How To Open a Bank Account in Hong Kong

Ranked as the fourth-largest financial centre globally, Hong Kong offers a strong banking infrastructure and a vibrant business environment. Its well-developed banking sector, combined with favourable tax regime and its status as a renminbi hub, makes Hong Kong a natural first choice to open a bank account to leverage its strategic location and financial advantages.

Whether you’re setting up a company or relocating for personal reasons, we’ve prepared this guide to walk you through the process of opening a bank account, including requirements for non-residents, common fees, and banking options to help you get started.

Understanding Banking in Hong Kong

According to the Hong Kong Monetary Authority (HKMA), a corporation must be granted a licence to operate as a bank in the jurisdiction. The Hong Kong banking system consists of three-tier of deposit-taking institutions:

- Licensed Banks offer a full range of banking services while maintaining deposits of any size and collecting cheques drawn and paid in by customers. They can use the term “bank” without any restrictions.

- Restricted Licence Banks can take any maturity deposits of HKD 500,000 or above. They are more focused on merchant banking and capital market activities.

- Deposit-taking Companies are companies often owned by or associated with banks. They engage in consumer finance, commercial lending, and securities while being able to accept deposits starting at HKD 100,000 within at least 3 months of the original term of maturity.

The HKMA sets strict anti-money laundering regulations for all banking corporations. Thus, Hong Kong banks must verify all information and conduct due diligence before approving any new individual or business accounts.

Quick Tips: Bank accounts in Hong Kong primarily support deposits in Hong Kong Dollars (HKD). However, many banks also offer accounts that can handle Chinese Renminbi (RMB) or Yuan (CNY) and US Dollars (USD).

Bank Account Opening Requirements for Foreigners

Non-residents and non-permanent residents can open bank accounts in Hong Kong, but it may require additional documents and information, and your choices for banks might be limited. While most banks typically ask for identification documents like a passport and proof of address, some may also request you to provide the following:

- Purpose of opening a bank account in Hong Kong

- Proof of income, such as salary slips, tax returns, and bank statements.

- Employment information, including occupation, employer details, and monthly salary.

- Proof of study, such as a letter from the university to support your visa or residency status.

- A reference letter from a previous bank that verifies your financial history and reputation.

It is important to note that while opening a bank account as a non-resident is possible, the eligibility criteria and specific required documents may vary between banks. Some banks also allow foreigners with valid reasons to open an account remotely before arriving in Hong Kong, but it's best to check with your chosen bank for accurate and up-to-date information.

Opening a Hong Kong Bank Account Online

To open a new account online, you’ll have to:

- Download the bank’s mobile app or access their website

- Fill in the application form, which typically asks for your name, address, and contact information

- Upload the supporting documents

- Complete identity verification, such as taking a video of yourself

- Activate your account once approved.

Most banks in Hong Kong, including virtual banks, offer online and mobile account opening processes. However, this is primarily available for permanent residents with Hong Kong Identity Cards (HKIDs).

Some banks also offer an online account opening option for businesses, but the eligibility requirements vary depending on the bank. If you are a foreign company or an entrepreneur without a HKID, consider business banking alternatives like financial service providers and fintech companies that allow you to open an account remotely from your home country.

What Documents Do You Need To Open A Bank Account?

The documents you need when opening a bank account will depend on the type of account and each bank's specific requirements.

We’ll cover the 2 most common types most Hong Kong banks offer: personal accounts and business accounts.

Opening a Personal Account

Opening a personal account is quite easy in Hong Kong. You can visit your desired bank's website or visit one of the branches and fill out the application form. Bank websites and branches will provide detailed information about their account options (like current accounts or savings accounts), interest rates, ATM access, associated fees, and promotional offers.

For personal accounts, most banks will typically ask for the following documents to open a new account:

- Hong Kong Permanent Identity Card (HKID Card) for residents

- Valid passport for non-residents

- Proof of Residential Address, such as recent utility bills.

