Key Takeaways

An outstanding invoice is an invoice received by the customer and waiting to be paid. When the due date is passed, it becomes a past due invoice.

9 in 10 businesses have to deal with late payments. An invoice with a clear structure and straightforward payment terms, including late payment fees and/or early payment discounts, can encourage timely payments.

Using dedicated invoicing software can streamline the outstanding invoice tracking process.

In a sales transaction, an invoice is an essential document that the seller sends to collect payments from the customer for the supplies or services purchased.

Invoices are crucial in maintaining a steady cash flow and healthy financial status. If you are a small business owner, unpaid outstanding invoices can cause considerable damage to your operations.

This article will guide you through what an outstanding invoice is and how to prevent it from being overdue. Keep reading for useful tips to get paid on time and how using automated software can streamline your invoicing process.

What Is an Outstanding Invoice?

An outstanding invoice refers to an invoice that the customer has successfully received but is yet to pay. It is also known as an unpaid or open invoice.

Typically, the seller must include the due date by which they expect the customer to pay the outstanding amount. Between this time frame, the invoice is considered an outstanding invoice before the customer makes the payment.

If the due date is not provided on the invoice, it usually implies a net 30 payment terms, meaning the invoice is payable in 30 calendar days.

💡 Tip: Always include the payment terms, specifically the due date, when creating an invoice. The terms should be agreed upon between the seller and the buyer to help both parties plan their budgets and prevent disputes.

Difference Between an Outstanding Invoice and an Overdue Invoice

While outstanding invoices are unpaid, the payment may be in process, and the customers might make the payment before the due date.

On the other hand, an overdue invoice is an unpaid invoice that is past the due date, but the seller has yet to receive the outstanding amount.

In short, all overdue or past due invoices are outstanding, but not every outstanding invoice is past due. Unfortunately, 87% of businesses have to deal with late payments past the due date. It is essential for the selling businesses to chase the outstanding invoice before it is overdue to maintain a healthy cash flow and financial status.

How to Get Outstanding Invoices Paid on Time

According to statistics, less than 15% of invoices are paid early on time. Although past due invoices may be inevitable, there are several ways to get the outstanding payments paid before they are overdue.

One of the main causes of delayed payment is invoice errors. If you frequently have to deal with overdue payments, the first step you can do is to review your invoice templates to see whether the details are easy to read and understand.

Additionally, there are other ways that can help you efficiently track and follow up on the outstanding invoice payment. Here are 7 tips to improve your chances of getting paid on time.

1. Send Your Invoices Promptly

Sending the invoices immediately after delivering the products is another practical way to reduce the risk of outstanding invoices going overdue, as it allows your clients to have sufficient time to process the payment.

If you are sending the invoice to a new client or a client who regularly pays late, you may contact them to confirm that they have received the invoice.

To ensure payments are made on time and avoid late fees, it is important to send invoices as soon as possible. It is recommended to send invoices at least two weeks before the payment due date to allow for processing and payment. If invoices are sent out less than two weeks before the due date, it is crucial to emphasize the importance of prompt payment with minimal reminders.

💡 Tip: Always make sure that the customers are expecting the invoices. If you are a vendor, you should notify your customers in advance that you are sending the invoice.

2. Send Payment Reminders

Sometimes, it is possible for the customer to miss the invoices in their inbox. This problem can be prevented by sending reminders for the outstanding payments.

However, excessive email sendings can strain the relationship between the seller and the buyer. Let’s look at an appropriate timeline of when to send a reminder.

| Timeline | When to send a reminder |

|

Before the due date |

• After 1-2 days of sending an invoice, send an email to confirm that the customer has received it. • Notify the customer of the approaching due date 7-10 days before if they have yet to pay. |

|

After the due date |

• Contact the customer 1-2 days after the invoice is overdue, and they haven’t paid. • Within 30 days after the due date, send a reminder for the outstanding amount at every suitable interval. • Notify the customer that you are taking the next step, such as legal action, if the invoice has been overdue for longer than 30 days. |

Here’s an example of a friendly reminder email template:

Subject: Payment Reminder: Invoice Number ST-001 Due Soon

Dear [Client Name],

I hope this email finds you well.

