Key Takeaways

A pro forma invoice is a preliminary bill of sales that helps businesses forecast budgets. On the other hand, a commercial invoice is a legally binding document that collects payments and is required for customs purposes.

In international trade, a pro forma and a commercial invoice are two documents that are essential for the importing and exporting processes.

It is crucial for businesses to understand the differences between the two types of export documents to avoid problems in customs clearance when shipping goods internationally.

In this article, we’ll walk you through the key differences between a commercial and a pro forma invoice, which you need to know whether you are the importer or exporter.

What Is a Pro Forma Invoice?

A pro forma invoice is a preliminary document that the seller issues to the potential buyer in advance of the delivery. It outlines the estimated costs of the purchase, including the price of the products or services and shipping fees.

The term “pro forma” means “for the sake of the form” in Latin, and the document is also referred to as a proforma invoice.

It is technically more similar to a purchase quote than an invoice. However, a pro forma invoice suggests that the customer is committed to buying from a particular vendor but has not yet finalized the negotiation or purchase agreement.

Typically, the buying businesses use proforma invoices to calculate the interim import fees and to plan their cash flow before making the purchase. As a preliminary invoice, customers are not obligated to pay the pro forma invoice.

When to Use a Pro Forma Invoice?

Businesses should issue a pro forma invoice to the customer before finalizing a sale. As a preliminary document, a proforma invoice streamlines the sales process and allows the customer to confirm the details in the invoice before the vendor begins manufacturing the order.

A pro forma invoice is commonly used in the manufacturing industry, particularly by businesses that frequently deal with bulk orders. It is also widely used by businesses in international trade to help the customer estimate import duties.

In some cases, a proforma invoice can be used as a document for customs officials to calculate customs duties required for goods being imported from other countries.

🔍 For Example: A pro forma invoice can be presented to customs authorities when importing goods to the US. However, the commercial invoice is still required and must be provided within 120 days.

What Details Does a Pro Forma Invoice Include?

A pro forma invoice should provide clear details of the transaction to ensure that there are no miscommunications between the vendor and the customer. Here is the list of information that should be included in a pro forma invoice:

- The term “Pro Forma Invoice” or “Proforma Invoice”: Make sure to include this term in the header of the document so the customer is aware that this is not the final invoice.

- Buyer and seller information: Include the name, address, and contact details of the buyer and the seller.

- Date of issue: Provide the date that the pro forma invoice was issued.

- Validity period: Provide a time period for the customer to accept or negotiate with the terms of sales.

- Details of the purchase: Include the descriptions of the goods or services being purchased, including quantities, specifications, and unit price.

- Shipping and delivery information: Provide the provisional shipping details, including interim shipping costs and estimated delivery date. You should be as accurate as possible.

- Total amount: Sum up the total cost and clearly mention the currency for the transaction.

- Payment terms: Specify in advance when the final payment is expected and the preferred payment methods. Also, include any policies for late payments.

- Terms of sales: Include additional terms and conditions, such as warranties, return, or refund policies.

Additionally, you can assign an invoice number to a pro forma invoice, but it should not be the same as the invoice number of the official invoice.