Depending on your circumstances and the banking services needed, banks may require additional information along with the above list. Specifically, this may include proof of income or employment for non-permanent residents or those who have just arrived in Hong Kong. However, the bank should inform you if this is needed and how it will be used.

Quick Tips: If you have just arrived in Hong Kong, you can provide a rental agreement or a letter from your landlord or university regarding your accommodation as proof of residential address.

Opening a Business Account

Opening a business account is similar to opening a personal current account, except businesses must provide more documents than individuals, mainly for compliance reasons.

Here are some of the documents that you will need to open a business or corporate account in Hong Kong:

- Certificate of Incorporation: An official document proving your company's legal registration with the Company Registries in Hong Kong.

- Business Registration Certificate: A certificate issued by the Inland Revenue Department as a tax identification document.

- Article of Association: A document outlining the company's rules and regulations and the rights and responsibilities of its shareholders, directors, and officers.

- Identification Documents of the Ultimate Beneficial Owner(s): Copies of the official identification document that proves the identity of the ultimate beneficial owner(s), such as a HKID or passport.

- Certificate of Incumbency: A legal document issued by the company secretary listing the names of the company directors, officers, and shareholders.

- Other Documents and Information: Such as a board of resolution, partnership agreement, proof of business address, business plans, an organisational chart, a recent bank statement, and a bank reference letter

Lastly, you must also state your purpose for opening a corporate bank account and the nature of your business activities and operations in Hong Kong.

Once all the documents and information are prepared, submit your documents to the bank representative you are in contact with or submit them online if your business account provider accepts online submissions.

Quick Tips: Before preparing the documents, make sure that you’ve researched the different types of business accounts and chosen the best fit.

The 4 Steps to Open a Hong Kong Bank Account

Now that you know what to prepare, let’s dive into how to open a bank account in Hong Kong. While specific steps may vary between banks, this general outline can give you a good idea of what to expect.

Step 1: Decide Which Bank To Use in Hong Kong

Each bank offers different packages for personal and corporate clients. Start by researching and comparing their offerings, service fees, and eligibility requirements that align with your specific needs. Here are some factors to consider when choosing a bank:

- Account Features: Depending on your preferences, look for features like online banking, mobile banking, multi-currency accounts, debit cards, and credit cards.

- Interest Rates: Compare interest rates on savings accounts and time deposit accounts to maximise your returns.

- Monthly Fees: Some banks charge monthly maintenance fees for certain accounts, while some offer promotional or conditional waivers.

- Transaction Fees: Consider banks with low or no fees for everyday transactions like ATM withdrawals and fund transfers. If you frequently make international transactions, also pay attention to related costs, such as foreign exchange fees.

- Additional Services: Explore additional services according to your needs, such as loans, insurance, investment products (including bonds, stocks, and mutual funds), merchant services, and wealth management services, especially if you’re a business.

And here’s what to avoid:

- High Fees and Hidden Charges: Some banks may charge excessive or hidden fees. Compare the fee structures of different banks to find one that fits your budget and transaction patterns.

- Limited Services: Does the bank offer the essential services you need, like international money transfers (SWIFT payments) or Internet banking? Also, make sure that the bank has branches and ATMs in multiple locations for convenient access to cash.

Poor Customer Service: A bank with unresponsive or unhelpful customer service can be frustrating, resulting in a bad banking experience.

Quick Tips: Since each bank may have its own policies on the types of entities they accept, we recommend reviewing the information on your eligibility to open an account with the provider before applying.

Step 2: Submit Required Documents

After choosing where to open your new account, prepare the supporting information and documents according to the bank’s requirements, then submit them with your application form.

Generally, banks in Hong Kong accept documents in either English or Chinese, but make sure to check with your bank first for specific requirements or additional guidelines.

Some banks offer a mobile account opening service that allows you to submit electronic copies of the documents online without visiting a branch. However, business clients may be required to make an appointment with a bank representative to submit the application.

Quick Tips: Hong Kong banks often require certified true copies of original documents to ensure their authenticity and validity.

