Key Takeaway

Remittance advice is a proof of payment the customers send to the suppliers to notify them that they have paid an invoice. It is usually used in international transactions or when transferring a large amount of money.

Invoice management can be challenging sometimes, especially when following up on payments from clients and chasing overdue invoices. The invoicing process is not simple, from preparing and sending to recording the paid ones. However, knowing how to handle each of the steps professionally can help boost efficiency and reduce the risks of errors, misunderstandings, and financial losses in business transactions.

A comprehensive and transparent invoicing process benefits both businesses and customers. Remittance advice is a document that can clarify the transactions and consequently help both parties save time and cost. But what exactly is it, and how to use them effectively?

In this article, we will explain what remittance advice is, what details should be included, why it is important, and when to use it so you can stay on top of your invoicing process.

What Is Remittance Advice?

In sales transactions, businesses would send an invoice to collect payment from their customers for the products or services provided. After receiving and paying the invoice, the customer may notify the supplier that the payment has been made and that they should receive it soon. That note is recognized as a remittance advice slip.

Remittance advice, or a remittance advice slip, is a document, a note, or a letter that a payer sends to inform the payee that they have received and paid the invoice. Typically, it provides information such as invoice number, payment date, and amount paid. It may include the expected arrival date for payments that take time to process. The term 'remittance' refers to the act of sending back money, usually in the context of overseas payments.

Remittance advice slips are often used when transferring a large amount or in cross-border payments made through wire transfers, telegraphic transfers, checks, or credit cards, as the money may take some time to arrive. Additionally, it can be a considerate way to inform the payee if the payment is requested to be made as urgently as possible.

In addition to business remittance advice, a remittance slip can also be created for personal money transactions, such as international transfers to family members abroad.

💡 Tip: Attaching remittance advice with a check payment helps clarify what the payment is for and ensures it is applied to the correct account or invoice.

What Information Does Remittance Advice Include?

To ensure that the payee can accurately record the remittance advice slip as proof of payment, it should include the following details:

- Payer or client's information: Include the name, address, and contact details of the payer (from whom the payment was made).

- Payee or supplier's information: Include the name, address, and contact details of the payee (to whom the payment was made).

- Remittance advice date: Provide the date the remittance advice is issued.

- Payment date: Include the date the payment is made, which is not necessarily the same as the remittance advice date.

- Payment amount: State the amount that is paid, which is usually the same as the total amount in the bill or invoice.

- Payment method: Specify how the payment was made, for example, by cheque, credit card, electronic transfer, or other methods.

- Invoice number: Include the invoice number and date of issue of the invoice to identify which invoice matches the payment. If it is made for multiple invoices, provide a list.

- Invoice date: The date when the invoice was issued is especially important for tracking and historical records.

- Payment reference: Provide any reference that verifies the transaction, such as a bank transfer reference number.

💡 Tip: Any useful additional information, such as the payment’s expected arrival time, can be included in the note section.