I am sending this email as a friendly reminder that invoice number ST-001 for [ project name or product purchased] that was sent on [ billing date] is due in 10 days. I’d appreciate it if you could confirm that the payment is being processed or is scheduled. I have also attached a copy of the invoice to this email.

If you have any questions or concerns about the invoice, please do not hesitate to contact me by replying to this email or calling me at [ phone number].

Best regards,

[Your Name]

⚠️ Important: Always include an invoice number when contacting your customers to make sure that you are referring to a correct invoice or transaction.

3. Request Advance Payments

If you are working on a project for an extended period or supplying expensive products in large quantities, you could request an advance payment from your customers.

Asking to be paid upfront or in advance is a common business practice that is a practical preventative measure for late payments. This amount could be deducted from the total amount charged at the project's end.

Advance partial payments can be considered as a deposit that provides a safety net for your business.

4. Offer Multiple Payment Methods

Offering flexible payment options is another way to ensure a timely payment since your customers can choose the most convenient way to pay.

For example, you can offer your customer an option to pay with a credit card in addition to providing your transaction details for a wire transfer.

In cross-border sales transactions where it might take time to transfer money internationally, providing online payment options can facilitate a convenient payment process for your customers.

5. Include Fees for Late Payments

Another way to avoid unpaid invoices is by implementing late payment penalties.

Late payment fees are often charged by the business and are added to an unpaid outstanding invoice. Some businesses will charge 1% monthly for overdue invoices.

You can also specifically include your policy for late payments in the original invoice, but it should be stated clearly, for example:

- A late payment fee of $25 will be applied to all balances outstanding more than 30 days past the due date.

- Total due by 7th July 2024: $700; Total due after 7th July 2024: $740

Late payment penalties serve as an incentive for timely payments. However, you should ensure that your clients are aware of them to avoid disputes and that you are charging an appropriate amount.

6. Provide Discounts For Early Payments

You can also offer discounts for customers who pay the outstanding amount early to encourage early payments.

Usually, early payment discounts would be applied as a percentage of the invoice amount and a number of days before the due date, such as “ 2/10 NET30,” which means the customer can get a 2% discount if they pay within the first 10 days of a 30-day payment period. After that, they will have to pay the full amount.

💡 Tip: You can include late payment policies and early payment discounts in the invoice, but ensure the information is clear and straightforward.

7. Give Your Customers a Call

If your customers do not respond to emails, you should contact them directly through a phone call to get a faster response.

Similar to when reaching out to customers via emails, you should keep your tone professional but friendly. You could ask the customer if they are facing problems concerning the invoice that you can assist with, such as issues with payment methods.

A phone call reminder also helps businesses maintain good customer relationships.

Using Invoicing Software to Keep Track of Outstanding Invoices

The best way to avoid having to chase unpaid invoices is to keep track of the outstanding balance and make sure your customers pay before the due date.

To save time and cost, you should consider using dedicated invoicing software to automate your invoice management process and easily follow up on outstanding invoices.

Statrys Invoicing Software can help you create professional-looking invoices, track the payment process, and conveniently manage your invoices all in one place so you can pay and get paid on time.

Here’s how Statrys can streamline your invoicing process.

