What is the Difference Between a Bill and an Invoice?

The terms "bill" and "invoice" are often used interchangeably, but they have distinct meanings. The main difference between a bill and an invoice is their context of use. A bill is typically used in one-time B2C sales where the request is more immediate, such as in a restaurant, whereas an invoice is more common in B2B transactions because it is a formal request for payment with clear payment terms and detailed information.

Although the terms "invoice" and "bill" are often used interchangeably or combined as "invoice bill payment," they do not exactly refer to the same document.

At a glance, a bill and an invoice may look too similar to distinguish. Even though they share some similarities, there are slight differences in their usage. Whether you are sending or receiving these documents, it is essential to understand the differences between a bill and an invoice in order to issue or request each of them in the right situation.

In this article, we will explain what a bill and an invoice are, the key differences between these two documents, and how to use them to get payments on time.

What is a Bill?

A bill is a document requesting payment for goods or services purchased from a vendor. It is usual for businesses to issue a bill immediately after the sales transaction is completed, and it informs the receiver that a payment is due.

Typically, the customer is expected to pay instantly upon receiving the bill. It is commonly used in one-time transactions and B2C settings, such as grocery stores, retail stores, restaurants, and online shops.

The term “bill” often refers to documents issued to collect payments in general. So, even though it usually has a one-time use, sometimes recurring bills are provided, such as bills for monthly subscriptions or internet providers.

In some circumstances, the seller may provide a date by which the customer has to pay. Bills issued within billing cycles, such as credit card or utility bills, often allow this flexibility instead of requiring immediate settlement.

However, it's important to note that the common concept of a bill typically implies prompt payment upon receipt, especially in retail or one-time service contexts.

💡 Tip: Some customers may request a bill when referring to an invoice. Clear communication is essential to avoid possible payment delays or discrepancies.

