Key Takeaways

Opening a business bank account in Hong Kong can be challenging if you are applying with a traditional bank. This is why entrepreneurs turn to alternatives, like Statrys.

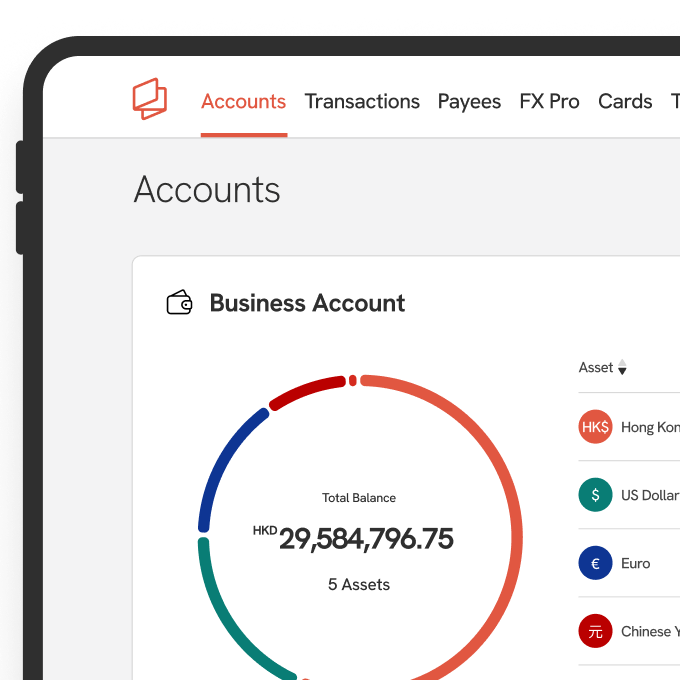

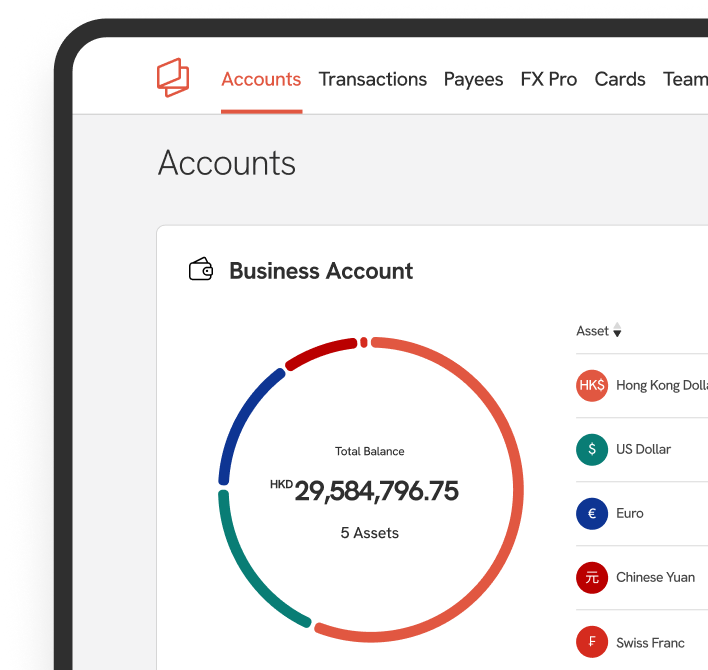

Statrys is not a bank, but we offer comparable services like a multi-currency business account with 11 major currencies, physical and virtual payment cards, FX services, accounting software integration, and more. The application process is 100% online, with no minimum deposits or balance requirements.

Whether you’re starting a new business in Hong Kong, moving your company, or expanding to the region, opening a Hong Kong business account is the next step you should take to simplify local transactions.

Opening a business account in Hong Kong offers significant benefits for companies. The jurisdiction provides access to a wide range of financial services and international transactions, which is ideal for businesses engaged in global trade. Additionally, Hong Kong remains an attractive base for expanding into mainland China and the broader Asia region.