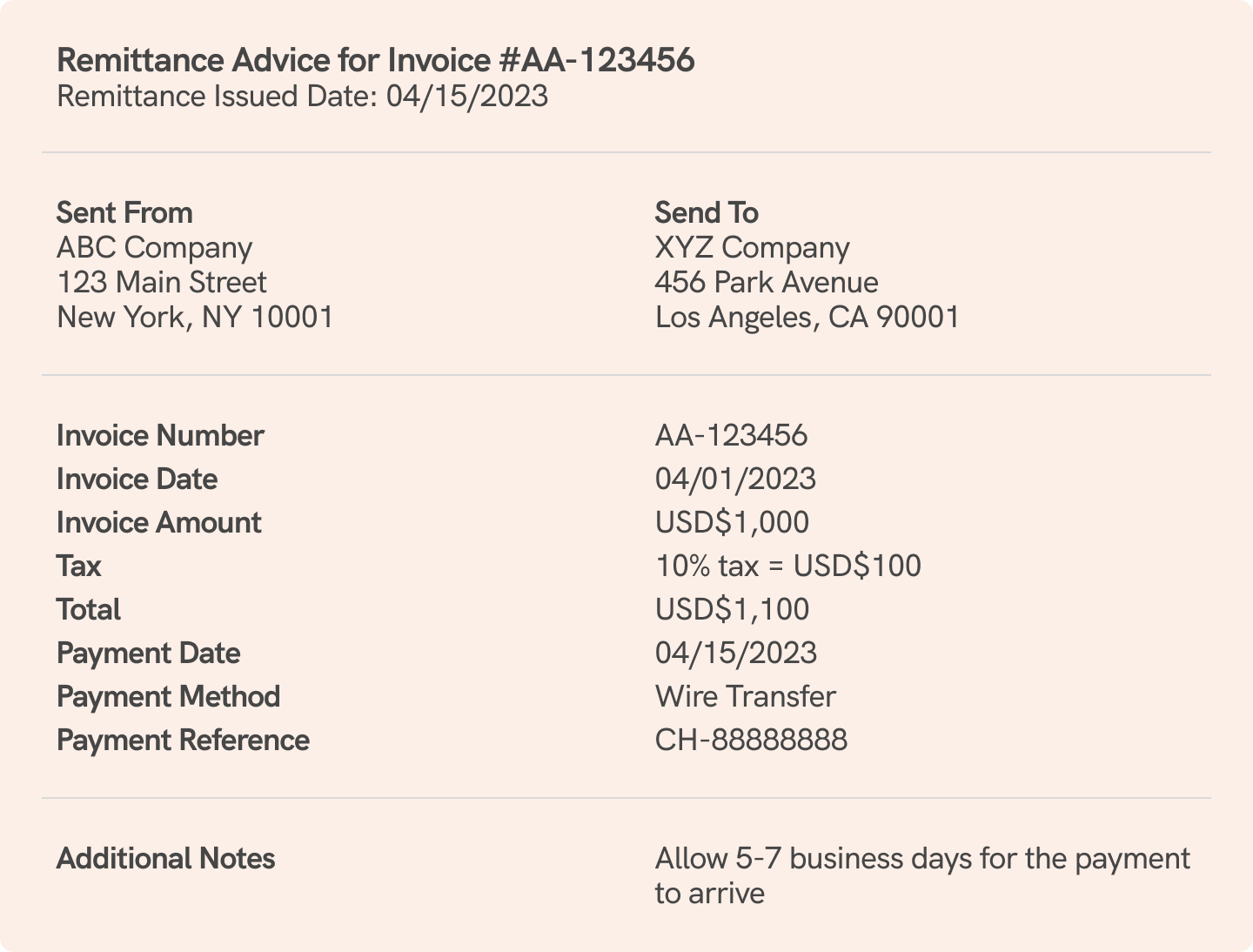

Remittance Advice Example

Remittance advice comes in different forms. It can be a templated document, a basic note, or a letter sent through postal mail, fax, email, web portal, or software.

While there is no specific mandated format for a remittance advice slip, all the essential details should be structured to ensure clarity and efficiency in financial transactions and to facilitate accounting processes.

Here’s an example of what a remittance advice note looks like.