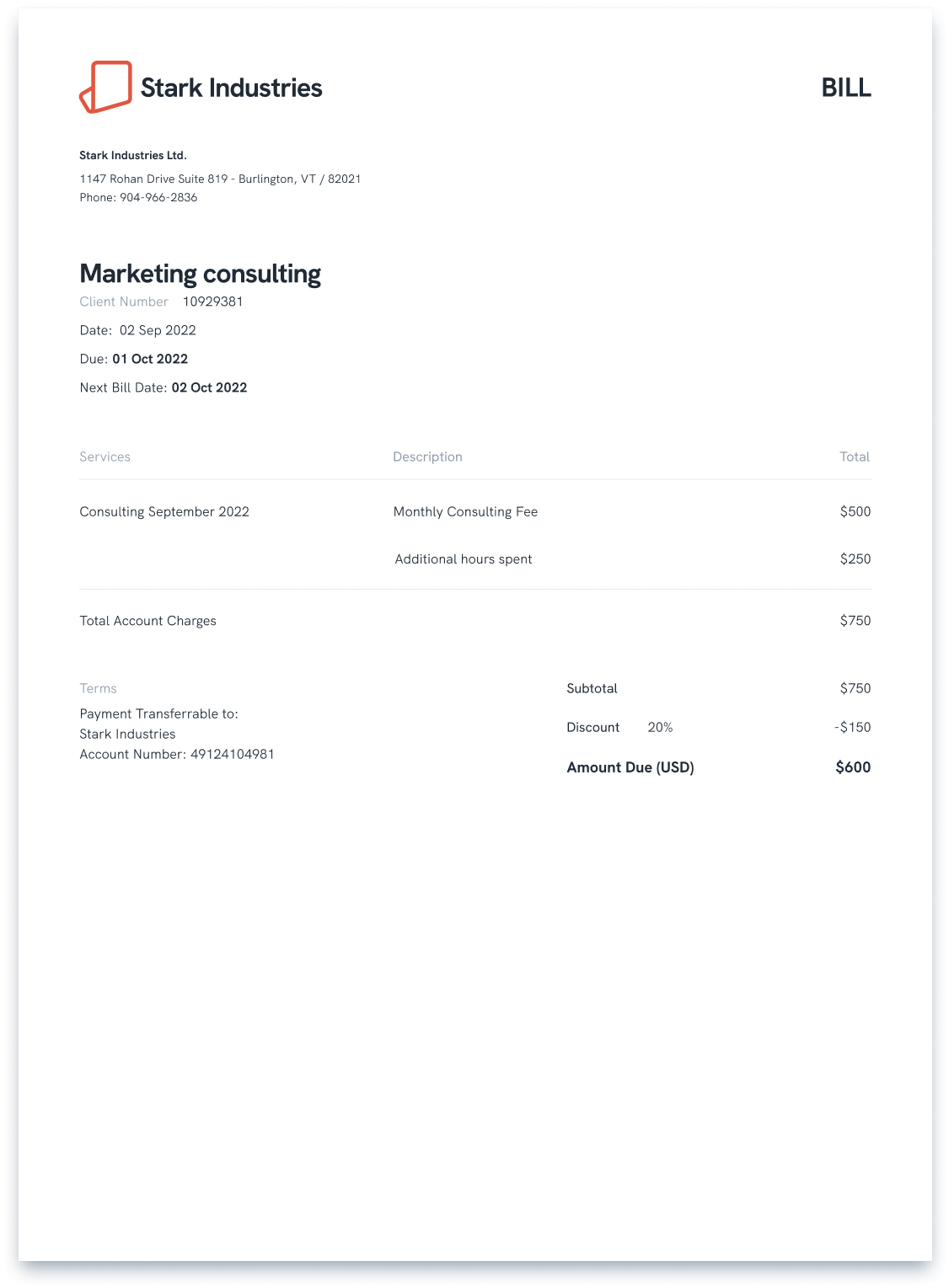

Example of a Bill

Below is an example of a bill from a billing cycle. You can see that the details in the document are simple and straight to the point, with the amount due provided and the next bill date.

What is an Invoice?

An invoice is a document businesses issue to collect payments for the products or services rendered. As it contains detailed information about the purchase, an invoice is also crucial for accounting, taxes, and financial management purposes.

Businesses normally send an invoice to collect payment within a specific due date, which is normally within 30 days. It usually provides essential details, such as:

- Invoice number

- Product or service descriptions, including quantity

- Date of purchase

- Payment method

- Payment terms, such as due date or late payment fees

- Applicable taxes

An invoice also plays a crucial role in financial reporting, taxation, and accounting. As an official document, it must adhere to compliance standards and include specific information such as invoice number, date of issue, and detailed descriptions of the goods or services sold. This makes it an indispensable tool for businesses in managing their finances and legal obligations.

Businesses across different industries issue invoices, but businesses in international trade, construction, and manufacturing most commonly use them. Wholesale businesses and service providers can also benefit from using invoices to manage their finances.

As an invoice provides a window of a payment period, it is crucial for the seller to make the invoice as straightforward as possible, with important details like the due date and payment method visible.

💡 Did You Know? Most businesses handle around 500 invoices monthly, both issuing to customers and paying the suppliers. Maintaining an organized invoicing management ensures business efficiency and on-time payments.