Step 3: Wait For Account Approval

After you submit the documents, the bank will thoroughly review your application to assess your eligibility and ensure compliance with its requirements.

In some cases, the bank may contact you for additional supporting documents, information, or verification. This is likely in cases of corporate bank account opening, where an interview with a bank representative is often a standard part of the Know Your Customer (KYC) procedure to verify the nature and legitimacy of your business.

Quick Tips: Personal accounts are typically approved within 1-5 business days if you have all the necessary documents. However, corporate account openings can take up to 2 weeks, depending on the specific circumstances.

Step 4: Activate Account

Once your application is approved, the bank will contact you to provide your new account details and instructions on how to activate your account. The activation typically involves making an initial deposit and registering for online banking services.

You can also register your Hong Kong mobile number with a compatible bank account to receive transfers via the Faster Payment System (FPS) without having to share your account details.

The time it takes to open a bank account in Hong Kong varies depending on several factors, including whether you’re opening a personal or business account, which bank you’re opening it with, and the completeness of documents.

Bank Fee & Charges

Opening a bank account in Hong Kong comes with fees, and some banks have an initial deposit and minimum balance requirements. Generally, you can open a basic personal account with minimal or no fees, while business accounts are more costly.

Each bank offers different fee structures, and some may have an exemption for some service charges. Be sure to check with the bank of your choice for these components before setting up an account:

- Account set-up fee: Banks typically charge this fee for setting up corporate accounts, which could range from HKD 1,000 to HKD 10,000.

- Initial deposit: Around HKD 10,000 – 50,000, depending on the account type.

- Minimum balance: HKD 50,000 – 500,000. Most banks charge a monthly maintenance fee of around HKD 200 if you cannot meet their minimum deposit requirement.

- Processing fee: Depending on the specific transaction type, it can be as low as HKD 200 or as high as HKD 10,000.

- Credit card: Annual fees for credit cards in Hong Kong typically range from HKD 300 or more. For international credit card orders, prices can range from HKD 30,000 to HKD 50,000 (this may vary depending on your bank of choice).

- Foreign transfer fee: HKD 15 – 120

- ATM withdrawal fee: HKD 0 – 25

- Closure fee: Around HKD 200 (when closed within 3 months of opening). Early fee closures may vary.

While the above information can help you approximate the cost of opening a bank account in Hong Kong, it is important to note that fees can vary widely depending on the type of account.

We recommend checking directly with your chosen bank for the most accurate information.

Quick Tips: If you plan to make cross-border payments or transactions in foreign currencies, check if the bank offers favourable exchange rates or opt for multi-currency accounts that can help you save on this cost.

Which Bank Should You Choose?

As a leading international financial centre, offering economic stability and a strategic location for RMB liquidity in international transactions, Hong Kong offers a diverse range of banking options covering the banking needs of individuals and businesses.

These are the popular banks in Hong Kong to consider:

Bank | Key Features |

DBS Hong Kong |

|

HSBC Hong Kong |

|

Hang Seng Bank |

|

Bank of China (Hong Kong) |

|

Quick Tips: Explore the best savings accounts in Hong Kong and the best business accounts in Hong Kong in 2024.