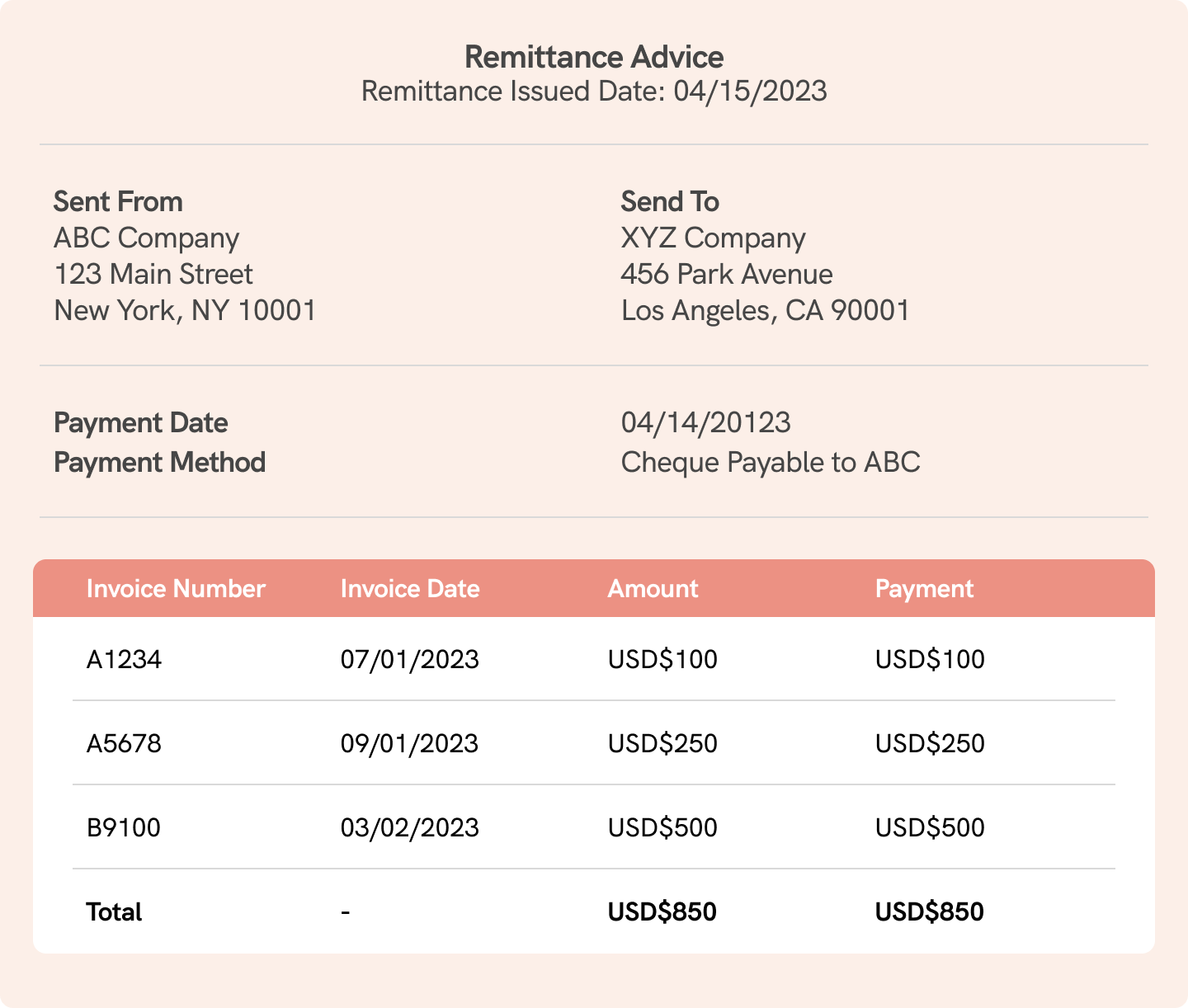

In case multiple payments are made to different but related invoices, they should be listed in a table for clarity.

💡 Tip: Consider using a business letterhead paper that includes the company name and logo to enhance professionality, credibility, and brand identity.

Types of Remittance Advice

There are three types of remittance advice that are commonly used. Businesses can generate remittance advice using software programs and templates in Microsoft Word, Excel, or Google Docs.

- Basic remittance advice - This is a simple document that provides essential information, like invoice numbers and payment details. It can be sent as a paper or electronic copy.

- Removable invoice advice - This is an invoice that includes a detachable remittance slip for the customer to fill out and return with the payment. If it is included, the vendor expects the customer to fill out the information and send it back to them after processing the payment.

- Scannable remittance advice - This refers to the remittance advice slips that can be scanned and recorded electronically. These are designed for electronic processing, allowing for easy record-keeping and automation.

What Is EFT Remittance Advice?

EFT remittance advice is a document sent by a customer to notify suppliers of a payment processed through Electronic Funds Transfer (EFT), such as ACH, electronic check, wire transfer, bank transfer, or direct deposit.

Typically, an EFT remittance advice slip looks the same as the standard remittance advice. It should specify how the payment was made, include the amount transferred, and reference the number of the invoice the payment is for.

Even though many online payment options automatically generate proof of payments for the payer, a remittance advice slip is still beneficial as a payment confirmation that facilitates accounting and financial management. It can be kept as part of accounting records for future reference, audits, or financial tracking, and also provides transparency and trust for both parties.

🔍 Fact: For international payments through the SWIFT network, the payer can request an MT103 as proof of payment as well.

Why Do Businesses Need Remittance Advice?

Although it is not obligatory for customers to issue a remittance advice slip, this document helps simplify the invoicing process for both the payer and the payee.

For the payer, it helps to keep track of their payment history to avoid overpaying or paying the same invoice twice.

For the payee, remittance advice assists in matching payment with an invoice. It is useful in the accounts receivable process, particularly when dealing with complex transactions, such as when a single payment was made to cover multiple bills with discounts applied or when dealing with a large number of invoices simultaneously.

Let’s look at a scenario where payment remittance advice is useful.