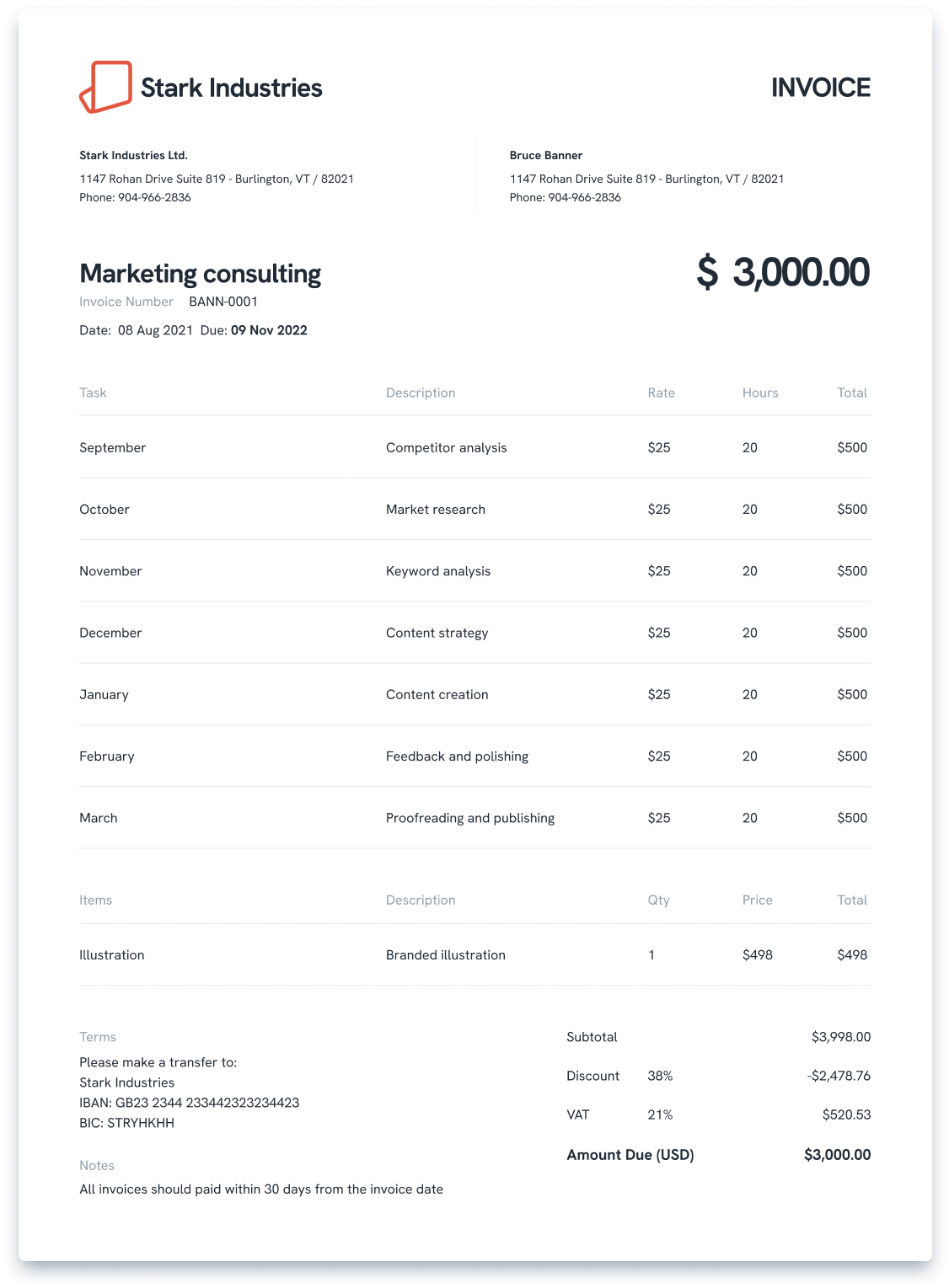

Example of an Invoice

Let’s look at an example of an invoice template. You can see that it includes an itemized of the services provided, including a price breakdown.

Difference Between Bill and Invoice

As both documents are used to collect a payment, an invoice is often confused with a bill and vice versa.

Both a bill and an invoice record details of the sales transaction, particularly the total amount the customer owes the business. However, there are differences between the two documents that you should know to manage your finances effectively.

Let’s take a look at the differences in detail.

Context of Use

The main difference between a bill and an invoice is the use context. While a bill is typically used in business-to-consumer (B2C) transactions, an invoice is more common in business-to-business or B2B payments.

Bills are usually used in everyday transactions, such as buying clothes from a retail store or dining at a restaurant. Because it contains fewer details, bills are preferred for straightforward, one-time purchases that can be paid instantly.

On the other hand, invoices are frequently used in transactions with more complexity, especially in transactions between businesses that require detailed information and price breakdowns. For example, a detailed invoice is more beneficial for a manufacturing business handling an order of a large quantity to keep track of the payment process.

🔍 Fact: The perception of a document as an invoice or a bill can vary depending on one's role in the transaction. A business may issue a document as an invoice, while the recipient might perceive it as a bill.

Payment Frequency

Even though some types of invoices can be used to request payments at agreed intervals, they can not replace recurring bills in a billing cycle.

Businesses providing ongoing services, such as subscription-based services, credit card companies, or internet providers, mostly use recurring bills to collect payment of the exact amount on a regular basis until the cancellation.

For an ongoing project, businesses can send interim invoices upon completing a portion of the project. However, the amount charged might not be consistent, depending on the agreement between the seller and the customer.

For a better understanding, here are 2 scenarios that explain the difference in terms of payment frequency:

| Scenario 1: Monthly Streaming Service Bill | Scenario 2: Web Development Project Invoice | |

| Context | You have a subscription with a streaming service provider for $15/month | You hire a web development company to create a website for your business. |

| Document | Each month, you receive a bill from the streaming service provider. This bill is for maintaining access to the service in the upcoming month. | After completing a significant phase of the website development, the company sends you an invoice. |

| Payment Frequency | The bill is recurring, arriving every month on the same date. It represents a fixed, ongoing expense. | The invoice is issued on an irregular basis, depending on the completion of specific milestones in the project. It's not a regular, recurring expense but instead relies on the progress of the work. |

| Expectation | The bill typically requires immediate payment, often by a specific due date within that month. | The invoice outlines the terms of payment, such as a due date, which might be set several weeks after the invoice date, allowing you time to review and process the payment. |

Detail Specificity

Another key difference between an invoice and a bill is how detailed the information provided on each document is.