However, with the many business account options, from local and international banks to virtual banks and banking alternatives, it might be challenging to find where to begin.

In this article, we guide you through the essential factors for selecting a business account, the available options, the required documents, and the process involved. We also address frequently asked questions about opening a business account in Hong Kong, including the time required, costs, and whether non-residents can open an account.

Why Is It Difficult to Open Business Bank Accounts in Hong Kong?

First, let’s answer the big question: Why is it difficult to open a business bank account in Hong Kong?

If you are a startup, new business, or foreign company, you might find opening a business bank account in Hong Kong challenging for the following reasons:

- Strict KYC Policies: Financial institutions must adhere to Know Your Customer (KYC) policies and Anti-Money Laundering (AML) regulations to ensure that the account will not be used for money laundering or other criminal activities. This results in lengthy application processes.

- Complex Background Checks for Startups: According to the Hong Kong Monetary Authority (HKMA), processing an application from start-ups takes longer and requires more supporting documents due to the complexity of the background checks, especially since startups often lack substantial business history or records to reference.

- In-Person Visit Requirement: For non-residents, opening a business account in Hong Kong can be even more challenging, including the necessity for in-person interviews at most banks and higher account opening fees compared to those for local companies.

Fortunately, while traditional banks can be tough to navigate, alternatives like neobanks and fintech companies are available. These digital services in Hong kong usually have simpler processes, allowing for quicker account openings and fewer requirements, making them a great option for small and foreign businesses.

Key Things to Consider When Opening a Business Account in Hong Kong

Banks and financial providers in Hong Kong offer a wide range of options for all types of businesses. Whether you're a small startup, SME, or an established international business, you'll find an account solution that fits your needs.

Here are some key factors to consider when looking at a business account in Hong Kong:

- Type of Provider: In Hong Kong, you have several options for managing your business finances. Traditional banks with physical branches are suitable for in-person services and complex financing needs. If you prefer convenience and lower fees, virtual banks offer a fast, entirely digital setup. For specialised services like international fund transfer or currency exchange, non-bank financial service providers often provide competitive foreign exchange rates.

- Eligibility: Most common business entities in Hong Kong, such as limited companies and partnerships, are eligible to open a business account. Some banks accept business account applications from offshore companies, though business owners and directors may need to be Hong Kong residents. Moreover, some banks may not provide corporate accounts for some types of business, such as sole proprietorship.

- Account Features: Depending on your business needs, features like accounting software integration for improved cash management, ATM access, or multi-user access may be essential. You may also consider business loans, payroll services, and advanced online banking tools such as mobile banking and mobile apps, internet banking, and real-time payment tracking.

- Fees: Common business banking fees in Hong Kong include setup fees, monthly fees, transaction fees, and charges for international transfers. Virtual banks and non-bank providers like Statrys often offer lower fees for maintenance, transactions, and international transfers.

- Minimum Deposit Requirements: Some banks require you to make an initial deposit and maintain a specific minimum account balance. Some virtual banks and non-bank options does not require minimum deposits.

- Customer Support: Evaluate the accessibility and availability of customer support, including the languages supported and contact channels like email and hotlines, to ensure timely and personalised assistance.

- Your Business Operation: If your business deals with international transactions, consider a business account supporting multiple currencies besides HKD to facilitate global operations. Most providers in Hong Kong that offer multi-currency capabilities typically support HKD, CNY(RMB), and USD.

How Much It Costs to Open a Business Account in Hong Kong

The cost of opening a business account in Hong Kong varies widely depending on the provider. Traditional banks charge between HKD 10,000 and 100,000, while virtual banks and non-bank options like neobanks and fintechs typically offer free account openings.

