Legal Entity Types

There are different legal entities in Hong Kong, and the main types are Sole Proprietorship and Partnerships. The two types of partnerships are General partnerships and Limited Liability Partnerships.

In terms of types of companies as legal entities, they are the main ones: Private Limited Company, Subsidiary Company, Public Limited Company, and Company Limited by Guarantee.

Your chosen legal entity dictates your company's rights, responsibilities, and entitlements. Therefore, making the wrong move could mean losing the crucial time, money, and energy your company requires to reach its potential.

To avoid this, we have prepared a complete guide for identifying the best legal entity to represent your company's identity.

This guide will outline the benefits of registering in Hong Kong, detail the different types of legal entities and their registration processes, introduce the vital documents required, and share some expert suggestions to help you decide.

The Benefits of Registering in Hong Kong

Primarily, Hong Kong has an attractive taxation system, so regardless of company size, it is a hugely popular choice for foreign companies. In line with this, Hong Kong is one of the few jurisdictions in Asia that offers distinctively business-friendly and, pivotally, secure processes for establishing legal entities.

It is also backed by a common-law jurisdiction, so the process for setting up a legal entity/business is, in many ways, akin to that of the UK, US, Canada, or Australia. This decreases the likelihood of registration complications, delays, and/or legal translation fees.

However, these benefits do not eradicate the impact that choosing the wrong entity type could have on your operations, structure, and, ultimately, goals.

Let’s dive into a few key points to consider when choosing your company type in Hong Kong.

Types of Legal Entities in Hong Kong: Details and Comparisons

In order to paint a full picture of each legal entity type, we will outline their; functions and intended purposes, divisions of legal responsibility and complexity of registration.

Sole Proprietorship in Hong Kong

The business owner is legally and individually responsible for the responsibilities of the business entity. This business model is the most basic and simple but also carries the most responsibility in a time of crisis.

Individuals who register as sole proprietors (otherwise known as ‘sole traders’) often intend to run small-scale businesses. The process is simple and legally uncomplicated. However, the business owner carries unlimited liability for the business's debts.

For larger businesses, this is often highly unattractive, but for smaller companies, this can be perfect.

💡 Tip: If you are interested in the steps required to register as a sole trader in Hong Kong, we have a detailed guide explaining the process.

Partnerships in Hong Kong

In a partnership, two or more people establish a company.

Two types of partnerships in Hong Kong are differentiated by their varying liability amounts.

Within a partnership, the company's ownership division is outlined in the partnership agreement; it does not have to be split evenly if that is not the intention.

Partnerships are popular even more when they involve limited liability.

This is because although limited liability partnerships engage a more complicated registration process, they ensure that the partners will not experience unlimited liability in relation to company losses or the actions of their partners.

| Type of Partnership | Description |

| General Partnerships | • One or more partners • Unlimited personal liability • Quick and easy registration process • Popular amongst small-size business owners |

| Limited Liability Partnerships | • One or more partners • Limited personal liability • More complicated registration process • Popular amongst medium-sized businesses owners |

Different Types of Companies as Legal Entities in Hong Kong

| Type of Partnership | Description |

| Private Limited Company | Unlimited number of members, each owning a percentage of the company. Each member is personally liable for the amount of share capital they hold. |

| Subsidiary Company | A private limited company incorporated in Hong Kong with its largest shareholder being a local/foreign company. Even if owned entirely by a foreign company, they pay Hong Kong taxes and are entitled to the same tax benefits as local companies. |

| Public Limited Company | A public company in Hong Kong is listed on the Hong Kong stock exchange. This invites the public to participate in the buying and selling of their shares through stocks or bonds. |

| Company Limited by Guarantee | This is the legal entity used by non-profit organizations, and so they do not have share capital distributed as ownership. |

Foreign Companies Operating in Hong Kong

Instead of establishing as a company in Hong Kong, companies can operate directly through ‘representations,’ also known as a branch or representative office. These entities are required to be officially registered with the Companies Registry in Hong Kong.

Branch Office: Operates as a part of the foreign company rather than a separate legal entity.

While setting up a Branch Office is straightforward, any eventual closing process can be complicated as the company is subject to debts associated with its operations in Hong Kong.

Alternatively, If a foreign parent company wants to investigate the market in Hong Kong and its potential viability, then before establishing a branch, they can establish a Representative Office.

Representative Office: Provides an opportunity for a foreign parent company to evaluate its viability in Hong Kong. Limited to non-profit activities with a simple set-up process.

Common Corporate Documents in Hong Kong

Depending on the legal entity, local authorities will issue a few certificates and/or corporate documents upon registration. In particular, two of these are very important but also often confused with each other.

Below, we briefly discuss their differences.

Certificate of Incorporation

Once a company has been fully established and incorporated in Hong Kong and is ready to begin active operation, the Companies Registry will issue a Certificate of Incorporation. This document proves the legal right to operate for companies with limited liability.

Business Registration Certificate

In Hong Kong, incorporation and business registration are not the same thing.

All businesses operating in Hong Kong must approach the Inland Revenue Department to obtain a Business Registration Certificate (BRC) to ensure the correct payment of corporate taxes in Hong Kong.

💡 Tip: If you want to learn more about the Business Registration Certificate, we have an article explaining everything you need to know.

Which Entity Type Should You Choose?

Given the many different types of legal entities, It is normal to be unsure of the choice for incorporating your company.

Here is a list of suggestions and considerations that are crucial to consider to make the right choice:

- The complexity of the incorporation process or requirements

- Applicable tax benefits and tiers

- Business assets or personal assets level of protection (liability)

- Public perception and reputation

- Maintenance requirements and operational costs

- Compliance requirements

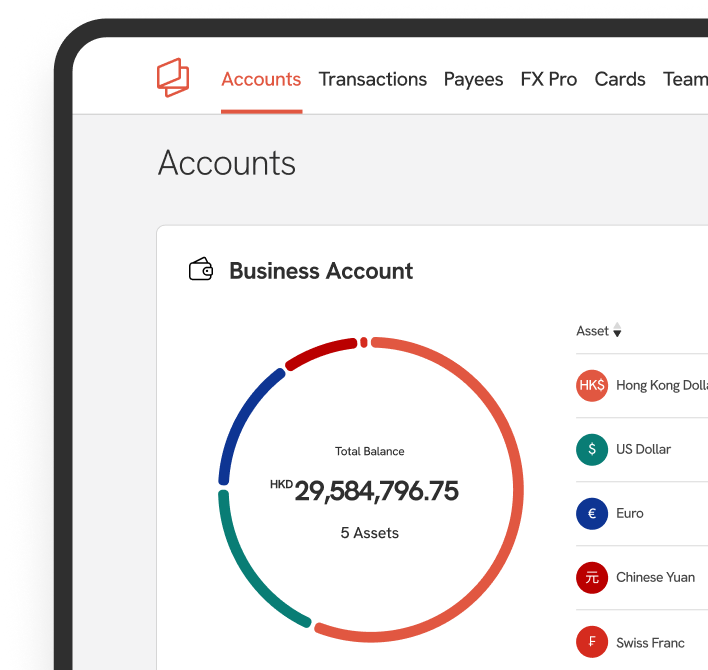

Making the right decision on which type of entity is right for your business will be a process. Consider the differences, especially considering risks, liabilities, and ownership. Once ready, you can start registering your Hong Kong Company with Statrys.

FAQs

What does incorporated entities mean?

Incorporated entities refer to the business that a company has incorporated into, which provides the company with its own 'legal identity'.

What are some common types of business entities in Hong Kong?

What are some key factors to consider when choosing a business entity?