Established in 1933, Hang Seng Bank has grown into one of the largest listed companies in Hong Kong, catering to over 3.9 million customers—more than half of the adult population—through a wide network of over 260 service outlets.

As a key member of the HSBC Group, Hang Seng extends its operations to nearly 20 major cities across mainland China, as well as in Macau, Singapore, and Taipei, employing over 8,600 staff.

The bank offers diverse services, including wealth and personal banking, business banking, and Hang Seng trade services, with a particular emphasis on providing a full range of renminbi (RMB) services.

Key Information | Description |

Eligible countries and regions | Hong Kong and Mainland China (other countries and regions may apply but are subject to review by Hang Seng Bank) |

Eligible company types | All business types |

Initial deposit | HKD 20,000 |

Account opening fee |

A company search fee may apply.

|

How long it takes to complete the application? | Within 20 minutes |

Average opening time |

|

100% online application | Only if your business is eligible for remote account opening. |

Criteria for a Remote Account Opening |

|

*Connected parties are Directors, Authorised Signers, Principal Shareholders, Beneficial Owners, Key Controllers and Direct Appointees.

Types of Accounts Available

Hang Seng Bank offers two different types of business accounts that cater to different requirements. The Biz Virtual+ Account is designed for local small and medium-sized businesses (SMEs) and startups, while the Integrated Business Solution Account is ideal for SMEs and well-established companies. Both accounts provide a comprehensive solution by combining the features of savings, checking, foreign currency accounts, and investment into a single package.

Here are the key account features:

- An all-in-one account that simplifies financial management

- Faster Payment System (FPS) services to facilitate quicker transactions

- Complimentary online payroll services to streamline employee payments

- Offer good exchange rates for cost-effective international transactions

- Applicable business debit card

Eligibility

Before diving into the account opening process, we will help you check eligibility requirements to help streamline your process.

Countries Eligible

Businesses registered in Hong Kong and Mainland China can apply for a business account with Hang Seng Bank.

However, we couldn't find the full list of eligible countries and territories on the Hang Seng Bank website. Therefore, if you require further information, please contact the Hang Seng Bank team directly.

Not yet registered? Learn the quick way to register your Hong Kong companies.

Company Types Eligible

Hang Seng Bank allows 3 business entities to apply for a business account, which includes:

- Sole Proprietorship

- Limited Company

- Partnership.

Businesses, schools, clubs, societies, and charities are also eligible to apply for an account.

What Documents Do I Need to Open a Hang Seng Bank Business Account?

Hang Seng Bank has provided a list of required documents to apply for a business account. Some of the necessary documents include:

Required Documents for Hong Kong Companies

- Valid Business Registration Certificate.

- Identification documents of sole proprietor, all partners, all beneficial owners, all authorised signers, and all key controllers.

- Certificate of Incorporation.

- Memorandum and Articles of Association (M&A)/ Articles of Association.

- Proof of residential address of sole proprietor, all partners, and all key controllers*.

- Ownership structure chart, which is certified by directors.

- Latest source of wealth of Beneficial Owners. (for newly established companies).

- Company Chop (if applicable).

- Business proof, such as confirmed orders, invoices, and sale contracts.

For more information, please refer to the full document checklist of local companies.

Required Documents for Mainland China Companies

- Valid Business Registration Certificate.

- Memorandum & Articles of Association / Articles of Association.

- Registered address proof.

- Identity documents for all authorised signers, all beneficial owners, all key controllers, and all direct appointees.

- Certificate of Incumbency.

- Trust Instrument (for a company with Trust as Ultimate Beneficial Owner).

- Business proof.

For more information, please refer to the full document checklist of PRC companies.

Required Documents for Overseas Companies

- Certificate of Incorporation

- Product or service information (e.g., applicant’s website, leaflets/brochures).

- Financial Information, such as audited reports and bank statements.