While a bill typically includes contact information, a billing number, a service date, and the total amount for the goods or services exchanged, it can be fitted in a simpler template than an invoice. It only sometimes needs to state the payment terms.

As a legally binding document, an invoice is more detailed. Some of the necessary information for invoices include your business contact details (address, contact information, etc.), a price breakdown for transparency, an invoice number to identify the purchase, and payment terms to ensure on-time payments. These specifics are essential for clarity and accuracy in financial transactions.

💡 Tip: It is essential for commercial invoices to provide accurate and detailed information about the products purchased, as this type of invoice is used for customs clearance.

From my experience, invoices hold significant legal importance. A payment dispute with a vendor could be efficiently resolved using the detailed information provided in the invoice. This highlights the invoice's value as a legal document in business, a role that bills typically don't fulfill.

Due Dates

The timeline by which the client is expected to pay also makes a bill different from an invoice.

Businesses that sell products or services on credit can send an invoice after delivering the goods or services, offering an option to pay later. However, a bill is issued immediately following the product or service delivery, and the seller expects their clients to make payment immediately.

Are Bill and Invoice Different from Quote?

If you’re purchasing from a supplier, you might come across other documents before bills and invoices. You might get a quote from the vendors when selecting where to buy from.

A quote, or a sales quote, is a document that provides an estimate of the total price you have to pay if you decide to buy from that vendor. In short, it is not the same as an invoice or a bill, as a quote cannot be used to request payment.

Here’s a brief timeline of when each document is issued during a sales transaction:

Quote (initial estimate) → Pro Forma Invoice (optional preliminary bill) → Invoice (official payment request) or Bill (payment notice for immediate or recurring charges) → Receipt (proof of payment).

When to Use a Bill vs. When to Use an Invoice?

This section will cover the different scenarios for using a bill or an invoice.

When to Use a Bill

A bill is suitable for businesses that expect customers to pay for goods or services immediately, such as brick-and-mortar stores, restaurants, or small businesses that usually have one-time transactions.

Moreover, service providers such as internet providers and credit card companies commonly use bills to charge customers for using their services on a regular schedule and then issue receipts once the payment is completed to confirm the transaction.

Sales transactions in these types of businesses are straightforward in nature, and the payment terms don’t need to be detailed as payment is immediate. The payment is either a one-off, following the purchase, or a regular recurring payment.

Businesses can issue a bill on paper as a physical copy or as a digital bill. With modern technologies, electronic billing is a more convenient and eco-conscious choice. Digital billing software is also an efficient alternative that can help streamline your billing system.

When to Use an Invoice

An invoice is preferred for businesses that frequently deal with bulk purchases of supplies, service providers, or companies that often handle complex orders. It is also a practical way to collect payments after the delivery or at points in a more extensive process.

Common examples of businesses that can use invoices include software and web developers, freelance writers and designers, construction companies, landscaping companies, and educational services providers. These specific services can clarify the details of the services provided in the invoice and offer payments in installments for ongoing contracts.

When invoices are part of a more extensive procurement process, they can be used to track order and payment status. Some types of invoices also have additional purposes. For example, a commercial invoice can be used to calculate importing taxes, and a pro forma invoice can be issued as an order confirmation with a settled total price.

Similar to bills, it is worth mentioning that e-invoices are becoming more popular among businesses as not only do they save papers, but they are also easy to generate and keep track of using invoicing software.

Many companies now also utilize secure e-signature systems to authenticate their invoices. This adds a layer of security and streamlines the transaction process, making it more efficient and trustworthy.

💡 Tip: Whether you’re issuing an invoice or a bill, providing a receipt to the customer as proof of payment after you’ve received the amount due is essential.

Final Note

If you are a business owner, using the correct type of document to collect payments is essential to getting your money on time. Understanding the differences between a bill and an invoice is one way to lessen the chance that you’ll have to chase outstanding invoices.

For businesses that frequently have to handle invoices, using invoicing software that has functions to create, send, and store invoices is an excellent way to optimize the efficiency of your invoicing management process.

FAQs

Is a bill and an invoice the same?

No, a bill and an invoice are not the same document. While both are used to request payments, a bill is more common in one-time transactions, and an invoice is used in complex B2B sales.