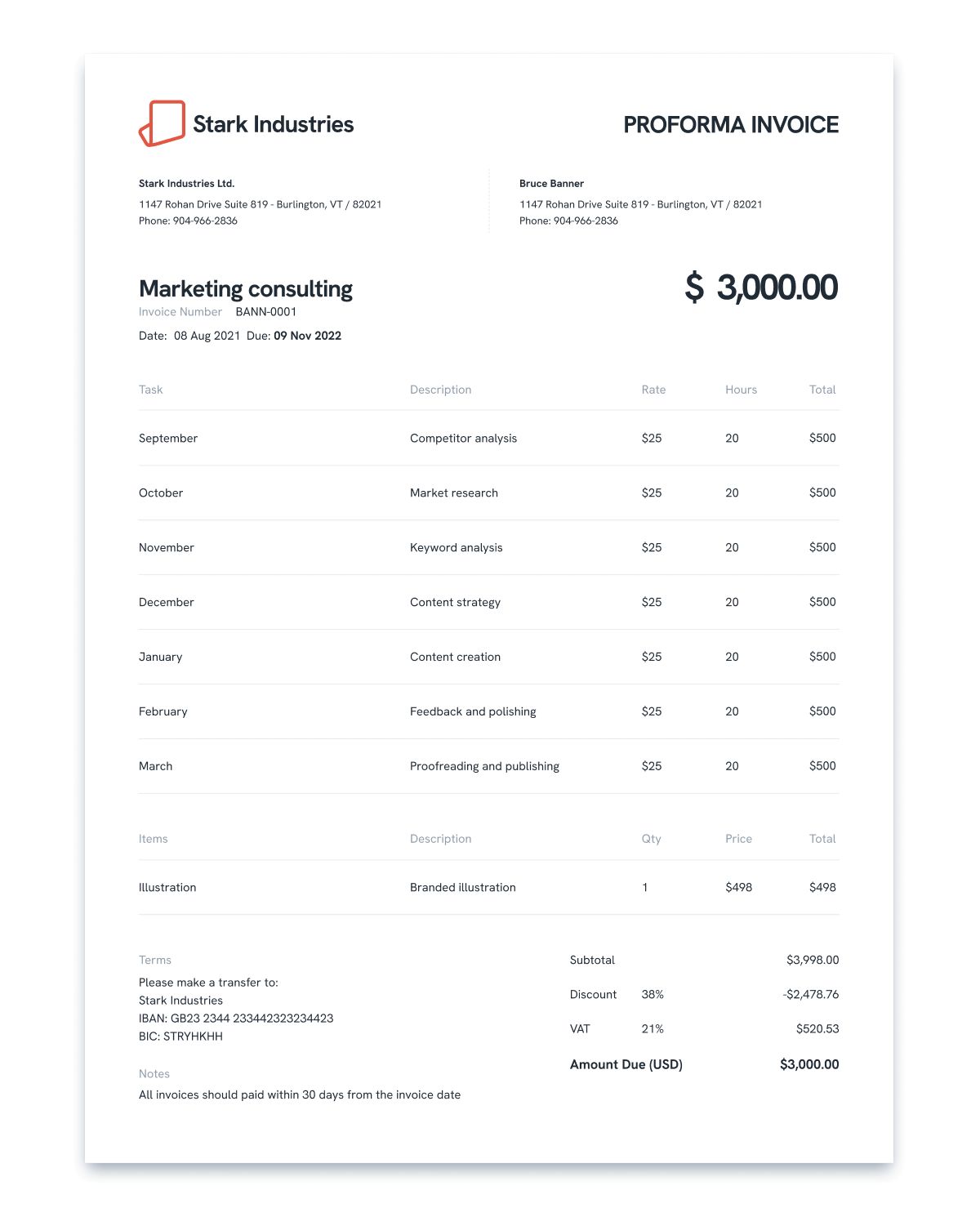

Let’s look at an example of a pro forma invoice:

💡 Tip: Pro forma invoices share the same format as the final invoice, and the total amount may also remain the same. Because of this, the pro forma invoice should be clearly marked as one to avoid confusion.

What Is a Commercial Invoice?

A commercial invoice is a legal document that is used for customs clearance in international transactions. It is a document that declares the quantity and value of goods that are being shipped across borders.

Commercial invoices are essential for customs agencies to assess appropriate duties and taxes for imported products. This invoice is an important form of proof for customs clearance when moving goods internationally. It is official proof of contract and sale between both parties involved in a transaction.

When to Use a Commercial Invoice?

A commercial invoice is a primary shipping document used when a company sends goods internationally. The seller issues a commercial invoice to the buyer or importer of the goods.

It is a mandatory document as part of the import and exporting process for international shipments, whether transported by land, sea, or air freight. A commercial invoice is used as an official document to demand payment from a buyer or importer.

It helps the relevant customs authorities working at the border of a country to work out the relevant export and import duties and taxes owed on the goods being shipped.

A commercial invoice is not necessary for domestic or local sales transactions.

What Details Does a Commercial Invoice Include?

As a final sales invoice, a commercial invoice also serves as a sales contract and legally binding agreement. For this reason, it should include detailed information about the transaction.

Apart from all the details included in a standard invoice, such as contact details, date of issue, invoice number, product description, and payment terms, commercial invoices should include the following information:

- The Bill of Lading number

- HS code (Harmonized System Code)