The following are typical costs associated with business account opening in Hong Kong:

Fee Types | Traditional Bank | Virtual Banks and Non-bank Alternatives |

Account Opening Fees | About HKD 1,200 for local companies or HKD 10,000 for offshore companies. An additional of around HKD 150 may apply for company search | Usually waived |

Initial Deposit | From HKD 10,000. | Usually not required |

Minimum Balance | Vary widely by provider and account type. For example, HSBC business integrated accounts require around HKD 50,000 | Usually not required |

Monthly Fee | Waived or around HKD 200 - HKD 500 | Usually waived or below HKD 150� |

Both options has other fees when you use the account, such as transaction fees, FX fees and ATM withdrawals. For banks, an account closure fee is typically charged if the account is closed within three months.

Tip: If you’re interested in learning more about bank fees, this article will explain 12 common types of bank fees and how to minimise them.

What Are the Required Documents to Open a Hong Kong Business Bank Account?

The documents you must prepare when opening a business account in Hong Kong depend on which bank or financial service provider you choose. Different banks in Hong Kong request varying supporting documents, while most non-bank alternatives may ask you to provide less paperwork.

Here are the commonly required documents you should prepare when applying for a business account in Hong Kong:

- Establishment Documents: Official documents verifying your company's lawful incorporation and registration. In Hong Kong, you’ll need a Certificate of Incorporation and a valid Business Registration Certificate.

- Articles of Association: A mandatory document that sets out a company's internal regulations and governance framework.

- Personal Identification: Copies of photo identification documents, such as passports, Hong Kong identity cards, or driver’s licences, of the directors, shareholders, and ultimate beneficial owners (UBOs)

- Proof of Address: Copies of recent proof of residential address in Hong Kong for directors, shareholders, and UBOs. This document should be dated at most three months.

- Organisational Chart: A concise chart outlining the company’s shareholding and managerial structure, indicating the directors, shareholders, and UBOs, along with their respective equity stakes.

- Business Plan: A brief business plan explaining the company’s operations, with projected expenses and revenues for the next 12 months.

- Board of Directors Resolution: An official written document that authorises opening a corporate account in the business’s name and designates an individual to manage the account opening process.

- Certificate of Incumbency (Certificate of Good Standing): This document outlines the management and ownership structures. It is essential for offshore companies incorporated outside of Hong Kong. In Hong Kong, a certificate of incumbency must be signed by your company secretary or a licensed TCSP. Alternatively, you might use a Company Particulars Report from the Companies Registry, which is government-issued and provides similar information, depending on your bank's requirements.

Most banks in Hong Kong provide an application form and a document checklist online for applicants to download. You can see some examples of the required documents on HSBC, Standard Chartered, Bank of China (Hong Kong), and Hang Seng Bank websites.

Important: Some documents that your bank requests may need to be certified true copies, which a company secretary or other authorised professionals can do for a fee. Check with your bank beforehand to avoid unnecessary costs.

What Are the Options for Business Accounts in Hong Kong?

With Hong Kong being one of the world’s leading financial hubs, your company has many business bank account options, from local and international traditional banks to virtual banks and non-bank alternatives.

Let’s look at each type:

| Who is it best for? | Options in Hong Kong |

Traditional Banks | Best for established businesses and enterprises with substantial funds looking for comprehensive banking services. Please note that businesses outside Hong Kong likely need to visit in person to open an account with traditional banks. |

|

Virtual Banks | Ideal for businesses interested in convenient, 24/7 banking services without needing physical branch visits. |

|

Non-bank Alternatives | Ideal for SMEs, startups, and international businesses seeking flexible, efficient financial services without the high fees and delays of traditional banks. It is a great fit for companies that require global payments and responsive customer support. |

Tip: In addition to banks, you should consider the type of business account that best suits your purposes. Business accounts, like personal accounts, offer options such as current accounts, savings accounts, and time deposits for consideration.

How to Open a Business Bank Account in Hong Kong

This section will walk you through each step, from selecting the right provider to completing necessary compliance checks.

