Revolut is a well-known neobank in Europe, and it currently provides financial services to over 30 million retail customers worldwide. With Revolut being a global payment, multi-currency accounts platform, it makes sense why business owners, entrepreneurs, and freelancers today are considering using Revolut to conduct their payments.

This article aims to provide you with 5 alternatives to Revolut to help you make an informed decision about whether Revolut is truly the right option for your business.

We will do this by reviewing all the core services of each alternative and providing our recommendations for who they are best for, all in one place.

Without further ado, let's dive into our list!

| Revolut Alternative | Key Services | Best For |

|

Business accounts, Local accounts in the EU and US, International transfers via SWIFT, Loans, Debit cards. and Accounting software integrations. | UK Businesses that engage with EU and US markets. |

| Business accounts, International transfers via Wise network, Physical and virtual debit cards, Bulk payments, and Accounting software integrations. | UK businesses that do not need to handle cash. | |

|

Business accounts, Virtual and physical Mastercard®, Cryptocurrency investment, and International transfers partnered with Wise | Self-employed workers and freelancers living in the EU area. |

| Transfer and convert 40+ currencies with interbank rates, Mass payments, Debit cards, and APIs integrations. | Freelancers and businesses with international clients | |

|

Virtual accounts, Wallets, Mass payments, Local collection, Payment cards, API Integration, and Plugins with popular ecommerce platforms. | Businesses with frequent global and cross-border payments |

1. Starling Bank

Starling Bank is an award-winning UK-based digital bank or neobank serving over 3 million users since 2014. Starling banks provide various banking services for UK businesses, from sole traders and startups to enterprises. Some of their core services include bank accounts, international transfers, and accounting software integration.

Despite being fully digital, eligible deposits with Starling Bank are protected up to GBP85,000 by the FSCS, similar to traditional banks.

Key Services Offered by Starling Bank

| Starling Bank Key Services | Description |

| Business Bank Account in the UK | Make and receive instant local transfers for free, as well as earn 2.50% interest on their savings with a Starling bank account. |

| EUR and USD Account | Provide a unique IBAN and USD account number for UK businesses to receive, hold, and transfer money like a local. |

| International Money Transfers | Send and receive money in 19 currencies across 35 countries via SWIFT. |

| Debit Card | Access funds through your business Mastercard® with customised control and spending limits. (VIrtual cards are not available at the time of review) |

| Loan Services | Offer loans ranging from GBP 25,001 to GBP 250,000 with repayment terms of 12 to 72 months. |

| Bulk Payments | Streamline your financial operations by sending money to multiple parties at once. |

| Expenses Management | Categorise your funds based on goals, track spending, and schedule bill payments in advance. |

| Accounting Software Integration | Integrate between Starling Bank and Xero, QuickBooks, or FreeAgent to better handle finances. |

We Recommend Starling Bank for

✅ UK Businesses that engage with EU and US markets. With EUR and USD accounts, they can collect funds like a local– saving more from transaction fees.

✅ Business owners who seek to streamline financial management. With bulk payments and accounting software integration, they can minimise manual tasks and close books faster.

✅ Those who prefer a straightforward and transparent pricing structure.

💡 Tips: Interested in their service? Learn more from our Starling Bank business account review.

2. Monzo

Monzo is a UK-based digital bank that was established in 2015. The bank is licensed and offers banking services to over 300,000 business clients. These services include business bank accounts, virtual and physical payment cards, and international payments to more than 70 countries through the Wise network. Monzo also provides loan services to sole traders to support their growth. Similar to Starling Bank, all eligible deposits with Monzo are protected up to GBP85,000 under FSCS.

It's worth noting that at the moment, Monzo allows businesses to deposit between GBP5 and GBP300 at a time, and there's a limit of GBP1,000 every six months.

Key Services Offered by Monzo

| Monzo Key Services | Description |

| Business Bank Account in the UK | Make and receive unlimited instant GBP transfers for free and earn 1.60% interest on their savings. |

| International Transfers | Transfer money to over 70 countries |

| Debit Card | Access funds for business expenses 24/7 with virtual and physical Mastercard® (compatible with Apple and Google Pay) |

| Invoicing | Create payment links or invoices in seconds–offering bank transfer and card payment (partnered with Stripe) options for customers. |

| Loan Services | Offer loans up to GBP 25,000 to sole traders. |

| Expenses Management | Track and categorise spending and schedule payments. |

| Accounting Software Integration | Integrate between Monzo and Xero, QuickBooks, or FreeAgent to better handle finances. |

We Recommend Monzo for

✅ UK businesses that seek primary or secondary business accounts with protection from the deposit scheme to manage their funds securely.

✅ UK business owners need a business account with business-friendly features to save more time on financial management and bookkeeping.