- Incoterm code

- Country of origin

- Insurance costs

- Shipping date

- Details of the freight forwarding agents

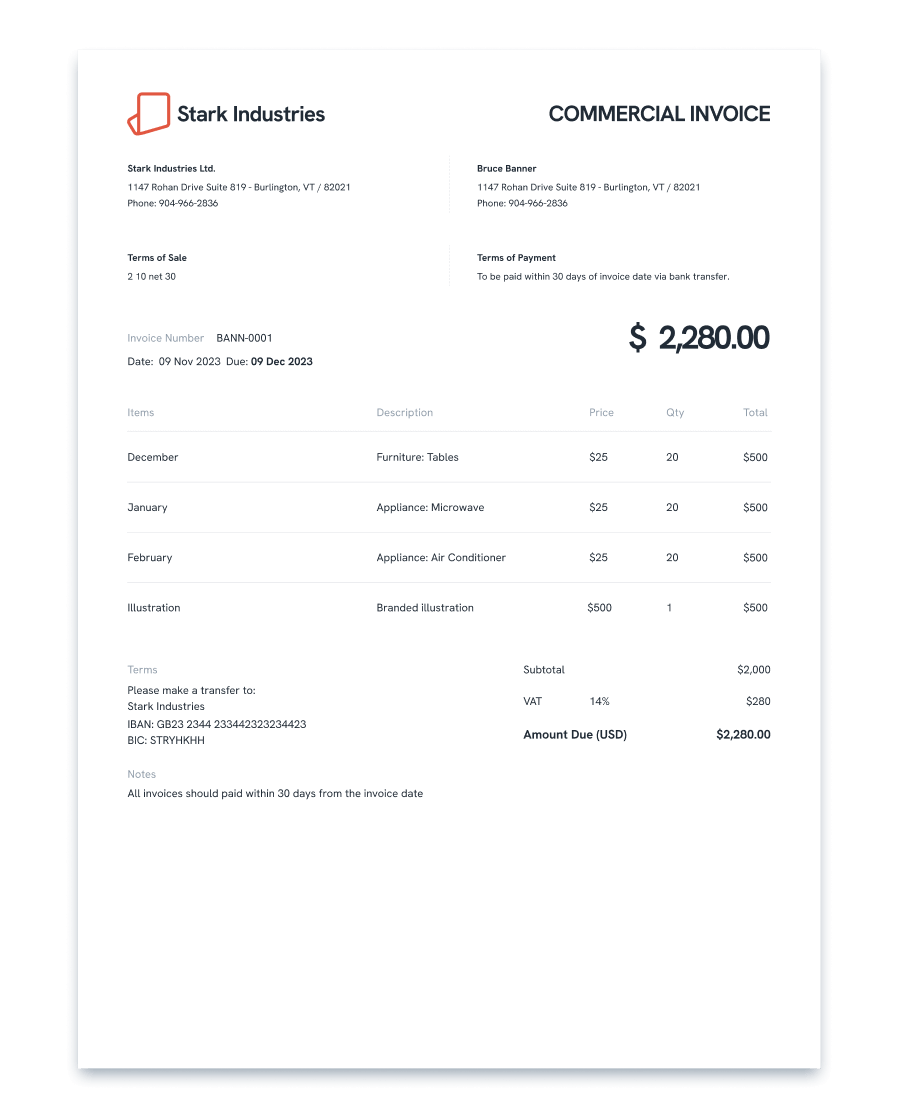

Here’s an example of a commercial invoice.

Commercial invoices are used in cross-border transactions, so a lot of the details will vary based on the laws and regulations of the countries involved in a sale. If you are exporting, make sure to read the import rules of the country you are shipping the goods to comply with the customs regulations.

What Happens if a Commercial Invoice Is Not Provided?

It is mandatory to provide a commercial invoice for international trade. It is also important to always provide accurate details on your commercial invoice.

This includes the product details of the goods being shipped and the accurate and actual real value of the goods. As customs officials use these invoices to calculate the taxes and duties owed on an item, discrepancies found can result in hefty penalties.

Failure to provide commercial invoices may also result in unnecessary hold-ups, shipping delay costs, or legal ramifications from tax authorities.

Pro Forma Invoice vs Commercial Invoice

Although both documents are used to support international shipments, there are several factors that make proforma and commercial invoices different.

| Pro Forma Invoice | Commercial Invoice | |

| Time of issue | At the beginning of the sales process | When the purchase is finalized |

| Purpose | To provide preliminary details about the unfinalized purchase | To collect payment and to be used as a document for customs declaration |

| Legality | Not legally binding; cannot be used for accounting purposes | Legally binding; can be used for accounting purposes |

Let’s take a closer look at the differences.

When Are They Issued?

Pro forma invoices are sent before an official invoice. This is because they are preliminary invoices that are only provided for customers to review the order before processing or to estimate customs duties and other import fees.

On the other hand, commercial invoices are sent after the sales are finalized, and the orders have been confirmed and processed. When exporting goods to another country, it is the seller’s responsibility to attach a commercial invoice to the shipment.

What They Include

While the information in the commercial invoice can remain the same as in the pro forma invoice, the seller must update the final details if there are any changes.

As an important commercial document for customs declaration, the commercial invoice must include accurate information about the shipment, including detailed product description, total value, HS code, Incoterm code, and details of the freight forwarding agents.

Why Are They Used

Not only is a commercial invoice a formal request of payment to a buyer, but it is also a legally binding and valid tax document that can be used for accounting purposes. More importantly, it is used by customs authorities to identify and assess duties for goods being imported and exported across the border.

A pro forma invoice, on the contrary, holds no legal validity. It is used as an estimate of what the costs will be for goods or services. The buyer still has the right to opt out of a transaction if both parties fail to reach a deal. It also cannot be used for taxation and accounting purposes.

Bottom Line

Understanding the differences between pro forma and commercial invoices is crucial for businesses, as using the wrong type of invoice can lead to problems with clients or, worse, customs authorities.

Using a reliable invoice generator or invoicing software can help ensure your billing process is efficient and professional.

With its customizable features and user-friendly interface, Statrys makes it easy for businesses to generate accurate and professional invoices, which can help build trust and credibility with clients.

FAQs

What is the difference between pro forma and commercial invoice?

A pro forma invoice is a preliminary invoice that is issued by a seller to a buyer before the goods or services have been provided. A commercial invoice, on the other hand, is a formal invoice that is issued by a seller to a buyer after the goods or services have been provided. It is also used for customs declaration.