shipping to the US, it is possible to use a pro forma invoice for customs, although the commercial invoice is still required and needs to be provided within 120 days.

Bill of Lading

Another important document for international shipment is a bill of lading.

A bill of lading is a legal document that the carrier issues to the exporter as a receipt of shipment. It outlines the details of the goods in transit, including product details, quantity, total weight, method of transportation, shipping route, and the date of shipment.

The difference between a bill of lading and a commercial invoice is the title of ownership. While the commercial invoice provides detailed information on the sales transaction, it does not imply ownership of goods. On the other hand, the bill of lading legally specifies who has the right to claim possession of the goods at the destination.

Packing Lists

A packing list is a document that contains an itemized list of the shipment’s contents. It is one of the essential customs documents that is crucial in export transactions, particularly for logistics purposes.

Typically, packing lists provide details similar to commercial invoices, including details of the parties involved, product descriptions, quantity, weight, and delivery and payment details. However, packing lists should also include the following details:

- Shipment date

- Port of origin

- Port of destination

- List of contents in each package

- Return address

Although both a packing list and a commercial invoice serve as crucial export documents, their role are different. A commercial invoice primarily deals with the financial aspect of the transaction. On the other hand, a packing list concerns the description of the actual material in transit to facilitate international freight forwarders or transport agencies to know what they are transporting.

Mistakes to Avoid for Accurate Commercial Invoices

It is a legal requirement that a commercial invoice is properly completed and filled out accurately to comply with customs regulations.

To avoid unnecessary hold-ups, shipping delay costs, or legal ramifications from tax authorities, make sure that every detail in the commercial invoice is correct and accurate before dispatching the package, especially the price and payment details that may cause customs duties miscalculations.

Here are the common mistakes to avoid when creating a commercial invoice:

- Omitting essential details: Failing to include necessary information such as the buyer and seller's contact information, invoice number, date, and detailed description of goods.

- Incorrect Classification of Goods: Using incorrect HS codes or incoterm codes can lead to improper duty assessments.

- Inaccurate value of goods: Undervaluing or overvaluing the goods can result in customs penalties or shipment delays.

- Incomplete Shipping Information: Providing incorrect or incomplete details about the shipment’s origin, destination, and terms of delivery can result in delayed or lost goods.

Bottom Line

When shipping goods across borders, you must be aware of the requirements imposed by customs authorities. Remember that a commercial invoice containing crucial information, such as the types of goods being shipped, their value, dimensions, and weight, is essential for customs officials to determine the correct import duties and taxes.

Now that you've reached the end of this article, you have a comprehensive understanding of the importance of commercial invoices in international trade.

With these best practices, you can confidently navigate the complexities of international shipping and avoid any potential shipment delays or financial losses.

FAQs

What does commercial invoice mean?

A commercial invoice is a legal document issued by the seller to the buyer in international sales transactions. It is a primary document for the customs declaration process.