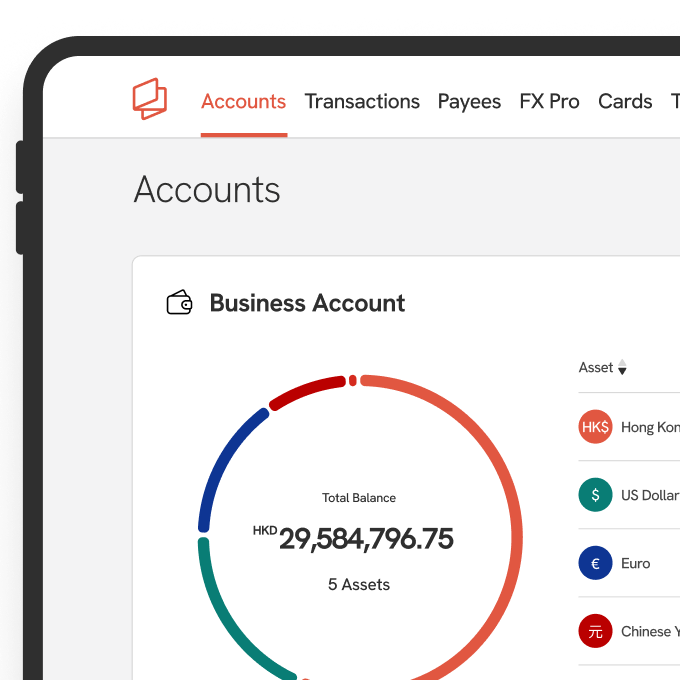

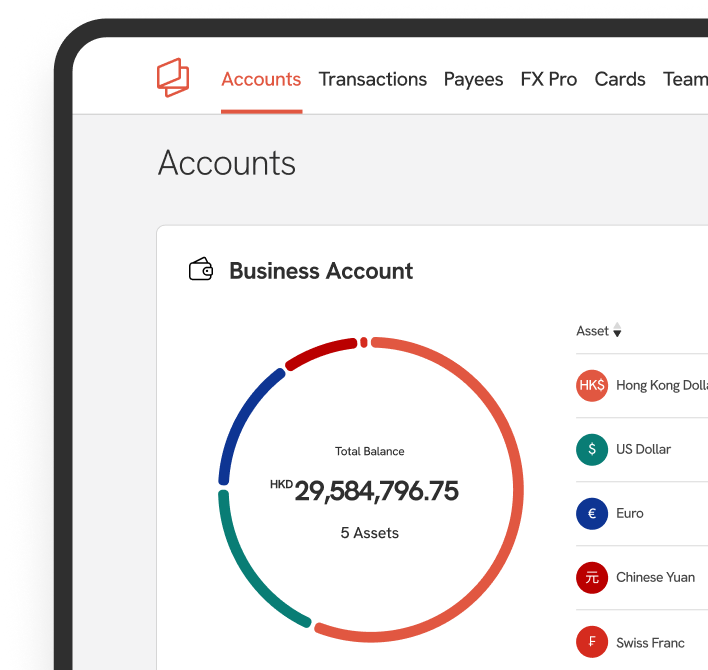

Alternatives to Traditional Banks

While traditional banks are often the go-to option for financial services, Hong Kong also offers a wide range of non-bank alternatives that might better suit your operations. These solutions provide cost-effective options and innovative products tailored to specific needs, such as:

- Business accounts with minimal fees and personalised support, which is ideal for growing startups and SMEs facing challenges with traditional banks.

- Multi-currency support that facilitates cross-border payments in various currencies beyond HKD, RMB, and USD.

- Account integration with accounting software or ecommerce platforms to streamline business operations.

Although not licensed as banks, these institutions are often authorised and regulated in Hong Kong as Money Service Operators (MSOs) or under other relevant licences, ensuring compliance with local regulations. Some examples include:

Financial Service Provider | Key Features | Best For |

Statrys |

| Global startups and SMEs seeking an affordable and personalised solution to streamline local and international payments |

Wise |

| Frequent travellers, expats, and ecommerce businesses |

Paypal |

|

Final Note

Opening a bank account in Hong Kong is a straightforward process that can be completed online or in person. By understanding the necessary documents, the general account opening process, and the diverse range of banking options available, you can streamline your personal and business financial management and navigate Hong Kong’s vibrant and favourable financial landscape.

FAQs

How long does it take to open a bank account in Hong Kong?

Typically, residents can open personal accounts as fast as the same day. However, it might take a few days or up to 15 working days for non-residents. For business accounts, the processing time may extend to 2 to 3 weeks.

Can I open a bank account in Hong Kong as a non-resident?

Can I open a bank account without going to the bank?

What if my bank account opening application is rejected?