- Company search report or certificate of incumbency

- Valid Business Registration Certificate

- Proof of residence

- Identity documents for all authorised signers, all beneficial owners, all key controllers, and all direct appointees

For more information, please refer to the full document checklist of overseas companies.

*Key controllers include CEO, COO, Chairman, Authorised Signatory with sole signing authority, CFO, Managing Partner, Chairman of Audit / Committee, and Nominee.

How To Open a Hang Seng Bank Business Account Online

Hang Seng Bank offers an online application platform for opening a business account. However, the remote account opening is only available for businesses that fulfil all the following criteria.

- The applicant’s connected party(ies)* must hold a Hong Kong or mainland China Resident Identity Card.

- The connected party(ies) have to be physically present in Mainland China or Hong Kong when they submit the remote account opening application and perform e-sign for the application.

Otherwise, you need to visit the branch to complete the application process. You have the option to complete the business account opening form beforehand to ensure a smoother and more efficient application experience.

*Connected parties include Directors, Authorised Signers, Principal Shareholders, Beneficial Owners, Key Controllers and Direct Appointees.

Step 1: Create an Account

First of all, you need a Hang Seng Bank account. Visit the online application platform to create a username and password and provide your basic information, including your name, business email address and phone number.

The bank will send a One-Time Password (OTP) to your email. Fill in the OTP to complete the process.

Step 2: Provide Company Information

Then, you have to provide your company details, such as your company name, type of business, and details of your relevant parties.

Step 3: Upload Relevant Documents

Hang Seng Bank will require you to submit the necessary documents to complete the application.

If your company is eligible to complete a remote account opening, you can proceed. Otherwise, the Hang Seng team will contact you to make an appointment after submitting the documents.

Step 4: Digital ID Verification

For remote account opening applicants, you have to download the Hang Seng Business Mobile App and enter your SMS verification code. Next, follow the provided instructions to scan your ID card and take a selfie successfully.

Please note that all connected parties have to complete this step.

Step 5: Create a Password for e-Confirmation

You will need to create a password to e-sign your account application.

Step 6: E-sign Your Application

After that, you will receive an SMS notification. Then, you and all your connected parties can complete your application by following the instructions to e-sign your business account opening successfully.

How to Contact Hang Seng Bank’s Customer Support

If you have further questions, Hang Seng Bank offers multiple channels to contact customer service representatives, including

- 24-hour Business Partner Direct: (852) 2198 8000 for Hong Kong, and 4001 20 8288 for Mainland China

- Business Banking Application Hotline: (852) 2198 8022

- Business Banking Centres,

- Chatbot,

- Live chat,

- and Query form.