✅ UK businesses that do not need to deal with cash since there's a limitation at the time of review.

💡 Tip: Explore Monzo’s features and fees with our in-depth Monzo review.

3. N26

N26 is a digital bank based in Germany that was established in 2013. It specialises in providing business accounts that are customised to meet the needs of self-employed individuals and freelancers. The bank is fully licensed and operates under the European Central Bank (ECB) and the German Federal Financial Supervisory Authority (BaFin). N26 offers a range of banking services to its clients, including business bank accounts, virtual and physical debit cards, and insurance services.

Finally, all eligible deposits are protected up to EUR 100,000 by the German Deposit Guarantee Scheme.

Key Services Offered by N26

| N26 Key Services | Description |

| Business Accounts | Offers 4 different business accounts (free and paid) to send and receive EUR payments instantly. |

| Debit Card | Offers virtual and physical debit Mastercard® for users to make purchases offline and online in any currency without any foreign transaction fees. |

| Make International Money Transfers | Send money abroad to over 70 countries by partnering with Wise |

| Cash Withdrawals | Withdraw money from an ATM for free up to 8 times. Unlimited withdrawals are possible at partner retailers. |

| N26 Crypto | Instantly buy and sell up to 200 cryptocurrencies within a few tabs. |

| Insurance Coverage | Provides on-demand insurance coverage on travel, electronics, and phone services. |

| Cashback Rewards | Earn cashback rewards and discounts at different designated merchants with an N26 payment card. |

| Budgeting and Financial Insights | Budgeting tools and financial insights to help users manage their finances effectively |

We Recommend N26 for

✅ Self-employed workers and freelancers in the EU can easily manage their finances with N26 digital banking.

✅ Those who often travel or are digital nomads will benefit from spending with payment cards without foreign exchange fees.

✅ Those who seek a licensed financial institution that facilitates investment in cryptocurrency.

💡 Tip: Learn more about their features and fees from our in-depth review of N26.

4. Wise

Wise is a regulated payment service provider based in the UK. It offers business accounts to companies of all sizes, allowing them to send payments to over 70 countries and receive payments from over 30 countries as if they were locals.

Wise also offers several features, such as batch payments, payroll, debit cards, and APIs for automation, making international payments simpler while providing interbank rates and lower costs for financial transactions.

Key Services Offered by Wise

| Wise Key Services | Description |

| International Transfers | Make foreign transactions with low exchange rates to 70+ countries. |

| Business Account | Add, hold, convert, and send payments in 40+ currencies. |

| Debit Card | Easily access your multi-currency account funds with the Wise debit card and earn 0.5% cashback on all eligible transactions. |

| Batch Payments | Only upload a single CSV file, and you can make up to 1,000 payouts at once. |

| Wise API | API for integrating into different platforms or applications |

| FX Services | Convert funds between different currencies at the real mid-market exchange rate |

We Recommend Wise For

✅ Businesses that deal with multi-currency payments can save a significant amount of time and money with Wise's payment network.

✅ Businesses make recurring international money transfers to internal or external stakeholders across the globe.

✅ Freelancers and digital nomads who require low fees and competitive exchange rates for foreign transactions.

5. Rapyd

Rapyd is a fast-growing payment service provider headquartered in London. Their core products include virtual accounts, wallets, a wide range of payment networks, API integrations, and payment cards. With Rapyd's solutions, businesses are capable of expanding globally more efficiently while providing a better user experience for their customers.

Key Services Offered by Rapyd

| Revolut Key Services | Description |

| Business Accounts | Collect sales like a local from over 40 countries in over 25 currencies. |

| Global Payouts | Make single or mass payments to over 190 countries with good exchange rates. |

| Wallets | Manage and transfer funds in over 70 currencies across different countries and payment methods with built-in compliances. |

| Payment Cards | Allow businesses to purchase online and in-store and make cash withdrawals from ATMs with customised control and spending limits |

| API Integration | Integrate Rapyd features with companies' workflow. |

| Plugins | Connect with popular ecommerce platforms, including WooCommerce, Shopify, Ecwid, and Wix, for businesses to easily collect sales and manage funds. |

We Recommend Rapyd For

✅ Businesses that send bulk payments globally to their internal and external stakeholders can improve financial management efficiency with Rapyd.

✅ Businesses expanding globally benefit from Rapyd's payment networks, which are capable of handling cross-border transactions in multiple currencies.

✅ Ecommerce businesses can collect sales like a local from popular ecommerce platforms like WooCommerce and Shopify.

💡 Tips: For a comprehensive understanding of their services, read our Rapyd review.