Case 1

XYZ Corporation transfers $5,000 to ABC Office Supplies for invoices ABC-51-001 and ABC-51-002 and emails a remittance advice detailing the payment and invoice numbers. ABC Office Supplies can quickly match the payment to the outstanding invoices, ensuring accurate accounts receivable records and maintaining a smooth and professional business relationship.

Case 2

Starr Industries in the US transfers $10,000 to Germany's BlueTech Solutions for Invoice BL-004 on 10th November 2023 and emails remittance advice with an expected settlement date of 15th November 2023, considering international processing time. This allows BlueTech to reconcile and track international payments efficiently.

How Businesses Use Remittance Advice

As businesses can be both senders and receivers of remittance advice, let’s look at how to use them to manage payments efficiently.

As a Sender

When paying suppliers. A business that pays other businesses for goods or services, especially through checks, EFT, or credit cards, may send remittance advice to its suppliers to maintain good relationships and ensure the timely delivery of orders.

Issuing a remittance advice slip as additional proof of payment also reduces the risks of making duplicate payments. Moreover, it is a functional method to keep track of the business’s expenses.

When paying employees' salaries. Companies that pay employees via direct deposit or EFT may send them remittance advice that shows their net pay, deductions, and other details. In this case, the payroll remittance advice can be sent as an electronic file or a paper copy.

As a Receiver

When preparing payment reconciliation and updating accounting records. This reconciliation or verification process involves the accounts receivable team comparing the transactions in the account with bank statements and confirming that the two are balanced at the end of the accounting period.

After reconciling, the business will update its accounting records. A record of remittance advice helps businesses match each payment to each invoice. Additionally, it helps keep track of cash flow, revenue, expenses, and taxes and helps prepare for audits or reports.

Is Remittance Advice the Same as a Receipt?

While a remittance advice slip is regarded as proof of payment, it is not the same as a receipt. The main difference between remittance advice and a receipt of payment is the issuer and the purpose of issuing.

- Remittance advice: Issued by the customer; confirms that the payment is made.

- Receipt: Issued by the vendor; confirms that the payment is received.

Another significance between receipts and remittance slips is how they are formatted and the details included in each document. A receipt would contain details of the purchase, while a remittance advice slip can include only the identifying number of the invoice.

Remittance Advice Best Practices

Issuing a remittance advice slip can streamline the financial management process for businesses. However, mismanagement of remittance advice may lengthen or complicate the payment process. Whether you're sending or receiving it, there are some considerations to keep in mind to ensure proper handling, such as:

- Keep a copy of all remittance advice documents for future reference

Remittance advice can be used to verify transactions, resolve disputes, or support claims. You can store them electronically or physically, depending on your security measures. - Automating the process

While remittance slips can streamline the accounting process, creating and managing them manually can be time-consuming and error-prone, especially when handling multiple transactions at once.

Consider using software and tools that can generate, send, receive, store, and automate remittance advice in a standardized and secure way.

In addition, you and your suppliers can use invoicing tools to send and keep track of invoice statuses.

What To Do When Sending a Remittance Advice

- Send remittance advice promptly

Send remittance advice as soon as possible after making the payment. Try to send it within 1-2 working days, if possible. This helps the payee acknowledge your payment promptly, reducing the chances of late fees or interest charges. - Make sure the details are accurate and legible

Always double-check for mistakes, such as misspellings, wrong invoice numbers, or printing errors, before sending payment remittance advice. Not only do these errors make your business look unprofessional, but they can also cause disruptions and disputes. - Confirm receipt of remittance advice with the other party

Confirm that the remittance advice slip has reached its destination via a quick phone call or email. This step can help to address potential issues on time, as well as establish a good relationship between the seller and the buyer.

🔎 Discover: When sending money abroad, make sure you understand how long a wire transfer can take to provide an accurate estimated arrival date of payments.

What To Do When Receiving a Remittance Advice

- Always verify the payment

Although a remittance advice slip is issued as proof of payment, it does not confirm that the payment is deposited in your bank account.

Some payment methods, such as international money transfers, may take several days to process or may be subject to fees or delays.

There are possibilities of errors like incorrect information or insufficient funds that also cause a transfer to fail. If you are expecting the payment, it is best to double-check if you actually received the money before continuing to the next process. - Compare remittance advice with records

Ensure that discounts are agreed upon and that all the number in the remittance advice matches the invoices and records. Contact the payer as soon as possible if you find any discrepancies. This can reduce future hassle.

FAQs

What is EFT remittance advice?

EFT remittance advice is a notification from a payer to a payee indicating that the payer has done an electronic fund transfer.