Hang Seng Bank Business Account Alternative: Statrys

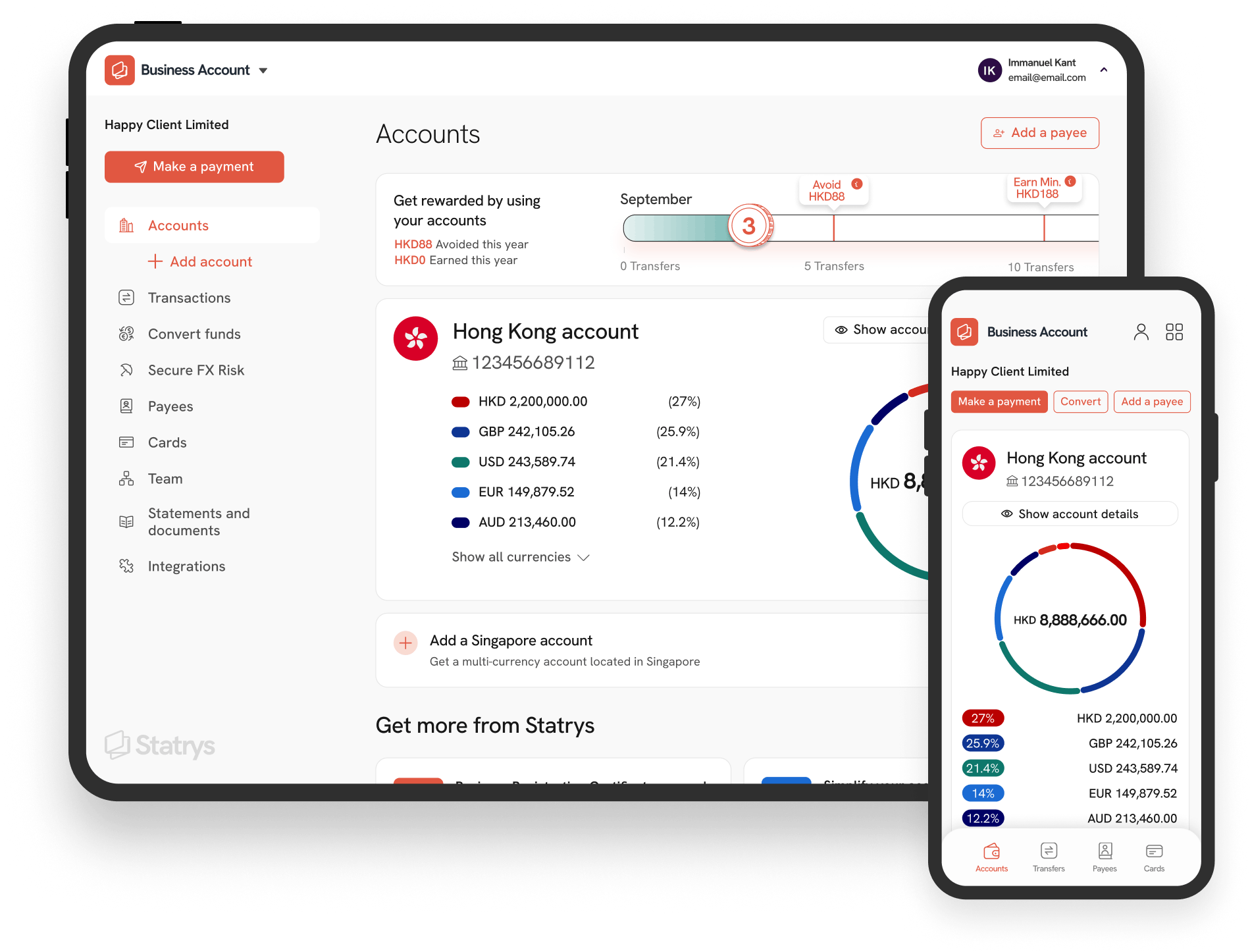

If you are looking for an alternative to traditional banks and prefer a hassle-free way to send, receive and manage money in multiple currencies, consider Statrys.

Statrys is a fully licensed Money Service Operator in Hong Kong, that offers payment services tailored for SMEs. Our multi-currency business accounts allow you to manage and hold 11 major currencies in one account number. We also provide competitive FX services and human-centric customer support.

Our business accounts are set up entirely online, and there are no initial deposits, account opening fees, or minimum balance requirements.

For businesses incorporated in Hong Kong, Singapore, or the BVI, Statrys is your gateway to seamless financial management.

Here is a summary of Statrys’ payment services

FAQs

Can I open a Hang Seng Bank business account online?

Yes, Hang Seng Bank offers an online platform for opening a business account. However, remote account opening is only available if connected parties, such as directors or shareholders, hold a Hong Kong or Mainland China Resident Identity Card and are physically present in those locations during the process.

How much does it cost to open a Hang Seng Bank business account?

How long does it take to open a Hang Seng Bank business account?

What are the services provided by Hang Seng Bank?

Is Hang Seng owned by HSBC?

Disclaimer

Statrys competes directly with Hang Seng Bank in the payment industry, but we are committed to providing an unbiased and thorough review. Click More info to read the full disclaimer on our review.