Have a Business in Asia? Consider Statrys

By now, you should have a clear understanding of which alternative options could potentially meet your business needs. You may also require a combination of services from various providers to fulfil all your specific requirements. There is no absolute answer. However, if you own a business in Asia or are considering entering the Asian market, then we recommend you consider Statrys.

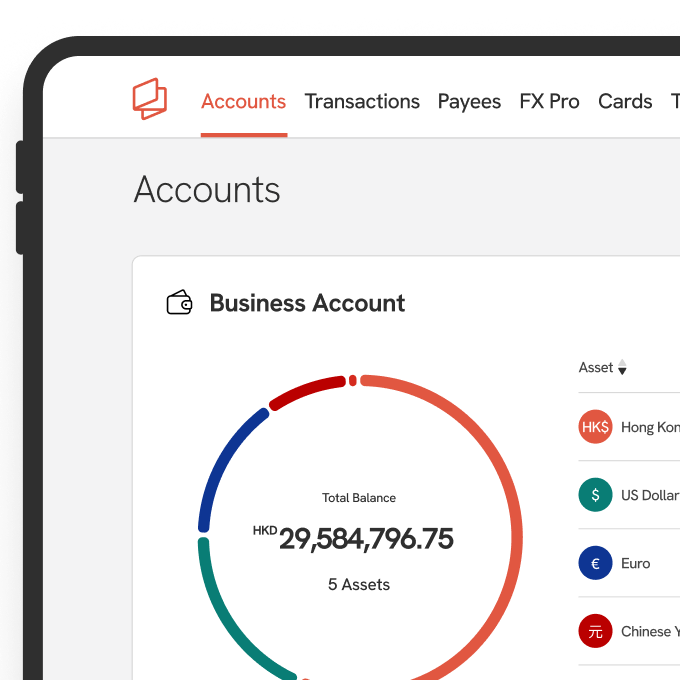

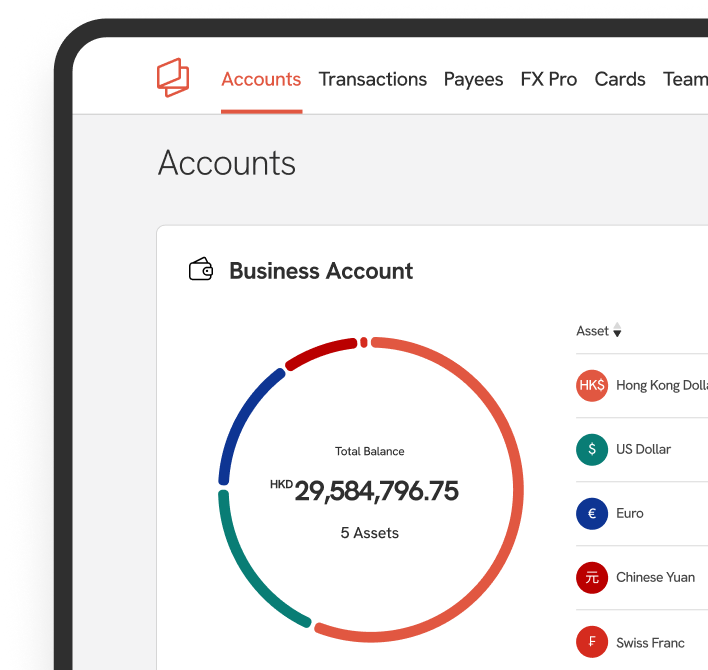

Statrys is a licensed payment service provider that allows businesses in Hong Kong, Singapore, and the BVI to open multi-currency business accounts that can hold 11 major currencies. Opening an account with Statrys is fast and efficient, with 85% of users opening their accounts in less than 3 days.

The biggest advantage of Statrys is its highly reputable customer support service, with guaranteed human support, low waiting time, and zero bots.

If you own a growing business and have clients and partners in Asia, be sure to check out Statrys' business account.

Disclaimer

Statrys does not directly compete with Revolut because we do not provide business accounts in the UK, EU, and US. We're committed to providing an unbiased, thorough review to help you make an informed choice.

Our insights are derived from industry experience and discussions with clients who have also used our competitors' services. While we'd love for you to choose us, what's most important is that you make the decision that's right for you.

If you have any feedback regarding this review, please contact us at marketing@statrys.com.

FAQs

What is Revolut?

Revolut is the biggest fintech company based in the UK. They provide financial services and solutions to individuals and businesses around the world.

Is Revolut a real bank?

What exactly does Revolut do?

Disclaimer

Some of the links in this article may be affiliate links, which means we may receive a small commission, at no additional cost to you, if you decide to make a purchase through one of our recommended partners. We only recommend products and services we trust and believe will be beneficial to our readers. This helps support our efforts in bringing you valuable content. Thank you for your support!