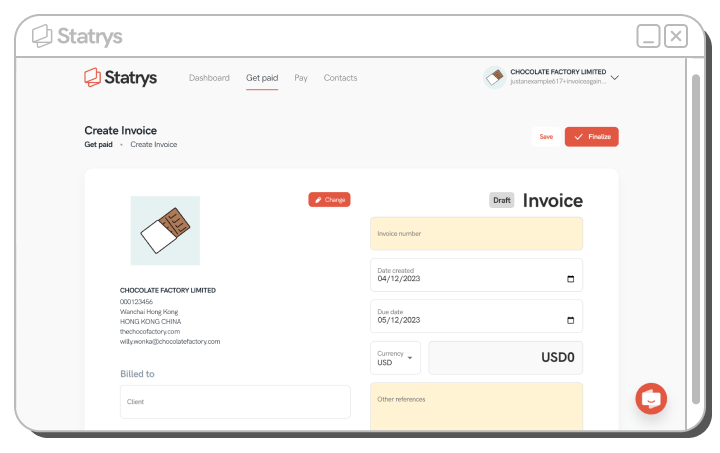

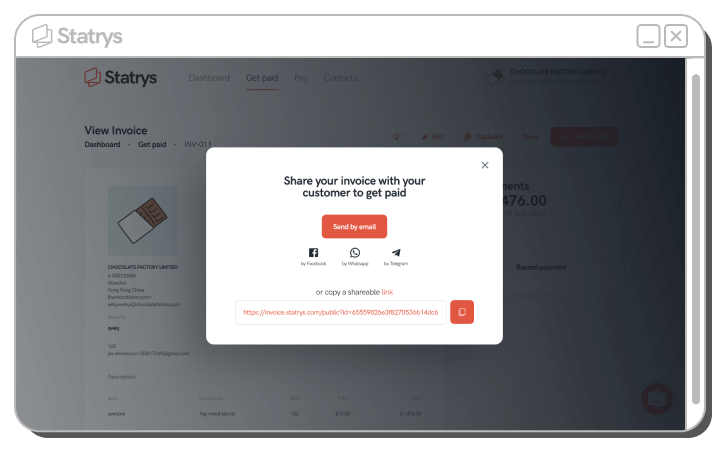

Create Invoices and Keep Track of Outstanding Payments

Creating invoices with Statrys Invoicing Software is easy. Simply fill in the details, such as company name, invoice number, product description, and discounts, then click “finalize.” You can also send the invoice to your customers with a single click.

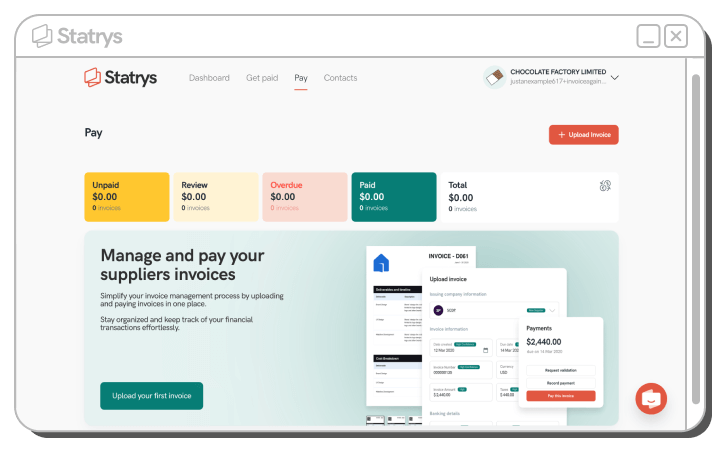

Upload and Pay Your Outstanding Invoices

You can also upload and record the invoices from your suppliers to keep track of your expenses and to make sure you pay on time.

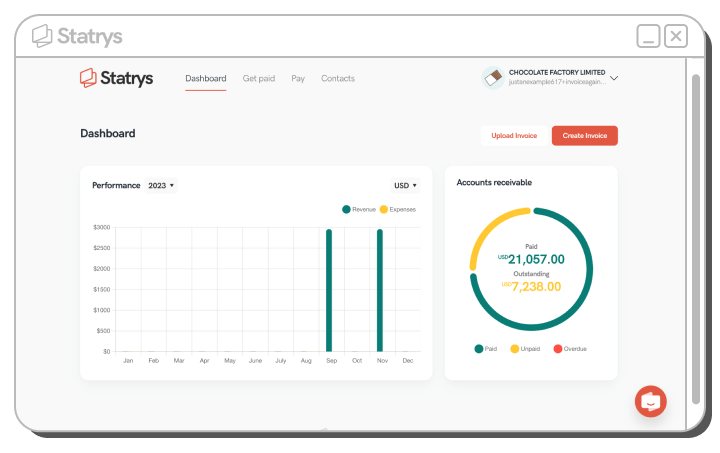

Track Your Financial Performance

Once you’ve recorded your invoices, you can conveniently keep track of your accounts receivable in the dashboard.

Chasing outstanding invoices to be paid on time might be a challenge almost every business owner faces. Still, by integrating the right software tool and practical tips we’ve provided, you can boost your business’s performance and stay in control of your invoicing.

FAQs

What is an outstanding invoice?

An outstanding invoice is an invoice that is sent to the customer and is waiting to be paid. If unpaid past the due date, it becomes a past due or overdue invoice.