Step 1 - Choose a Bank or Provider

To choose the best business account provider for your business, consider factors like the size of your company, the nature of your business, the account purpose, and the services offered by each provider.

If you are a startup or small business with a limited budget or simply looking for a digitally convenient way to make cross-border payments, non-bank alternatives like Statrys or virtual banks like ZA Bank are better choices for your needs.

Tip: Not sure which provider to choose? Take a short quiz to find the best business account for your needs.

Step 2 - Prepare the Supporting Documents

After choosing an account provider, the next step is to prepare the supporting documents.

While each bank and company structure may have different requirements, most banks provide a downloadable checklist to guide you through the process.

Step 3 - Submit Your Application or Make an Appointment

Although most banks in Hong Kong now offer online applications and document submission for eligible applicants, some may still require you to schedule an appointment to submit the documents in person.

If you're looking for a fully online process, virtual banks and alternative banking platforms often allow you to apply and submit documents without needing to visit a branch.

Step 4 - Go Through KYC Process

After submitting your documents, you'll need to complete the KYC (Know Your Customer) process. This involves verifying the identities of your company's directors and shareholders. Some banks may also ask for additional documentation, such as proof of the company's source of funds, especially for new or international businesses.

In some cases, banks may require an in-person visit for an interview with a bank representative. Alternatively, some online banks or non-bank solutions offer digital KYC processes, such as through video calls.

Banks and financial institutions implement the KYC process to prevent fraud, money laundering, and to comply with regulatory requirements.

Step 5 - Activate Your Account

After your application is approved, you can access your new business account. Depending on your chosen bank or financial institution, you may have to take additional steps to activate your account, such as setting up the mobile app or digital banking platform and adding funds.

How Long Does It Take to Open a Business Bank Account in Hong Kong?

Opening a business bank account in Hong Kong typically takes a few days to a couple of weeks. However, it can extend to months, depending on the bank and specific circumstances.

Typically, you will have to make an appointment with a bank representative to submit the required documents. Then, your application will go through a review, where you might be asked to provide additional information or documents. This review could take up to months.

However, some commercial banks like HSBC, DBS, and Hang Seng Bank offer business bank accounts designed for smaller businesses that could take as fast as 3 working days to open an account.

Additionally, virtual banks, neobank and non-bank alternatives can offer faster and more convenient options for opening business accounts in Hong Kong. You can usually open an account online in just 1 - 3 days, without needing in-person appointments or extensive paperwork.

Tip: 85% of customers opened their online business account with Statrys within 3 working days.

Can Non-Residents Open a Hong Kong Business Bank Account?

Yes, non-residents can open a business bank account in Hong Kong, but the requirements and available options depend on your providers and your circumstances.

Local banks adhere to stringent procedures when opening accounts and typically require all relevant parties to visit the bank in person before approving any new business accounts.

While some banks allow you to start the application process online and access documents through their website, in most cases, you’ll still need to present your paperwork at a branch.

What to Do if You’re a Non-resident

For those outside Hong Kong, you should consider banks with an international presence and check if they offer branch visits in your location to complete the process.

Alternatively, online-only banks and virtual banks typically allow for fully remote account openings with digital KYC processes.

If you need a solution primarily for payments rather than traditional banking services, fintech providers can be a great alternative.

However, non-bank options provide limited services, excluding features such as business loans, traditional debit or credit cards and interests.

FAQs

Is It possible to open a Hong Kong business account online?

Yes, some banks–especially online or virtual banks–provide remote account setups for companies registered in Hong Kong. For most traditional banks, you need an in-branch visit to complete the process, even though you can start the application online.

If you prefer an entirely online method for managing business payments in Hong Kong, non-banks such as fintech companies or payment service providers like Statrys offer a fully online account application process.

Which documents are required to open a business bank account in Hong Kong?

Why is it difficult to open a business bank account in Hong Kong?

How long does it take to open a business bank account in Hong Kong?

Which business account is best for a small business?